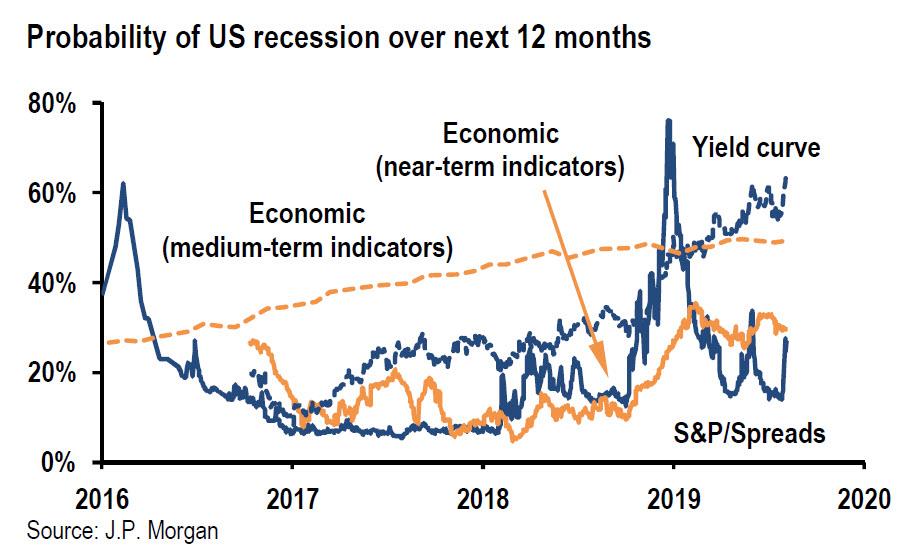

Earlier this week, with bond yields plunging and the yield curve inverting to a level last seen just days before the 2008 financial crisis, we brought out one take on the odds of the coming recession, that of JPMorgan, which was somewhat complacent because, as the bank said, “while the economic data highlight elevated recession risk, the likelihood of a downturn in the coming 12 months was still below 50%” And while JPM admitted that recognizing economic data can be too backward-looking during times of rapid change, the bank stuck with its macro indicators which see the odds of US (and global) recession in the coming 12 months closer to 40%.

In other words, while JPM’s recession indicator is the highest it has been in the past decade, it still has some room before investors should panic.

That’s not the case for Rabobank, however.

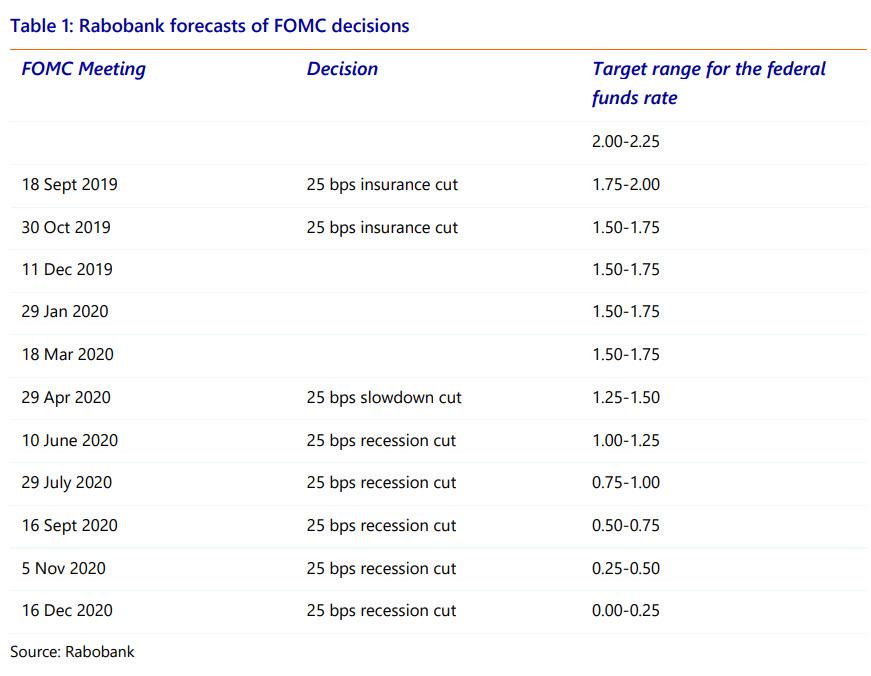

Commenting on the recent escalation of the US-China trade conflict, the Dutch bank now expects the Fed to make two additional insurance cuts of 25 bps each before the end of the year.

