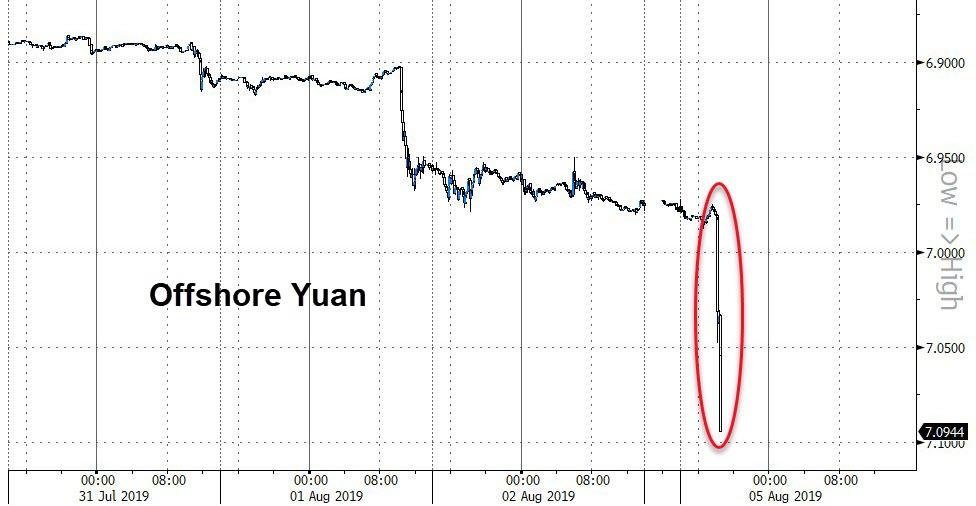

U.S. equity futures slumped, European stocks tumbled and Asian markets were in freefall on Monday, after China finally struck back in its trade dispute with America, letting its currency plunge below the key psychological level of 7 vs the USD.

This unexpected escalation by Beijing, which sent the Yuan to a level last seen in 2008, spooked a selling panic across global risk assets, sending the S&P below 2,900, and world markets in a sea of red…

… as Treasuries, gold – and yes, cryptos – led a global bond rally as investors dashed to safer assets.

“Markets had not been expecting the latest US-China trade talks to conclude with any significant breakthrough last week, but very few expected President Trump to slap 10% tariffs on $300 billion worth of Chinese goods,” said Hussein Sayed, chief market strategist at FXTM.

In addition to the yuan devaluation, Bloomberg reported that China asked state buyers to halt their US agriculture imports. China’s US Ambassador said on Friday that if the US wants to talk about trade, then so will China, and if the US want to fight, so will China, while he added that new tariffs are an irrational and irresponsible act which Beijing will take new adequate countermeasures against. The Ambassador also commented on Hong Kong protests which he said are turning out to be violent as well as chaotic and should no longer be allowed to continue.

MSCI’s All Country World Index was down 0.7% on the day. That put it down almost 2% including Friday’s loss.

European stocks tumbled to a two-month low, suffering the biggest two-day sell-off in more than three years. The Stoxx Europe 600 Index fell as much as 2.1%, bringing the combined loss with Friday to the worst since June 2016 according to Bloomberg. An index tracking European basic resources stocks slumped as much as 3.8%, erasing its gains for the year, as iron ore and copper prices take a hit amid increasing U.S.-China trade tensions. The STOXX Europe 600 Basic Resources declines as much as 3.8%, before trimming loss to 2.9% at 8:30am in London, the region’s worst-performing sector on Monday.

Ahead of Monday’s plunge, European equities had already fallen 2.5% on Friday, the most since December, after the White House dangled the prospect of new tariffs over Chinese goods. Tensions escalated further today after China responded by letting the yuan tumble and asking state-owned companies to suspend imports of U.S. agricultural products.

