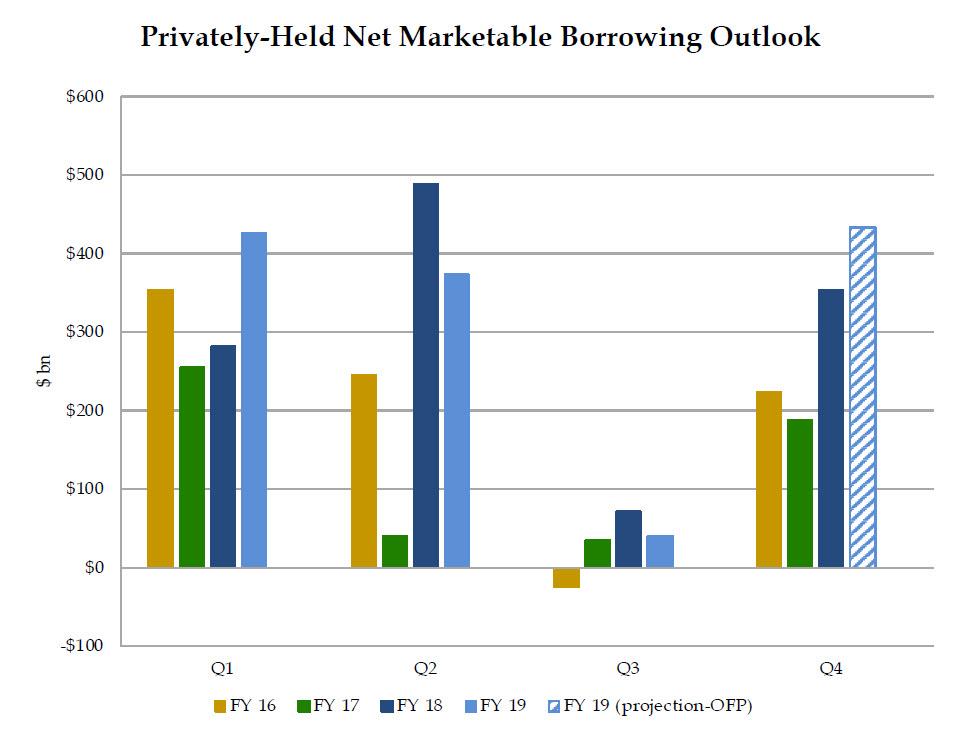

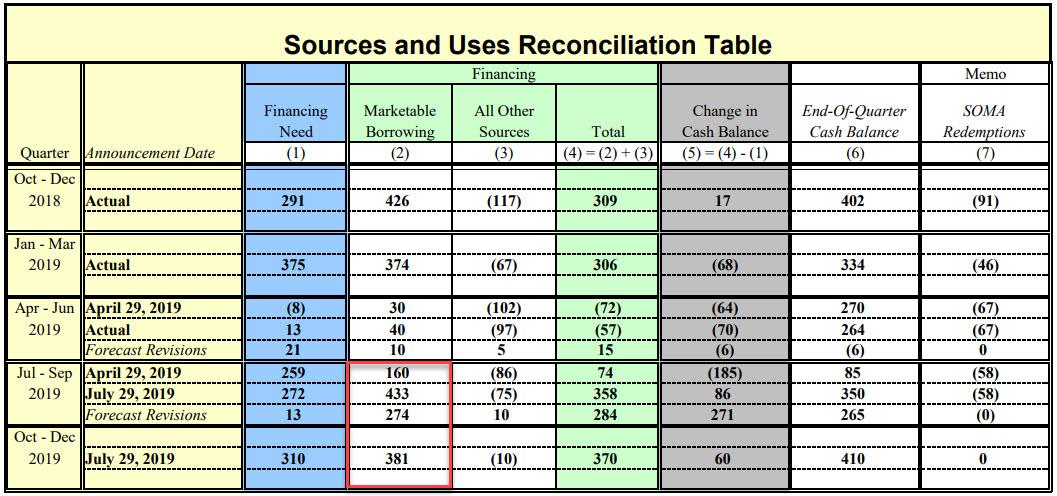

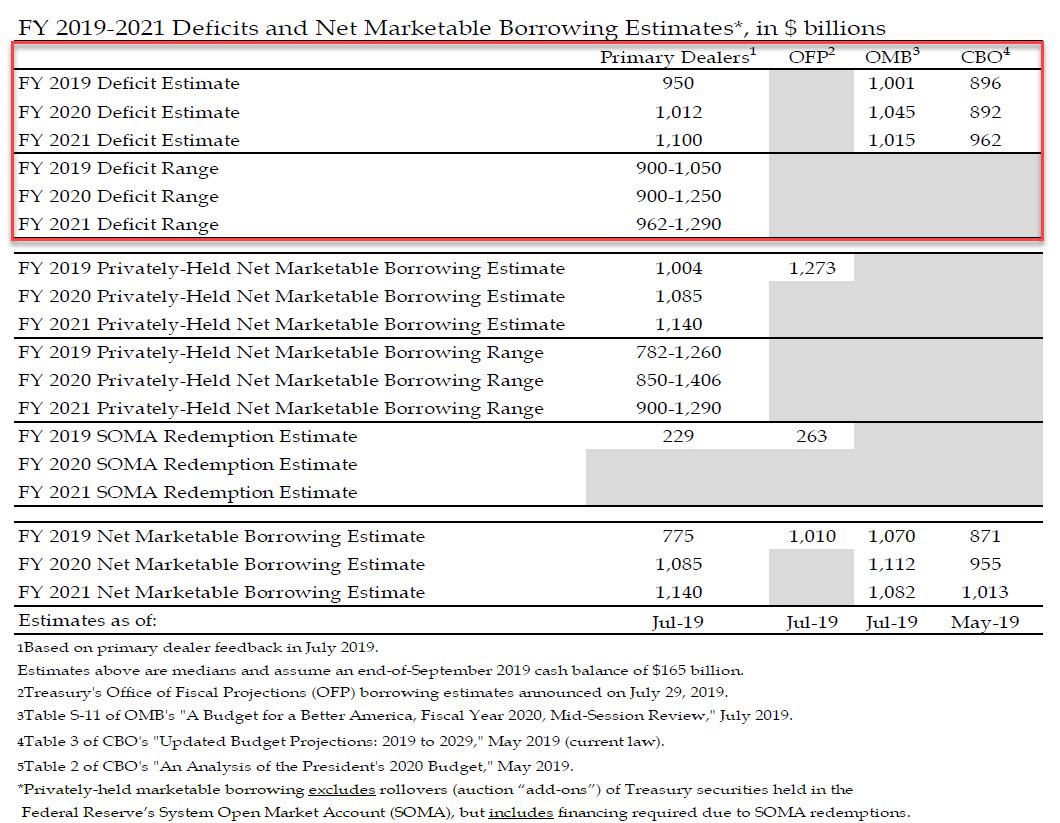

Two days after the Treasury announced that in the aftermath of the debt ceiling deal reached last week between Trump and democrats, it would rapidly rebuild its cash balance back up to $350 billion by borrowing a whopping $433 billion in debt in the current quarter…

