Chinese authorities weakened the Yuan Fix for the 8th day in a row overnight, sending offshore yuan down to 7.10/USD, drifting back towards last week’s devaluation lows.

Some have proclaimed the recent ‘stability’ – i.e. yuan hasn’t kept collapsing in a straight line despite capital outflow fears and the political crisis in Hong Kong – a positive…

But as Nordea warns, The PBoC is the key for global risk sentiment currently.

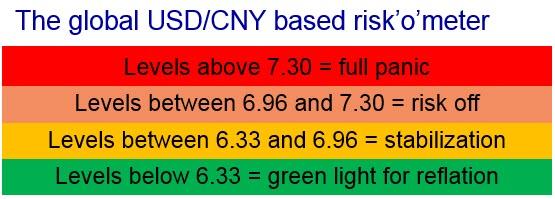

USD/CNY has become the most important gauge of the trade outlook and a further move north would spell trouble for risky assets. 7.30 is an important line in the sand in our view. To counter the newly announced 10% tariffs on the rest of the Chinese export goods, the PBoC would have to allow USD/CNY to move to 7.30 to counter the effects 1 to 1.

A move above 7.30 would likely lead to panic mode in the financial markets, while the interval between 7.00 and 7.30 is to be considered risk-off territory. Below 7.00 is stabilisation territory.

Chart 1: The USD/CNY risk’o’meter

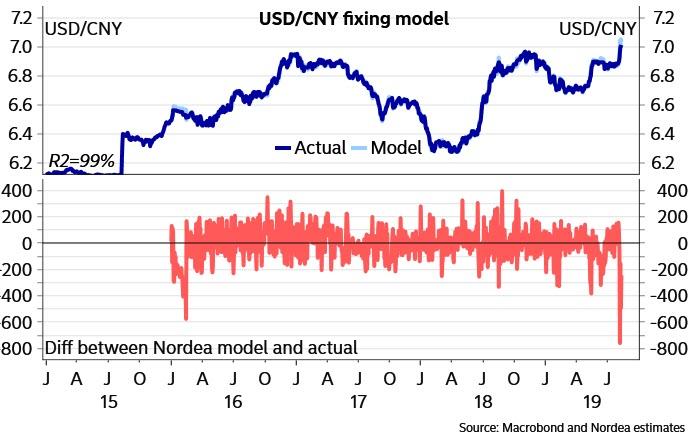

We take at least some comfort in the current policy from the PBoC. They have continuously set the USD/CNY fixing lower than “they should” over the past days. This is in our view a sign that the PBoC is trying to cave in the upside pressure on USD/CNY. Remember that markets, not the PBoC, weaken CNY versus USD, and currently the PBoC is fighting against the market. They will not continue fighting gravity forever.

Chart 2: The PBoC sets the USD/CNY fixing at too low levels, a sign that they fight against market forces

In the coming days we will likely see a lot of stories on “China pondering selling Treasuries as part of the trade war”. In our view this is a non-sensical storyline. China only offloads Treasuries when market pressure is on the upside on USD/CNY. So right now, the PBoC may be offloading USDs and Treasuries, but all in an attempt to stabilise USDCNY. The market (almost solely) dictates the USD & Treasury holdings of the PBoC, not the PBoC itself.

And so there it is… Don’t Panic quite yet… but soon.

via ZeroHedge News https://ift.tt/2ORv6fQ Tyler Durden