An ugly start to the week for stocks ended “meh” but bonds and bullion (and bitcoin) safe-havens were better bid…

Stocks message to the world “don’t panic!”, Bonds and Gold’s message “don’t panic, but protect!”

China stocks were considerably weaker on the week led by the tech-heavy Shenzhen index…

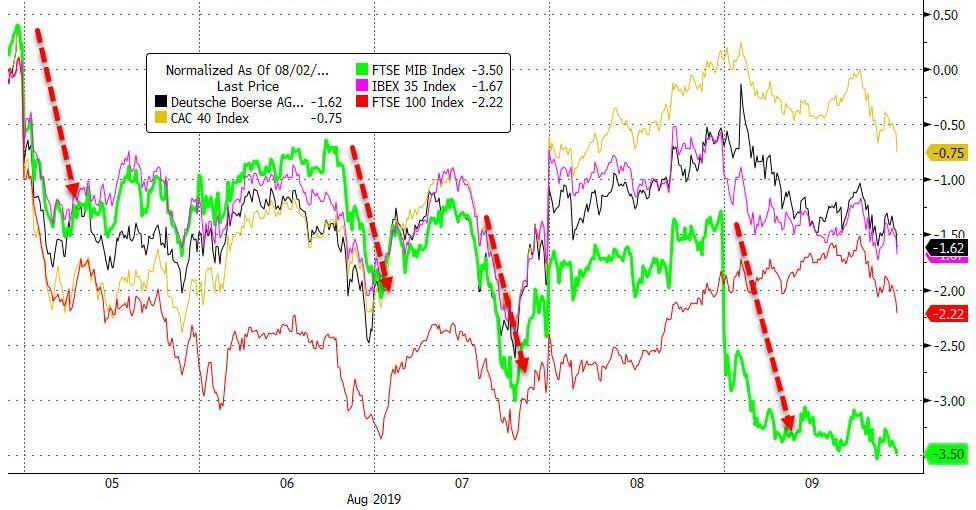

European stocks were also all lower on the day led by Italy (more political crises looming)…

