If there is anything today’s violent reversal in the market demonstrated, where this morning’s inexplicable levitation (well, maybe explicable now that “terrible news is great news” again) was smashed with stocks plummeting once Trump tweeted that the China trade war ceasefire is dead, and the US would impose “a small additional Tariff of 10% on the remaining 300 Billion Dollars of goods and products coming from China into our Country”, it is that algos, quants, and systematic funds remain the marginal price setters of the US stock market.

Indeed, as Bloomberg’s Andrew Cinko said when commenting on today’s early morning levitation, it “looks more like it’s being driven by ETF flows or perhaps quant- or multi-strategy firms. That’s money that tends to go out as quickly as it came in, leaving the S&P vulnerable to a reversal as the bid dissipates.” Ironically, just minutes later we got definitive proof of just how fast the passive, or algo money, flees in the milliseconds following Trump’s tweet.

So with the question of who did all the buying and subsequent selling today laid to rest, it makes further sense to ask what happens next, now that the ETFs, quants and generally math PhDs are in charge.

Well, according to Nomura’s quant insight team led by Masanari Takada, the answer is nothing good.

As Takada writes in his FOMC post-mortem analysis, he notes that in his baseline scenario, he expects selling of equities by CTAs and other such market participants “to not go beyond the clearing out of long positions; we would not expect these investors to start staking out new short positions unless the US economy were to suffer an obvious loss of momentum.” Which is precisely what Trump’s restart of the US-China trade war virtually assures.

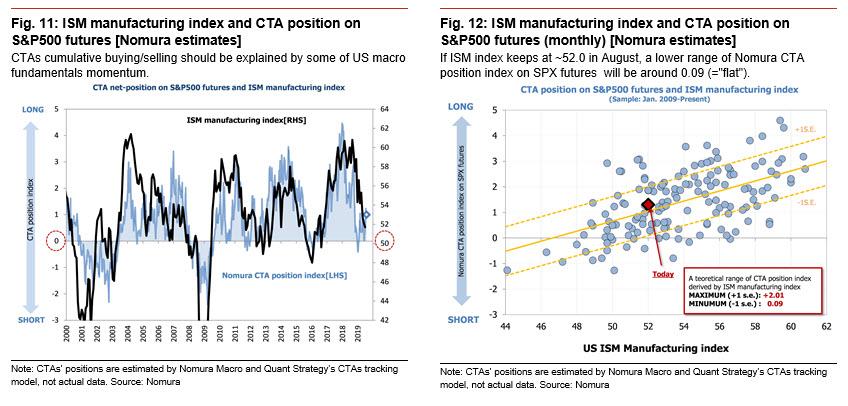

Looking over the positioning of various speculative traders, Nomura says that it appears that the selling of US equities has been led by trend-following algos (CTAs, risk-parity funds). For the moment, then, the selling thus appears to be mostly technically driven.

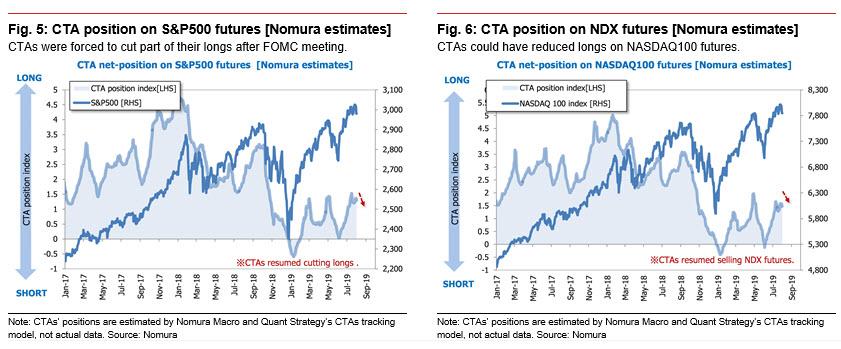

As the Nomura quant notes, “trend-following CTAs seem to be prioritizing exits from long positions in US equity futures. Having recently built up sizable net long positions in both S&P 500 futures and NASDAQ 100 futures, CTAs are now paring those positions in response to uptick in volatility and shift in market tone that followed the FOMC meeting.”

However, the selling by CTAs is as of yet just a matter of profit-taking. According to Takada, the average break-even line for CTAs’ net long position in S&P 500 futures is at around 2,960, below which the selling will accelerate in linear fashion. Which is precisely where the S&P is trading as of this moment.

Furthermore, the net long position itself is only about 15% smaller now than it was at the most recent peak on 16 July. Similarly, CTAs’ net long position in NASDAQ 100 futures breaks even at around 7,220 on average, and the position has shrunk by only around 11% since the 11 July peak.

