Last week, in the aftermath of the Fed’s “mid-cycle” rate cut which sparked a tantrum in the market demanding the start of an easing cycle (which Trump appeared to deliver when he announced an escalation in the trade war with China which resulted in a devaluation in the yuan below 7.00 just days later), Nomura’s quant team cautioned that as a result of surging economic uncertainty, it anticipated the loss of the “buying support it has been getting from macro-oriented funds and longer-term investors” and the result would be systematic selling pressure which “could gain the upper hand for a while.”

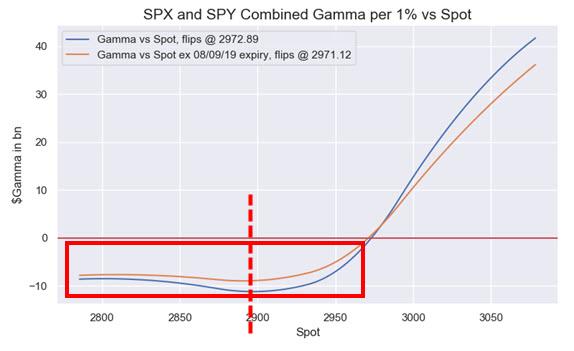

This, as Charlie McElligott detailed, is precisely what happened on Monday when the S&P dipped below key CTA selling thresholds, as we discussed yesterday in “Here Comes The “Extreme Negative Gamma” Selling Avalanche” which materialized almost instantly, sending the S&P on its biggest daily drop of 2019:

Another reason why Nomura’s quants were worried was simpler: the calendar, i.e., August is a month where liquidity is especially thin as traders are on vacation, and the result tends to be a “volatility shock.”

And most remarakble was Nomura short-term forecast, according to which the Japanese bank saw “the S&P 500 being taken down into the 2,850-2,900 range.”

Just a few days later that’s precisely what happened.

But while Nomura should be commended for correctly predicting the dramatic market plunge that followed Thursday’s chaos, even if it did not necessarily anticipate the catalysts that caused it, what is more concerning is what Nomura sees happening next, namely that the “arrival of first volatility spike sets up the possibility of another one in late August or early September.“

As Nomura’s Masanari Takada recaps recent events, “equity markets in the US and worldwide were hit with a massive selloff yesterday. As market participants with a focus on fundamentals would have it, a somewhat hawkish FOMC meeting outcome dashed expectations for another exercise of the “Fed put”, and the US’s invocation of a fourth round of tariffs on Chinese goods added to fears of an intensifying battle between the US and China on the twin fronts of trade and currency policy.”

So far so good. What is not is the punchline, namely that Nomura has been expecting the “vol-up” scenario to arrive in two waves, and yesterday’s developments confirmed that the first wave had arrived.

To be sure, there was nothing shocking about this: as Nomura’s own forecast last week indicated, and going by an analysis of speculative traders’ methods and the available quantitative data on various market anomalies, Takada notes that the present selloff looks like a mostly predictable affair that has unfolded just as one might expect: yesterday’s selloff met the criteria for a “vol-up” scenario in that as of the 5 August market close,

- the VIX had broken above 20,

- the VIX futures term structure had gone into backwardation (between UX1 and UX2), and

- the VVIX had broken above 100.

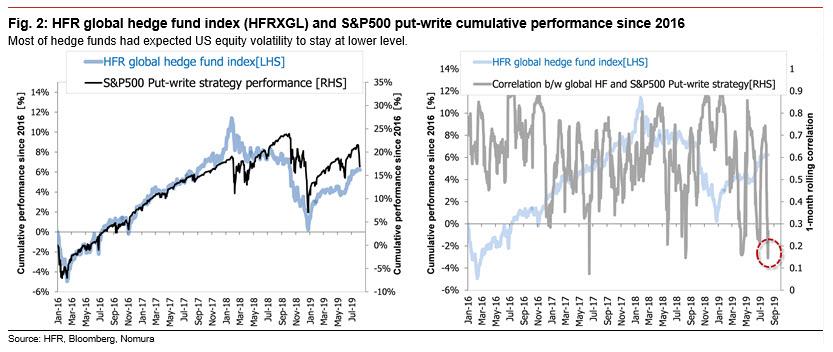

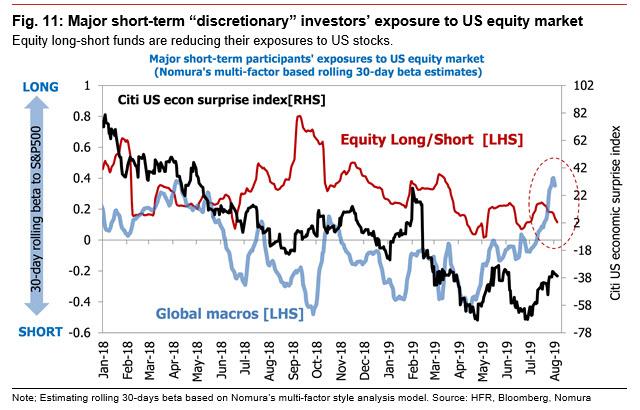

In attempting to pinpoint what supply-demand factors set the stage for the arrival of the first wave of higher volatility, Nomura highlights that hedge funds, after building up bullish positions in equities starting in mid-June and throughout July, have had their positions suddenly and seriously undermined.