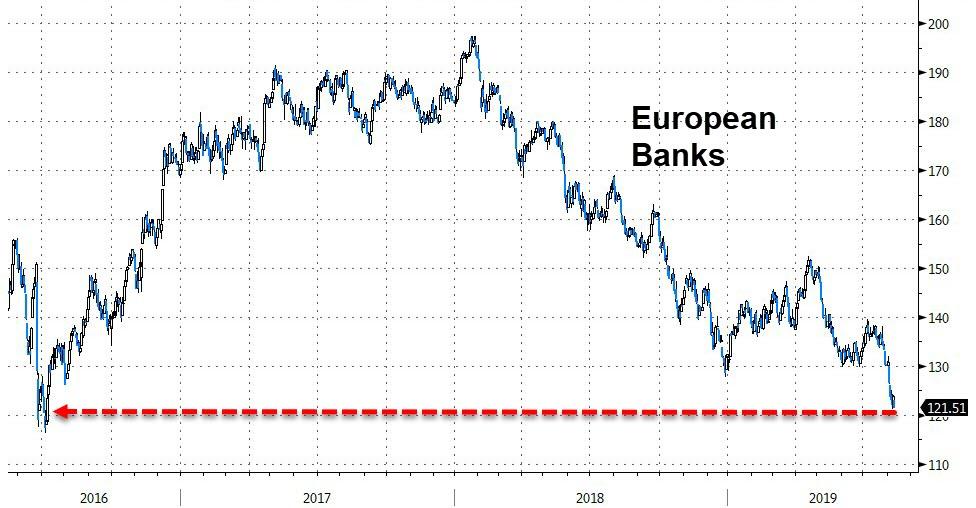

European banks were battered to their lowest since June 2016’s Brexit vote…

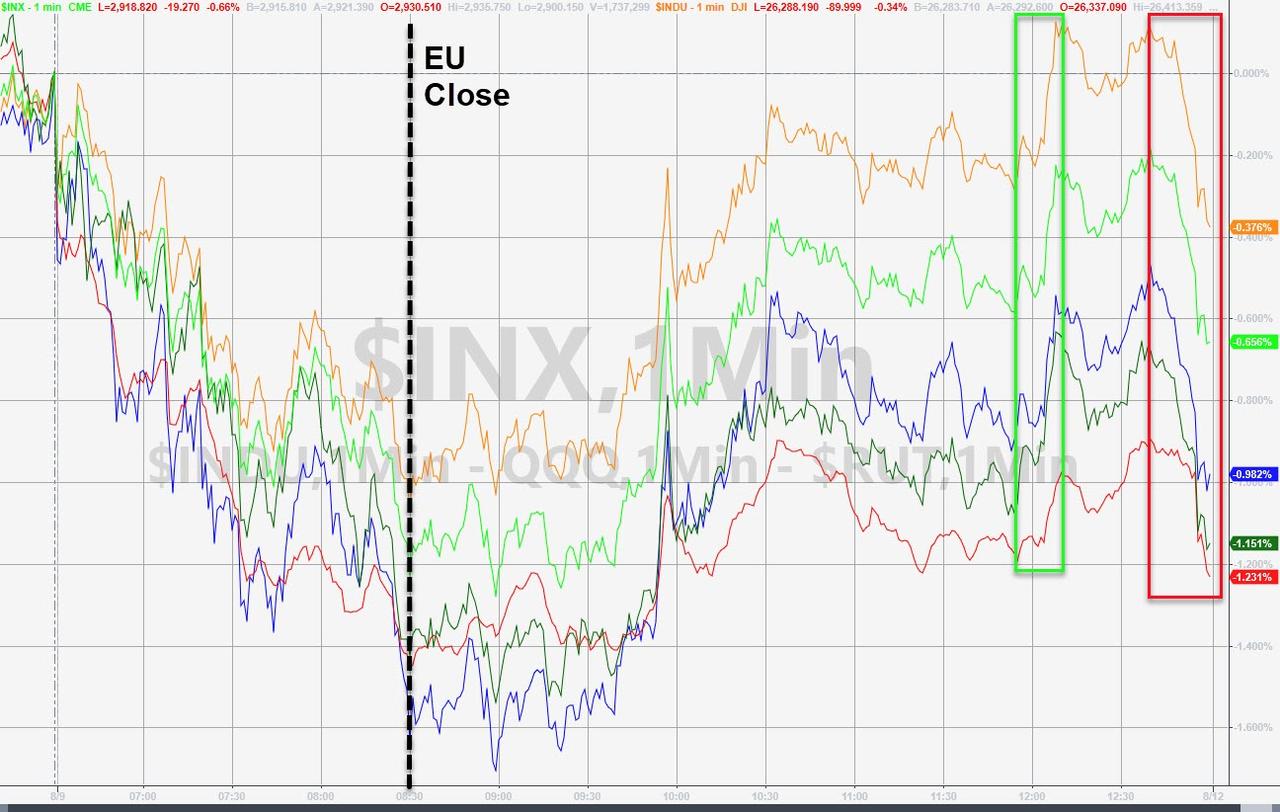

Despite a lot of volatility, US equity markets scrambled back to small losses only on the week (S&P and Nasdaq best on the week, Trannies and Small Caps worst), but traders puked into the close on Friday…

Today was another ridiculous one, especially the panic bid in the last hour (absent headlines) to get The Dow into the green (Dow was the only index to make it green on the day), but an ugly close spoiled all the fun…

