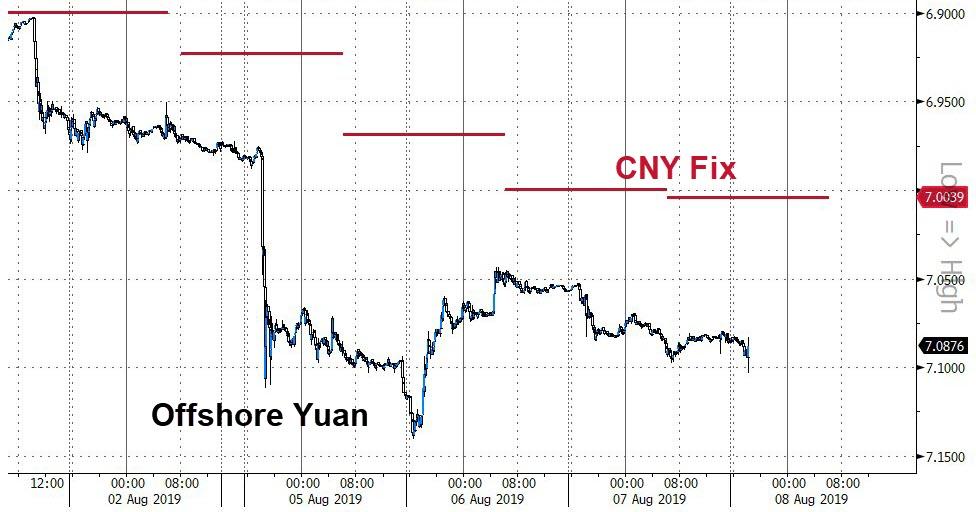

A quick case study on the power of expectations: On Monday, when the PBOC fixed the Yuan below 6.90 for the first time in 2019, well below consensus estimates, the offshore yuan collapsed, tumbling below 7.00 and as far as 7.10 for the first time since 2008, its biggest drop since the Aug 2015 devaluation and unleashing famine and pestilence across global capital markets. Then, on Thursday, one day after the comical fixing of 6.9996, the PBOC finally broke the seal, and set the daily reference rate of the yuan at 7.0039 per dollar, the first fixing weaker than 7.0000 in 11 years…

… but because the fix was a tad stronger than the 7.0156 rate estimated by analysts, the market took this as bullish and reacted with a relief rally sending S&P futures sharply higher from session lows.

And while China was quick to talk down the historic fix, and the market was clearly delighted by the fact that the fixing was not as worse as it could have been, the event was nonetheless momentous.

In a recent Bloomberg opinion piece, former UBS chief economist and China watcher George Magnus wrote “China allowing the yuan to slide below 7 to the dollar is a watershed moment for currency markets that’s symbolically equivalent to the U.S. and other countries abandoning the gold standard in the interwar period, or the collapse of the postwar Bretton Woods system of fixed exchange rates four decades ago. The implications for the global economy are equally significant.”

To be sure, the market has been eying the fix for insight on what constitutes a ‘comfortable’ level for the PBOC. UBS noted that although the PBOC has stepped up measures to slow the yuan’s pace of depreciation (including: introducing a larger counter cyclical factor, issuing central bank bills in Hong Kong to manage liquidity, pledging to keep the yuan stable) the market remains concerned about further weakening. “Today’s fixing is a clear message that China doesn’t mind letting its currency depreciate beyond any specific number, but would like to control the pace it weakens and mitigate market volatility as ‘stability’, which is PBoC governor Yi Gang’s main goal.” UBS believes that upward pressure on USDCNH is likely to persist in the near-term, as does Citi and SocGen, both of which expect the yuan to drift to 7.50 and lower against the USD.

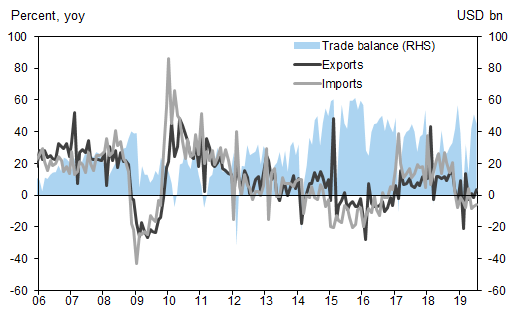

For now, however, China’s stronger than expected fix provided a brief comfort to markets, and global stock markets enjoyed a tentative recovery on Thursday after the PBOC print as well as better-than-expected Chinese export data. On the latter, China’s NBS reported that exports increased 3.3% yoy in July (USD terms), up from a decline of 1.3% yoy in June, and imports continued to soften, declining 5.6% yoy in July (v.s. -7.4% yoy in June). Both readings were above consensus expectations despite the Sino-U.S. tariff struggle.

