A manic day in stocks and bonds today with an early collapse panic-bid back to unchanged as precious metals soar and commodities crash.

The extreme vol prompted a warning from Guy Haselmann, chief executive officer of FETI Group LLC and Scotiabank’s former head of capital market strategy, who said global markets are moving closer to a Minsky moment, or a sudden collapse of asset prices. FETI is a Summit, New Jersey-based company that works with portfolio managers.

“An extended period of low volatility like we have seen in recent years significantly increases leverage and risk-seeking behavior,” he said in an interview.

“When volatility turns like it has, people often need to sell assets to meet margin calls. That’s what makes this so combustible”

“Just one more waffer-thin quantitative easing…?” What could go wrong?

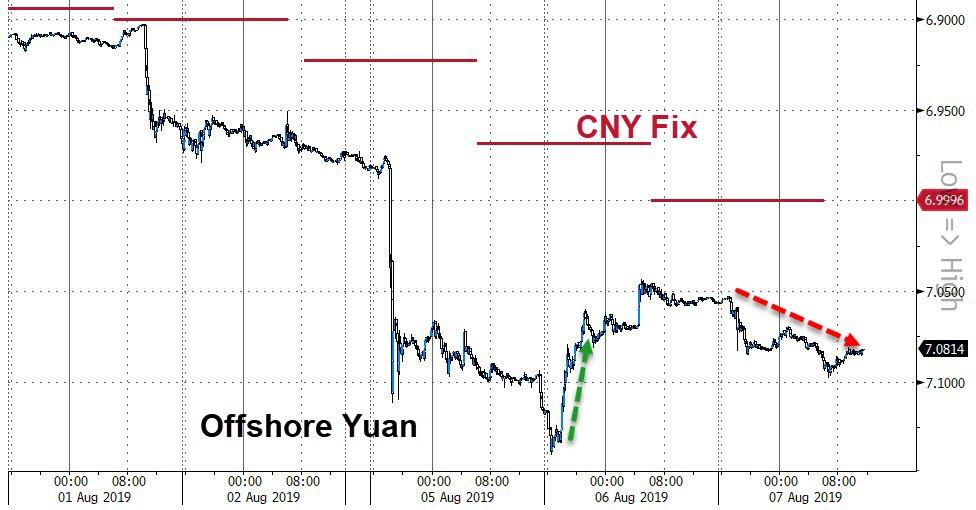

A weaker than expected (though fractionally stronger than 7) Fix by the PBOC unleashed hell globally once again overnight…

But, thanks to rate-cuts from New Zealand, Thailand, and India combined with Chicago Fed President Evans comments suggesting more easing and QE4EVA prompted some PPT-sponsored panic-bids in US equities.

“…you could take the view that the risks now have gone up, and as we think we’re going to get closer to the zero lower bound with higher probability, that would also call for more accommodation.”

Nevertheless, investor sentiment has collapsed from euphoric greed just a month ago to “extreme fear” …

In the US, markets were mixed with Nasdaq best as desperate panic bids appeared to lift stocks back to unch (and to top the farce off a super-spike at the close)…

Dow futures ramped 600 points off the overnight lows back into the green and tagged 26k before limping back lower…