… a massive $274 billion higher – or more than doubling – its prior forecast announced in April 2019…

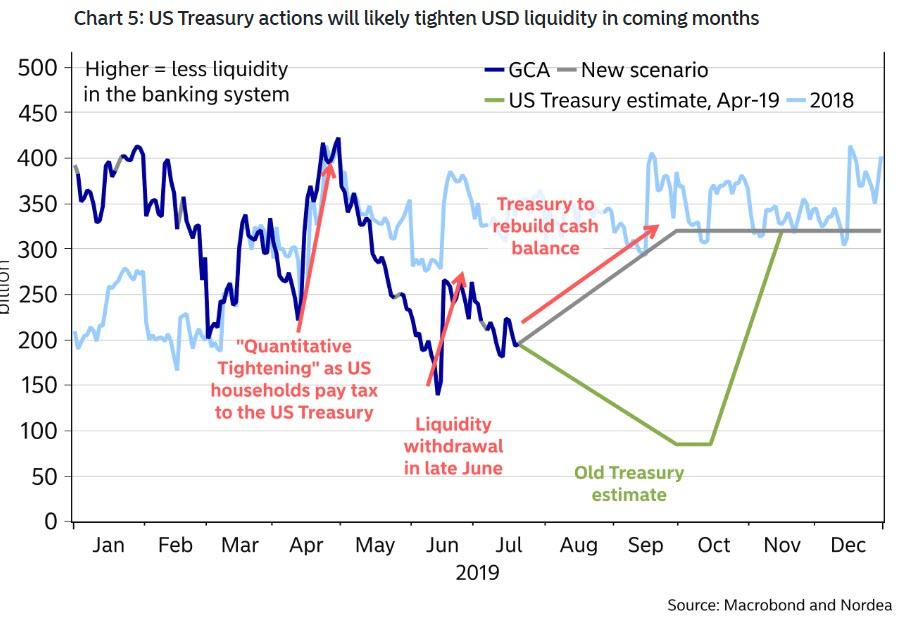

… in the process significantly tightening up liquidity in the banking system and potentially resulting in turmoil in funding and money markets as the world is flooded with an issuance of T-Bills…