Earlier in the session, Asian shares suffered their steepest daily drop in 10 months, with MSCI’s broadest index of Asia-Pacific shares outside Japan sinking 2.5% to depths not seen since late January. Japan’s Topix tumbled 1.8% to lowest close since Jan. 4 as the yen surged. Hong Kong’s Hang Seng Index lost 2.9% after protesters moved to shut down the city with a general strike. The Philippines’ benchmark was the region’s worst performer, dropping 3%. Investors moved to risk-off mode as the U.S.-China trade war escalated after U.S. president Donald Trump ratcheted up rhetoric by saying that he could boost levies on China to a “much higher number.” To counter the threat, China asked state-owned enterprises to suspend imports of U.S. agricultural products. South Korea’s Kospi Index declined 2.6% as the won weakened below 1,200 to the greenback for the first time since Jan. 2017.

And with S&P futures were down 1.4%, sliding below 2,900, the VIX index rose to 21.2%, its highest since May 9, while Europe’s equivalent hit its highest since early January.

“We reiterate our view to scale back equity positions to strategic allocations after strong gains year to date, amid the ongoing trade-related uncertainties,” Credit Suisse analysts wrote in a note to clients.

Meanwhile, China’s headaches persisted elsewhere, as protests continued in Hong Kong in which police fired tear gas into protesters, while Hong Kong authorities expect flight cancellations and other transport disruptions as 500k protesters plan a city-wide strike. Hong Kong Chief Executive Lam said protests have brought Hong Kong to the edge and protesters are pushing it to an extremely dangerous situation, while she added she will remain in her job to try and restore order.

The good news: Hong Kong Police said there is no chance of deploying People’s Liberation Army (PLA) officers in protests… at least for now. Most recently, reports that Beijing are to announce ‘something new’ regarding Hong Kong on Tuesday, an official has stated that Beijing’s position is largely unchanged., SCMP citing a source

Looking at the carnage in currencies, the biggest mover was of course the yuan, which fell past the key level of 7 to the dollar as Chinese authorities – expected to defend the currency at that level – allowed it to break through to its lowest in the onshore market since the 2008 global financial crisis. The offshore yuan fell to its weakest since international trading of the Chinese currency began. Headed for its biggest one-day drop in four years, it was last down 1.4% at 7.0744 in offshore markets.

“Over the past couple of years, China has kept the renminbi stable against the basket, but with the renminbi TWI (trade-weighted index) now testing the lower end of the range in play since 2017, investors may turn nervous, introducing another dose of volatility,” Morgan Stanley strategists wrote in a note to clients.

The currencies of other Asian economies closely linked with China’s growth prospects also dropped: a gauge of emerging-market currencies headed for its biggest drop in about a year. South Korea’s won tumbled 1.4$, its biggest one-day loss since August 2016, while India’s rupee and Mexico’s peso felt the brunt of the pain.

Developing-nation stocks fell for a ninth day, the longest streak of losses since December 2015. “There is probably more pain to come for EM currencies” given the unwinding of carry trades, reduction in growth exposure through equities and build-up in speculative wagers, Jason Daw, the Singapore-based head of emerging-markets strategy at Societe Generale SA, wrote in a report. “The strong policy signal by China has put the renminbi back in the driver’s seat; it will be a leader in the global currency cycle for the foreseeable future.” Sterling hovered near 2017 lows at $1.2117, pressured by concerns about Britain exiting the EU without a trade deal in place.

On the other side, the Japaness yen saw its traditional safe haven bid, rising 0.7% to its highest since a January flash crash. The Swiss franc was also boosted by safe-haven demand, despite intervention by the SNB seeking to keep appreciation minimal. Trump is also eyeing tariffs on the European Union, but has yet to make a formal announcement. The euro was 0.3% higher to the dollar at $1.1137.

Meanwhile, the stock of negative yielding debt hit new record highs as Dutch 30-year government bond yields turned negative for the first time as euro zone yields sank further amid concerns about U.S.-China trade and a no-deal Brexit. U.S. 10-year Treasury yields dived 7 basis points to 1.77%, while Germany’s 10-year bund yields fell to -0.53%. The three-month to 10-year U.S. yield curve was at its most inverted in 11 years.