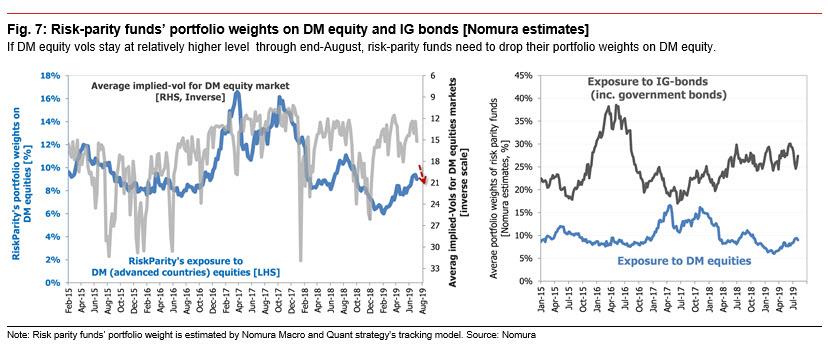

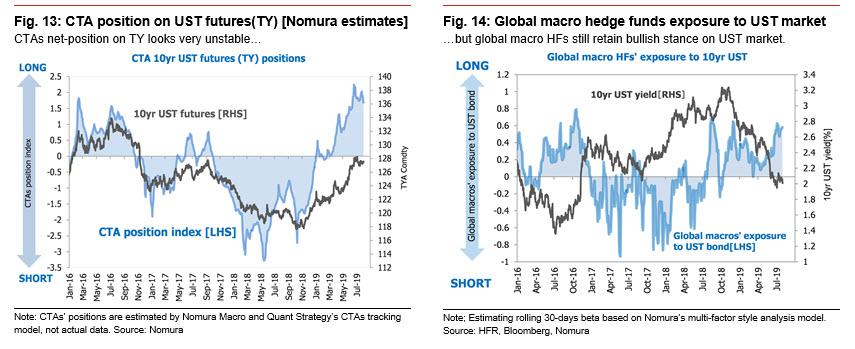

Risk-parity funds are mostly waiting out the rise in volatility in DM equity markets, although they are slightly more inclined to sell than to buy. However, if stock market volatility were to rise in a more pronounced fashion in August, Nomura is certain that they would likely take urgent steps to rebalance their portfolios by selling equities and buying bonds.

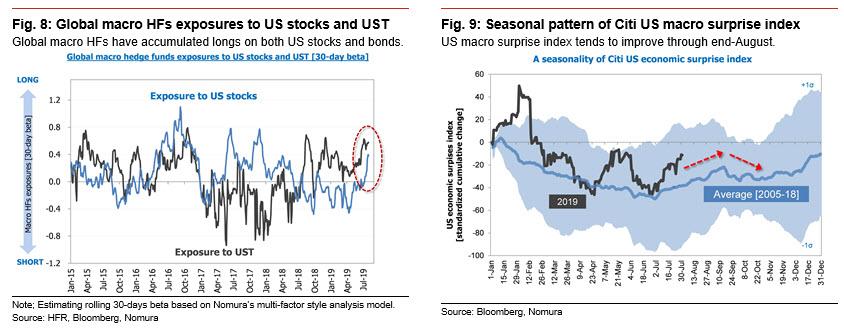

Meanwhile, when looking at global macro hedge funds, as of August 1st, it still seems possible that the steep drop in US equities will turn out to be just a matter of temporary undershooting, but what happens over the next two or three days should bring some clarity. Of particular importance is whether global macro hedge funds and other fundamentals-oriented investors pile in to buy a perceived dip in US equities over the next few trading days.

While fundamentals-focused global macro hedge funds seem to still be bullish on US equities, their swing to bullishness in July can be explained by a combination of the dovish turn that the Fed took in June and the improvement observed in the US economic surprise index.

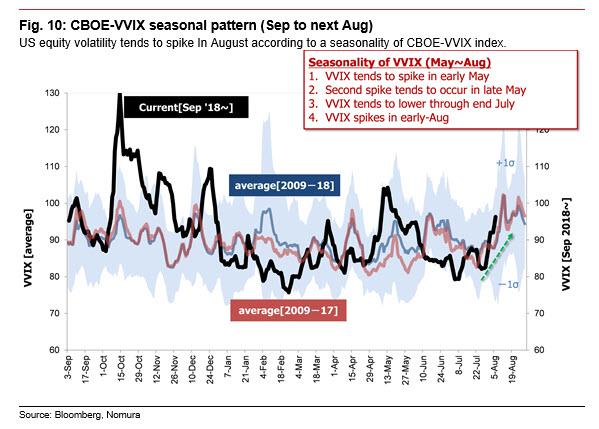

Yet, despite looking bullish on US equities now, macro-oriented market participants that had latched onto the dovish tone that the Fed struck in June may take the July FOMC meeting outcome as a reason to become less optimistic about US equities. If the market loses some of the buying support it has been getting from macro-oriented funds and longer-term investors, systematic selling pressure could gain the upper hand for a while. In that event, the US stock market as well as the global stock market could, true to form, be faced with the customary August volatility shock.