In sequential terms, China’s exports rebounded 2.6% mom sa non-annualized in July, reversing a contraction of 0.9% in June. Imports went up by 2.6% mom sa non-annualized in July following two consecutive months of decrease. China’s trade surplus moderated to US$45.1bn in July from US$51.0bn in June. Exports to the US continued to contract by 6.5% yoy in July, and exports to Japan also declined 4.1% yoy. In contrast, exports to the EU rebounded 6.5% yoy in July from a decline of 3.0% yoy in June, and exports to ASEAN increased strongly by +15.6% yoy in July.

This was enough for the beaten down market to express some modest bullish sentiment overnight, and the MSCI world equity index rose 0.25%, led by Asia and Europe, even though it remains down more than 3% since the start of August.

Futures on all three of the main U.S. equity indexes advanced after the S&P 500 eked out a gain on Wednesday, although much of the gains have been pared as traders walk in to their desks.

The Stoxx Europe 600 also climbed for a second day, following Asia higher in early trade, led by tech and chemicals shares. European tech stocks lead gains, rising for a second day as investors bought into chip stocks and names which have lagged this year. The Stoxx Tech index rallied as much as 1.7%, led by chip maker AMS +3%, telecom carrier United Internet +2.5%, IT services co. Capgemini +1.9%, and Sweden’s Hexagon +2.1%. News that Japan has granted the first export license to South Korea also helped boost sentiment: “This is positive for the sector as this is one of the macro uncertainties (along with China-U.S.) with the potential to endanger a recovery,” Bankhaus Lampe analyst Veysel Taze said.

Earlier in the session, a gauge of Asia stocks increased as China’s Shanghai Composite rebounded from the lowest level since February. Asian stocks advanced for a second day, led by material firms, with most markets in the region up, led by Indonesia and Taiwan. Japan’s Topix slipped 0.1%, dragged by SoftBank Group and Takeda Pharmaceutical, after the yen extended gains against the dollar for a second day. The Shanghai Composite Index climbed 0.9%, driven by Kweichow Moutai and China Merchants Bank, as the nation’s July exports topped estimates. Chinese domestic equities are getting a boost in MSCI Inc.’s benchmark emerging-market indexes. India’s Sensex rose 0.8%, supported by HDFC Bank and Infosys, as investors weighed a bigger-than-expected rate cut against a less optimistic growth forecast by the central bank.

Emerging-market stocks headed for their first daily gain in 12 sessions, on track to end their longest losing streak in four years as investor concern over the yuan’s depreciation and the start of an all-out currency war faded. MSCI Inc.’s developing-nation equities index rose 0.9% after touching its lowest level since January earlier this week. “If the dovish pivot among global central banks manages to stay ahead of weaker growth data, risk and EM assets will likely find their feet even if USD/CNY stabilizes around a higher level,” Goldman Sachs strategists wrote in a client note.

Meanwhile, yields have continued to be volatile following the latest rate spasm which began when central banks in New Zealand, India and Thailand surprised markets on Wednesday with aggressive interest rate cuts. The Philippines followed suit and overnight the Monetary Board (MB) of Bangko Sentral ng Pilipinas (BSP) cut its key policy rates by 25bp, lowering the overnight borrowing rate, the overnight lending rate and the overnight deposit rate to 4.75%, 4.25% and 3.75%, respectively