VIX was smashed back to a 19 handle…

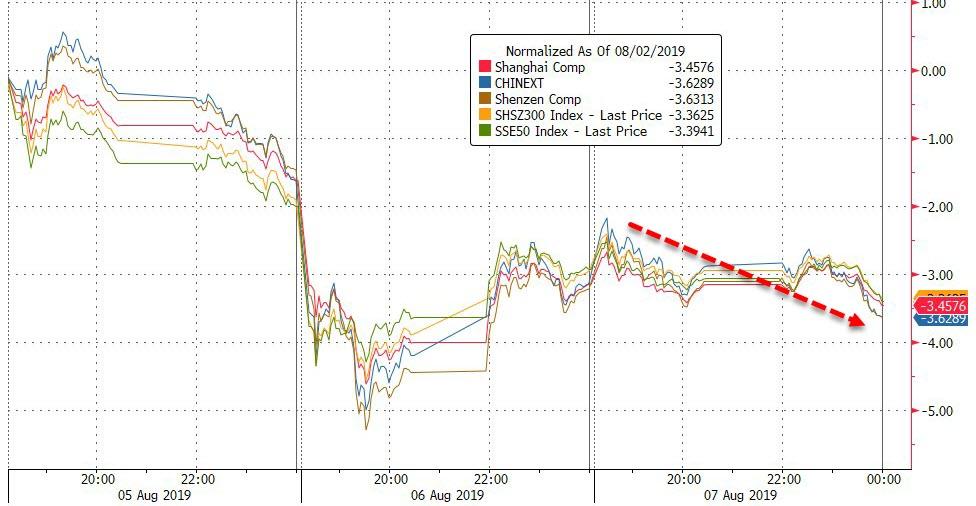

China stocks drifted lower overnight, closing at the lows…

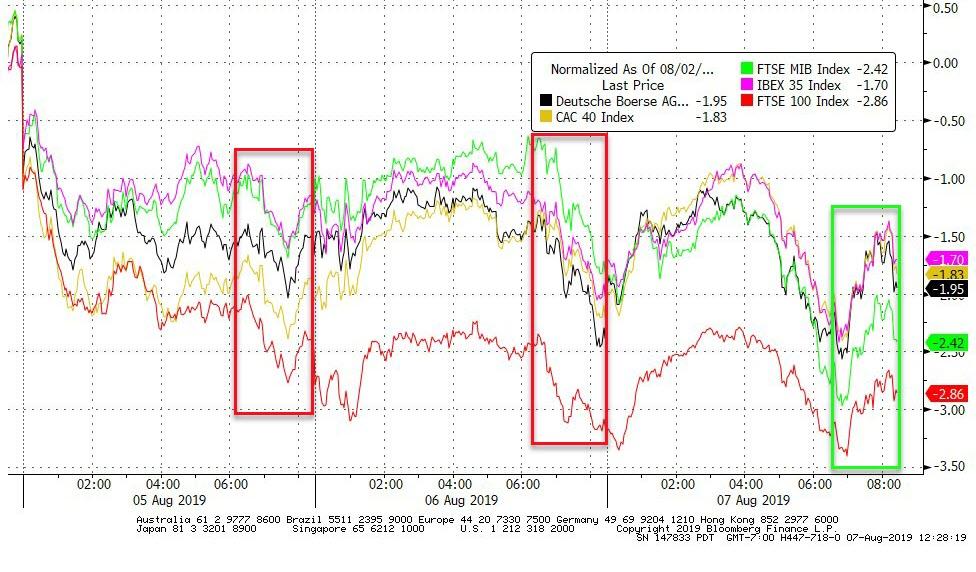

European stocks (German IP collapse) ended higher as the US open sparked buying off the lows…

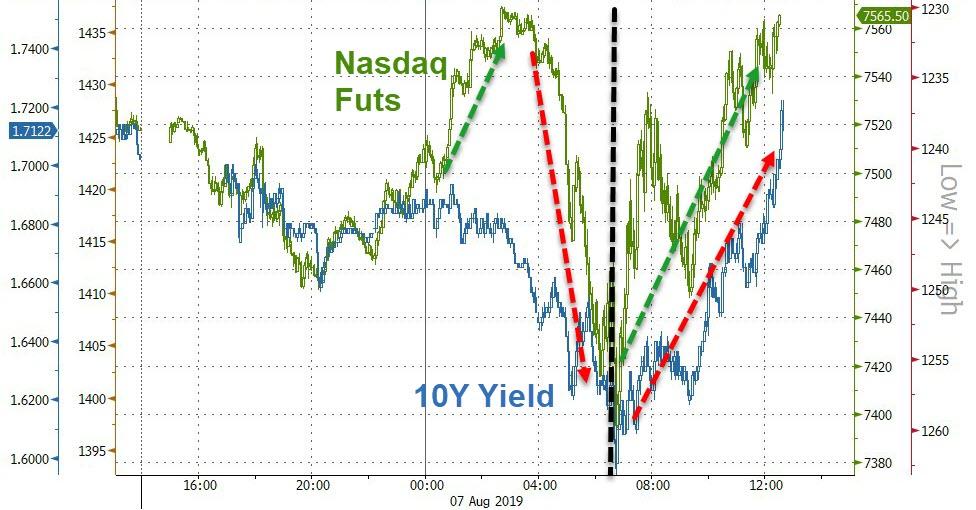

Stocks and bonds decoupled overnight, with stocks tumbling back to bonds reality, but then the US cash open sparked stock-buying, bond-selling all day…

