Authored by Ian Lyngen via BMO Capital Markets,

Today Echoes Great Recession, Euro Crisis & 2016 Election

There are moments of inflection in the market when the phrase ‘prices have changed more than the facts’ becomes particularly apropos and today’s Treasury rally ostensibly qualifies. We’ll caution here however that the devolving macro narrative is very consistent with with such a repricing.

The overnight round of Asian central bank cuts combined with the weakest yearly change in German industrial production since 2009 are symptoms of changing expectations rather than the root cause of the move. Nonetheless, 10-year German yields dipped as low as -0.613% to a fresh record low. The selloff in domestic equities offers echoes of Q4 2018, with the primary difference being the Fed just cut rates versus the December hike-too-far.

Our primary concern linked to the sharp selloff in stocks is a spike in equity vol that tightens financial conditions to rapidly price in the Fed’s series of three quarter-point-eases.

An inter-meeting ease isn’t on our radar; although the futures market shows the August contract trading with an implied rate of 2.115% — 1.5 bp of easing (or a 6% chance of a quarter-point emergency move).

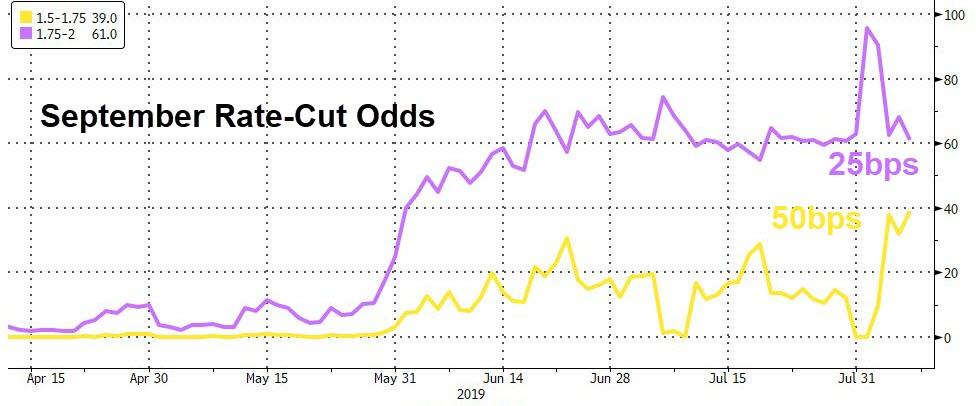

What is even more compelling are the odds of a 50 bp cut in September jumped >50% — 54% depending on how one slices it or 38.5 bp net easing. To say the Fed’s fine tuning ambitions just became a lot more complicated would be an understatement.

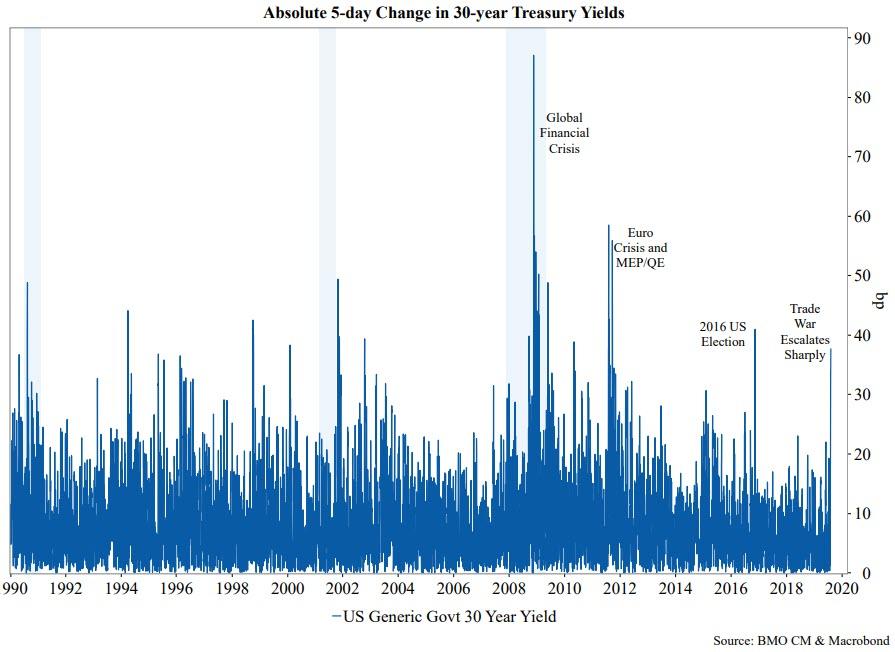

We’ve included a chart of the absolute 5-day change in 30-year yields dating back to 1990 to illustrate just how dramatic the recent 40 bp rally in the long bond has been. Every time the market moved in a comparable fashion, ‘something has changed’ was invariably the takeaway.

The last three episodes were 1) 2016 US Election, 2) Euro crisis and Twist/QE, and of course 3) the Global Financial Crisis/Great Recession. If there was ever any question whether or not there is a significant shift in investor expectations afoot, the performance of the long bond should make it abundantly clear — particularly in light of the proximity to the August refunding auctions.

Remember when supply events warranted a concession? So pre-crisis.

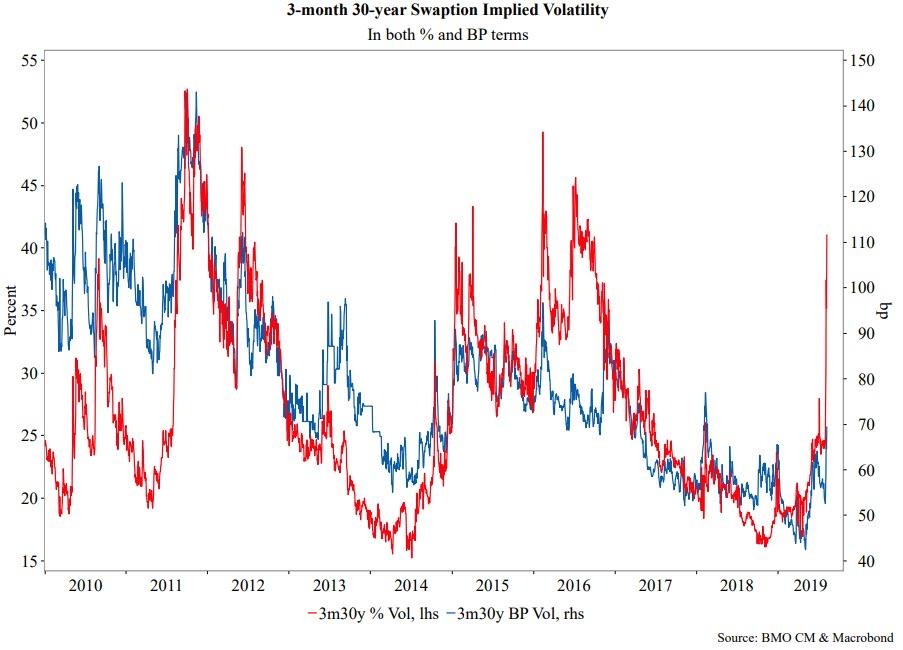

In keeping with our efforts to demonstrate the relevance of the magnitude of the recent move, we offer a chart of 3-month 30-year swaptions implied volatility — in both percentage and basis point terms.

The significance of the spike is difficult to overstate.

via ZeroHedge News https://ift.tt/2Tg5oAm Tyler Durden