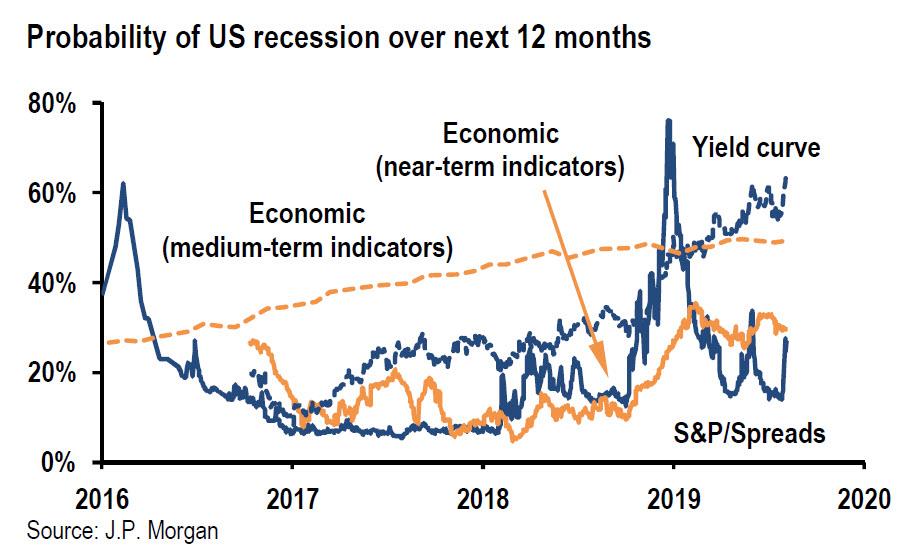

“Financial markets are raising risks of recession,” said JPMorgan economist Joseph Lupton. “Equities continue to slide and volatility has spiked, but the alarm bell is loudest in rates markets, where the yield curve inverted the most since just before the start of the financial crisis.”

In response, markets ramped up their expectations for more easing by the U.S. Federal Reserve, but the question remains how fast Fed policymakers will move. Futures now price in a 100% probability of a Fed cut in September and a near 24% chance of a half-point cut. Some 75 basis points of easing is implied by January, with rates ultimately reaching 1%. Curiously, there is a non-trivial chance of an emergency, August rate cut.

In rates, U.S. government bond yields resumed their drop on Thursday, while in Europe German and French 10-year yields rose from record lows after a rally in recent sessions. The 10-year U.S. Treasury yield dropped to 1.7120%, although it reached a low of 1.595% on Wednesday.

Gold also benefited this week as investors scrambled to find somewhere safe to park their cash, rising above $1,500 for the first time since 2013. Spot gold was last at $1,498 per ounce, down from as much as $1,510 on Wednesday. Gold is up 16% since May.

In foreign exchange markets, the Japanese yen rose again, gaining 0.2% to 106.04 yen per dollar. China’s yuan also gained. In the offshore market it rose 0.2% to 7.0734 yuan per dollar after touching as high as 7.14 yuan on Tuesday. The Bloomberg Dollar Spot Index inched lower Thursday as the greenback fell against all G-10 peers. The biggest overnight gains were seen in Australia’s dollar, which rose from a 10-year low as risk appetite stabilized.

In commodities, oil prices regained some ground amid talk that Saudi Arabia was weighing options to halt its decline, offsetting an increase in stockpiles and fears of slowing demand. Brent crude futures climbed $1.25 to $57.48, though that followed steep losses on Wednesday, U.S. crude rose $1.46 to $52.53 a barrel.

Market Snapshot

- S&P 500 futures up 0.2% to 2,885.75

- MXAP up 0.3% to 151.68

- MXAPJ up 0.8% to 489.77

- Nikkei up 0.4% to 20,593.35

- Topix down 0.08% to 1,498.66

- Hang Seng Index up 0.5% to 26,120.77

- Shanghai Composite up 0.9% to 2,794.55

- Sensex up 0.7% to 36,927.55

- Australia S&P/ASX 200 up 0.8% to 6,568.15

- Kospi up 0.6% to 1,920.61

- STOXX Europe 600 up 0.7% to 371.14

- German 10Y yield rose 2.0 bps to -0.561%

- Euro up 0.2% to $1.1223

- Italian 10Y yield fell 9.3 bps to 1.069%

- Spanish 10Y yield rose 1.2 bps to 0.183%

- Brent futures up 2.2% to $57.48/bbl

- Gold spot down 0.2% to $1,497.66

- U.S. Dollar Index little changed at 97.49

Top Overnight News from Bloomberg

- The yuan steadied after China’s central bank set the daily fixing stronger than analysts expected, providing some reassurance to traders rattled by a tumultuous week in markets.

- China’s export growth rebounded in July, and imports shrank less than forecast, signaling some recovery in trade just as companies brace for the arrival of new tariffs from the U.S.