Treasury yields tumbled again overnight but ramped back higher after Europe closed…ending the day practically unchanged

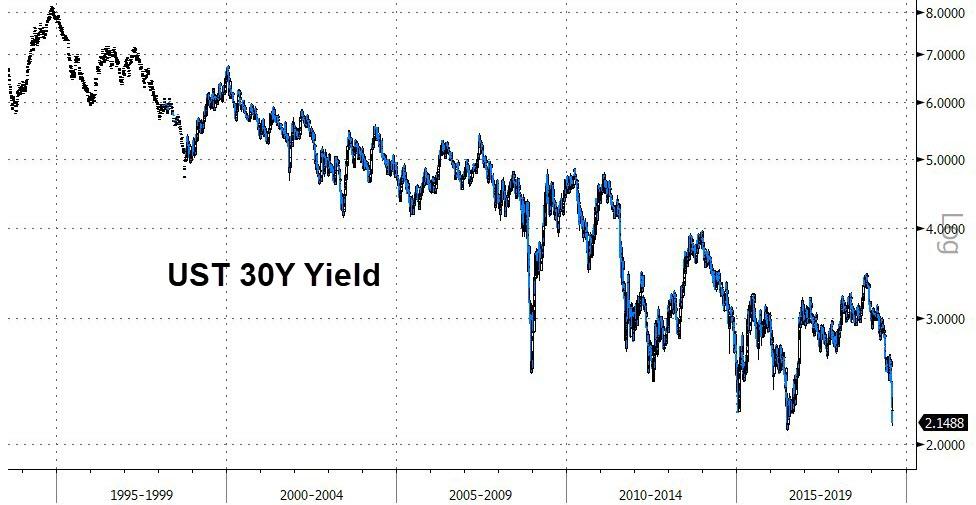

30Y Yield plunged to near record lows…

And before we leave bond-land – We bet you wish you bought more Austrian Century Bonds…