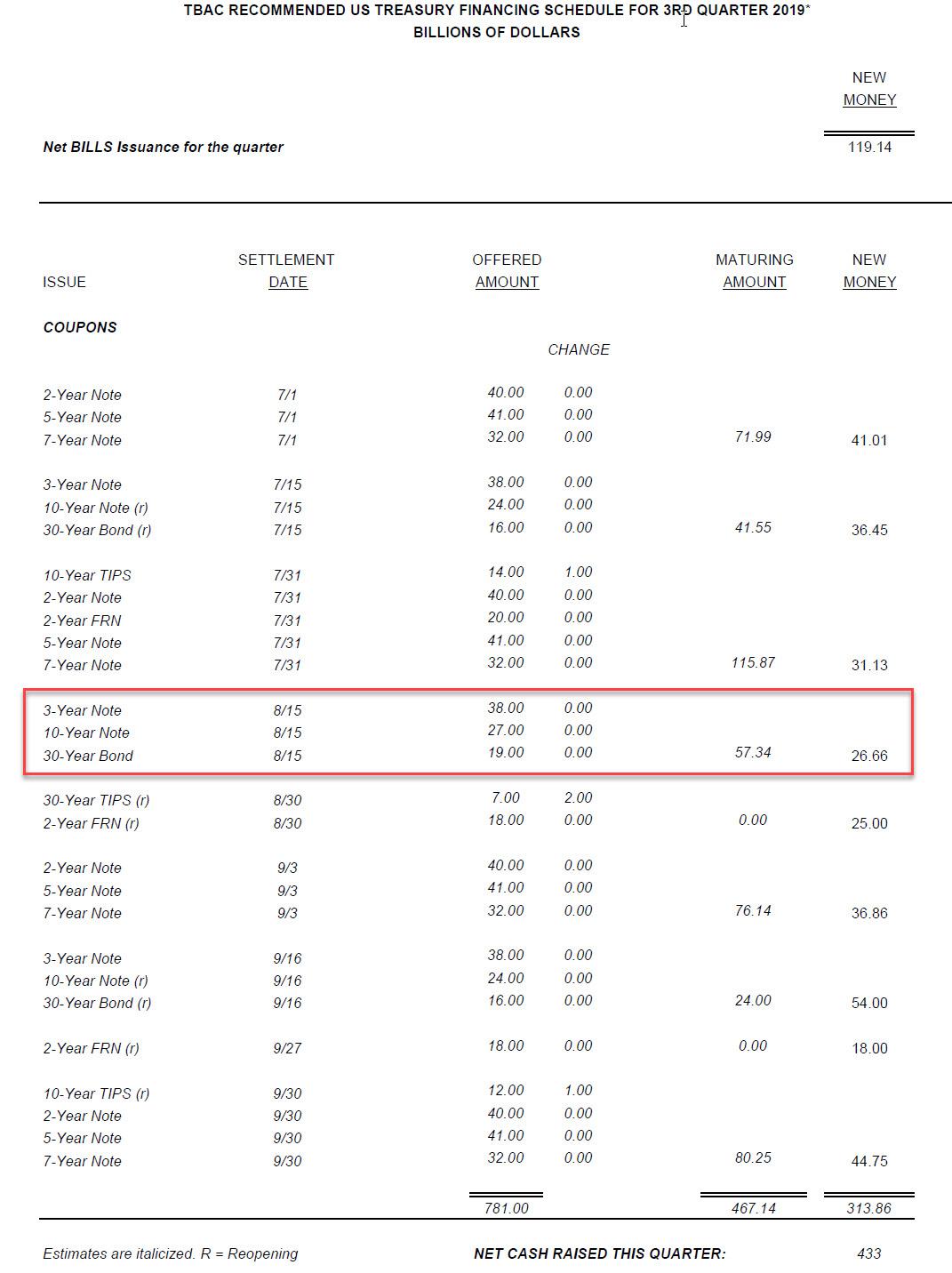

… the Treasury issued its quarterly refunding statement in which it revealed that it will keep its auctions of nominal coupon and floating-rate debt at a record this quarter as the US budget deficit continues to grow.