- The Trump administration is rushing to finalize a list of $300b in Chinese imports it plans to hit with tariffs in a few weeks’ time, as U.S. companies make a last-ditch appeal to be spared from the latest round of duties

- China is mulling the biggest changes to its futures market since 2015, an overhaul that would give global investors unprecedented access, make it easier to execute bearish trades, and lay the groundwork for wagers on stock-market volatility

- The global trade storm battering manufacturing in Europe’s largest economy is about to reach the labor market. German joblessness, which declined from one record low to the next for much of the past decade, is no longer falling and risks a reversal as workers endure the repercussions of the country’s factory slump

- Deputy Premier Matteo Salvini increased pressure on Italy’s ruling coalition, reportedly giving Prime Minister Giuseppe Conte a Monday deadline to shake up the cabinet and indicating that if his partners in the Five Star Movement don’t yield to his demands he’ll dissolve the government.

- The exodus from active funds has sent fees inexorably lower, led to the loss of thousands of jobs, forced large-scale consolidation among firms and pushed the industry to the brink of a shakeout that only the strongest will survive. Now, the $74 trillion industry, as measured by the Boston Consulting Group, is on the brink of a shakeout that only the strongest will survive

- Large fluctuations in currency and stock markets are not good for the economy, Japanese Finance Minister Taro Aso said

- Oil rebounded from the lowest level since January after Saudi Arabia contacted other producers to discuss options to stem a rout that’s been driven by the worsening U.S.-China trade war

Asian equity markets gained as a firmer than expected PBoC reference rate setting and Chinese trade data helped the region shake off the initial tentativeness following the tumultuous day on Wall St, where stocks staged a dramatic intraday recovery and although the DJIA closed in the red, it posted its largest rebound YTD. ASX 200 (+0.7%) was initially subdued amid losses in its top weighted financials sector following earnings from AMP Capital and Insurance Australia Group but then conformed to the improved risk tone led by gold miners after the precious metal rallied above USD 1500/oz for the first time since 2013, while Nikkei 225 (+0.4%) was underpinned by currency flows and KOSPI (+0.6%) outperformed after Japan approved some exports of tech materials to South Korea for the first time since curbs were imposed last month. Hang Seng (+0.5%) and Shanghai Comp. (+0.9%) were positive with sentiment underpinned by relief after the PBoC announced the reference rate which was set beyond the 7.0000 level for the first time since 2008 but not as weak as expected, while participants also digested Chinese trade data which topped estimates across the board and still showed a significant, albeit narrower imbalance in US-China trade. Finally, 10yr JGBs were initially lower with mild pressure seen amid the improved risk tone in the region, although prices then returned flat with support seen amid firmer demand at the 10yr inflation-indexed auction.

Top Asian News

- China Plans Biggest Futures Market Overhaul Since 2015 Clampdown

- Philippine Central Bank Cuts Interest Rate as Economy Slows

- Shady Japan Bond Sale Practice Returning as Yields Fall

Major European stocks are higher across the board [Eurostoxx 50 +1.1%], following on from a positive Asia-Pac handover after optimistic Chinese trade data lifted sentiment in the region. Indices are posting broad-based gains, although UK’s FTSE 100 (+0.1%) lags its peers amid a slew of large cap ex-divs. Sectors are also in positive territory, although defensive sectors are somewhat lagging. Looking at individual movers, Adidas (-1.3%) shares opened lower by over 2% as investors for weeks sought an upgrade to guidance, particularly after its rival Puma (+2.5%) raised its sales and profit forecasts recently. Sticking with the DAX, Thyssenkrupp (+3.3%) shares rose despite an EBIT guidance cut as investors shifted focus to its elevator division IPO (expected in FY19/20) and expression of interests for other divisions. Finally, Osram Licht (-6.6%) slumped to the foot of the Stoxx 600 after the Co’s largest shareholder rejected the EUR 3.4bln takeover offer form Bain & Carlyle. It’s also worth noting that Goldman Sachs has downgraded trade sensitive sectors (EU autos and basic resources) in light of the recent developments between US and China, although individual stocks are little swayed by the broker update.

