Despite stocks still being down 5% from pre-Powell levels, today’s dead-cat-bounce has prompted a resurgence of ‘everything is awesome’ with several speaking heads proclaiming “the resilience” of markets…

It all began when China fixed the yuan a smidge stronger than expected…

China stocks managed a small bounce in the afternoon but it was not enough to recover from the US-driven catch down…

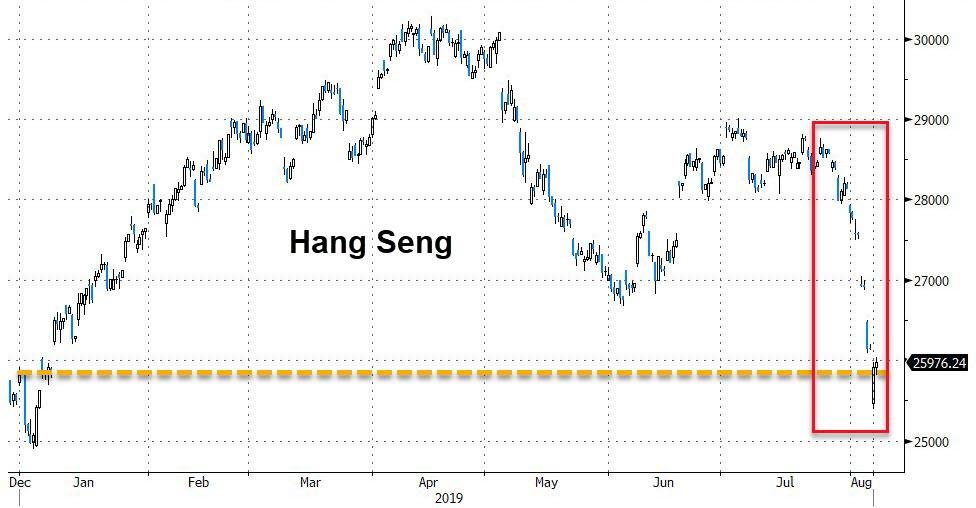

Hong Kong stocks are down 7 of the last 8 days (its biggest drop since Feb 2018) back in the red for 2019…

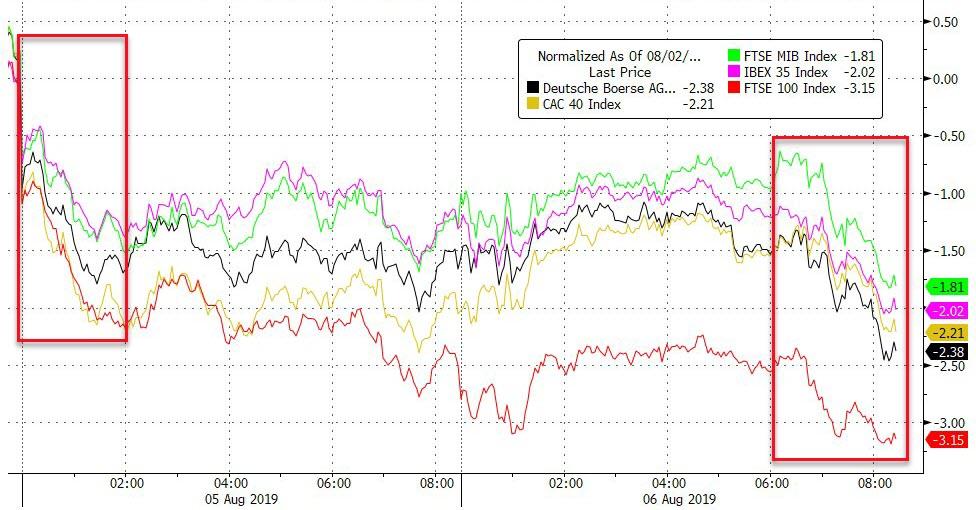

European stocks did not play along with US markets, ending very weak into the close…

US Equities had their momentum ignited and despite a pull back into the EU close (and then reacceleration after), managed to squeeze hold gains with Nasdaq best…

NOTE – this was S&P’s best day in 2 months and first up-day in the last seven.

But still ugly on the week…

After Europe closed, the short-squeeze in US stocks began…

Nasdaq led the day, bouncing off a key trendline level…

Dow futures soared over 900 points off the overnight lows hit after UST called China a currency manipulator… (seemed like Dow 26k was all the algos wanted)

NOTE – Dow futs plunged right after hours, erasing yesterday’s late-day 200 point rampathon – before the currency manipulator calls.

