It looks like a new page has turned in the tug of war between Tesla bears and bulls. Gone are the days of Elon Musk taunting short sellers. Gone are the days of mailing David Einhorn pairs of “short shorts” to take jabs at his public short position of the company.

And here to stay, perhaps, are the Tesla bears in the proverbial “driver’s seat”.

So far in 2019, Tesla has become the most profitable short bet in the U.S., according to Bloomberg. As Tesla’s stock has plunged 30% this year, short sellers have netted a massive $2.75 billion in mark-to-market gains.

Shares have bounced off of their 52 week lows near $177 and recovered slightly, but are still far off from the $300 level they started the year near. The company’s stock remains on pace for its worst annual decline in its history, prompted by continuing concerns about demand, the inability to consistently turn a profit and a CEO that may or may not be involved in the Jeffrey Epstein scandal, as we recently reported.

According to Aug. 9 data from S3 Partners, gains from shorting Tesla are about three times that of the second most lucrative short of 2019, Abbvie.

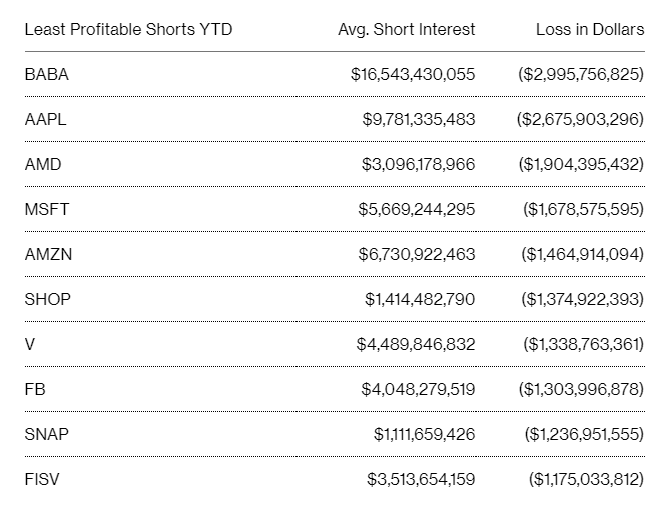

The worst performing shorts of the year, according to the same data, include names like Alibaba, Apple and AMD. Alibaba shorts are down almost $3 billion, while shorts in Apple are down about $2.7 billion.

The tech-heavy list of names on the “least profitable short” list coincides with the fact that the S&P 500 Information Technology index is up 28% in 2019. The index includes about half of the names on the list.

…as if we needed even further proof of what we already know: Tesla is a car company, not a technology company. And, if it truly is assigned a car company valuation, shorts likely stand to catapult even higher on the “profitable short” list in the future.

via ZeroHedge News https://ift.tt/2TAyF9a Tyler Durden