Authored by Ted Dabrowski and John Klingner via WirePoints.org,

There’s perhaps no indicator more damning of a state’s failure to govern than the flight of its residents to other states.

People of every stripe are leaving Illinois. Old and young, rich and poor. They are going to warm states and cold states, big states and small states. Overall, Illinois netted losses of residents to 43 other states in 2016.

That has major implications for the state and the Illinoisans who remain. A shrinking population means a future with less economic growth, less investment, falling real estate values and an eroded tax base. And as people leave, fewer residents will be left to pay down the state’s growing debts, meaning the already massive burden will only gets worse.

Illinois has netted a loss of 1.5 million people to other states since 2000, based on U.S. Census data. And as international immigration and births in Illinois have declined in recent years, they’re failing to make up for Illinois net outmigration. As a result, the state’s population has shrunk five years in a row. Wirepoints analysed the results of the census data in our report: Illinois’ Demographic Collapse.

The following multi-part series will reveal just who is leaving, where they are going and what incomes they’re taking with them.

Wirepoints’ analysis uses national state-by-state migration data compiled by the Internal Revenue Service. The IRS reviews tax returns annually to track when and where people move. It also aggregates the ages, income brackets and adjusted gross incomes of filers.

In this first piece, we’ll cover Illinois’ net loss of tax filers and their incomes since 2000.

* * *

Losing people and their incomes

Illinois is a national outlier when it comes to losing residents and their taxable income to other states.

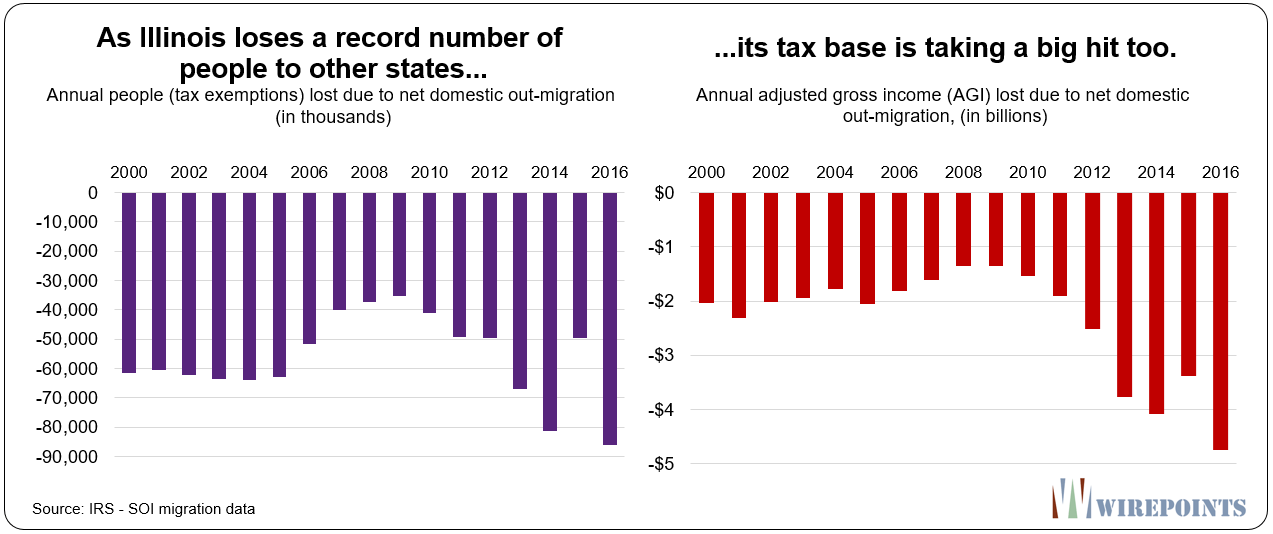

In 2016, IRS data shows Illinois gained nearly 165,000 people from other states and they brought with them a combined Adjusted Gross Income (AGI) of about $6.3 billion. Meanwhile, more than 250,000 Illinoisans left the state and they took more than $11 billion with them.

That means Illinois suffered a net loss of about 86,000 residents and a loss of $4.8 billion in taxable income – the equivalent of more than $100 million in state income tax revenues.

And that doesn’t include the additional loss in sales, property and other taxes those residents no longer pay.

Illinois has lost tax filers and taxable income, on net, every year since 2000. Between 2000 and 2010, the state averaged net losses of about $1.8 billion in taxable income each year. Since then, the state’s losses have accelerated by about $500 million a year, growing to $4.8 billion by 2016.

