The FOMC will almost certainly cut the funds rate by 25bps to 2.00-2.25% today at 2pm. Whereas banks such as Goldman, BofA and Deutsche Bank expect a 25bp move – because virtually all of the signals from the committee point that way – there are several outliers, such as Morgan Stanley who are expecting the Fed to cut 50bps.

While the Fed leadership hasn’t taken a public position but seems to support 25bp privately, based on an article in the Wall Street Journal and an unusual statement by the New York Fed indicating that a (dovish) speech by President Williams was not a signal about the upcoming meeting. Other FOMC members are mainly debating whether to cut rates at all, with little overt support for 50bp. With that said, we cannot entirely rule out a 50bp move (for reasons listed yesterday).

Markets are currently priced for 30bp of easing, and this number could grow further on any significant disappointments in the economic data or adverse trade news before July 31. If so, the committee might be unwilling to deliver a large hawkish shock, given their apparent focus on bond market pricing.

So with that big picture out of the way, here is a snapshot of what Wall Street expects, courtesy of RanSquawk:

RATES:

The base case is a rate cut of 25bps, lowering the federal funds rate target to 2.00-2.25%, with the FOMC justifying the move as “insurance” to prolong US economic expansion amid global growth and trade uncertainties which continue to weigh on its outlook. Money markets still assign a negligible risk for a 50bps move, though it seems to lack widespread consensus among policymakers, particularly amid upside surprises in some key domestic data.

SIZE OF CUT:

The recent dovish remarks by Fed Vice Chair Richard Clarida and FOMC Vice Chair John Williams boosted expectations of a 50bps move, though pricing pared as the NY Fed walked back comments made by the latter, and analysts interpret the former as an argument for sooner rate cuts before data deteriorates, rather than aggressive rate cuts. A recent report said Fed officials were not prepared to cut by 50bps as recent economic developments were yet to signal an imminent downturn, sources told the WSJ, though these sources did suggest that the Fed could lay out potential stimulus beyond the July meeting. Voter Charles Evans said the argument between 25bps or 50bps of easing was a matter of strategy, while there could be further action ahead; fellow dove Bullard (who dovishly dissented at the June meeting, calling for a rate cut) noted his concerns on inflation and the yield curve for some time, but said 50bps might be excessive.

HAWKISH DISSENT:

In remarks just before the blackout window, voter Eric Rosengren said that as long as the economy continues doing well, accommodation was not needed, and he did not want to loosen policy if the economy is doing well without it; while voter Esther George said she saw nothing in the data to change her outlook, leaving scope for two possible hawkish dissents calling for rates to be left unchanged. George is almost certain to be the lone dissenting voice to today’s rate cut; if more than just one dissenter emerges, stocks will take it as a potentially hawkish surprise.

FUTURE CUTS

It is worth noting that Bullard, Clarida and Evans have all alluded to the ‘insurance’ rate cuts made by the FOMC in 1995 and 1998 as a potential blueprint; the Fed cut rates by 25bps three times during each of those episodes. Markets still expect further easing ahead, with 68bps of easing priced through the end of this year, and around 100bps of easing through 2020. The June ‘dots’ revealed that just under half of participants are comfortable with the notion of 50bps of further cuts through the end of the year. The statement could give a nod to that pricing by maintaining guidance that “the Committee will closely monitor the implications of incoming information for the economic outlook and will act as appropriate to sustain the expansion,” language that was inserted into the June statement to supposedly prepare for the July cut.

BALANCE SHEET:

There is a possibility the Fed might announce a sooner than anticipated end to its balance sheet normalisation plans, which will presently conclude in September (and then in October, the Fed will be a net buyer of between USD 10-20bln of Treasuries per month). Powell has previously indicated that the Fed would be prepared to adjust the run-off as necessary. Ending the run-off early would be bullish for Treasuries, TD Securities thinks, since USD 28bln of Treasuries within the Fed’s portfolio mature in August and September; if the runoff ended in July, it would result in USD 28bln of less supply for the private market to digest, TD explains, and additionally, MBS runoff would be reinvested in Treasuries, resulting in between USD 35-40bln of additional Treasury buying over two months.

