Authored by Richard Breslow via Bloomberg,

There has been a lot of talk recently about intervention. And we certainly need one. Looking at the charts this morning, one word comes to mind — failure. True, traders are still trying to sort their positions out from earlier in the week, so it’s problematic to come to too many this-will-lead-to-that conclusions. But even with the dollar starting the day looking like it suffered another failed breakout, a lot of assets that should welcome this development, like emerging markets, have taken no comfort. This might be a short-term phenomenon, but it merits very close monitoring.

It’s only human nature to watch what’s going on in the news and the latest price action and be perturbed. So much of the analysis centers around speculating on the game theory aspects of events and the shifting odds of rate cuts. Fear and greed never die. And that isn’t at all untoward. That’s people doing their jobs. And in difficult circumstances.

Indeed, they would be remiss not to take note that the odds for a September rate cut have changed rather decisively. And the fact that, at the moment, they don’t appear at all subject to change.

One has to ask, however, what possible good can another cut do? It’s easy, looking at them as coming from the reaction function of enablers, to understand their potential harm. Earlier this week, consumer confidence blew away all estimates. Now speculate on whether anyone is going to run out and remodel their kitchens from an extra 25 basis points. They are far more likely to think: “here we go again.”

And if businesses supposedly like large doses of certainty before making capital investments, where would they find it in hearing the message of global headwinds, geopolitical tensions and supply chain disruptions? They already borrow at effectively no cost.

But, make no mistake, if there is any doubt that further rate cuts are coming, that notion can be dispelled. And it won’t change because some next piece of news sends stocks back to Thursday’s happier levels. No one can even hazard an educated guess whether that will happen or not. Far more pertinently, and worrying, it will take a while before economic numbers will have the ability to change the calculus. In the short term, they will only matter if they affect the level of the dollar such that it affects other markets.

Having said that, it in no way means that the Fed’s choice of eschewing a shock-and-awe move this week was wrong. It just means things would have fallen from higher levels. And not earned them any extra kudos from the constituencies that really matter.

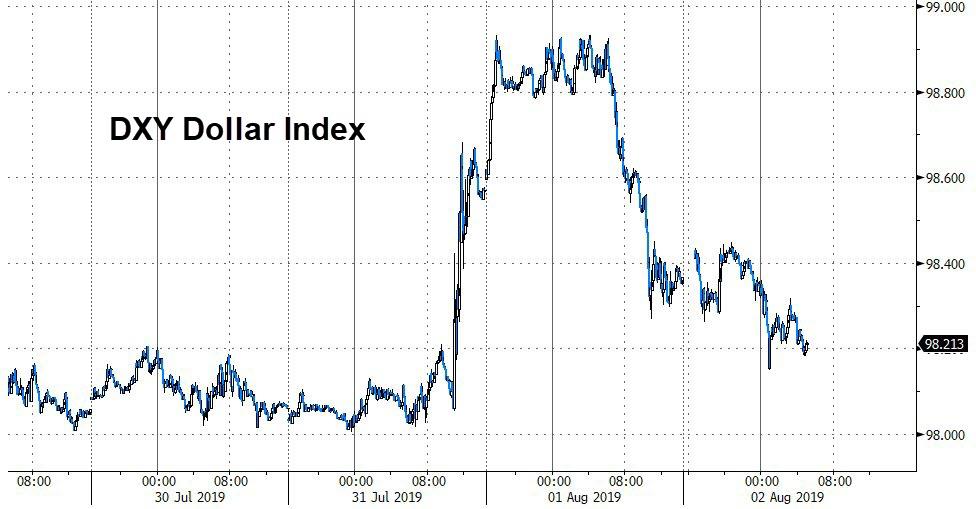

Both the Dollar and Bloomberg Dollar indexes are at important crossroads. They are both very much in play. With some very smart people having diametrically opposed views of where they are headed. DXY looked like it was making a decisive move higher, but has fallen back to no man’s land. Sitting on an important pivot level means how it ends the week will provoke a lot of position adjusting. Good for business, if nothing else.

BBDXY is the more interesting of the two. It topped out on Thursday, right in a zone that has been significant multiple times over the course of the last year. It never properly broke out. Where this one goes will be where the global version of Main Street will be most riveted.

via ZeroHedge News https://ift.tt/2MAnonS Tyler Durden