Top European News

- Thyssenkrupp Open to Selling Divisions, Cuts Profit Outlook

- The Inside Men Who Johnson May Tap for a More Understated BOE

- Aviva Reviews Asia Unit as New CEO Tulloch Starts Turnaround

- Novozymes Finance Chief Makes Sudden Exit as Outlook Darkens

In FX, the Dollar is on a softer footing against its G10 rivals, and most EMs amidst another revival in broad risk appetite, prompted in part by Chinese trade data that beat consensus across all key components and offset or appeased concerns over the ongoing incline in the Usd/Cny reference rate. However, the index is still straddling 97.500 and from a technical perspective holding above key Fib support at 97.392 on a closing basis, if not intraday, and it remains to be seen if the latest upturn in sentiment proves more sustainable or transitory like on Tuesday.

- AUD/NZD/GBP/CAD – In keeping with the improved risk tone noted above, Aud/Usd has turned full circle and a bit more from midweek session lows towards 0.6800, but unlikely at this stage to reach hefty expiry options residing between 0.6840-50 (1.2 bn), while Nzd/Usd is still underperforming within 0.6468-35 parameters following more dovish RBNZ rhetoric on balance after yesterday’s double-barrelled ½ point OCR cut. Elsewhere, Cable is back around 1.2150 and the Loonie has rebounded through 1.3300 along side crude prices ahead of Canadian house price data.

- JPY/EUR/CHF/XAU – The safer-havens are off best levels, but interestingly and perhaps tellingly still relatively bid as the Yen contains losses below 106.00 to circa 106.30 with decent option expiry interest likely to cap further upside in Usd/Jpy given 1 bn running off from 106.45-55. Similarly, the single currency is holding above 1.1200, but also likely to be stymied by expiries as 2.4 bn awaits between 1.1230-40, while the latest ECB monthly bulletin is far from Euro supportive given a downbeat assessment of the Eurozone economy and outlook, albeit largely a repetition of President Draghi’s post-policy meeting text. Elsewhere, the Franc is pivoting 0.9750 and Gold is rangebound either side of Usd1500/oz.

- EM – The Rand continues to underperform with Usd/Zar mostly above 15.0000 after recent technical breaks to the upside and with weaker than forecast SA mining data not helping.

- RBNZ Assistant Governor Hawkesby said outlook for rates is more balanced after 50bps cut but added there is still some probability OCR will need to be reduced further, while Hawkesby also stated the central bank are watching inflation expectations closely and that unconventional tools are a contingency in the event inflation tanks although they would need to exhaust conventional policy tools first. (Newswires)

In Commodities, a day of consolidation for the oil complex thus far after yesterday’s wave of downside in which the benchmarks declined almost 5% as demand concerns continue to materialise. WTI and Brent prices have rebounded off worst levels and reside around 52.23/bbl and 57.14/bbl respectively at the time of writing (vs. yesterday’s lows of 50.55/bbl and 55.90/bbl). The recent trade-induced sell-off has caught the attention of Saudi officials who are reportedly looking at options to stem the decline in the oil market. At the moment, no details of potential actions were mentioned, although desks note that anything else other than compliance control and further output cuts could be unrealistic, even then, reaching an OPEC+ consensus on further curbs could prove difficult given the debacle at the June meeting between the producers. Nonetheless, the media reports have seemingly underpinned the benchmarks for now. Elsewhere gold prices are tentative, albeit off its 6-year peak of 1510/oz and back below the psychological figure. Protectionism risk remains in the forefront for the yellow metal with trade sources noting that China expects the 10% levy on Chinese goods to be implemented on September 1 and thereafter be ramped up to 25% as China stands firm. Meanwhile, copper prices are flat on the day amid the cautiousness in the market, although the red metal did receive some short-lived impetus to test 2.60/lb to the upside as Chinese trade data topped estimates across the board, however, iron ore prices failed to benefit from the data amid ongoing supply glut and lower demand concerns. Finally, nickel prices surged over 10% overnight due to speculation that Indonesia could reel in an export ban on nickel ore in a regulatory move, although an official announcement is yet to be made.

US Event Calendar

- 8:30am: Initial Jobless Claims, est. 215,000, prior 215,000; Continuing Claims, est. 1.69m, prior 1.7m

- 9:45am: Bloomberg Consumer Comfort, prior 64.7

- 10am: Wholesale Trade Sales MoM, est. 0.2%, prior 0.1%; Wholesale Inventories MoM, est. 0.2%, prior 0.2%