In geopolitical news, Iran seized an Iraq oil tanker that was allegedly smuggling fuel in the Gulf, although the Iraq Oil Minister denied any links to the tanker. Turkey plans to carry out an operation east of the Euphrates in Syria, while US and Russia have been notified.

Finally, oil extended losses with U.S crude down 1.55% at $54.8 and Brent down 1.55% at $60.92. Gold prices jumped more than 1% to their highest in more than six years, with spot gold prices up 1.1% to $1,456.51 per ounce.

US President Trump is to address the nation on Monday (10:00 ET) and suggested that more gun control may be needed following a mass shooting incident in El Paso, Texas in which 20 were killed, while there was also a mass shooting in Dayton, Ohio. Other expected data include PMIs. Linde and Marriott International are among companies reporting earnings.

Market Snapshot

- S&P 500 futures down 1.3% to 2,894.00

- STOXX Europe 600 down 2% to 370.54

- MXAP down 2% to 152.42

- MXAPJ down 2.5% to 491.47

- Nikkei down 1.7% to 20,720.29

- Topix down 1.8% to 1,505.88

- Hang Seng Index down 2.9% to 26,151.32

- Shanghai Composite down 1.6% to 2,821.50

- Sensex down 1.4% to 36,616.90

- Australia S&P/ASX 200 down 1.9% to 6,640.30

- Kospi down 2.6% to 1,946.98

- German 10Y yield fell 2.2 bps to -0.517%

- Euro up 0.3% to $1.1140

- Italian 10Y yield fell 3.9 bps to 1.19%

- Spanish 10Y yield fell 2.2 bps to 0.224%

- Brent futures down 1.3% to $61.11/bbl

- Gold spot up 1.2% to $1,457.46

- U.S. Dollar Index down 0.2% to 97.87

Top Headline News from Bloomberg

- China responded to Trump’s tariff threat with another escalation of the trade war on Monday, letting the yuan tumble to the weakest level in more than a decade and asking state-owned companies to suspend imports of U.S. agricultural products. Trump criticized Beijing for managing its currency unfairly and failing to keep promises to buy more U.S. crops

- The yuan plunged beyond 7 per dollar for the first time since 2008 amid speculation Beijing was allowing currency depreciation to counter Trump’s latest tariff threat. PBOC says it’s able to keep yuan stable at a reasonable and balanced level

- Hong Kong leader Carrie Lam warned of a “very dangerous situation” as protesters moved to shut down the Asian financial hub with a general strike on Monday after a ninth straight weekend of unrest in opposition to China’s tightening grip

- HSBC Holdings Plc confirmed its plans to eliminate jobs, axing more than 4,000 posts and warning that senior executives will be a focus of the cutbacks. “We expect this year to have $650 million to $700 million of severance costs; that involves less than 2% of our workforce,” CFO Ewen Stevenson said in a call with analysts

- Boris Johnson has dramatically boosted public spending since taking office, fueling speculation the U.K. prime minister is preparing not only for Brexit by Oct. 31, but a general election as well. The two are likely to be linked

- India has revoked the special constitutional status of Kashmir in a move that’s drawn protests in parliament and risks deepening the deteriorating security relationship with rival Pakistan in the disputed region

- Turkish banks approached the Treasury about swapping some of its local-currency bonds maturing early next year with longer-dated debt as the two sides discuss ways to soften the blow of a looming financing hump, according to four people with knowledge of the matter

- Spanish King Felipe VI said it’s best for the nation to resolve the current political deadlock before holding new elections, newspaper El Pais reported Sunday

- Iron ore has gone from high-flier to sinking star in a matter of weeks. Copper drops to two-year low as the latest U.S. tariffs on China fueled a global market sell-off

