The Fed may have launched its first easing cycle since 2007 and liquidity-sapping quantitative tightening may finally be over, but Powell may have a much bigger problem on his hands – one which has nothing to do with China, and everything to do with a dramatic drain of liquidity in the market over the next two months.

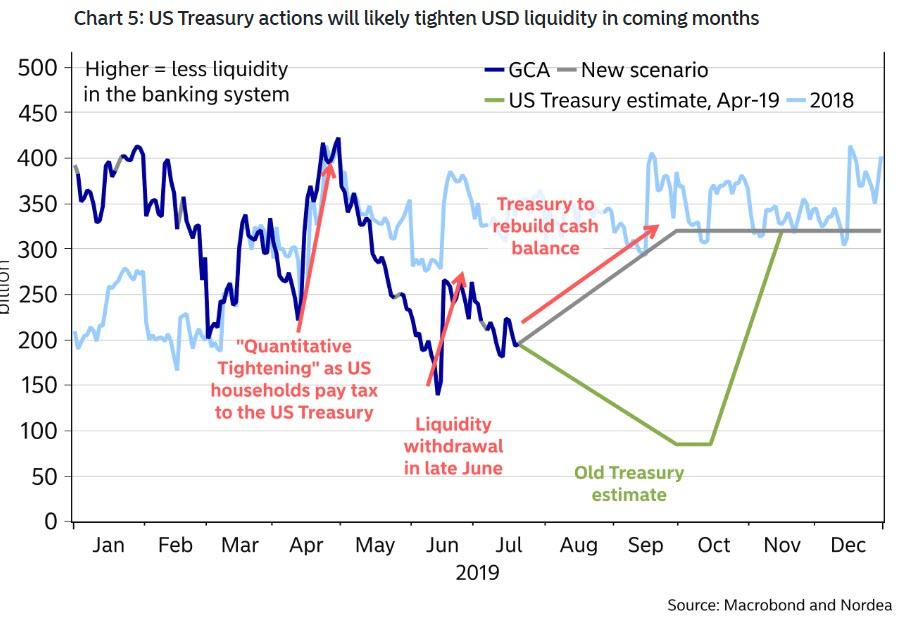

We first hinted at this last week when we noted that as part of the recently completed debt ceiling deal, instead of taking its time in replenishing the cash balance (green line in the chart below), the US Treasury will scramble to rebuild its cash balance up to $350 billion, from today’s level of $133 billion (gray line), a process which as we said last Wednesday will “significantly tighten up liquidity in the banking system and potentially result in turmoil in funding and money markets as the world is flooded with an issuance of T-Bills” as the Treasury seeks to fill the $217 billion cash hole, which will lead to a substantial liquidity withdrawal from the broader financial system as shown in the following Nordea chart.

The problem, in a nutshell, is that traditionally such a rapid liquidity withdrawal leads to weaker risk appetite, a far stronger USD and lower treasury yields, while widening the LIBOR/OIS spread and further depressing the already negative EURUSD cross-currency basis.

While we cautioned about all this last week (even before the FOMC announcement), it appears that our appreciation of just how severe this problem may be for the Fed and capital markets was overly optimistic, because according to a new analysis by Bank of America’s Mark Cabana, the Fed may have no choice but to resume Quantitative Easing and start expanding its balance sheet again – potentially as early as 4Q – in order ease funding pressures expected during the coming wave of Treasury supply.

For those unfamiliar with the funding problems the Treasury’s cash rebuild entails, these are four-fold, as BofA explains by using the poetic description that “it will keep on raining and funding levy is likely to break“, or said more technically, USD funding market pressure will keep rising through year end due to the following four factors:

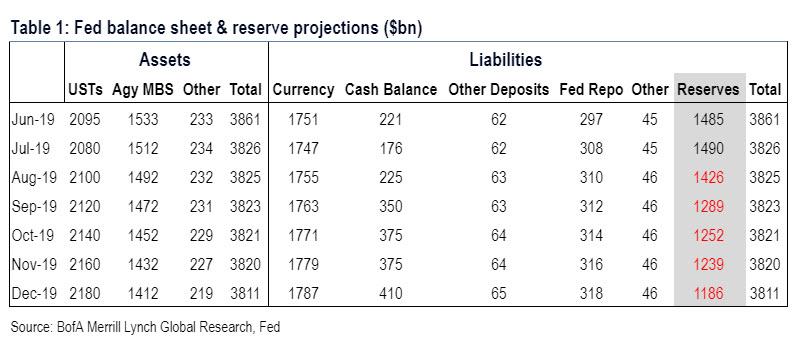

- 1. Treasury supply: Treasury supply will be elevated in the wake of the debt limit resolution. From now thru year end BofA expects net UST supply of ~$750bn (~$500bn coupons, ~$250bn bills). This supply will come to market rapidly: in August alone we expect $90bn net coupons and $160bn net bills. These estimates are close to Treasury; as we noted last week, the Treasury’s financing estimates suggested a net $814bn supply increase in 2H 19.

