The global smartphone bust is currently underway (has been for some time) – but there’s a new, surprising trend that could highlight one reason why the Trump administration has waged economic war against China.

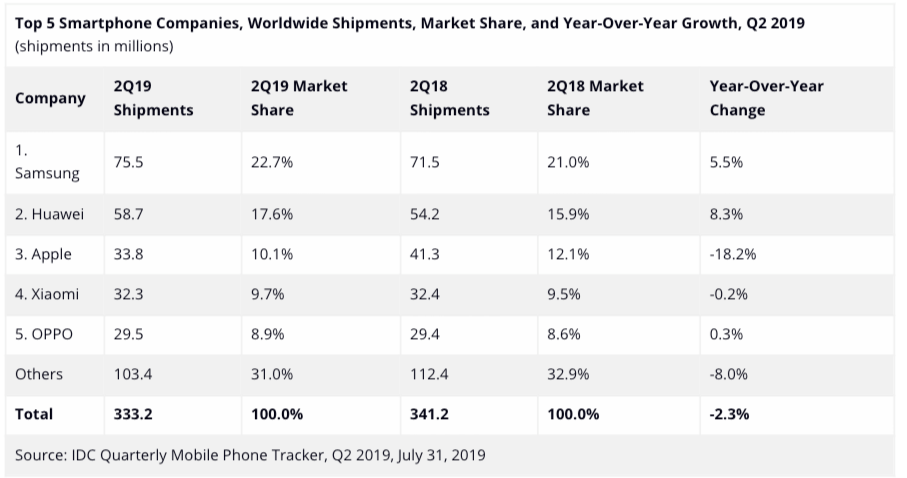

First, let’s start with the global smartphone shipment data from the International Data Corporation (IDC) Worldwide Quarterly Mobile Phone Tracker.

This new data details how worldwide smartphone shipments fell 2.3% in 2Q19 YoY. It also states that smartphone manufacturers shipped 333.2 million phones in 2Q19, which was up 6.5% QoQ.

An escalating trade war between the US and China contributed to sharp declines in shipments in both countries over the last year. However, the declines weren’t nearly as severe as expected in China over 1H19 versus 1H18, suggesting that three years of a smartphone bust in Asia could be nearing a recovery phase. Asia/Pacific (excluding Japan and China) maintained solid momentum in 2Q YoY, with shipments up 3% in the quarter fueled by Southeast Asia markets.

The surprising trend IDC detected is that Huawei surpassed Apple in 2Q19, making it the first time in seven years that Samsung and Apple weren’t the top smartphones manufactures in the world.

Now it seems that a South Korea company [Samsung] and a Chinese company [Huawei] are the world leaders in smartphone shipments, something that has irritated the Trump administration.

Samsung ranked No.1 with 75.5 million shipments in 2Q19, a 5.5% YoY increase. Huawei was No.2 with 58.7 million shipments in 2Q19, a 8.3% YoY jump. Apple was No.3 with 33.8 million shipments in 2Q19, a -18.2% YoY plunge.

“Despite a lot of uncertainty surrounding Huawei the company managed to hold its position at number two in terms of market share,” said Ryan Reith, program vice president with IDC’s Worldwide Mobile Device Trackers.

“When you look at the top of the market – Samsung, Huawei, and Apple – each vendor lost a bit of share from last quarter, and when you look down the list the next three – Xiaomi, OPPO, and Vivo – all gained. Part of this is related to the timing of product launches, but it is hard not to assume this trend could continue.”

IDC Smartphone Company Highlights:

Samsung

Samsung maintained the top position in the market for 2Q19 and returned to annual growth of 5.5% with a total of 75.5 million smartphones shipped. As noted in its recent earnings call, the company struggled to sell flagship devices as many consumers are holding onto devices longer than ever and opting for a less expensive replacement option. The pending announcement of the next Galaxy Note device likely held off some of those that are loyal to the brand. Meanwhile, Samsung’s A-series devices did well in the quarter, particularly the A50 and A70.

Huawei

Huawei saw its shipment volumes decline 0.6% when compared to 1Q19, which could be regarded as better than expected given U.S.-China trade tensions. Shipment volumes in China hit an all-time high and accounted for 62% of Huawei’s 2Q19 total with 36.4 million units. The China success during the quarter was in part due to actions taken following the US trade ban as Huawei relocated significant human resources back to China with a focus on distribution channel management in the Chinese lower-tier cities. The P30 and P30 Pro, which launched in mid-April, also had a relatively good reception as its predecessor, P20 series, had created a positive ripple effect.

Apple

Apple shipped 33.8 million new iPhones during 2Q19, which was down significantly from the same quarter a year ago. However, when factoring in the success of the iPhone upgrade program as well as Apple’s ability to sell more refurbished iPhones through its channels, the argument can easily be made that its position in the market is still dominant. Regardless of slightly lower market share and device selling prices, as pointed out in yesterday’s earnings call, the iPhone installed base continues to grow. So irrespective of the hardware – as a new iPhone, an older model, or a refurbished product – the expansion of iOS users is what appears to matter most going forward.

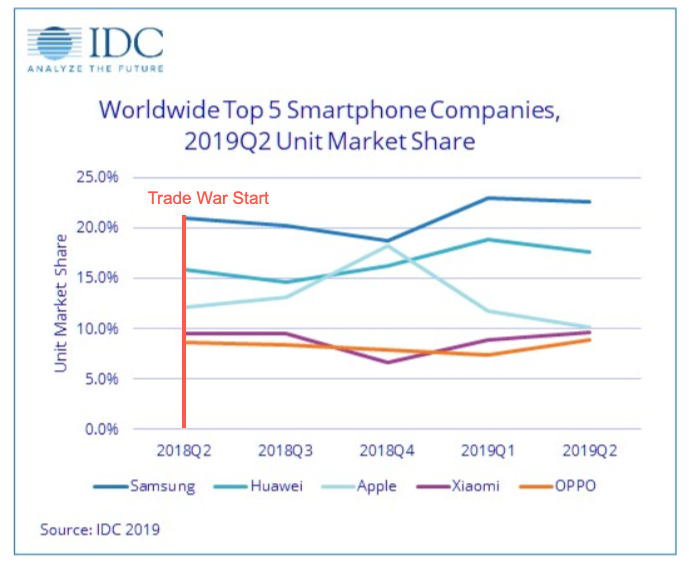

IDC provides a clear chart that shows from when the trade war started — Apple lost global market share while Samsung, Huawei, Xiaomi, and OPPO either gained or held their respected market share.

Apple being displaced as No.2 smartphone manufacturer in the world by a Chinese company suggests one reason why the Trump administration has waged economic on the Shenzhen-based smartphone manufacturer.

Trump is acting like he holds all the cards in the trade war, and as we explained earlier: “he doesn’t.” Apple will continue to hemorrhage global market share as Chinese and South Korean smartphones are dominating Asia and Europe. Apple is a dying fad, more importantly, the American global dominance is a dying empire.

via ZeroHedge News https://ift.tt/2SXlezA Tyler Durden