Asian equity markets were lower across the board as the stock rout resumed from last week’s tariff announcement by US President Trump and with retaliation from China in which it asked state-run purchasers to halt US agriculture imports, while a collapse in the CNH through the 7.00 handle also exacerbated the risk averse tone. ASX 200 (-1.7%) weakened with the trade sensitive sectors such as tech and materials front-running the declines, although gold names bucked the trend on the precious metal’s safe-haven status, while Nikkei 225 (-1.7%) was pressured by a firmer currency and several disappointing earnings including Kobe Steel and Yahoo Japan. Hang Seng (-2.8%) and Shanghai Comp. (-1.6%) also slipped amid the escalation of trade tensions with underperformance in Hong Kong as protests continued and with a 500k-strong city-wide strike said to be planned which disrupted public transport and saw more than 130 flights cancelled, while the latest Hong Kong PMI data printed at a decade low due to the impact from the ongoing disorder and trade dispute. Furthermore, a miss in Chinese Caixin Services PMI added to the glum, with the selling exacerbated after the PBoC weakened the reference rate which pressured CNH to a record low against the greenback past the 7.0000 level seen by some to be a sticking-point for China and in turn, raised concerns of China weaponizing its currency. Finally, 10yr JGBs were underpinned as the widespread risk averse tone spurred safe-haven buying which saw 10yr JGB futures post a record high and the 10yr yield drop to its lowest in 3 years at around -0.2%, while T-notes also found support overnight and the BoJ were present in the market today under its massive bond buying program.

Top Asian News

- India Seeks to Revoke Special Autonomy to State of Kashmir

- China’s Bond Market Leverage Ratio Falls on Lower Liquidity

- Macau’s Gaming Regulator Clamps Down on Use of AI in Casinos

- Philippines Central Bank Chief Sees 50bps Rate Cuts Rest of Year

Major European bourses have begun the week firmly in negative territory [Euro Stoxx 50 -1.4%] following on from a downbeat Asia-Pac handover after market sentiment took a hit from dwindling trade hopes as China asked state-run purchasers to halt US farm goods imports. Additionally, the collapse of the CNH to 7.0+ status vs. the USD also added further jitters to the trade-sensitive sentiment. Indices are firmly in the red but have crawled off lows in recent trade after China State Planner dismissed President Trump’s accusation that China has not bought US farm goods, adding that US and China agreed to China will purchase 14mln tonnes of soybeans from the US, with 2mln to be loaded in August. Sectors are in the red across the board with some mild resilience in defensive sectors. To the downside, miners fare the worst amid the freefall in base metal prices due to a bleaker demand outlook in the sector as protectionism ramps up. Thus, ArcelorMittal (-4.5%), Antofagasta (-3.3%), Rio Tinto (-2.4%), and Anglo American (-3.5%) have all fallen to the foot of their respective bourses. However, Fresnillo (+4.0%) bucks the miners’ trend as the Co. benefits from the safe-haven surge in gold prices. European luxury names and the auto sectors are also bearing the brunt of the US-China trade spat with LVMH (-2.9%), Kering (-2.1%), Volkswagen (-2.7%), Daimler (-2.5%), BMW (-2.4%) and Peugeot (-3.1%) all lower as a result. In terms of individual movers HSBC (-1.0%) shares opened lower due to the surprise stepping-down of CEO Flint, despite improvements in its metrics and the announcement of a share buyback program.

Top European News

- U.S. Imposes More Sanctions on Russia for Chemical Agent Use; Russia’s Ruble Bucks EM Rout With Sanctions More Bark Than Bite

