Fishing for some fascinating trivia about the “New Abnormal” period we live in? Here are ten remarkable observations from BofA’s Micharl Hartnett that demonstrate that we live in a time like no other.

- Fed cut makes it 729 global central bank cuts since Lehman bankruptcy.

- Soaring US consumer confidence at highest level vs. plunging German business confidence since Q4’98…when Fed cut rates “mid-cycle” igniting bubble of ’99.

- EM equities at lowest level vs. US equities since 2003…China weak, US$ strong.

- Wall St (US private sector financial assets) now 5.5x the size of Main St (US GDP)… between 1950 & 2000 the norm was 2.5-3.5x…Wall Street is now “too big to fail”.

- Global debt now 3.2x the size of global GDP, an all-time high.

- Fresh China tariffs in Sept would raise average US tariff on total imports to 5.6% from 4.5%, highest since 1972…was 1.5% before Trump.

- US companies spent $114 on buybacks for every $100 of capex in past 2 years… between 1998 & 2017 they spent $60 for every $100 of capex.

- Inflows to bond funds ($278bn) rising at a record pace in 2019.

- Past 10 years $4.1tn into passive investment funds vs. $1.5tn out of active funds.

- Just 6% of MSCI ACWI stocks account for 53% of YTD global equity return.

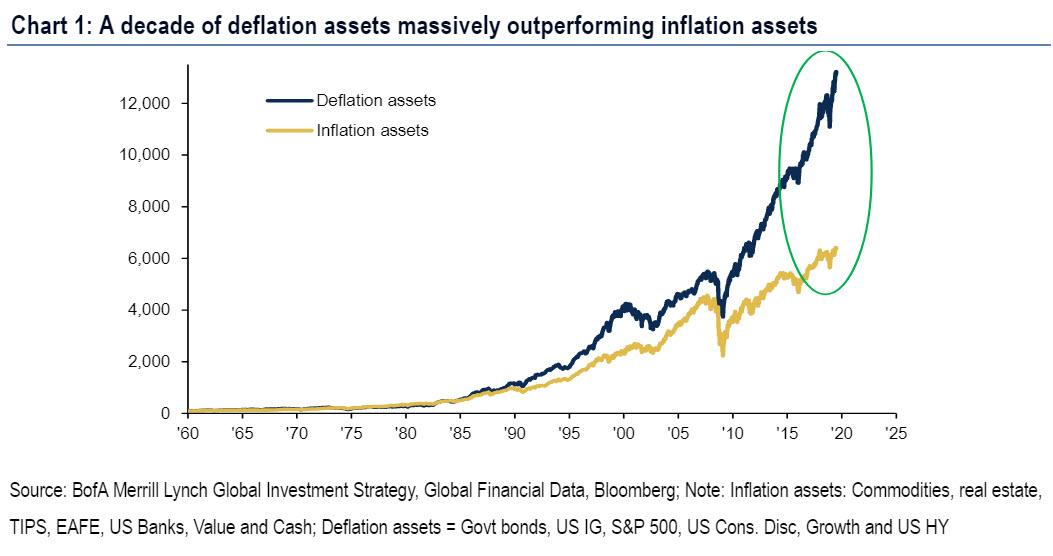

As Hartnett summarizes, “the above reflect a decade of Maximum Liquidity & Minimal Growth, of tech disruption, aging demographics & Chinese rebalancing, of polarized outperformance by deflation assets (US stocks, HY bonds, growth stocks) vs. inflation assets, of expectations for higher inflation, yields, volatility consistently being dashed.

His contrarian recommendations for 2020s:

“long inflation” & “short Wall St” driven by populism, protectionism, policy impotence, popping bond bubbles, peak globalization.

In short: brace for the deflationary ice age end of the world as we know it.

via ZeroHedge News https://ift.tt/2ZrzlQ5 Tyler Durden