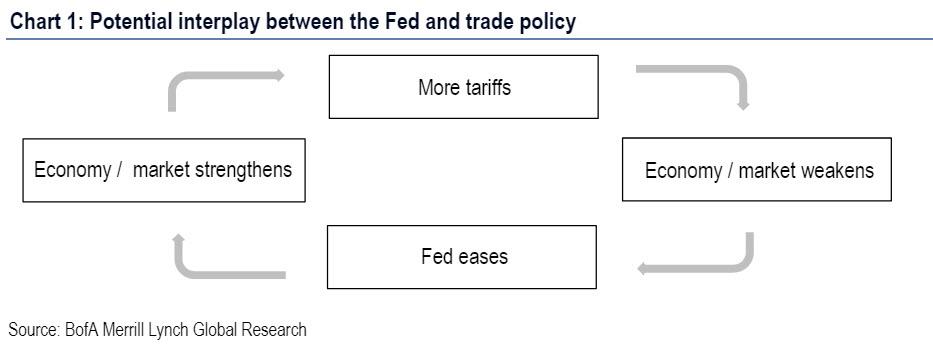

By taking a risk management approach to trade policy uncertainty, the Fed is amplifying the effect of trade policy on monetary policy. There is now a strong feedback loop between trade policy and monetary policy that will force the FOMC to make more insurance cuts in the coming months, probably as early as September and October.

There is just one problem: as Rabobank’s Philip Marey writes, “the insurance cuts won’t be enough to avert a recession in the second half of 2020.”

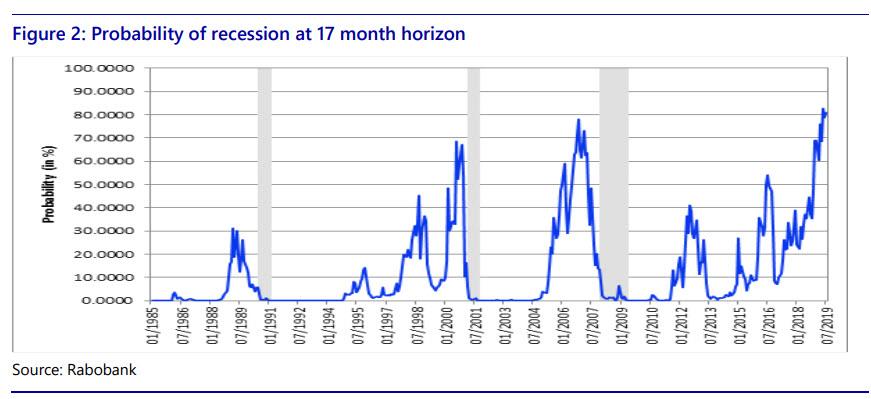

As Marey notes, while the Fed may think that a few insurance cuts should be enough to keep the US economy ‘in a good place’, the shape of the yield curve is telling us otherwise: “The inversion of the US treasury yield curve suggests that a recession lies ahead. Historically, inversions of the yield curve have preceded recessions by 12-18 months.”

In fact, according to Rabo’s recession probability model, the probability of a US recession by December 2020 is 81%. This is higher than the recession odds the model spit out in 2000, just before the dot com bubble burst, and also in 2007, ahead of the housing bubble. In fact if Rabo is correct, the US is facing a recession that is even worse than the Global Financial Crisis.

The warning given by the yield curve is supported by cracks in the real economy, according to Rabo: consider that the Fed’s hiking cycle – despite a recent insurance cut – has reduced home buyer affordability. Consequently, residential investment – the most interest-rate sensitive component of GDP – has been falling for six quarters in a row. The recent declines in mortgage rates have not been enough to turn residential investment growth positive again in Q2; one wonder if negative mortgages is what it will take to finally spark some residential investment.

More recently, the uncertainty caused by trade policy has led to a 0.6% decline in business investment in Q2 (quarter-on-quarter, at an annualized rate). This, as Rabo notes, was one of the reasons for the FOMC to make an insurance cut in July. However, as far as the decline in business investment is caused by trade uncertainty, the bank’s economist “fails to see how interest rate cuts are going to turn this around if the trade war persists.”

And the punchline: “in the end businesses may also decide to cut jobs, which in turn will undermine consumer spending. When this happens, a recession seems inevitable.”

So how will events play out over the next year?

After a pause in early 2020, Rabo expects the Fed to respond to the rapidly deteriorating economic outlook by a rate cut of 25 bps in April. “By the June meeting of the FOMC it should be clear that a recession is imminent. This should bring the FOMC out of its mid-cycle delusion and make another rate cut of 25 bps.” And as it is unlikely that the Fed will be able to avert a recession, Rabobank expects a 25 bps cut at each following meeting, until the zero bound is reached in December 2020.“

We have summarized our baseline scenario for the Fed in Table 1. In hindsight, a full-blown cutting cycle (6 consecutive cuts of 25 bps each) from April through December will bring the federal funds rate back to zero before the end of 2020. While this decline may seem steep, we should keep in mind that you cannot fight a recession with only one or two rate cuts. What’s more, since we assume only a shallow recession of two quarters of modestly negative GDP growth in the second half of 2020, we have not even put a 50 bps rate cut or emergency rate cuts (i.e. outside of regularly planned FOMC meetings) in Table 1. This would become appropriate however, Ze rise in business debt and its partial securitization through CLOs could be a possible risk factor. However, for now Rabo maintain “a run-of-the-mill recession in our baseline scenario.”

In light of all this, it is not difficult to see why Trump is doing everything in his power to delay the inevitable start of the next recession – which will be far worse than even the 2007-2009 recession. If he fails to delay the day of historic reckoning, president Biden is as good as inaugurated.

via ZeroHedge News https://ift.tt/2YThosN Tyler Durden