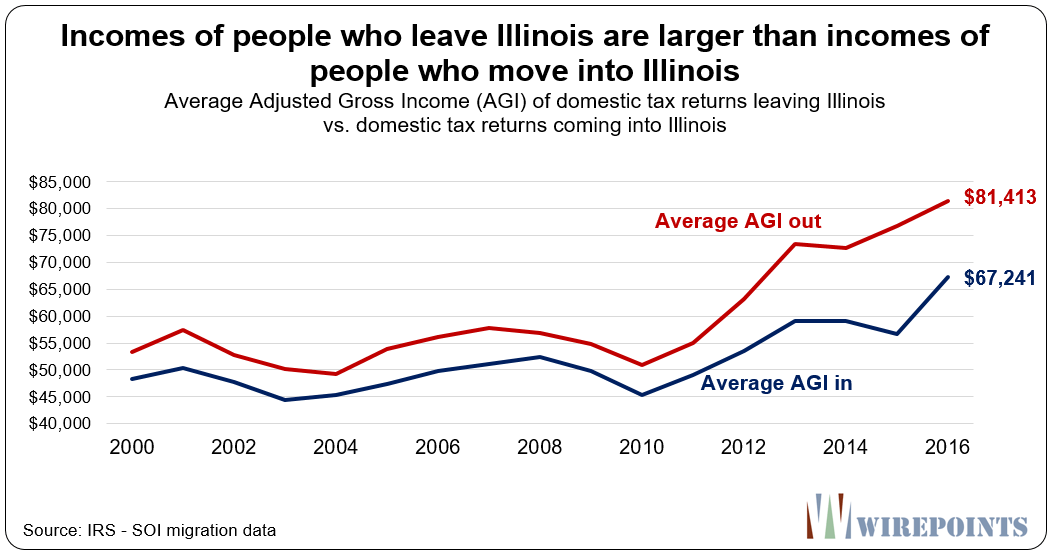

The problem isn’t just that more people are leaving than coming into Illinois. It’s also that those who leave, on average, earn more than those moving in. That too is draining the state’s tax base.

In 2016, the average taxable income of people leaving Illinois was in excess of $81,000. The taxable income of those coming from other states was just over $67,000.

So not only did Illinois lose a net 86,000 people and their AGI, but it also lost an average of $14,000 in AGI for every person that moved into Illinois in 2016.

Illinois the outlier

How did Illinois rank nationally for loss of AGI? We’ll take that up in our next piece, but for now we’ll share how Illinois stacks up on a per capita basis.

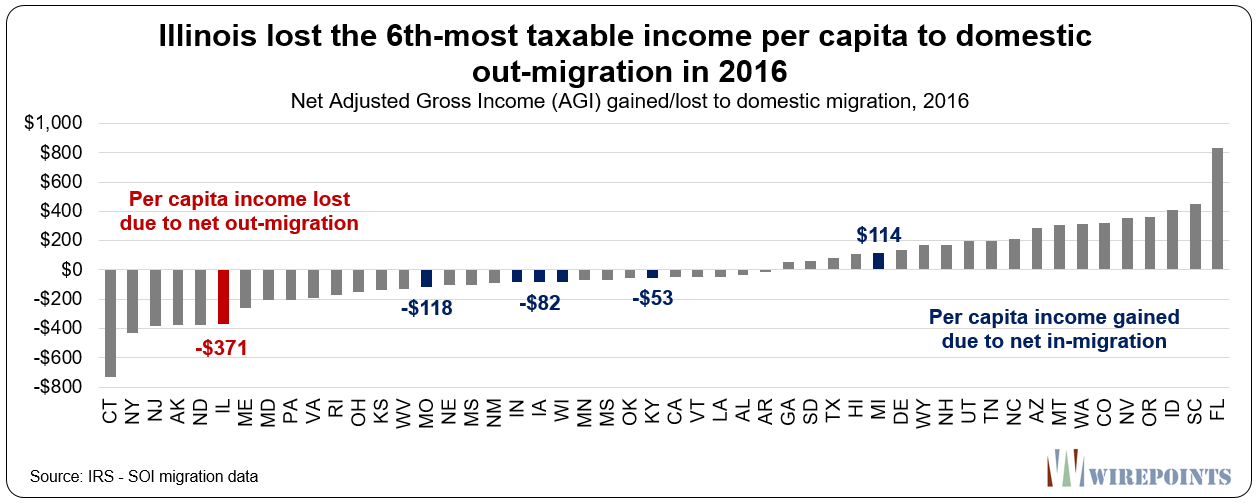

Take Illinois’ $4.8 billion AGI loss divided by the state’s 12.8 million people and Illinois lost $371 in income per person in 2016. Only 5 states lost more AGI per capita, including Connecticut, New York and New Jersey.

In contrast, states that are winning people saw their tax base grow. Florida gained more than $800 in AGI per capita in 2016. Idaho and South Carolina, more than $400. Even neighboring cold-state Michigan gained $114 in AGI per capita.

Illinois out-migration situation is dismal. And the problem becomes even more stark when you look at the state’s record nationally over time. That’s the subject of Part 2 of this series.

via ZeroHedge News https://ift.tt/2TqbNZT Tyler Durden