DB’s Jim Reid concludes the overnight wrap

A couple of days left before a 2-week break for me and a period where I won’t be able to use the excuse that I can’t look after the children as I have work to catch up on. Well unless the trade war goes even further into overdrive! Holidays are always a bit of a culture shock for me in that regard as the terrors are full on and very demanding. Work is mentally demanding but childcare is physically and mentally demanding. I’m quite happy to sit on an exercise bike for an hour but when there are three nappies to change with them all moving in opposite directions (and wriggling when you catch them) then that is harder. August is always hectic for me as I hunker down and finish off writing the annual long-term study. I’ve been sending my team on various wild goose chases this week in terms of researching stuff so an open apology to them all. If you have any theories about how the global debt mountain develops over the next several years feel free to offer up your pearls of wisdom or send me in the direction of must read material. Although to be honest I probably should have asked this at the beginning of the process a few weeks back rather than 2 days before my holiday. Better late than never.

Talking of better late than never, US equities again bounced as yesterday’s session wore on mirroring the pattern from Tuesday. S&P 500 and Nasdaq futures were down -1.83% and -1.54% ahead of the New York open, but subsequently traded higher throughout the day to end +0.08% and +0.38%, respectively. Fixed income markets saw similarly sharp swings, with the 2y10y treasury curve flattening as much as -4.4bps to a new cycle low of 7.1bps at one point. The move was driven by a further sharp rally in the long end, with 10-year yields dropping as much as -10.9bps, as two-year yields fell a more modest -8.1bps. At one point, 30-year yields dipped below the fed funds rate to 2.122%. However, yields roared back alongside equities and 10-year bonds reversed all gains and actually ended +0.8bps higher, partially a reflection of improved sentiment and partially as a result of weak auction demand for fresh 10y paper. That auction tailed 1.6bps, despite being sold at the lowest yield since 2016 at 1.670%. The 2y10y curve ended just -0.2bps flatter in the end at 11.4bps

As for the improvement in sentiment yesterday, there wasn’t a single clear catalyst which makes sense if you look at the steady reversal higher all session. An article from the South China Morning Post used relatively optimistic language and said that “insiders on both sides expect September’s trade talks to go ahead,” which helped investors anticipate at least the potential for a trade war deescalation. On the other hand, the White House posted a rule effectively banning government agencies from purchasing equipment from five Chinese firms, including Huawei. The Huawei issue is likely still a major sticking point alongside the tariff subject. While the rule won’t have a large immediate impact, it will ban the US government from doing business with companies that separately do business with Huawei, making the measure a backdoor ban on many firms maintaining relationships with the sanctioned Chinese tech firm.

Over in Europe, bond markets shut before the rebound for risk, leaving closing prices there at fairly eye-watering levels. Benchmark 10y Bunds broke through -0.60% for the first time ever and closed -4.5bps lower at -0.581% yesterday. The entire Bund curve is negative again, with 30y Bunds now trading at -0.095%. To think it started the year at 0.875%. The cash price of that 2048 Bund is now 139.6 which means it is up around 30pts in cash terms alone in 2019. Curve flattening is also accelerating in Europe with the 2s10s Bund curve now at 26.9bps and the lowest since the GFC. Here in the UK we also saw the 2s10s curve get to just 2.7bps. Yields were 5-10bps lower elsewhere in Europe. Amazingly Spain and Portugal now trade inside of 0.20% and are racing towards zero. The amount of negative yielding debt unsurprisingly hit a new high given the moves yesterday at $15.62tn.

As for Austria’s 100 year bond, this security deserves its own paragraph. Since October, it has gone from a cash price of 107.3 to 191.6. It was also as “low” as 148.7 in mid-July. So that’s a rough return of +79% in ten months and +29% in four weeks. That takes its year-to-date gains to +64.40%, making it, to our knowledge, at or around the best performing asset of the year so far, better than the December Dalian iron ore future (+46.50%), Jamaica’s JSE index (+40.38%), Greece’s ASE index (+36.57%), and gold (+16.79%).

Oh and if you want to buy a UK 30 year inflation linked bond at the moment, your yield will be -2.08%. That’s their lowest levels ever.

The fixed income repricing also saw Fed Funds contracts move to price in 66bps of cuts by year end and 108bps by the end of 2020, though, in line with other moves, those were 9bps off their intraday highs. The various dovish central bank actions around the world yesterday obviously played a big role in the price action including the 50bp cut by the RBNZ (25bps more than expected), 35bps by the RBI (10bps more than expected), 25bp cut by the BoT (25bps more than expected) and 50bps cut by Belarus (might be the first mention for the country in the EMR). Today we have the Philippines and Peru rate decisions so we’ll be keeping an eye on whether the aggressive global easing trend continues.

