Authored by Mark Cudmore via Bloomberg,

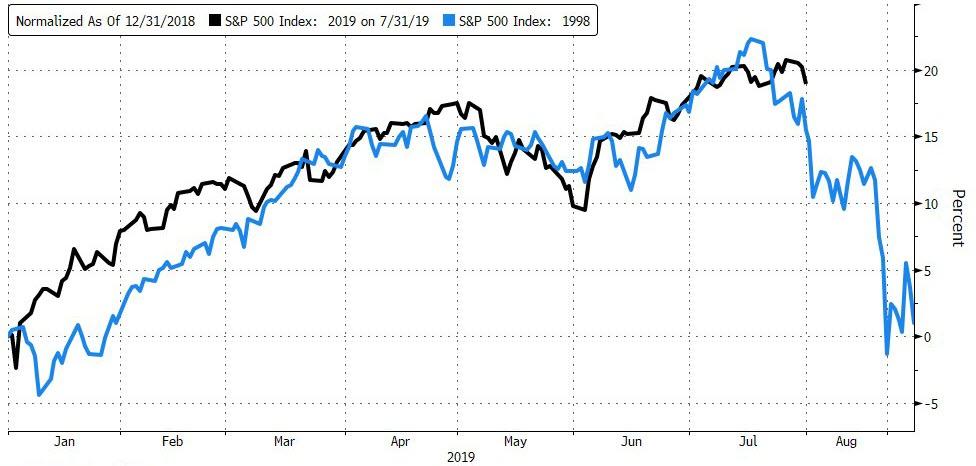

July may be about as good as it gets for the S&P 500, as all of the potentially positive catalysts appear to be behind us.

So much noise and effort, and yet the S&P 500 struggles to gain much ground. The month started with trade optimism before easing hopes were added. We then got a narrative that the U.S. economic data was surprisingly resilient and corporates were still making money.

There’s a great statistic that the S&P 500 was never negative on the month for a single second of July and yet it only gained a total of 1.3%. In fact, it’s not even 1.2% above where it closed three months earlier.

That’s what happens when an already expensive asset is then priced optimistically for all the major risk events. Good news doesn’t help it much.

On Monday last week, I listed the five upcoming potential positives cited by bulls:

-

a 50 basis points cut by the Fed,

-

a surprise ECB cut,

-

a U.S.-China trade deal,

-

a surprisingly strong earnings season,

-

and investors not being sufficiently long stocks.

The first three didn’t transpire.

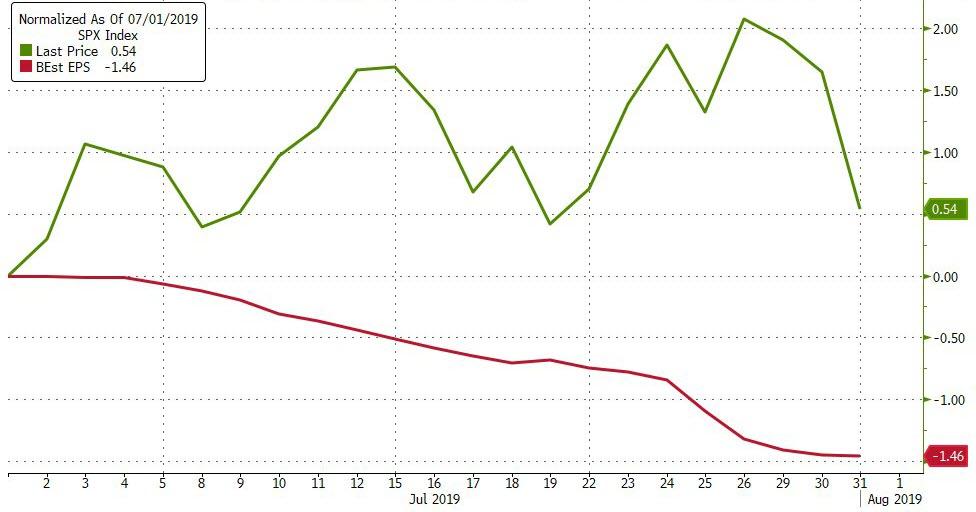

Earnings have been OK but forward guidance has been very negative, causing 3Q estimates to fall — it’s now expected to be the first quarter of shrinking profits for S&P 500 companies since 2015.

And the price action makes abundantly clear that few investors feel underexposed and compelled to buy the index. There’s been no threat to the top-side danger levels (3065 and 3105) outlined a few weeks ago.

The sharply flattening yield curve suggests many bond investors think the Fed is overly complacent over the economy.

That means we may be about to enter the next phase of the equities reaction function to data — where bad news is very bad for stocks, while marginal data beats don’t provide much relief.

via ZeroHedge News https://ift.tt/2OzMTbx Tyler Durden