With all eyes focused on whether Jay Powell will go 25, 50, and/or end QT, Nomura’s Charlie McElligott notes that dealers are generally positioned aggressively long and additionally ‘long gamma’. However, given the potential for some serious volatility tomorrow, what levels should investors be watching for chaotic unwinds to begin.

Via Nomura,

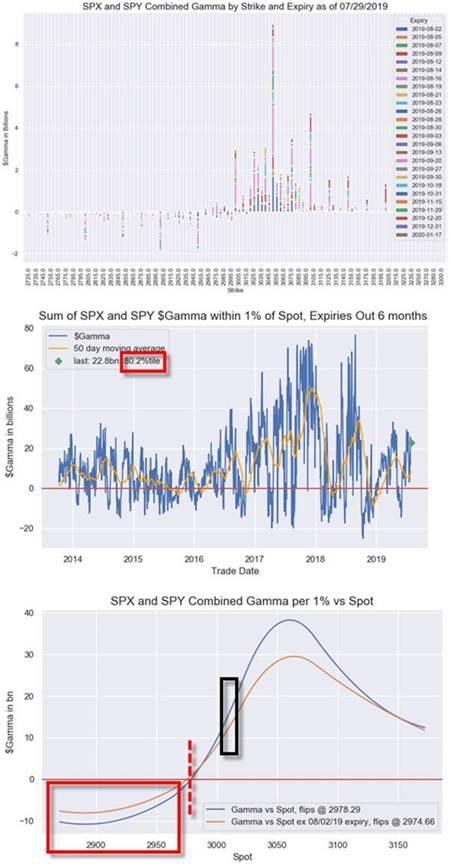

Our analysis shows that Dealers are currently “long Gamma” across combined SPX / SPY options, with $Gamma at 80th %Ile since 2013.

However, we would see that position “flip” to “Short Gamma” down at 2978, or 2974 ex the 8/2/19 expiry

Strikes that matter: 3050 ($9.375B), 3100 ($5.000B) and 3000 ($4.507B)

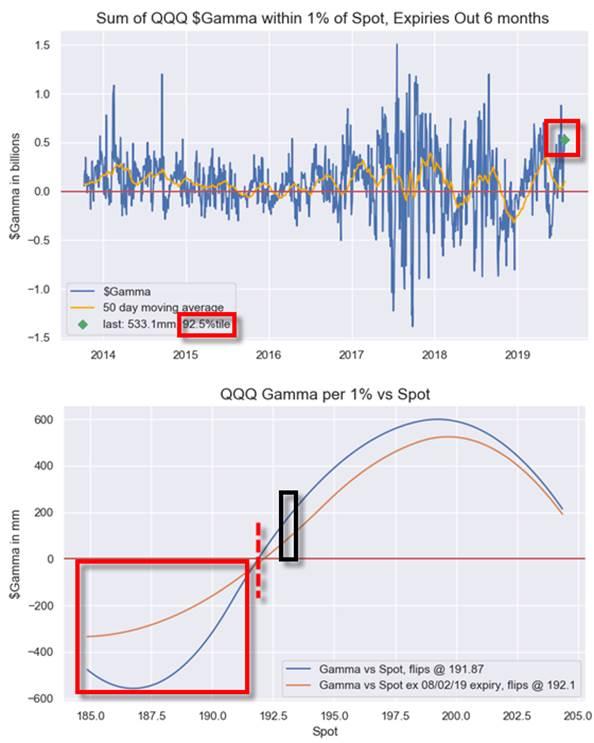

Also worth noting is the VERY long positioning in crowded Nasdaq.

This leaves QQQ too nearing a flip from current Dealer “Long Gamma” positioning to the “Short Gamma” flip-zone at 191.87 / 192.10 (ex 8/2/19 expiry)…

Particularly relevant at the $Gamma is currently extreme at 92.5 %ile since 2003.

Trade accordingly.

via ZeroHedge News https://ift.tt/2YcehAB Tyler Durden