- U.K. 10-Year Bond Yield Slides to Record Low on Haven Buying

- Ascom Slumps to Six-Year Low as CEO Quits, 1H Hit by Poor Demand

- Euro-Area Growth Momentum Slides as Industry Pain Overwhelms

In FX, the Aussie has been hit particularly hard by the Yuan’s slide through 7.0000 vs the Greenback on and offshore after the PBoC raised its official mid-point fix to 6.9225 overnight from 6.8996 last Friday. However, the sharp Cny and Cnh depreciation was sparked by reports that China has halted US agricultural produce purchases in retaliation to President Trump’s fresh tariff threat, with a softer than expected Caixin services PMI not helping as the composite PMI hit a 5 month low and Hong Kong’s headline print plunged to 42.8. All this undermining broad risk sentiment and base metals like iron or, with Aud/Usd dipping under 0.6750 at worst in the run up to the RBA policy meeting overnight with options pricing in a 50 pip break even that could expose the early January 0.6715 flash crash low if the Bank firmly flags more easing after a widely anticipated pause this time round – see the headline feed and/or Research Suite for a full preview.

- NZD/CAD/GBP – Also victims of heightened risk aversion amidst rising US-China trade tensions, with the Kiwi down though 0.6500 at one stage vs its US peer, but holding up a bit better than the Aussie ahead of Wednesday’s RBNZ rate decision that is unanimously forecast to result in the OCR being cut by a further 25 bp to 1.25%, mainly due to supportive cross-winds as Aud/Nzd reverses through 1.0400 again. Meanwhile, the Loonie is back below 1.3200 against the backdrop of retreating crude prices and with trading volumes impaired by Canada’s Civic holiday, but the Pound has gleaned some support from another UK PMI beat and by a greater margin in services compared to manufacturing and construction. Indeed, Cable has bounced from close to 1.2100 and Eur/Gbp stopped just shy of 0.9200, though remains elevated on persistent no deal Brexit concerns.

- CHF/JPY/EUR – In stark contrast to the above, and to the overall detriment of the US Dollar (DXY losing more post-NFP momentum and sub-98.000) the Franc, Yen and Euro are all outperforming on safe-haven grounds, with Usd/Jpy probing through 106.00 and beneath a key Fib (106.06) that could be crucial on a closing basis. Usd/Chf is under 0.9750 and Eur/Usd has rebounded firmly to 1.1150 from 1.1105 even though Eur/Chf has fallen further below 1.0900 towards 1.0850 amidst mixed Eurozone services PMIs and a bleak Sentix survey.

- EM – Regional currencies are generally weaker vs the Buck on the aforementioned risk-off environment, but once again the Try is holding up better than rivals within a 5.5490-6175 range as the Lira responds favourably to Turkish inflation data that was not as strong as expected, plus the CBRT’s RRR moves that will culminate in a net Usd2.1 bn liquidity drain.

- CBRT says RRR for FX deposits/participation fund have been increased by 100bps for all maturity brackets, remuneration rate for USD-denominated RR,Reserve options and Free Reserves held at the CBRT had been decreased by 100bps. (Newswires)

In commodities,WTI and Brent futures are on the backfoot due to the prospect of lower global demand amid the seemingly widening gap between US and China in trade, in turn souring sentiment. WTI now straddles north of the USD 55/bbl mark while its Brent counterpart has just reclaimed USD 61/bbl after finding a base below the round figure. Looking ahead, tomorrow sees the release of the EIA Short-Term Energy Outlook, followed by the IEA Monthly Oil Report on Friday. Elsewhere, metals markets were rattled by the latest developments in the US-China saga with spot gold jumping over 1% to a peak of 1459/oz, the highest level in six years. Meanwhile, copper prices slumped to a 2-year low, but have since crawled off lows, with the red metal increasingly threatening USD 2.5/lb to the downside. Finally, Dalian Iron ore futures hit limit down after crumbling over 6% after declining below USD 100/tonne amid demand woes from the aforementioned US-China fallout, which was exacerbated by rising stockpiles of the raw material.