Dow futures have recovered Fib 61.8% of the post-Powell plunge…

Buybacks dominated the surge…

Defensives outperformed Cyclicals on the week…

FANG stocks ended the week lower – but the machines ran all the stops first…

VIX ended higher on the day, but unchanged on the week…

Bonds and stocks decoupled once again…

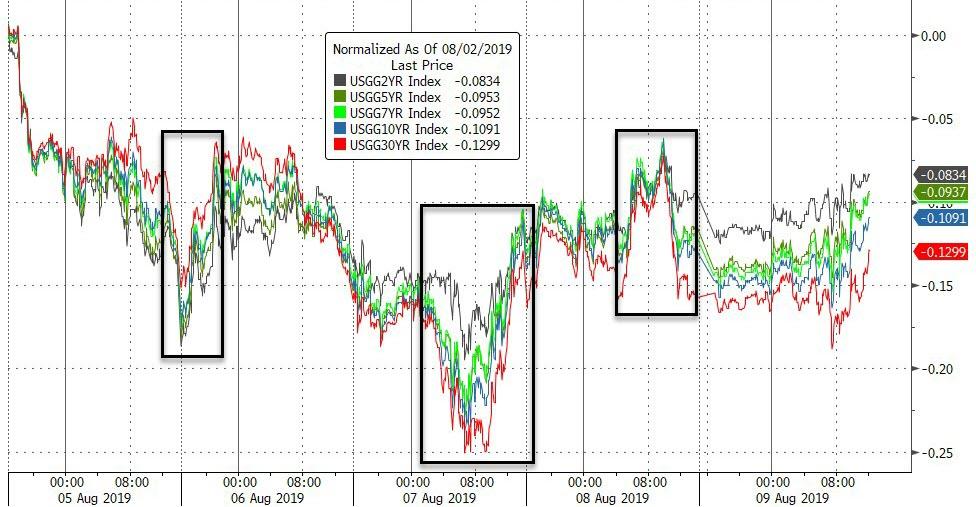

Treasury yields tumbled for the second week in a row…

This is the biggest 2-week drop in 10Y Yields since Aug 2011…

NOTE – the close to close vol was barely noticeable but intraday was huge (daily closes: 1.70, 1.70, 1.73, 1.72, 1.74)