So once the stops are taken out, Nomura then sees the S&P 500 being taken down into the 2,850-2,900 range. Meanwhile, Takada also warns that “the US rates market may well start moving in a way that pressures the Fed to cut policy rates again in September”, a way such as this for example, which saw the 2Y yield plummet after the Trump tweet…

… lending indirect support to the US stock market.

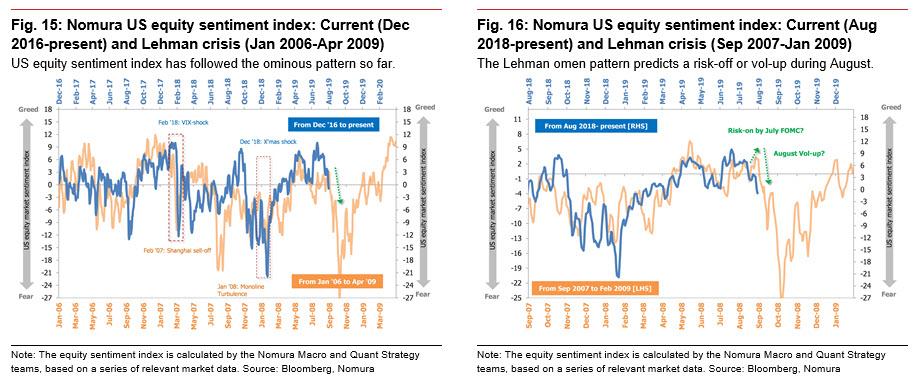

And here comes the punchline, because according to the Nomura quants, “if the latter half of August brings increasingly clear signs that the pick-up in US economic indicators is running out of steam, there could be a global run of stock-selling by CTAs and fundamentals-oriented investors alike.” In that event, Takada believes there would be a plausible tail risk of US stocks sinking into crisis-driven market conditions in September comparable to those that prevailed at the time of the Lehman crisis. If this were to happen “the Fed, having fallen behind the curve, would be dragged into making an emergency rate cut of at least 50bp.“

Some more details on how this August risk off/September crisis scenario would look like:

Fluctuations in CTAs’ net long position in S&P 500 futures tend to be restricted to a range that is consistent with US economic growth momentum. Although CTAs’ trades are driven by technical considerations in the short term, it appears that they seldom stray far beyond the constraints imposed by fundamentals over the longer term. The US ISM Manufacturing PMI for July came in just below expectations, but because it held near the same level in August, Nomura estimates that CTAs’ net position in S&P 500 futures (indexed) should fall in a range with a lower end of 0.09, still in net long territory. In other words, selling of equities by CTAs will go no further than the complete liquidation of outstanding longs, provided that there is no clear downward break in US economic growth momentum.

Incidentally, just prior to the FOMC meeting, CTAs had been leaning towards closing out long positions in 10yr UST futures (TY). However, the average cost of CTAs’ recently accumulated longs corresponds to a 10yr UST yield of around 2.06%, so we yields below this would not be conducive to such selling.

So having gone over NOmura’s baseline forecast scenario, Takada lays out the risk scenario, which in the aftermath of Trump’s tweet, now appears will come true as any hope of a trade deal between the US and China has been crushed. According to the Nomura quants, if the latter half of August brings increasingly clear signs that the pick-up in US economic indicators is running out of steam, fundamentals-oriented investors could well decide to join CTAs in selling off stocks. In this scenario, Nomura warns that “the possibility of US stocks sinking into crisis-driven market conditions in September comparable to those that prevailed at the time of the Lehman crisis stands as a plausible tail risk.“

Nomura concludes by noting that if this were to happen, the Fed, having fallen behind the curve, would most likely be dragged into making an emergency rate cut of at least 50bp.

The problem is that – just like during the financial crisis of 2008 – by then it would be too late to stop what may soon be the biggest crash in capital markets history.

via ZeroHedge News https://ift.tt/2ytL9FV Tyler Durden