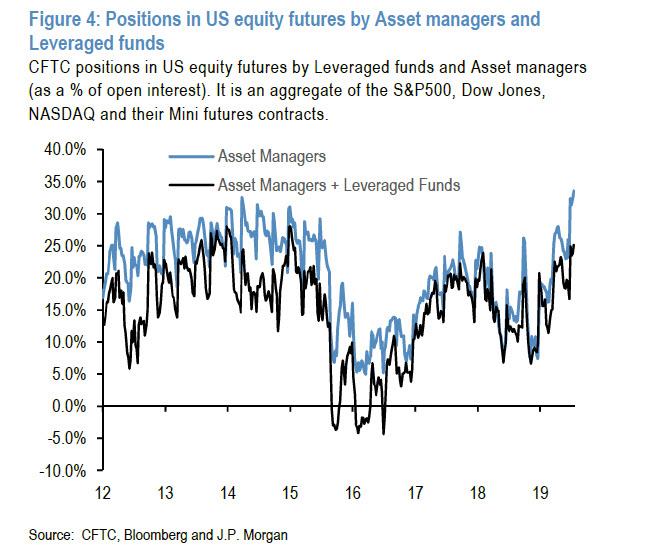

It’s not just institutional investors who, as we warned last weekend were massively bullish on stocks heading into the Fed rate cut and in fact had the longest net equity position in US equity futures going back to the financial crisis, are getting crushed today.

As Bloomberg writes, today’s jarring escalation of the U.S.-China trade war which sent the Dow Jones down as much as 900 points intraday, is also hammering retail investors: the reason – last week a whopping $4.4 billion flowed into two ETFs that have been favored by “moms and pops“, just in time for one of the fastest drawdowns of the decade-long bull market. The IVV, or the iShares Core S&P 500 ETF, added $3.4 billion, while the VOO, or Vanguard S&P 500 ETF, absorbed $995 million.

Oops.

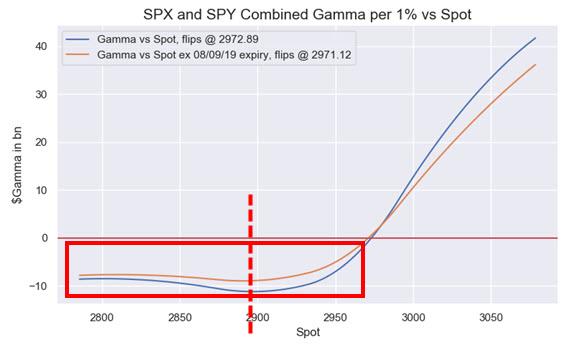

This is a vivid reminder of what happens when buying the dip… fails. While BTFD may have been seemed appealing to some long-term investors after the worst week for stocks’ since the start of the year, with equities dumping more than 3% on Monday after China effectively devalued the Yuan, Bloomberg notes that “the professionals are earning their reputation as the “smart money” for sitting this one out”, even though as we showed above that is also not true, and in fact it is only a matter of time before the so-called pros are swept with the bathwater as a result of the coordinated selling by CTAs and systematic investors, which in turn are crushed by maximum negative gamma.

Other ETFs were not spared: the venerable SPY, the SPDR S&P 500 ETF Trust, one of the most-active equities in the U.S., lost $3.9 billion last week as traders bailed.

Or to summarize visually:

Today’s markets action pic.twitter.com/dbqpiQ5GQv

— The_Real_Fly (@The_Real_Fly) May 17, 2019

via ZeroHedge News https://ift.tt/2T8yHol Tyler Durden