US Event Calendar

- 9:45am: Markit US Services PMI, est. 52.2, prior 52.2; Markit US Composite PMI, prior 51.6

- 10am: ISM Non-Manufacturing Index, est. 55.5, prior 55.1

- 1:30pm: Fed’s Brainard Speaks on the Payment System

DB’s Jim Reid concludes the overnight wrap

Friday was very nearly the last Early Morning Reid ever. I finished up writing it early as usual, got on my bike to the station and on route got hit by a car and was flung in the air and off my bike. The guy didn’t stop at a roundabout and took me out while I was nearly exiting it. What saved me was that I was so far round the roundabout that he bashed me at an angle and into the curb and didn’t run over me. I’ve got a lot of scrapes, a sprained ankle and a heavily bruised coccyx (I hope only) from my landing. Oh and a ripped pair of GAP chinos. A van behind had a dashcam so the footage is available so you can all see for yourselves how lucky I was and judge the quality of the car driving!! I’ve put the link to the clip on my Bloomberg header or let me know and I’ll send it to you.

So I feel fortunate to see this coming week in markets. Hopefully the zen feeling of just being glad to be here carries on for a while yet! After last week’s high-octane news flow, you would naturally think things will calm down from here but markets will struggle to relax given all that’s going on. Indeed the breaking news this morning that the onshore and offshore Chinese Yuan have broken through the key level of 7.0 has caused a mini shockwave through markets already in Asia and goes to show that last week’s fallout will very much continue to dictate markets in the near term. August can be quite a difficult month as negative news flow can also be exaggerated by a lack of liquidity. So be warned. Our asset allocation team led by Binky Chadha have been raising red flags of late suggesting that the S&P 500 is still well above the 2700 or so level implied by current growth indicators. The US 10y yield is pretty much in line ( link ). However as they point out, leading indicators of growth continue to point to further slowing to come, even before taking the impact of the latest escalation into account. In their view, a resolution of the trade war, and not Fed easing, is the key for a turn-up in growth. See their latest from Friday night here ( link ). There’s also an interesting piece on how systematic strategies have been the key marginal drivers of the US market, and how their equity allocations are currently very elevated.

Back to Asia where as mentioned all the focus this morning is on the moves in the FX market. Both the onshore CNY and offshore CNH have weakened to 7.0274 and 7.0772 respectively as we go to print, moves of -1.25% and -1.45%. The PBoC have said that the moves are due to tariff expectations and protectionism and that the central bank will fight against short-term speculation on the Chinese currency and stabilize market expectations. There’s been plenty of debate as to whether China would let the currency weaken past 7.0 so this is a very significant move especially as authorities had explicitly capped a move past 7.0 following the May 5th breakdown in talks. The question for the market now is what will be the response of the US administration and will they argue for currency manipulation in offsetting the impact of the tariffs.

The significance of the moves are certainly not to be underestimated and we’re already seeing a fallout at a broader asset level in markets. The biggest falls in equity markets have been for the Hang Seng (-2.89%) and Nikkei (-2.28%) while the CSI 300 and Shanghai Comp are down -1.03% and -0.81% respectively. The Kospi is also down -2.10% and ASX -1.64% while futures on the S&P 500 and NASDAQ have dropped -1.23% and -1.58% respectively. In rates, 10y JGBs immediately dropped -2.0bps to -0.197% while Treasuries have rallied a fairly incredible -7.2bps to 1.773%. Rarely have we seen such a big move in Treasuries on a Monday morning. The short end hasn’t quite rallied as much meaning the 2s10s curve is 2.7bps flatter at 13.4bps. The market is also now pricing in 59bps of cuts by the Fed by the end of this year. Meanwhile Gold is up +0.82% while the likes of WTI oil is down -1.22%. In the rest of FX the Yen (+0.55%) and Swiss Franc (+0.38%) are the notable perceived safe-haven outperformers while the likes of the South Korea Won (-1.33%) and Mexican Peso (-0.87%) have dropped. Indeed South Korea have called the move in the Won “excessive” and “abnormal” while Japan have stated that they are watching moves in the FX market “with urgency”.

It’s worth noting that this morning China also asked state-owned companies to suspend imports of US agricultural products which is clearly adding to the negative circle of newsflow while China’s Caixin services PMI was reported as dropping 0.4pts in July to 51.6 and below expectations for 52.0.

