Authored by Ted Dabrowski and John Klingner via WirePoints.org,

Only in Illinois does a surprise increase in tax revenues and more pension debt equal “stability” for a state’s finances.

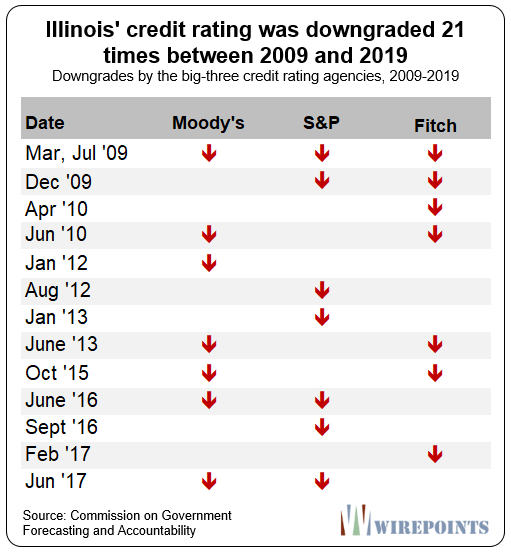

Fitch Ratings just improved Illinois’ rating outlook from negative to stable, partly basing its decision on an unanticipated $1.5 billion state revenue surge and an on-time fiscal 2020 budget. It said “the potential for a downgrade in the near term has receded.”

Here’s what Fitch said:

The Outlook revision to Stable from Negative reflects key developments over the last three months for the state including an unanticipated revenue surge in April 2019 that positioned the state to resolve a sizable fiscal 2019 mid-year budget gap and enact an on-time fiscal 2020 budget. The positive April revenue surprise seen in Illinois, and other states, supported a significant increase in fiscal 2020 estimated revenues, easing the path to budget adoption and allowing the state to reduce (but not eliminate) reliance on non-recurring measures. The state now has a plausible and achievable 2020 budget plan, leaving it better positioned from a fiscal perspective, and the potential for a rating downgrade in the near-term has receded. The recent gains, however, are somewhat tenuous and their sustainability hinges on the state’s actions over the next several years, particularly around the November 2020 ballot initiative on the graduated individual income tax.

But if anything, Fitch’s points in favor of stability are just the opposite – they actually made Illinois weaker.

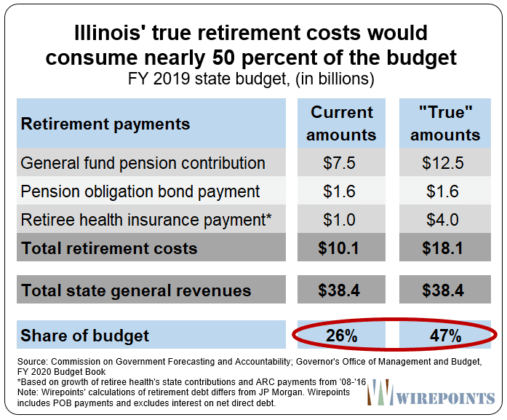

Windfall revenues allowed politicians to push off spending and structural reforms once again. And a “balanced” budget based on phony accounting means lawmakers will let the state’s retirement debts grow by billions in 2020. (Illinois’ “balanced” budgets don’t require the state to make its full, actuarial pension payments. See the details here.)

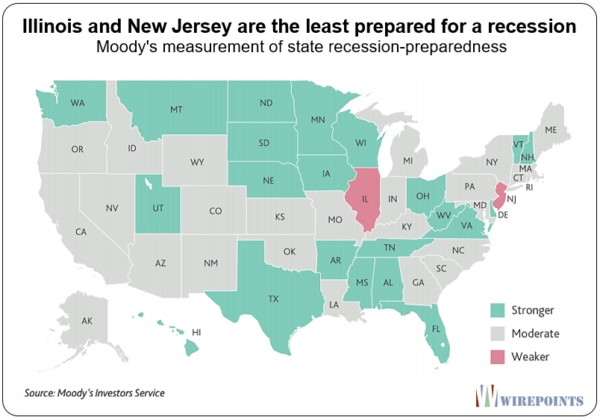

Even more, politicians did nothing to address Illinois’ absolute lack of preparedness for the next inevitable recession. Illinois has no resources to weather a downturn and, along with New Jersey, is the nation’s least prepared state.

Fitch’s “stable” outlook is for the benefit of bondholders, who may breathe a sigh of relief after years of downgrades. Since bondholders are the first in line to get repaid, they benefit from any short-term games politicians might play.

But for ordinary Illinoisans, the situation has only gotten worse. The 2020 budget puts Illinois into an even deeper hole.

via ZeroHedge News https://ift.tt/2OKCHg8 Tyler Durden