STANDING REPO RATE FACILITY (SRF):

The June FOMC meeting minutes showed participants were briefed on a possible new repo facility which could allow the Fed to better manage the effective fed funds rate within the target range, preventing unusual spikes via providing incentives for banks to shift the composition of their portfolios of liquid assets away from reserves and toward high-quality securities. The Fed could use this help to boost liquidity conditions, however, desks have noted that the mechanics of setting up a repo facility will take time – it took over a year for the Fed to set up the reverse repo facility, for instance.

GOLDMAN UNCONVINCED

In a surprising dissent with the coming rate cut, in its preview of the FOMC decision, Goldman said that its own assessment “remains that the justification for rate cuts at the current juncture is tenuous in terms of the Fed’s own mandate.” We were unconvinced of the need for easier policy even at the time of the June 18-19 FOMC meeting, and virtually all of the information since then has come in on the stronger side. President Trump postponed the threatened tariff escalation versus China, all of the major economic reports—including payrolls, retail sales, the manufacturing surveys, core CPI, and UMich 5-10 year inflation expectations—have surprised on the upside, and financial conditions have eased further since the meeting. Our outlook for the next year is for real GDP growth in the 2%-2½% range, unemployment falling below 3½%, and core PCE inflation rising to 2%+.

In other words, when it comes to controlling the Fed, Trump now has more power than even Goldman, a historic regime shift in its own right.

For those wondering what a 25bps rate cut Fed statement will look like, here is Goldman’s take on how the Fed statement changes will look like:

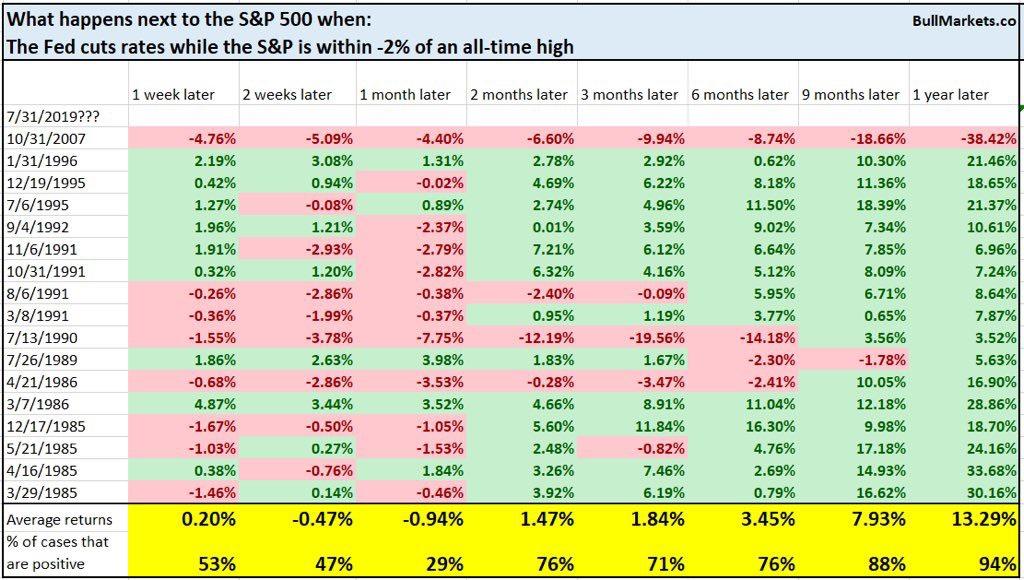

Finally, some historical trivia: courtesy of bullmarkets.com, here is a look at what happened in the past when the Fed cut rates with the S&P within 2% of all time highs.

via ZeroHedge News https://ift.tt/2GG5pIJ Tyler Durden