Authored by Andrew Sheet, chief cross-asset strategist at Morgan Stanley

Two questions are swirling around markets at the moment.

- First, will central banks provide more or less accommodation than investors expect?

- Second, can that accommodation (among other factors) improve the weak cyclical backdrop materially?

On both scores, we are cautious, a key reason why we remain underweight equities and credit.

Before going further, we’d stress that this is not some screed on central bank action, a disquisition on how everything would be better if only different decisions were taken. The Fed, ECB, BoE and BoJ all face extremely difficult (if somewhat different) challenges. They will do what they will do. Our focus is on how their actions may differ from what markets are currently pricing, and the impact going forward. Let’s start by reviewing recent central bank statements and subsequent market gyrations.

On July 25,at the press conference following the ECB meeting, President Mario Draghi stated that further interest rate reductions for July had not been discussed.For some market participants, this apparent lack of urgency came as a surprise. Our interest rate strategists estimated that the markethad placed a 40- 50% probability on a 10bp rate cut at that meeting, following a notable rise in expectations for a cut after the ECB’s Sintra forum.

On July 31, at the press conference after the Federal Reserve’s July meeting, Chair Powell struck a relatively balanced tone, surprising markets that had expected more openness to further, faster easing. Stocks may have fallen since the Fed’s rate cut for several reasons, including increased trade tensions. But it’s important to emphasize just how optimistic markets had become on the scale of accommodation the Fed would provide.

Over the past 20 years, including the post-crisis period, stock and bond prices have generally moved in opposite directions, a function of the fact that equities often prefer better growth to worse, even if it means higher yields. But on July 16, as the Fed’s decision neared, stock and bond prices were moving in the same direction (stocks higher,yields lower) to the greatest extent in over 15 years. The “have your cake and eat it” mentality – the expectation of powerful central bank action lifting both stocks and bonds – raised the bar for disappointment.

The market’s initial reaction to both July central bank statements was to assume less accommodation. But subsequent reactions have assumed more. Expectations for ECB rate cuts rose, to ~17bp by the October meeting, while Fed easing expectations grew, to ~92bp in total cuts through July 2020,and ~31bp in rate cuts by the September meeting of this year.

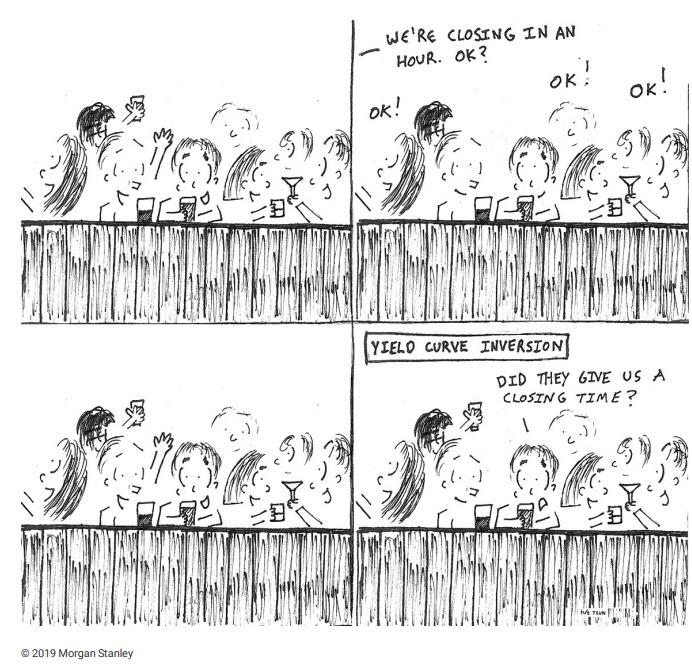

More visibly, bond yields plunged, with charts bringing to mind a late-1990s internet stock turned upside down. US 30-year bond yields are near an all-time low, 30-year German Bund yields touched an all-time low of -0.10%,and a 100- year Austrian bond that began 2019 with a 1.7% yield has rallied by ~62% year-to-date. But what’s most notable is that as yields have raced lower and markets have priced more and more central bank accommodation, the yield curve in the US and Europe is becoming flatter and flatter. That pricing, at least to us, is consistent with central banks taking increasingly aggressive action, but those moves failing to lift growth or inflation sustainably over the medium term.

Needless to say, that isn’t a great story. Unfortunately, it seems to be confirmed by other markets. Inflation expectations have been falling. Commodity prices have been dropping. Cyclical and small-cap stocks are underperforming. All these dynamics are consistent with continuing growth risks.

Sentiment measures suggest more investor caution in the wake of recent volatility,a good thing. We remain cautious,as we believe that a number of challenges remain. Among them, the risk thathigh policy expectations make disappointment more likely,and that even if those aggressive expectations are met,easing isn’t expected to improve growth or inflation materially.

Hence, we remain underweight equities and credit. In our framework, we view lower yields (especially with a flatter curve) as a negative for risk assets. Higher yields (especially with a steeper curve), signalling an improvement to growth, would likely make us more optimistic.

via ZeroHedge News https://ift.tt/2KtoMqR Tyler Durden