Adjust your tin-foil-heat for one second but we can’t help but wonder if this is President Trump calling Fed Chair Powell’s bluff over an “extended easing cycle.” Trump quickly realized after yesterday’s Powell performance that he just needs to destabilize China for The Fed to keep cutting (or cut rate quicker).

Trump’s action sent September rate-cut expectations to 95% (from 61%)…

And the market’s expectation has shifted dramatically dovish from 1.5 rate-cuts in 2019 to 2 rate-cuts…

Dismal ISM and Construction Spending data sparked a rally in bonds and stocks this morning (because bad news is good news as it forces Powell’s hand to tilt more dovish), but then Trump surprised with new broad tariffs on China imports and that sent stocks, yuan, oil prices, and bond yields crashing.

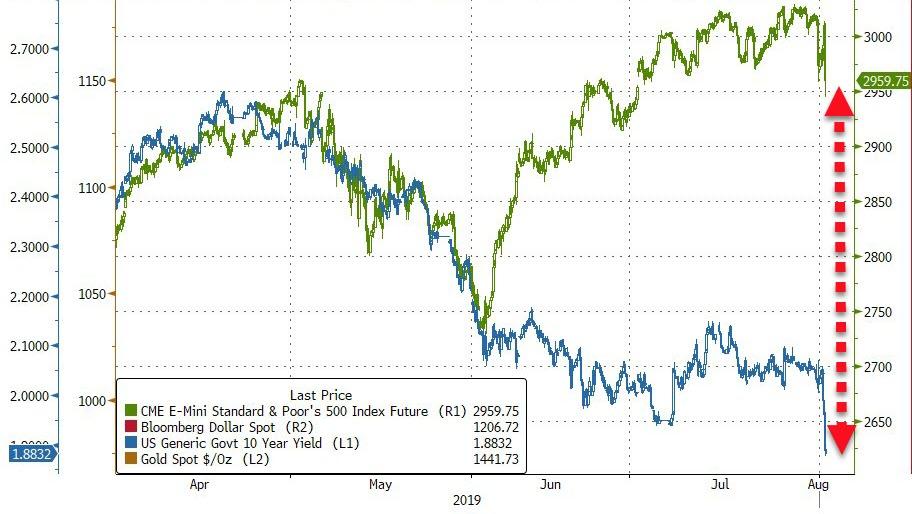

Bonds & Gold (and the dollar) are best post-Powell/Trump with stocks down…

US equities are all down hard… Trannies are the weakest with the rest of the majors down around 2% post-Powell and Trump…

Dow futures swung 600 points from high to low…

As expected, cyclical stocks were hammered on the trade headlines…

FANG Stocks were ugly…

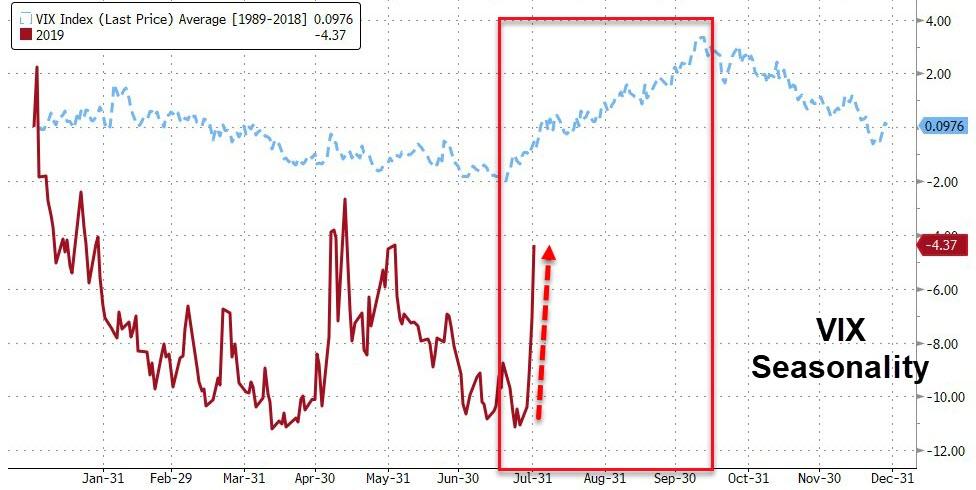

VIX surged intraday to 19.00 – its highest since the start of June…

And the seasonal surge in risk has only just begun…

And the VIX term structure has shifted dramatically…

Credit markets shit the bed today…

The jaws of death were starting to narrow until Trump sent yields crashing…

Bond bears were battered (short-end outperformed the long-end – 2Y down 17bps, 30Y down 10bps)…