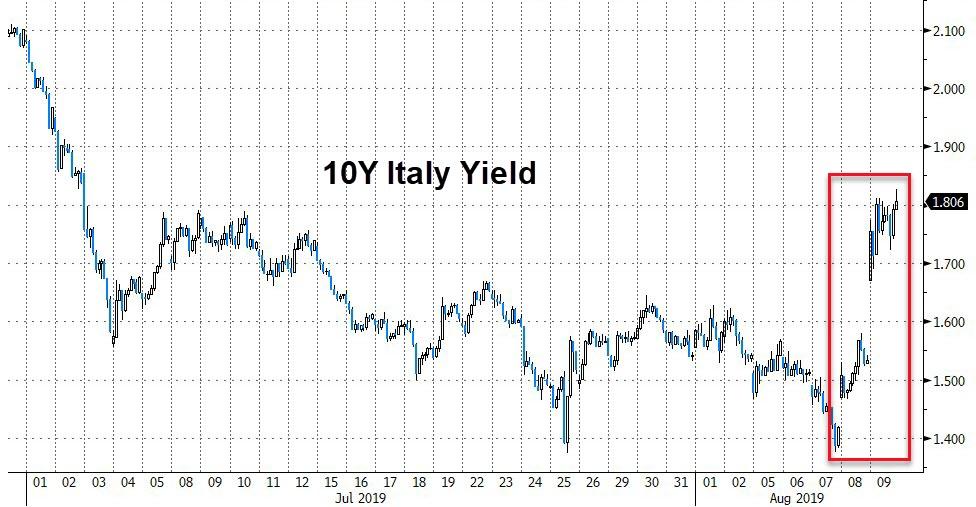

Italian yields exploded higher on the week as political crises re-emerge…

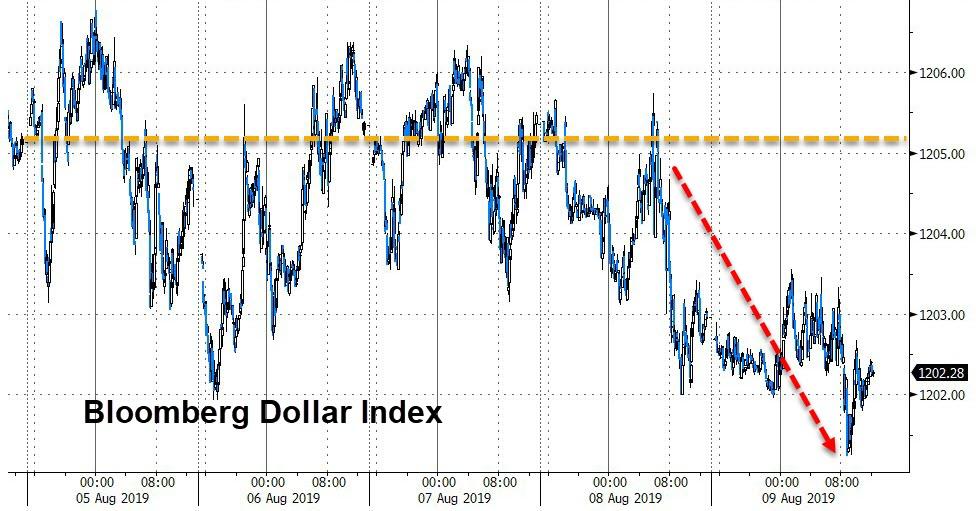

The dollar ended the week lower, but traded in a narrow range…

Cable collapsed to a fresh cycle low (Surprise contraction in GDP)…

Offshore Yuan continued to plunge – its worst week since June 2018…

Cryptos were very mixed on the week with Bitcoin strong and altcoins weak…

Bitcoin just could not hold above $12,000…

Thanks to a decent bounce today, oil wasn’t as ugly as it could be on the week but PMs were best…

Gold soared over 4% on the week, above $1500 – its best week since April 2016…

Silver topped gold on the week, but was unable to hold $17…

WTI ramped back aboive $54 (after tagging a $50 handle mid-week…

Credit markets suggest this bounce in oil prices won’t last…

Global negative-yielding debt soared $700 billion this week (up over $3 trillion in the last month)

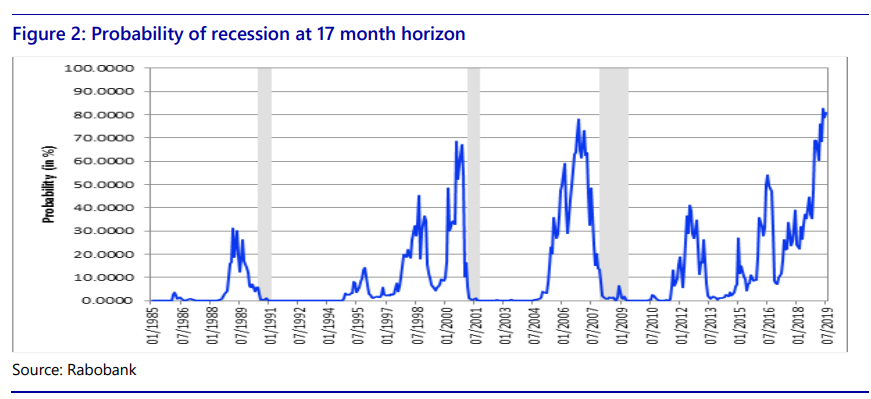

Finally, Rabobank’s recession indicator is at its highest in over 30 years…

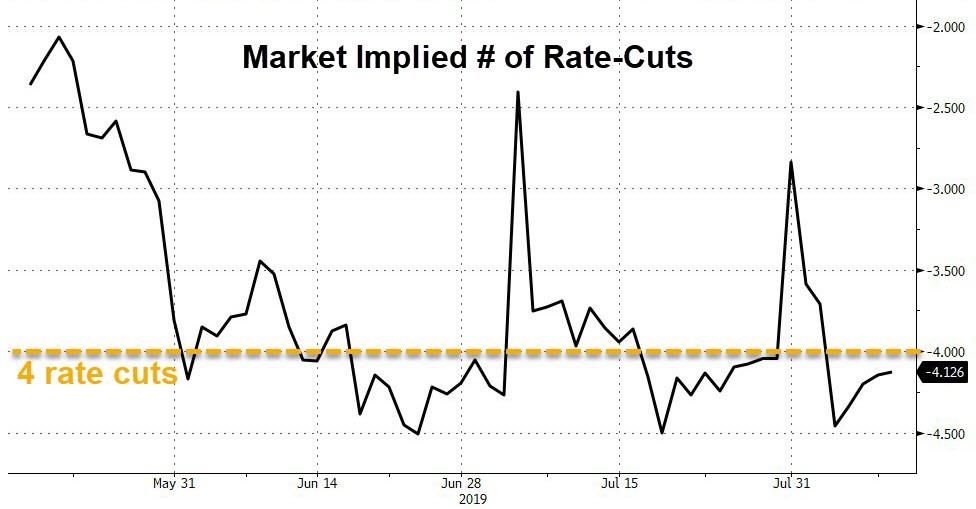

Which explains why the market is demanding at least 4 rate-cuts by The Fed, to save the world…

Still, despite this week’s ‘resilience’ in stocks, they remain laggards since Powell started speaking and bonds and bullion the best…

And gold is now the leader year-to-date, marginally outpacing stocks…

via ZeroHedge News https://ift.tt/2KFGHJC Tyler Durden