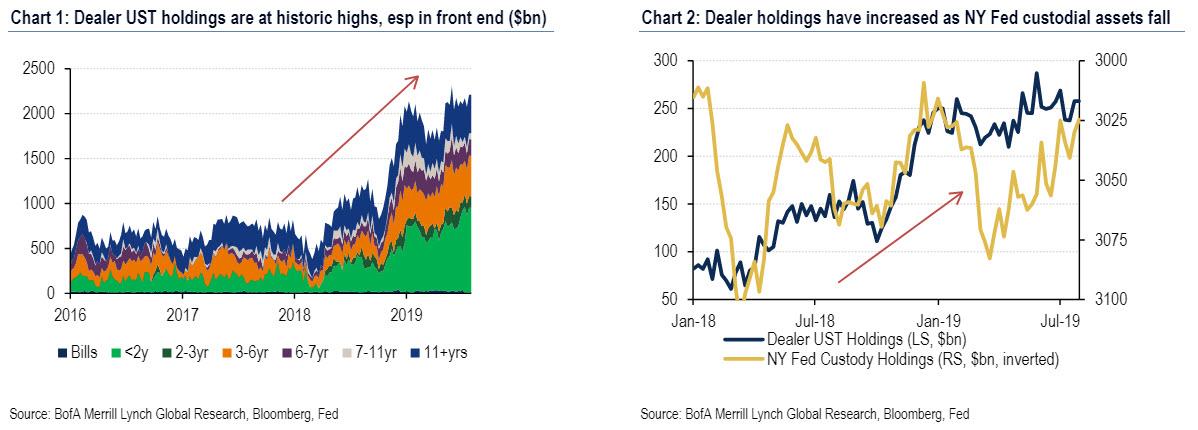

- 2. Dealer UST holdings: Primary dealer balance sheets are near historic highs and concentrated in short-dated holdings (bottom chart, left). The elevated dealer holdings are likely due to both voluntary and involuntary reasons: voluntary = dealers may view USTs cheap vs OIS and futures, involuntary = heavy UST supply and overseas reserve manager selling (bottom chart, right). Already bloated dealer balance sheets would likely pose intermediation challenges for UST supply, especially with year-end GSIB regulatory constraints.

