When it comes to the recent sharp slump in Emerging Market currencies (and the ongoing surge in the dollar), few banks have been as accurate in calling the current lay of the land as SocGen, which has been bullish the dollar and bearish EMs for a long time (by comparison, virtually every other bank was until recently bearish the dollar; many of them still are resulting in massive losses for their clients). And if the French bank’s EM strategist Jason Daw, is correct there is much more pain to come for the emergers, and especially the yuan, which after sliding below 7.00 for the first time ever this week, is now expected to plummet as low as 7.70, a level which would certainly prompt currency war retaliation from the Trump administration.

As Daw writes overnight, the US and China are increasingly engaged in an entrenched tit-for-tat escalation phase, and as he correctly predicts “one of the two sides probably need to reach their pain limit before there is a chance of a de-escalation phase.” And since such a breaking point has yet to emerge, policymakers could tolerate USD-CNY staying above 7.0 on a sustainable basis unless the unlikely situation evolves that the US tariff threat is retracted, a solution is reached prior to Sep 1, or somehow global / Chinese growth spontaneously improves, according to Daw. While none of that is expected to happen, it nonetheless won’t be a straight line higher in USD-CNY.

Meanwhile, “the Chinese authorities can deploy their formidable defenses to stop or slow the depreciation”, as they may want to see the impact on capital flows before permitting another leg higher. However, as the SocGen strategist cautions, the upside risks to USD-CNY have intensified and he now forecasts USD-CNY modestly higher than our previous forecasts (to 7.10, 7.15, 7.20, 7.25) over the next four quarters.

Worse, if the US escalates the tariff fight further (i.e. 25% tariffs on the remaining $300bn of Chinese imports) or takes other additional measures against China, “it would not be inconceivable for USD-CNY to rise to 7.50 or 7.70.”

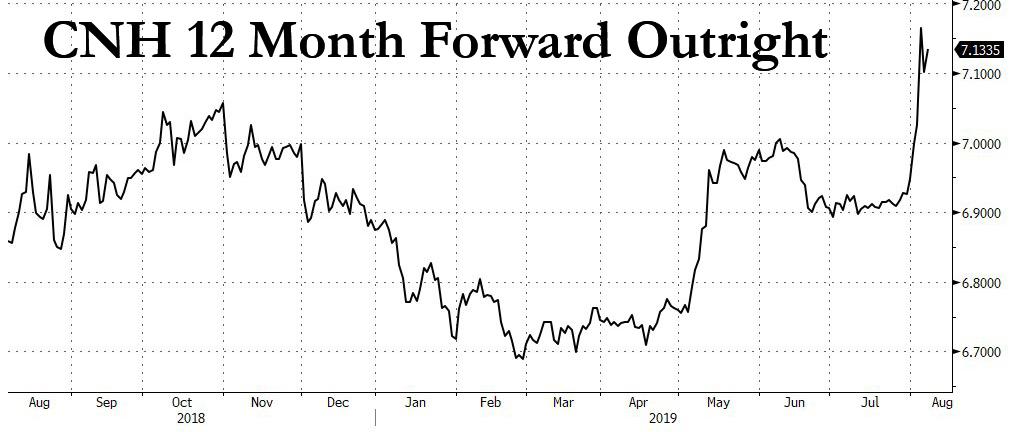

If Daw is right, the trade is simple: buy either the USDCNH or the USDCNH +12 month forward outright, which as of today is pricing in that the Offshore Yuan will only drop to just 7.1335 in 12 months time.

That said, even the bearish FX strategist concedes that it is important to remember that the Chinese authorities have strong policy tools and it is likely that CNY will only weaken as much and as quickly as they want it to. In other words, if China really wants to devalue its currency, it can, and will do so with relish. The question is what Trump will do to provoke such a devaluation.

via ZeroHedge News https://ift.tt/2KybbNJ Tyler Durden