Specifically, the Treasury will offer $84 billion of Treasury securities – matching the amount sold in each of the last two quarters – to refund approximately $57.3 billion of privately-held Treasuries maturing on August 15, 2019, which will raise new cash of approximately $26.7 billion. The securities are:

- A 3-year note in the amount of $38 billion, maturing August 15, 2022;

- A 10-year note in the amount of $27 billion, maturing August 15, 2029; and

- A 30-year bond in the amount of $19 billion, maturing August 15, 2049.

The 3-year note will be auctioned on August 6, 2019, the 10-year note will be auctioned on August 7, 2019, and the 30-year bond will be auctioned on Thursday, August 8, 2019. All of these auctions will settle on Thursday, August 15, 2019.

The balance of Treasury financing requirements over the quarter will be met with the weekly bill auctions, cash management bills, the monthly note auctions, the August 30-year Treasury Inflation-Protected Securities (TIPS) reopening auction, the September 10-year TIPS reopening auction, the new October 5-year TIPS auction, and the regular monthly 2-year Floating Rate Note (FRN) auctions.

The US government is scrambling to finance a soaring budget deficit that is set to surpass $1 trillion in coming years as President Donald Trump is set to approve a bipartisan deal to suspend the debt limit until mid-2021 and boost spending. As a result, Wall Street analysts are predicting that auction sizes will need to be lifted again within about a year’s time. The deficit was $779 billion in fiscal 2018.

Meanwhile, commenting on the recent latest debt ceiling deal, members of the Treasury Borrowing Advisory Committee wrote to Steven Munchin that they were “pleased that you were able to negotiate a debt limit suspension bill with Congress well in advance of the deadline and are optimistic that the bill will become law in short order. It was noted, however, that this would mark the 7th debt limit suspension in less than 7 years.” and added that as debt limit suspensions expire, “Treasury has been required to employ extraordinary measures – increasing market volatility, operational risk and ultimately taxpayer cost.” And since the Committee strongly believes that “discussions on total borrowing are more appropriately considered when making appropriations rather than when funding previously approved appropriations”, the Committee “urged Congress to consider a repeal of the debt limit well ahead of the proposed 2021 expiration of the suspension.” Of course, that will never happen and instead there will be yet another debt limit suspension in due course, now that the debt limit has become nothing more than a farce.

Going back to the refunding announcement, the Treasury said it currently anticipates no further changes in issuance sizes for nominal coupon and floating-rate securities for the rest of the calendar year. The department also detailed changes to sales of Treasury Inflation-Protected Securities, or TIPS, over coming months as it continues plans it originally laid out last year to bolster its use of the securities.

Specifically, as Bloomberg notes, the Treasury said that it expects to increase the August TIPS 30-year reopening auction size to $7 billion, raise the September 10-year TIPS reopening auction size to $12 billion, and introduce the new October five-year TIPS at an auction size of $17 billion. The overall increases are consistent with the department’s prior guidance, the Treasury said.

Also of note was the discussion on potential turmoil to the money market as a result of the accelerated Bill issuances to rebuild cash balances, to wit:

A trimmed mean of primary dealer responses indicated that Treasury is anticipated to increase the supply of Treasury bills outstanding by $178 billion over the eight-week period following resolution of the current debt ceiling impasse. In comparison, primary dealers estimated market capacity to digest bill issuance without a significant price adjustment or deviation from fair value over the same period to be $210 billion. Furthermore, the primary dealers generally expected Treasury to resume meeting its cash balance policy at some point between September mid-month, related to the receipt of corporate taxes, and the end of the month. Committee members discussed the Treasury’s cash management policy, noting both the policy’s benefits related to risk management as well as the potential market disruptions that could occur if bill supply were increased too rapidly. Smith emphasized that Treasury carefully balances these considerations when making its issuance decisions. The Committee generally agreed that Treasury’s projected measured increases in bill supply balanced these factors well.

In other words, the Treasury doesn’t expect any disruption in money markets as a result of the planned increase in bill sales aimed at reaching the cash-balance goal. The net amount of bill sales at about $160 billion is seen as within the limits of what primary dealers have indicated the markets can handle and is less than what was issued following the previous suspension of the debt limit, according to an official who spoke to Bloomberg.

Finally, there was no mention of how the coming end to QT, or the Fed’s drawdown of its bond holdings, will affect debt sales. The Treasury also said it “continues to evaluate the possibility” of issuing a floating-rate security linked to the Secured Overnight Financing Rate, and here too no decision has been made. The government is interested in adding new securities that would bring in incremental demand for Treasury debt, Bloomberg reported.

via ZeroHedge News https://ift.tt/2ypea5B Tyler Durden