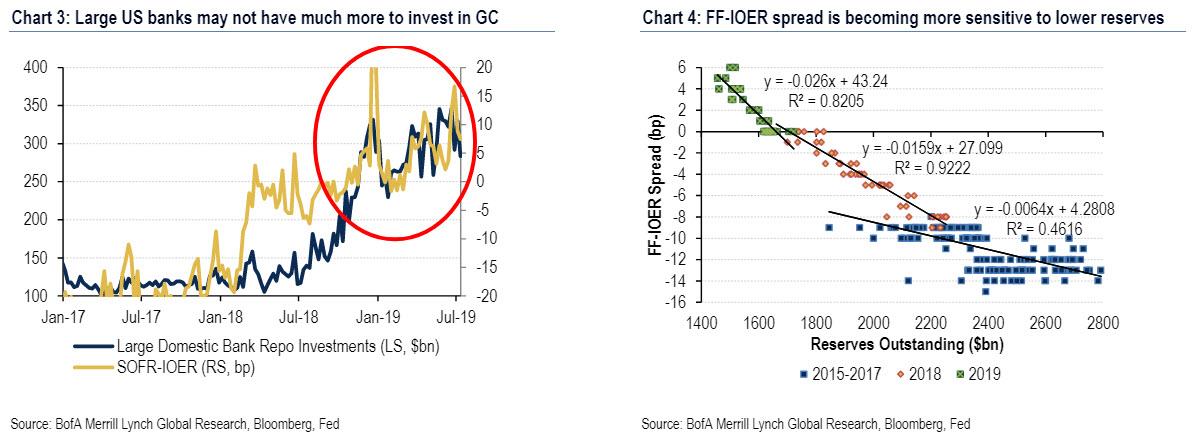

- 3. Banking system and reserve scarcity: Reverting to a topic which was especially dear during the QE ear, Bank of America notes that it is becoming increasingly concerned that the US banking system is nearing reserve scarcity. This can be seen via reluctance of large domestic banks to move out of reserves and into the closest HQLA level 1 substitute of O/N UST GC repo. Instead, large banks prefer to hold reserves as the most core component of their HQLA portfolios since reserves can be directly monetized and accessed intraday. Large domestic banks had previously been a key backstop to the O/N UST GC repo market as SOFR cheapened vs IOER; however, their GC investments have not been as sensitive to further UST cheapening (Chart 3). As such BofA is concerned that large domestic banks may not have as much ability or willingness to backstop the GC market as heavy UST supply arrives this month. This also coincides with increased sensitivity of FF to IOER at lower reserve levels (Chart 4).

- 4. Reserve manager selling: the recent sharp CNY depreciation should all else equal support Chinese UST purchases. However, the market is likely more concerned about trade tensions that slow China growth, support mainland capital outflows, and result in PBOC selling of USD to stem CNY depreciation pressures. This would result in a further decrease in Chinese UST holdings and additional Treasury cheapening.

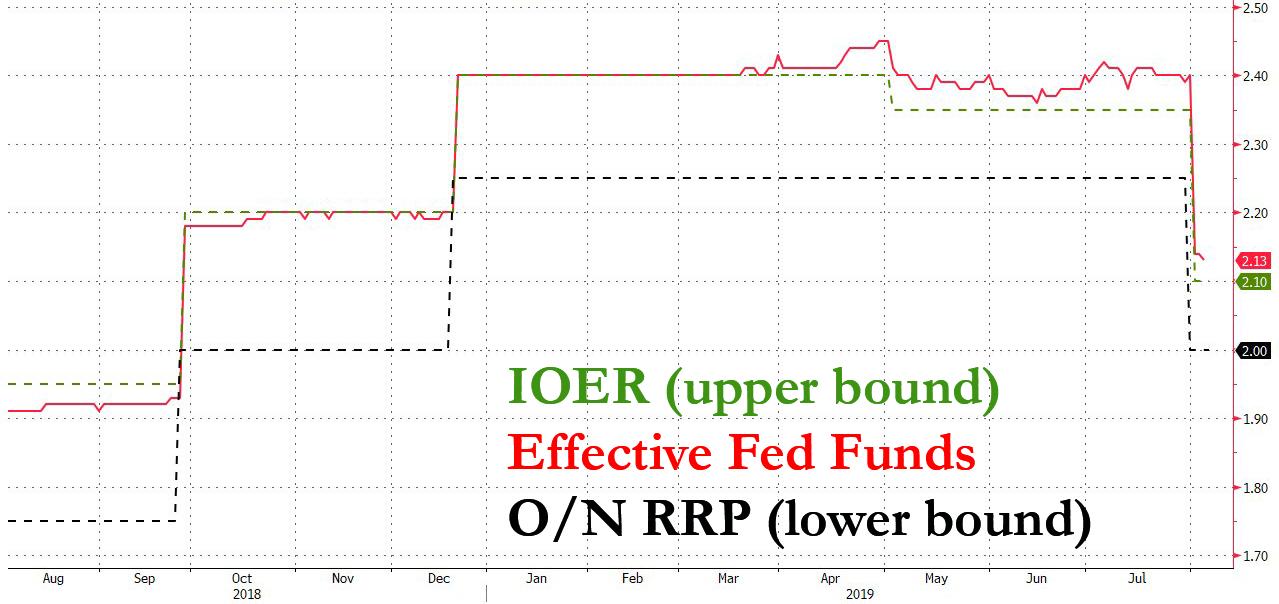

While we hardly have to remind readers of the ongoing inversion in the Fed Funds vs IOER rate, we can easily say that each of these factors has contributed to heightened sensitivity of money markets in relation to changes in UST supply and reserves, of which the FF-IOER “flip” is the most immediate consequence.

Of course, it will not come as a surprise to any rates experts that there has been a clear relationship between UST supply, lower reserve levels, and higher SOFR- and FF-IOER spreads (Chart 4, Chart 5, Chart 6). As a result, BofA expects even greater upward pressure on SOFR- and FF-IOER spreads by year end. Specifically, Cabana’s best guess is that the net $750bn of UST supply and $300bn of reserve drain by year end will place upward pressure on SOFR-IOER of 10-15bp and FF-IOER of 5-10bp vs current levels, substantially tightening liquidity conditions despite the end of QT.

