The market is not exactly screaming its excitement at The Fed’s rate-cut, especially bank stocks…

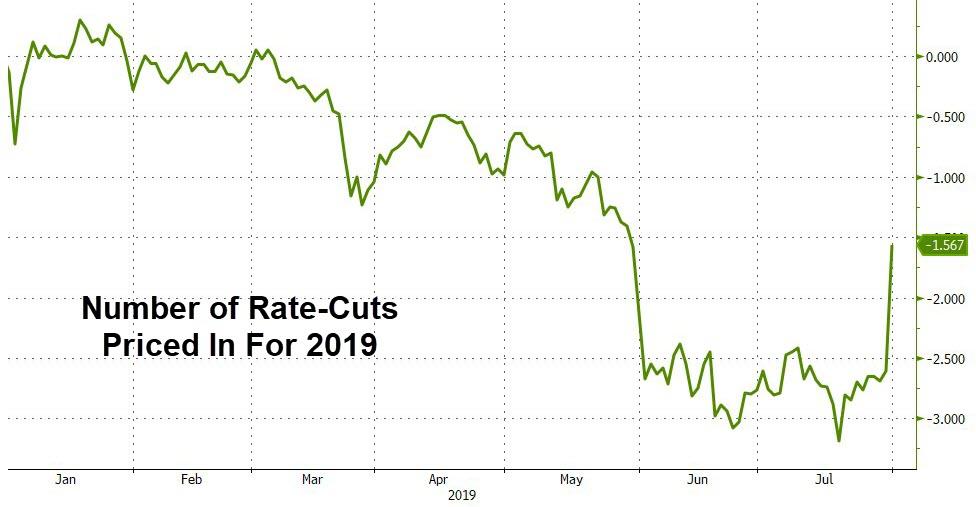

The market is still demanding 1.5 more rate-cuts by year-end…

Bonds (at the long-end) are rallying, along with the dollar and gold very marginally…

The long-end is rallying hard…

As the short-end sees yields rise…

With the yield curve flattening dramatically…

And stocks are down…

If stocks plunge here, Trump will slam Powell for not hiking 25 bps

— zerohedge (@zerohedge) July 31, 2019

Get back to work Mr. Powell

via ZeroHedge News https://ift.tt/31gfvIn Tyler Durden