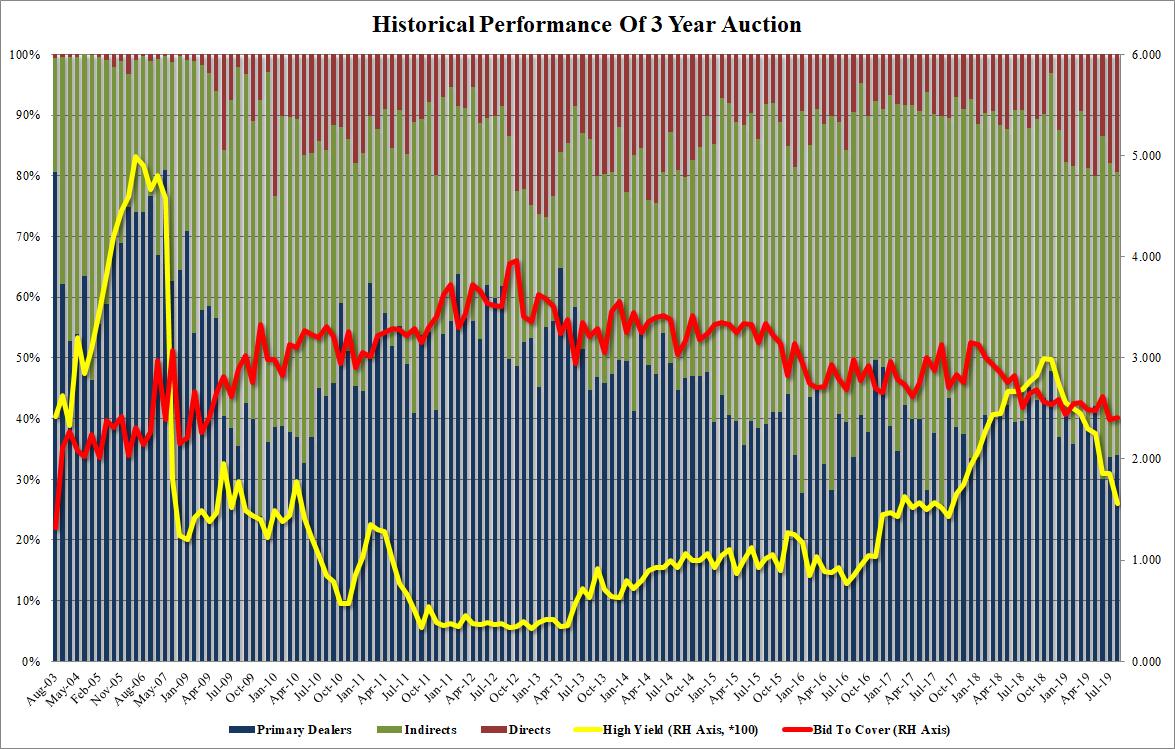

One week after a series of rather disappointing auctions, the US treasury has launched the week’s refunding sales, starting with today’s sale of $38 billion in 3Y notes, which moments ago stopped at a high yield of 1.562%, stropping 0.1bps through when issued 1.563%, and the lowest yield for the tenor since September 2017. This was the third consecutive 3Y auction that has stopped through the When Issued, a sign that investors still have substantial appetite for the short-end.

There was less enthusiasm if one looks at the bid to cover, which despite rebounding from last month’s 2.39, was still the second lowest since March 2009.

Finally, the internals were generally in line, with foreign buyers, or indirects awarded 46.7% of the auction, right on top of the 6 auction average; Directs saw a modest increase to 19.3% from 17.9% a month ago, and above the 16.3% average, while dealers ended up with 34% of the auction, unchanged from last month and just below the recent average.

Overall, a solid auction and one which sets up nicely for tomorrow’s sale of benchmark, 10Y paper.

via ZeroHedge News https://ift.tt/2Kk04Jl Tyler Durden