It could get worse: according to BofA, risks are skewed to the high side of these estimates given the non-linearity we have recently observed in money markets.

* * *

Before we look at the various measures the Fed can take to fix this funding problem, let’s take a quick look at how this could affect markets.

Market implications: the clearest implications of these funding pressures are

- cheaper SOFR and USTs vs IOER and FF;

- wider FRA-OIS;

- tighter front-end swap spreads; and

- greater USD premium via XCCY basis.

SOFR vs FF futures are already pricing increasing funding pressures over 2H19, but August SOFR-FF futures are implying only a modest pickup in funding pressures. Sep and Dec ’19 FRA-OIS have widened materially in the past month, although there is scope for a further 5bp or so move upward given September is only pricing in a 2bp increase vs spot. For those asking, BofA believes the FRA-OIS widens via a UST “crowding out” channel whereby higher SOFR => higher bills => higher CP => higher LIBOR. Cabana also expects front-end swap spreads will tighten with the UST cheapening move and that the USD funding pressures will be reflected via wider USD XCCY basis.

Which brings us to the biggest surprise in the entire analysis: what will the Fed’s response be?

All else equal -and these days discounting World War III may seem almost overzealous – the Fed will need to respond to these funding pressures to maintain control of its target FF rate (even though it has already lost control of it). However, according to BofA it is unlikely to respond proactively. This is largely because the Fed seems to believe the banking system is not near reserve scarcity and has capacity to backstop the upcoming UST supply surge. NY Fed acting SOMA manager Lorie Logan stated in her most recent April speech “reserves remain ample and well above the level the banking system demands”. Assuming this view holds, expect the Fed to be reactive and stumble through its policy response. Needless to say, the Fed stumbling through a potential market crisis is hardly a good thing.

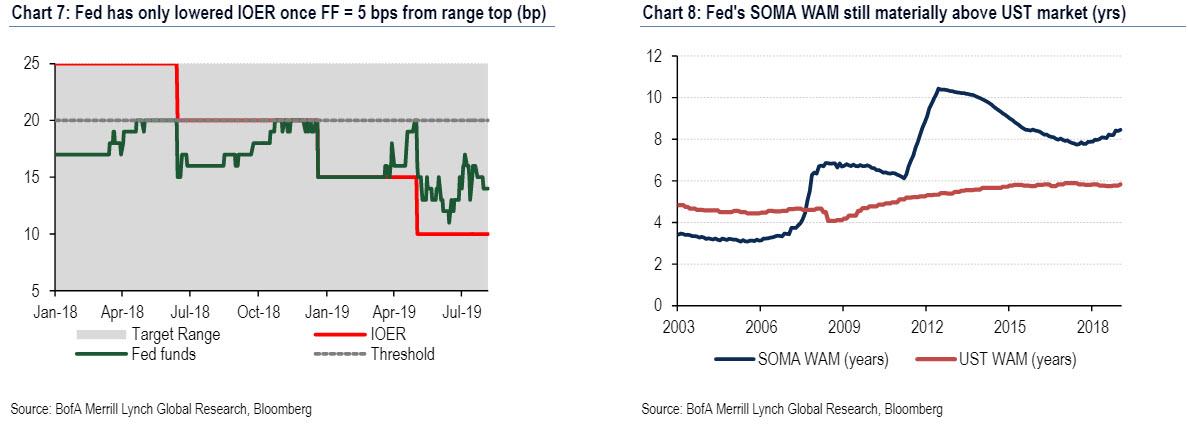

While BofA is unsure what the Fed’s threshold will be to offset funding pressures, it expects this to be a function of both level and pace. The Fed may start growing uneasy about the extent of funding market pressure after it adjusts IOER further and FF reaches 20bp over IOER (ie, IOER at range bottom and FF5bp from range top). Keep a close eye on the Fed Funds rate which Cabana expects to move “relatively rapid;y” as a result of upward FF, i.e., lack of liquidity, pressure that forces the Fed to act.

What this means? Stated simply, whenever the Fed decides to intervene more aggressively in funding markets, expect a partial reversal of the UST cheapening discussed above. It should limit upward pressure on SOFR, tighten FRA-OIS and short-dated swap spreads, and cause the swap spread curve to flatten. However, and here is the first shocker: the Fed will likely need to start growing its balance sheet (ie, OMOs, QE, SRF) before seeing such moves.

