Authored by Richard Breslow via Bloomberg,

There are clearly a lot of disgruntled traders out there. They’ll get over it. As soon as their positions get back to where they want them and make some decisions about how much they, as members of the collective group of investors, want to be engaged in the tricky month of August. This will happen sooner than thought. Although, ironically enough, there will be an ongoing yearning to receive greater clarity from Fed speakers. Which is the last thing anyone should expect. I suspect market commentators will take longer to regain their equilibrium.

It’s probably overly-harsh to rake Chairman Jerome Powell too much over the coals for a less-than-spectacular performance at the press conference. He didn’t have a lot to work with. He had to be the voice of an obviously divided committee. The meeting minutes will be more than anxiously anticipated. Try not to be disappointed. Events could make them out of date very rapidly.

But, make no mistake, the short-lived market mayhem wasn’t just an overreaction to the “mid-cycle adjustment” line. That was merely an unfortunate necessity to appease the dissenters and fence-sitters. And, perhaps, a reminder to others that he views only financial conditions indexes as having the right to threaten their institutional independence.

The scramble was caused by having too many traders skew their books in response to the recent comments made by New York Fed President John Williams. The subsequent clarification fell on many a deaf ear.

He slipped up. But it wasn’t by letting the cat out of the bag. And those with positions who got their game theory wrong all had to try to right themselves using the same pool of late-day liquidity. A very small taste of what can happen when everyone is the same way around.

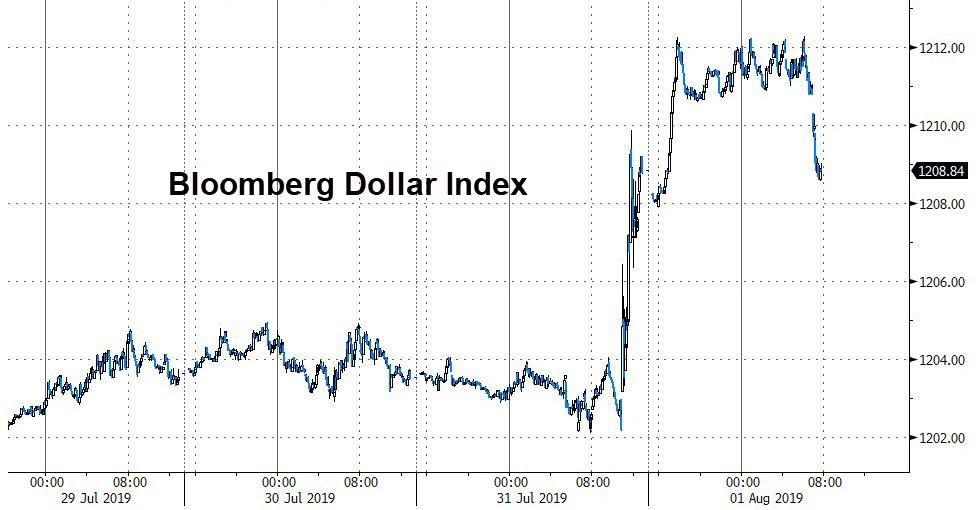

Now, traders will have to decide if they want to further liquidate their marginal positions, sit tight or add at better levels. And, while it is comforting to assume option number two will be the clear choice, we first need to see how this dollar break-out plays out. Especially as it broke through resistance on the last day of the month. Technical analysts will be salivating. In any case, we all know where the stops will be if it corrects back lower.

While the damage done in equities, fixed income, credit and commodities has been minimal, if over-hyped, they won’t be able to indefinitely ignore an ever strengthening dollar. Emerging markets look to be the most immediately affected and are definitely looking queasy. They should be front and center, along with the dollar, on all traders’ screens. No matter what you trade. Because we all are in never-ending search for tells and canaries.

Should the dollar continue on its way, it will ultimately affect everything else. Perhaps even your central bank. Not to mention, there are an awful lot of portfolios structured around the assumption of a weaker dollar. Throw in a growing dollar funding squeeze and things could get very interesting… in the Chinese curse sense of the word. When the currency gets up a true head of steam, it takes a lot more than simple verbal intervention to turn it around. Which is why this is all unlikely to be a one-day phenomenon.

Meanwhile, there will be some important economic releases over the next two days. And while it is tempting to think they have been put on the back burner given yesterday’s events, that couldn’t be further from the truth. The second guessing game aside, the dollar is in play. Which means it will respond to the results. And how it does react will necessarily influence the portfolio allocation decisions that will define trading imperatives across the whole spectrum of assets.

via ZeroHedge News https://ift.tt/2Ztc14A Tyler Durden