10Y Yields crashed to their lowest since before the Trump election…

2Y Yields collapsed (down over 25bps from yesterday’s highs)…

The yield curve (3m10Y) collapsed…

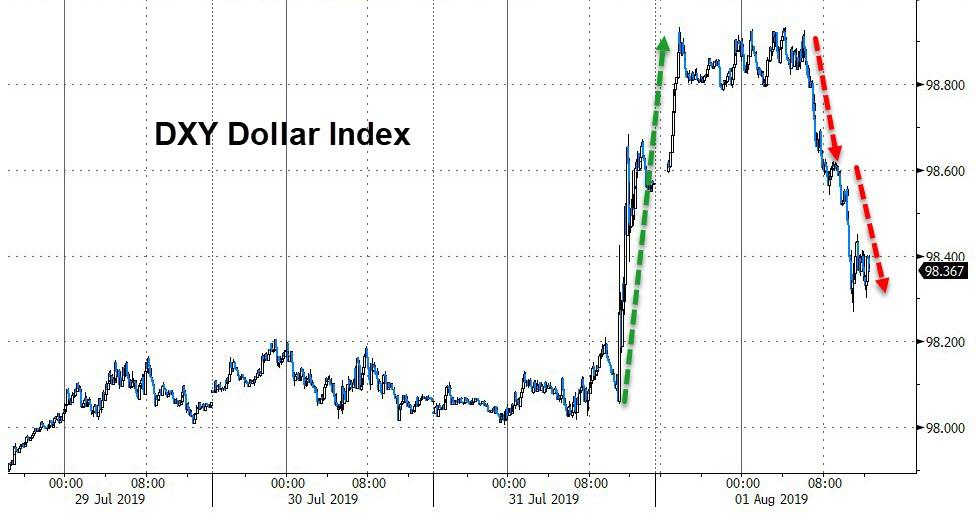

The dollar dumped on dismal data (more easing) and then again on Trump tariffs…

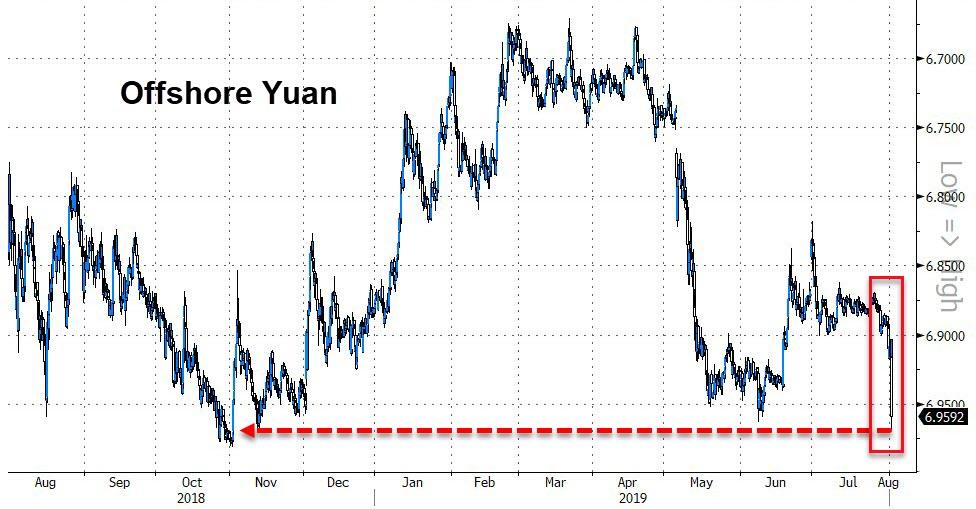

Yuan was clubbed like a baby seal (plunging almost 7 handles!), crashing to its weakest against the USD since Oct 2018…

Gold in sterling surged to a record high…

Bitcoin surged back above $10,000…

But Litecoin is leading on the week…

WTI plunged and gold surged as Trump’s tariff headlines hit…

Oil prices utterly collapsed – with WTI crashing 8% – the biggest drop since Feb 2015…

Spot Gold was just about to test $1400 when the dismal data hit this morning and then accelerated higher on the Trump Tariff headlines…

Gold has outperformed Silver for the last few days…

Gold and Bitcoin rallied as the global volume of negative-yielding debt tops $14 trillion (and that is before Europe opens)

Finally, as Nomura’s Charlie McElligott noted earlier…

“I wonder how many times the Fed knew they were embarking on a massive easing cycle when they made their first cut. My guess is not many.”

Not many indeed.

And as a reminder, Gluskin Sheff’s David Rosenberg reminds us that:

“Only one other time has the market declined the day of the first rate cut — in October 1987. Thanks for the walk-back, Jay!”

Trade accordingly.

via ZeroHedge News https://ift.tt/2GG2ksm Tyler Durden