Which brings us to the punchline: what, according to BofA, are the Fed policy implications, or as Mark Cabana puts it, “a tepid start, a forceful finish.” And what a finish it would be…

Initial Fed policy response: lower IOER and possibly shorten SOMA UST WAM

- IOER cuts: The Fed is likely to make two additional technical adjustments to IOER by the year end. The Fed has typically lowered IOER once FF has reached 5bp below the top of target range (Chart 7). According to current projections, this will be needed again in Sep and Dec. Technical IOER adjustments do not solve any fundamental issues; they simply allow the Fed more time to see how funding evolves. It remains unclear if the Fed will consider cutting IOER and ON RRP below the bottom end of the target range. The Fed’s decision to drop IOER below the bottom end will likely depend on the velocity of the move in funding markets; it could also be interpreted by the market as the Fed’s loss of faith in its own rates corridor. If rates are moving slowly and orderly the Fed might lower IOER below the bottom. However, according to BofA, once they start, money market movements will be rapid and not afford the Fed this option.

- SOMA WAM reduction: Many banks, BofA includes, have long expected the Fed to shorten the WAM of its UST holdings / reinvestments (i.e. a reverse Twist operation). Such an action would be important to offset expected near-term funding pressures from the elevated UST supply and reserve drain. However, shortening WAM would also represent a tightening of financial conditions and the Fed may pass on such an action if it sees downside risks or is cutting rates, as the two actions would offset each other.

More powerful steps: temporary repos, outright QE, standing repo facility

- Temporary repo operations: these repo open market operations (OMOs) are a part of the Fed’s standard playbook and were used with great frequency prior to the financial crisis. However, this tool may be limited in size due to dealer balance sheet constraints. Fed OMOs bloat dealer balance sheets and large OMOs (>$100 bn) may distort dealer B/S management as they look to manage positions for year-end GSIB reporting.

- Standing repo facility (SRF): SRF has long been our preferred means for Fed control over funding markets (detail here, here, here). However, we are skeptical the Fed will have an SRF rolled out and in place by the time material funding market pressures are evident. The greatest sticking points will be (1) creation of a special “discount window” near the top of the Fed’s target range to improve bank HQLA “monetization” assumptions and (2) transacting with primary dealers via FICC to allow for balance sheet netting. We expect it will take until 1H20 at the earliest to have an SRF stood up and functional.

And the punchline: bring back QE, a move which will surely bring delight to president Trump:

- Outright QE: after OMO dealer capacity is exhausted the Fed may need to start permanently expanding its balance sheet. The Fed would likely describe this as offsetting “bank reserve demand and growth in other non-reserve liabilities”. Regardless, it would represent the Fed permanently buying USTs outright to maintain control of funding markets well above the ZLB.

Of course, since one war or another the Fed will have to resume QE, it may as well use this particular loophole – i.e., blaming the Treasury for its accelerate cash rebuild – to begin it. After all, it’s only a matter of time before Trump starts badgering Powell to do QE. After all, everyone else will soon be doing it again.

What are the political implications?

Well, for one, doing QE while still above the zero lower bound is guaranteed to raise concerns over Fed independence. To wit, any Fed action that results in balance sheet expansion to control front-end rates would likely receive the following criticisms:

- Fed indirect financing of UST fiscal deficits;

- independence of US monetary and fiscal policies; and

- US slipping toward MMT.

Of course, each of these potential criticisms over Fed balance sheet expansion is rooted in the issue of too much UST supply and constrained dealer balance sheets; of course, in the case of MMT the “independent” Fed will be done away with entirely as it starts monetizing all bond issuance, a la helicopter money. Here, BofA struggles to see how the Fed avoids such criticisms without regulatory changes for treatment of USTs (e.x. exempting them from SLR) or dealers (e.x. broader FICC repo clearing across assets).

What the Fed will ultimately choose is unclear, however in any case the upcoming wave of UST supply will present challenges for the Fed to control its target FF rate. These challenges largely stem from simply too much UST supply and the market’s ability to warehouse it – a challenge that will only grow in the coming years, which is why we have been warning for much of the past year to watch out for market crashes – these are a conveniently and easy scapegoat for the Fed returning to the old QE regime.

For what it’s worth, Bank of America believes “the Fed will need to step in to offset these funding market pressures through outright balance-sheet expansion or QE, potentially in 4Q.” And while the Fed could get ahead of these issues by laying out a framework around money market control before greater criticisms and questions emerge about the independence of monetary/fiscal policies or the path to MMT, it won’t do that, and instead it will wait for another, even greater “Lehman-like” crash to float the idea of imminent QE… which is precisely what Nomura warned about earlier in the day..

via ZeroHedge News https://ift.tt/2YKVQyt Tyler Durden