As McElligott hinted yesterday when he slammed being short gamma in an environment such as this, the quintessential examples of such positions are:

- trend-following strategies targeting the topside for US equities; and

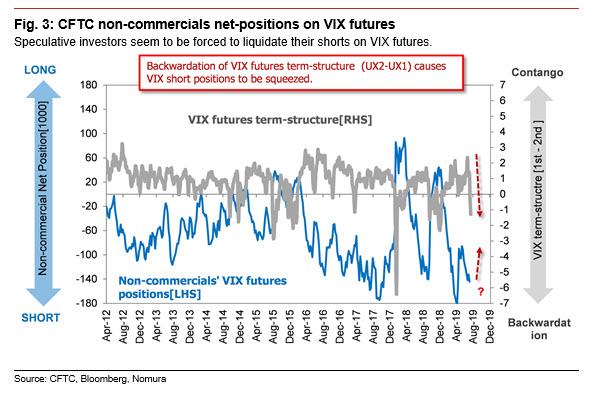

- bets on continued low volatility including short gamma strategies (like the selling of S&P 500 puts) and short positions in VIX futures.

Meanwhile, as we warned last weekend, speculative traders had piled into these positions in lockstep to the point of herding, so their moves to buy back puts (thereby pushing up implied volatility) and sell futures (whether to unwind positions or to hedge other positions) set off a chain reaction of selling in the stock market. The data show that hedge funds had in fact started reducing their net exposure to US equities (estimated 30-day rolling beta) on 1 August.

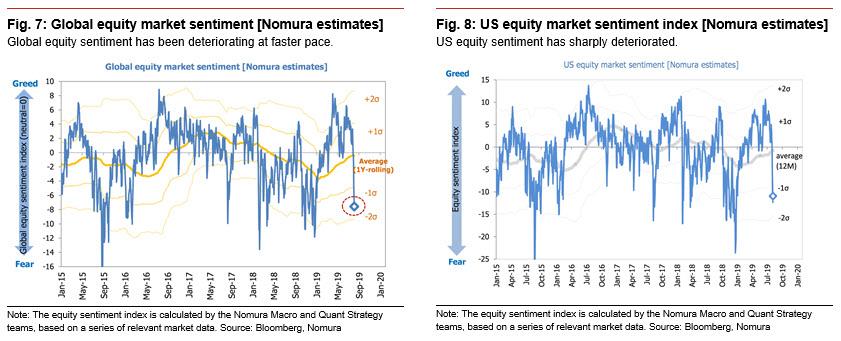

The risk-off mood also gained momentum, with Nomura’s proprietary gauge of US stock market sentiment registering a more negative reading (indicative of risk avoidance) than at any time since January 2019. Speculative traders of all stripes sold off US equities so as to reduce their net exposure. From the other direction, some global macro hedge funds and ultra-short-term traders hoping to partake in a near-term spontaneous rebound may well step in to buy stocks in a hunt for bargains. Nevertheless, Nomura thinks conditions on balance are such that among speculative traders, trend-following algos are especially likely to continue looking for opportunities to close out long positions. This is particularly true of CTAs, which may well exit the entirety of their existing net long positions in S&P 500 futures and NASDAQ 100 futures so as to make their positioning market-neutral, even without an assumption that a US economic recession is imminent.

What happens next?

In laying out the sequence of events, the Nomura quants predict that once the first wave of volatility has passed, global equity markets are likely to experience a spontaneous rebound. Contributing factors to such a relief rally could include expectations for a substantial rate cut by the Fed at the September FOMC meeting and stock purchases made by short-term contrarian investors.

However, for three specific reasons, Nomura expects any near-term rally to be no more than a head fake, and thinks that any such rally would be best treated as an opportunity to sell in preparation for the second wave of volatility that the bank expects will arrive in late August or early September. Worse, Takada warns that “the second wave may well hit harder than the first, like an aftershock that eclipses the initial earthquake. At this point, we think it would be a mistake to dismiss the possibility of a Lehman-like shock as a mere tail risk.”

