For the first time that we can remember, an FOMC member – Boston Fed president Eric Rosengren – listed the (record) level of the stock market as one of the reasons why he dissented from Wednesday’s decision to cut rates as he found the case for cutting interest rates was not “compelling.”

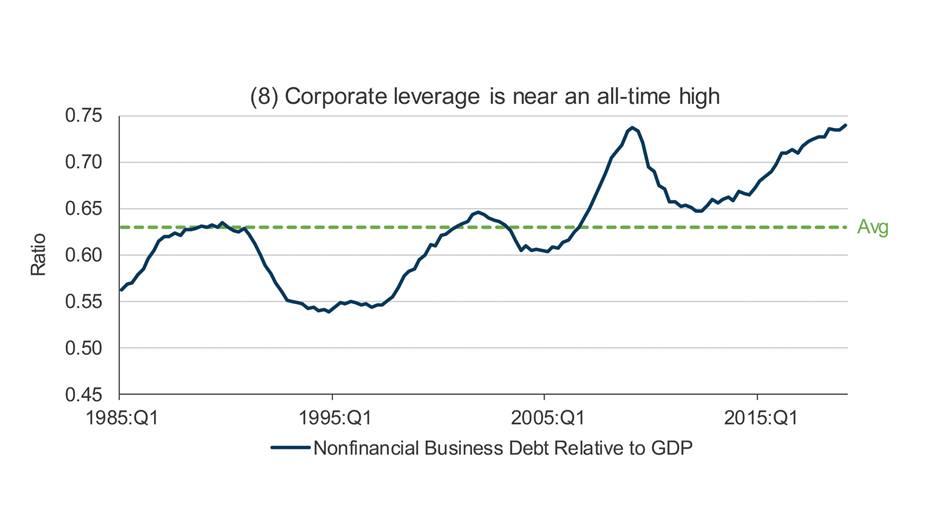

“I do not see a clear and compelling case for additional monetary accommodation at this time,” he said in a statement Friday that listed 8 charts showing low unemployment, inflation likely to rise toward the Fed’s 2% target, and financial stability concerns “given near-record equity prices and corporate leverage” to wit:

But what was most remarkable, as noted earlier, is the fact that Rosengren explicitly noted the level of the market, noting that “stock prices are near all-time highs” as one of the eight market-linked reasons not to cut. Why is this notable? Because this is an indirect admission that the Fed was responsible for pushing stock prices to all time highs with its easy policies; as a result cutting here will only lead to even higher asset prices (unless of course, Trump intervenes and launches World War III as he appears to have done).

As a reminder, the Boston Fed president and his Kansas City Fed colleague, Esther George, were the two dissenters in favor of keeping rates on hold, leading to Jerome Powell’s first double dissent since he took the Fed’s helm in February 2018.

via ZeroHedge News https://ift.tt/335KQ1X Tyler Durden