Yesterday, when presenting Goldman’s preview of what the Fed would likely say in its historic statement (which turned out to be spot on) we highlighted the bank’s surprising dissent with the coming rate cut, because as Goldman’s chief economist Jan Hatzius said, the bank’s own assessment “remains that the justification for rate cuts at the current juncture is tenuous in terms of the Fed’s own mandate” adding that he was “unconvinced of the need for easier policy even at the time of the June 18-19 FOMC meeting, and virtually all of the information since then has come in on the stronger side.”

Overnight, it its post-mortem of what the Fed did say, Goldman doubled down in its role as the leader of the Fed’s hawkish #resistance, and as Jan Hatzius explained, while the bank expects a second cut at the September meeting, “we continue to see little need for it.” Here’s why:

In recent research, we have shown that uncertainty is not actually particularly high and capex expectations are not particularly depressed; that the role of manufacturing in the economy is overemphasized; that cutting when financial conditions have already eased considerably does not reduce downside growth risks by much.

Goldman’s biggest criticism of what the Fed just did – in addition to crushing its credibility and eroding its “independence” as Chris Rupkey noted last night – is that “aggressive “insurance cut” policies do not actually reduce the frequency of recessions because of the risk that unnecessary easing depletes the central bank’s ability to respond to future downturns.“

Goldman’s mini rant aside, the bank goes on to note that it saw the results of Wednesday’s meeting as consistent with its baseline expectation “that easing will end with a second 25bp cut, for a total funds rate recalibration of 50bp” and sees a

- 55% chance of a 25bp cut in September,

- 5% chance of a 50bp cut,

- 40% chance of no cut.

… for an 80% cumulative probability of another cut at some point this year. To be sure, a second cut in September would provide continuity according to Hatzius, and complete the desired recalibration sooner, and would come ahead of a likely rebound in core PCE inflation in the August report that will not yet be available. However, as the Goldman economist notes, “timing the second cut later in the year would allow Fed officials to get a better sense of how the current risks will play out.”

In any case, the market saw Powell’s statement as a hawkish rate cut, and as Goldman notes, the FOMC statement introduced a bit more ambiguity about a possible second cut in September by slightly watering down its policy guidance to “act as appropriate” with the preface, “As the Committee contemplates the future path of the target range for the federal funds rate.” Moreover, it downgraded the promise to “closely monitor” developments to a weaker “continue to monitor…”

Powell also made several comments about the FOMC’s broader intentions that tempered market expectations for a deeper cutting cycle somewhat. Powell described the Fed’s strategy as “a mid-cycle adjustment to policy” and said three times that the FOMC was aiming to adjust policy “to a somewhat more accommodative stance,” adding “over time” in the last instance. He also clarified that the FOMC does not expect a rate cutting cycle that goes on for a long time because it does not see “real economic weakness” or expect “a recession or a very severe downturn.”

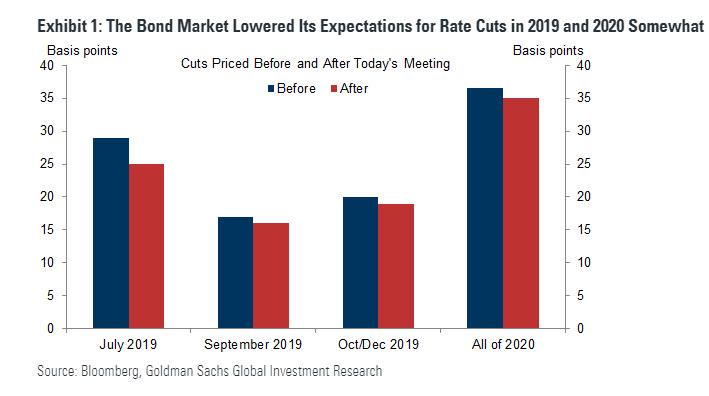

As a result, the new guidance about both September and the total intended recalibration of policy “came as a moderate hawkish surprise to bond market expectations” and total pricing of rate cuts through the end of 2020 in the fed funds futures market declined by about 8bp in total.

Finally, in response to the question that inspires dread among traders: “What would it take for the FOMC to not deliver a second cut at all?”, here is Goldman answer:

Like a couple of the journalists who asked questions today, we are admittedly less clear about the Fed’s reaction function than in the past. But we suspect it would likely require steady growth numbers, a sizeable move up in inflation to a level close to target, and a significant reduction in trade tensions.

So for Trump, who desperately wants more rate cuts, the playbook is clear – do everything that would ensure more rate cuts, i.e. smother the economy… but not too much.

Finally, Goldman hinted at the one wildcard that could force the Fed to cut more:

“We also see risks in the other direction, especially on a significant escalation of tariffs against China.”

So if an acceleration in the trade war with China is what the Fed will need to cut more, it’s pretty clear what that means for the chances of any trade deal between Washington and Beijing.

via ZeroHedge News https://ift.tt/2yuY6zi Tyler Durden