Dow cash bounced off its 200DMA…

Today’s gains were led by defensives…

On the heels of a proposed Opioid settlement, drug stocks were monkeyhammered…

NFLX is back in a bear market, down 20% from July highs and down 16 of the last 19 days…

BYND Barfed back to its secondary offering levels…down 35% from record highs

Credit spreads tightened very very modestly on the day…

Bonds and stocks decoupled during the US day session – both bid…

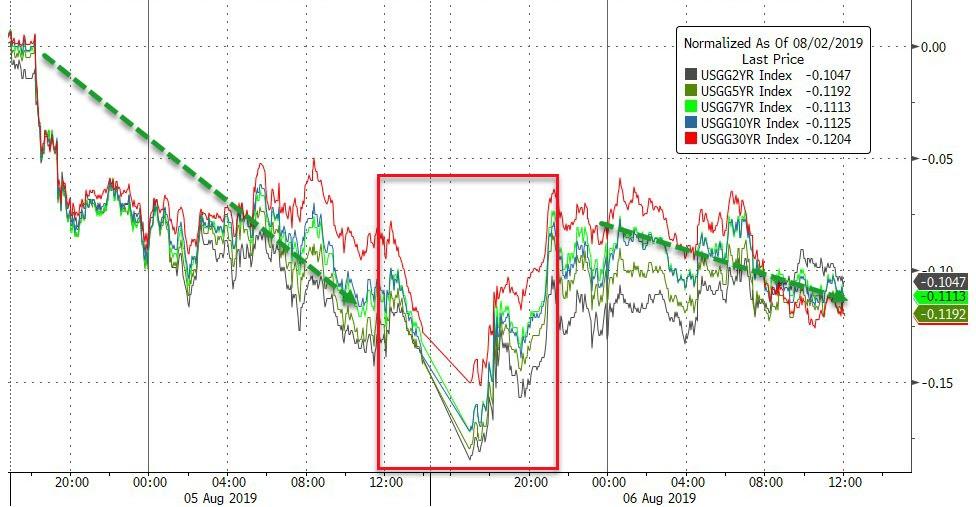

Treasury yields rose on the day, with the short-end underperforming (2Y +4bps, 30Y +1bps)… but remain dramatically lower on the week…

NOTE – 30Y yields slipped to unchanged from the US equity cash close.