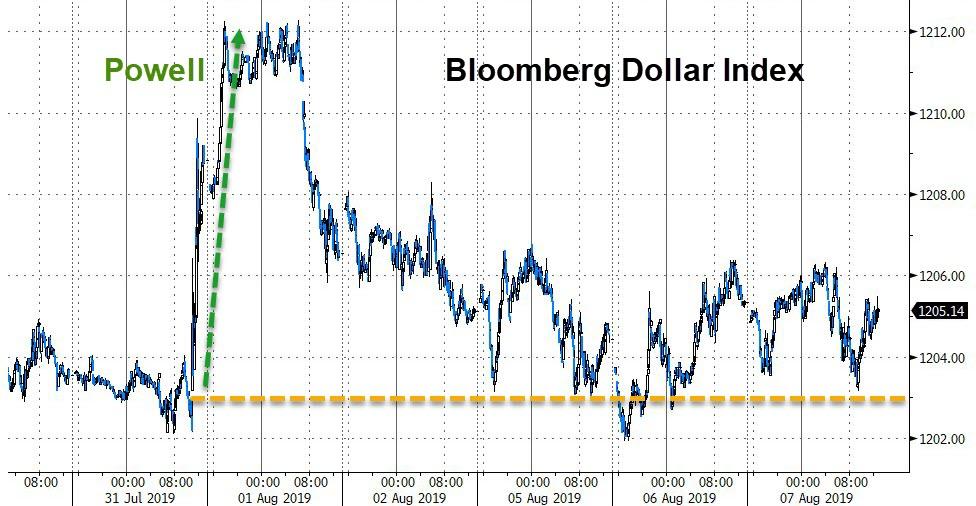

The Dollar roundtripped like everything else to end unch…

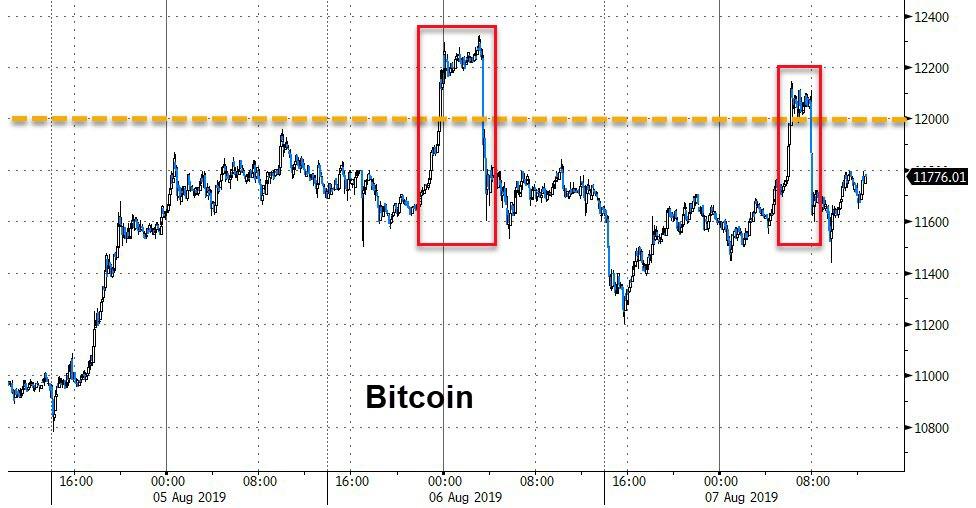

Cryptos were mixed to flat today…

As Bitcoin once again tested $12k and rejected it…

PMs dramatically outperformed every other asset class today..

Gold surged to new six-year highs…

Silver soared above $17…

Silver dramatically outperforming gold on the day…

Oil prices collapsed, as a double-whammy of global demand concerns and a surprise crude build sent WTI prices back to a $51 handle…BUT then late in the day, a Saudi headline promising to do whatever it takes to halt oil price drop sparked a surge back above $52…

Finally, with $15 trillion (and rising tonight) in negative-vielding debt, bullion and bitcoin appear the preferred safe haven against policy-maker panic…

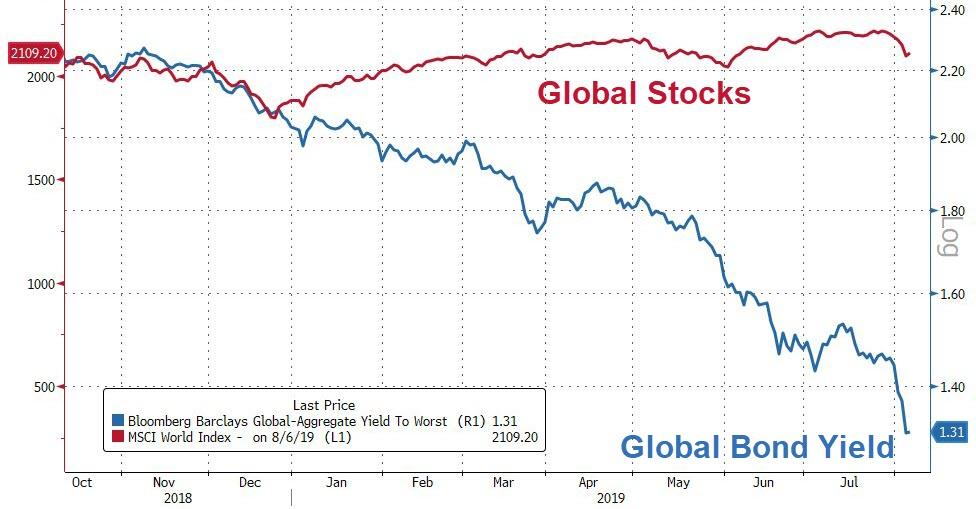

Still, global bonds and stocks remain massively decoupled…

So can you guess who will be right in the end?

via ZeroHedge News https://ift.tt/2KCW6ua Tyler Durden