Away from fixed income, European equity markets were initially playing catch up to the late gains on Wall Street on Tuesday but bourses did fade towards the end with the STOXX 600 eventually closing +0.24%. WTI oil prices slid -2.57% after US inventories data again disappointed, with a 2.3mn increase in stockpiles instead of the expected -2.5mn drawdown. However, prices did end a bit off their lows after Saudi Arabia said that they are considering all options to arrest the commodity’s price decline. WTI is now reversing these losses (+2.92%) this morning on news that Saudi Arabia has contacted other producers to discuss options to stem the rout. Gold crossed the $1500 level before ending +1.58% at $1497.78 yesterday. EM was mixed with the MSCI EM index gaining +0.45%, while the Turkish was up +0.58% against the dollar. The South African rand underperformed, falling -0.81%, likely harmed by headlines from the central bank governor that “we are not there yet” in terms of needing an IMF bailout. Not the cast-iron denial that perhaps investors wanted to hear.

After all that Asian equity markets are trading up this morning following Wall Street’s long climb from the lows last night with the Nikkei (+0.55%), Hang Seng (+0.67), Shanghai Comp (+0.91%), and Kospi (+0.96%) all advancing. Korean markets are also getting helped by the news that Japan has allowed exports of some semiconductor manufacturing materials to South Korea, the first such approvals since Japan tightened export controls in July. The Chinese onshore yuan is trading up this morning at 7.0430 (+0.24%), helped by the PBoC setting the daily reference rate at 7.0039 (vs. 7.0156 expected). This is encouraging a belief that the PBoC want a very controlled currency move even if they are slowly devaluing. Elsewhere, futures on the S&P 500 are up +0.44%.

We’ve also had the July trade numbers out of China where exports rose surprisingly by +3.3% yoy (vs. -1.0% yoy expected) while imports dropped -5.6% yoy (vs. -9.0% yoy expected) bringing the trade balance to $45.06b (vs. $42.65b expected). In terms of trade with the US, exports in July were down -6.5% yoy (YtD -8.2% yoy) while imports came down -19.1% yoy (YtD -28.3%) bringing the July trade balance to c.$28b (-0.41% yoy) and YtD trade balance at $168.3bn (+3.88%). So an expanding trade surplus with the US before the latest trade tensions. Interestingly the trade surplus increased with the EU perhaps suggesting more of their exports being switched there.

In other newsflow yesterday, President Trump delivered yet another salvo against the Fed via Twitter. He said that “Our problem is a Federal Reserve that is too proud to admit their mistake of acting too fast and tightening too much (…)They must Cut Rates bigger and faster, and stop their ridiculous quantitative tightening NOW.” Of course, the Fed already did cut rates last month and already ended its balance sheet runoff, effective last week. Trump went on to say that “Yield curve is at too wide a margin” which may be a reference to the flat curve. Whatever the intention behind the tweets, they unequivocally raise the pressure on the Fed.

As for actual Fedspeak yesterday, the only remarks came from Chicago President Evans, who said that “ inflation alone would call for more accommodation than we’ve put in place with just our last meeting” and said that on top of that, “risks now have gone up.” He, like his fellow dove Bullard yesterday, said that he had expected two 25bps rate cuts this year when he submitted his dot in June, but seemed to indicate that he favours more accommodation now.

Elsewhere, Italy’s Deputy Premier Matteo Salvini hinted yesterday that if his governing coalition partners M5S don’t yield to his policy demands then he could decide shortly to dissolve the power-sharing arrangement with his League party. He said, “I am not one for half measures, either we can do things fully and well or I am not one who clings on to his seat,” while adding, “something has broken down in recent months,” referring to the coalition. This morning Corriere Della Sera is reporting that Salvini, in a meeting with Prime Minister Conte, threatened to bring government down if some ministers aren’t replaced which includes Finance Minister Tria. The story also adds that Salvini has given Conte until Monday to act, after which he could meet with Italian president in the first step of breaking up government.

Finally to the day ahead, which is another painfully quiet one for data, with the only releases due in the US including jobless claims and the June wholesale inventories figures. Away from that there are central bank meetings due in the Philippines and Peru while Uber will report earnings.

via ZeroHedge News https://ift.tt/2YX7XZu Tyler Durden