The bank then lists the three reasons:

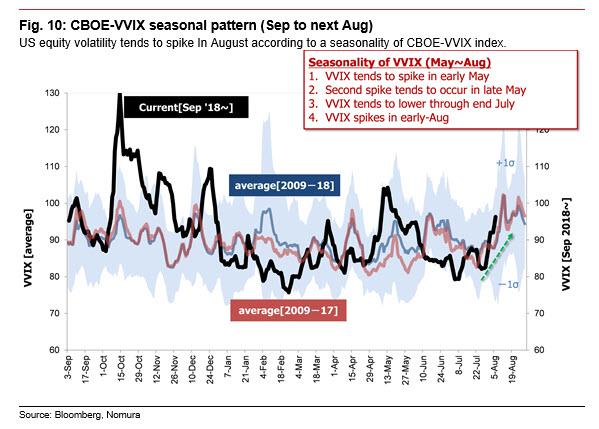

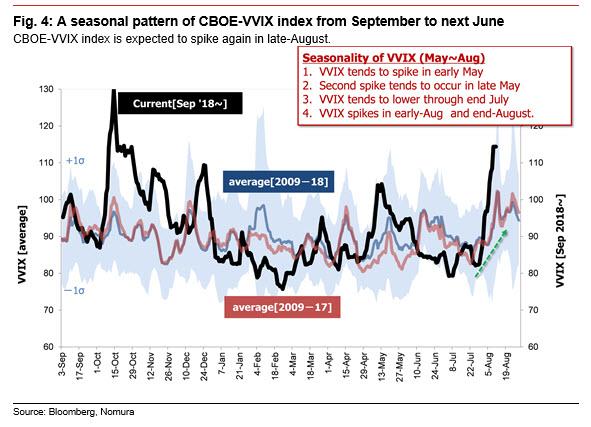

1. The first reason for expecting any near-term rally to be short-lived is the seasonal pattern in US stock market volatility. The VVIX index (which measures the volatility of the VIX index, itself a measure of volatility) tends to spike twice in August, once in the first half of the month and once in the latter half. Whether these spikes occur in a given year depends to a large extent on whatever imbalances in supply-demand have built up in the market just ahead of the event, but the risk of a vol-up scenario in August does tend to materialize in years like this one, with speculative traders having staked out rather hefty bullish positions in equities through the end of July.

2. The second reason we cite is the positioning of trend-following algo traders in equity markets. Like hedge funds, trend-following algos including CTAs and risk-parity funds have been sucked into the aforementioned chain-reaction selloff. Even so, CTAs’ net long position in S&P 500 futures is still only about 45% smaller than it was at its most recent peak on 16 July. With much of the unwinding still left undone, we think CTAs are likely to continue selling futures for loss-cutting purposes. Meanwhile, we estimate that heightened stock market volatility will leave risk-parity funds having to dispose of another USD 15-20 billion worth of DM country equities in order to rebalance their portfolios. On this point, we need to emphasize that rebalancing trades by risk-parity funds tend to be clustered at the end of each month.

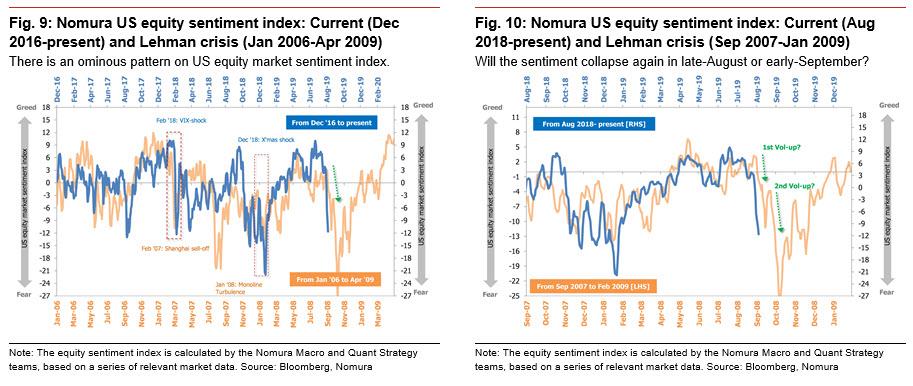

3. Third, global stock market sentiment is collapsing in an irregular way. Nomura reads the current trend in sentiment as suggestive of both deterioration in supply-demand for equities and a sharp downward break in fundamentals. Above all, the pattern in US stock market sentiment has come to even more closely resemble the picture of sentiment on the eve of the 2008 Lehman Brothers collapse that marked the onset of the global financial crisis.

Of course, Nomura caveats that the resemblance could “turn out to be merely superficial” however, Takada also warns that “it could also be that the market’s repeated pendulum swings between optimism and pessimism over how the US-China standoff might end have a meaningful historical parallel in the market’s long-ago mood swings over how the subprime mortgage crisis might play out.”

Therefore the quant thinks that even if US stock market sentiment were to start picking up, it may well collapse again in late August or early September. His conclusion: “we accordingly see a non-negligible threat of tail risks materializing in a way that shocks the market into panic selling.”

via ZeroHedge News https://ift.tt/2Zzff6M Tyler Durden