So, no time to recover from last week and already plenty to consider and in terms of events outside of the trade war this week we’ve also got US/European earnings season continuing, albeit at a reduced pace, while data highlights include the important global services PMIs (today), German factory orders (tomorrow – after the steepest fall since Sept ‘09 last month), Q2 GDP from Japan and the UK (both Friday), Chinese trade balance for July (Thursday), and China CPI/PPI (Friday). We’ll also get monetary policy decisions from the Reserve Bank of India (Wednesday) and the Reserve Bank of Australia (Tuesday) which will be important given the ratcheting up of the trade war.

In terms of other central bankers, we’ll see the return of Fed speakers after their blackout period and last week’s FOMC. St Louis Fed President Bullard will be speaking tomorrow, followed by Chicago Fed President Evans on Wednesday. Meanwhile on Thursday, the ECB will release their latest Economic Bulletin.

Earnings season continues, although at a slower pace than last week, with 62 S&P 500 companies reporting, along with a further 78 in the STOXX 600. The highlights this week include HSBC and Linde today; Walt Disney on Tuesday; Unicredit, AIG, Commerzbank, Glencore and Booking Holdings on Wednesday; Deutsche Telekom, Zurich Insurance Group and Aviva on Thursday; and Novo Nordisk on Friday. The day by day week ahead is at the end as usual.

To recap last week, equity markets sold off following a perceived disappointing Powell FOMC press conference and the escalation of the trade war, with President Trump announcing that 10% tariffs would be placed on a further $300bn of Chinese imports from September 1st.The S&P 500 declined every day last week to finish down -3.10% for the week (-0.73% Friday), while the NASDAQ fell -3.92% (-1.32% Friday) as both indices experienced their worst week of the year so far. The Dow Jones had a slightly smaller fall however, down -2.60% (-0.37% Friday). European markets were also reeling on Friday as they reacted to Thursday evening’s tariff news, with the STOXX 600 having its worst day of the year so far, losing -2.46% on Friday, bringing its losses for the week to -3.22%.

Fixed income rallied however, as investors flocked to safety and hoped for further monetary stimulus. 10yr Treasury yields fell for a 6th consecutive session on Friday, ending the week down -22.5bps (-4.8bps Friday) to their lowest level since President Trump’s election, while ten-year bund yields fell -11.9bps (-4.6bps Friday) to a fresh all-time low. German 30-year yields fell -20.4bps last week to close at +0.5bps, and at one point intra-day on Friday actually yielded negative for the first time ever. Pretty crazy really. Other safe havens also rallied last week, with gold ending the week up +1.55% while the Japanese Yen strengthened by +1.95% against the dollar, its biggest weekly appreciation since February 2018. Credit spreads widened considerably however, with indexes of cash HY spreads in the US and Europe up +26bps and +27bps respectively (+7bps and +23bps Friday). Meanwhile, in a sign that central bank easing doesn’t seem to be persuading markets on inflation expectations, or that trade wars/growth fears outweigh them, five-year forward five-year inflation swaps fell in the US and Europe last week, down by -10.6bps (-1.7bps Friday) and -13.3bps (-8.2bps Friday) respectively to reach 2.01% in the US and 1.22% in Europe.

The other main event on Friday was the US jobs report, which came almost exactly in line with expectations at +164k (vs. +165k expected), though the prior two months were revised down by -41k. The three-month average also fell to 140k, the lowest since September 2017. Earnings rose slightly above expectations at +3.2% (vs. 3.1% expected) while the unemployment rate remained at 3.7% (vs. 3.6 expected). In more positive news, the broader U6 measure that includes those underemployed fell to 7.0%, the lowest since December 2000. From Europe, the main data release was Eurozone retail sales for June, which rose by +1.1% mom in June (vs. 0.3% expected), the strongest mom gain since November 2017. The move brings the yoy change to +2.6% (vs. +1.3% expected).

via ZeroHedge News https://ift.tt/2YIWVe8 Tyler Durden