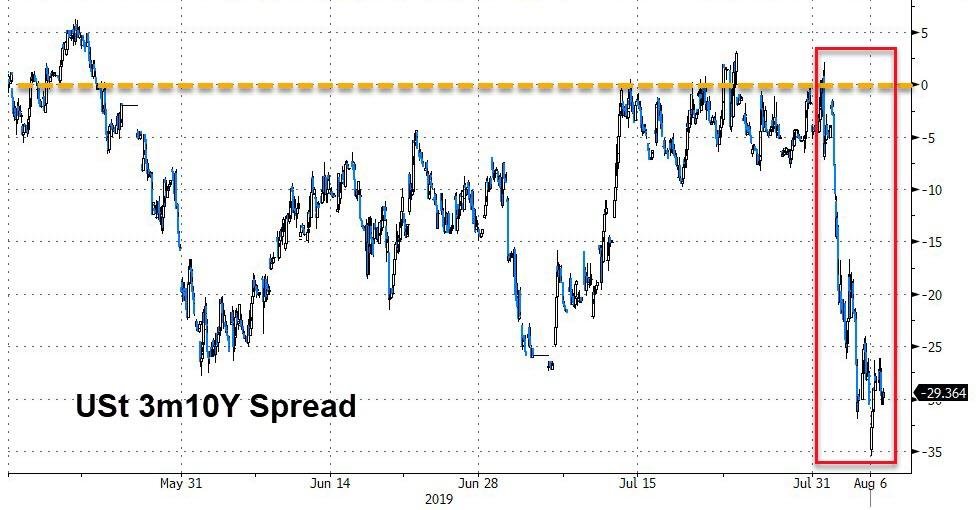

The yield curve did not steepen, staying at its most inverted of the cycle…

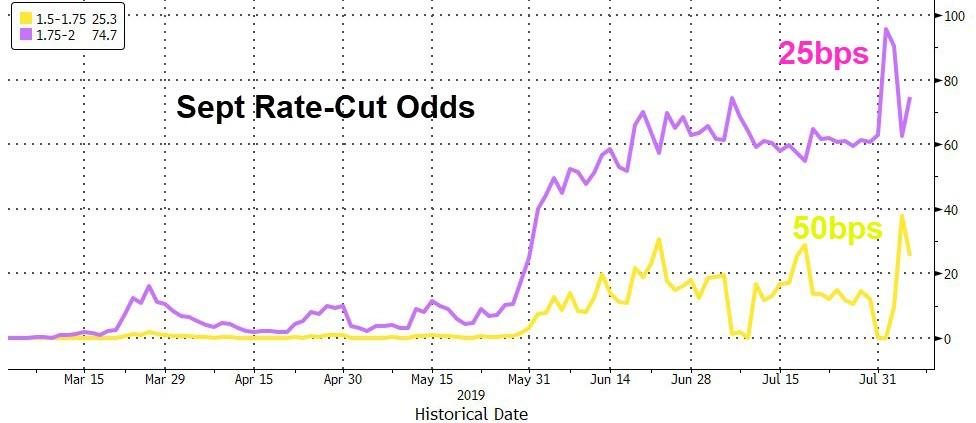

Markets are pricing in 2.5 more rate-cuts in 2019 (completely ignoring Powell’s insurance cut last week) – not at all what Jim Bullard was hinting at today…

The market is once again getting excited about the prospect of a 50bps cut in September…

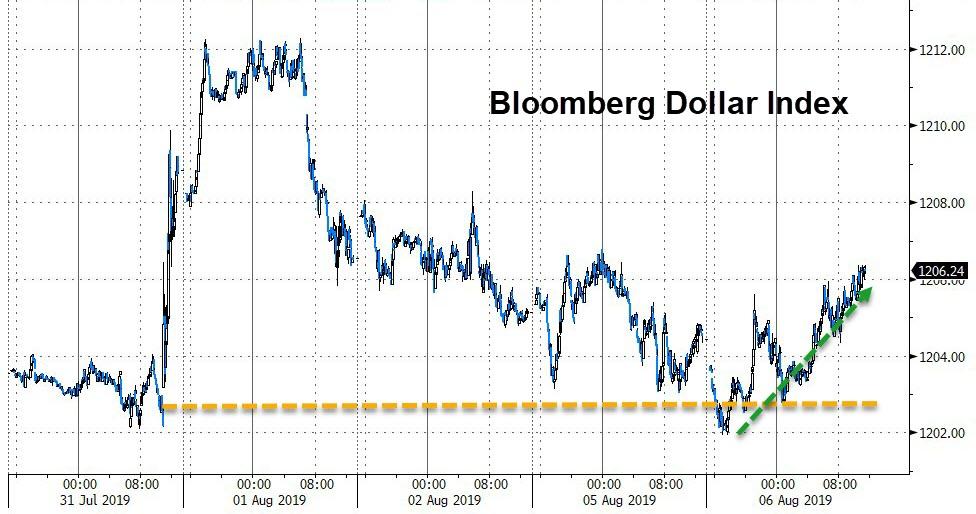

The Dollar Index found support at pre-Powell levels and rallied today…

Cryptos ended lower on the day – despite a big pump-and-dump intraday…

Bitcoin spike above $12k intraday…

Oil was worst as the dollar rallied but PMs managed gains…

Gold was bid back up to overnight highs after tumbling on the CNY Fix…

Oil prices plummeted late on with WTI back below $54…

WTI closed in a bear market, down 21% from April highs…

Finally, with Negative-yielding debt now over $15 trillion, bitcoin and bullion seem like solid sanity trades…

The Value Line Geometric Composite (VLG), an index that tracks the median U.S. stock performance among a universe of roughly 1800 stocks, is at a critical level…

And as for stocks, its time to party like its 1998…

And so to summarize:

China fixed the yuan slightly stronger than expected and US equity markets soared rather unbelievably… but Chinese stocks did not, Hong Kong stocks did not, European stocks did not, the dollar rallied, crude crashed, gold gained, bonds were bid even as stocks squeezed higher, and Jim Bullard poured cold water on hopes for ever more rate-cuts. So everything else in the world was saying this is not a reduction in rhetoric, but US mega-tech stocks “know better.”

via ZeroHedge News https://ift.tt/2OIuXeV Tyler Durden