With currency turmoil and social unrest, China’s economic assault tonight was supposed be the great equalizer – confirming that a few trillion here or there and everything looks awesome and happy, and not a tiny bit angry (and that the Americans are not to blame for everything).

Ahead of today’s data, broadly speaking, macro data globally has been weak, but in China, recent credit growth numbers slumped and steel production slowed, suggesting graver concerns. And so here it is…

-

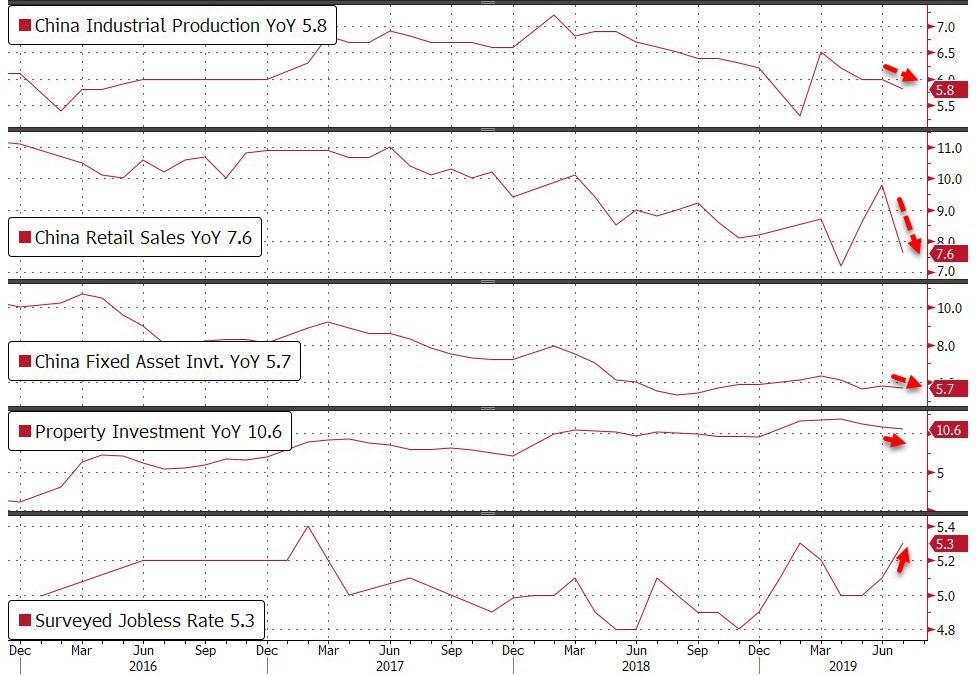

China Industrial Production BIG MISS +4.8% (+6.0% exp, +6.3% prior)

-

China Retail Sales BIG MISS +7.6% (+8.6% exp, +9.8% prior)

-

China Fixed Asset Investment MISS +5.7% (+5.8% exp, +5.8% prior)

-

China Property Investment MISS +10.6% (+10.9% prior)

-

China Surveyed Jobless Rate MISS +5.3% (+6.0% exp, +6.3% prior)

Now all that is left is to figure out if bad news is good news, or not…

(The principle of “housing is for living in, not for speculation” was mentioned at the politburo meeting again last month.)

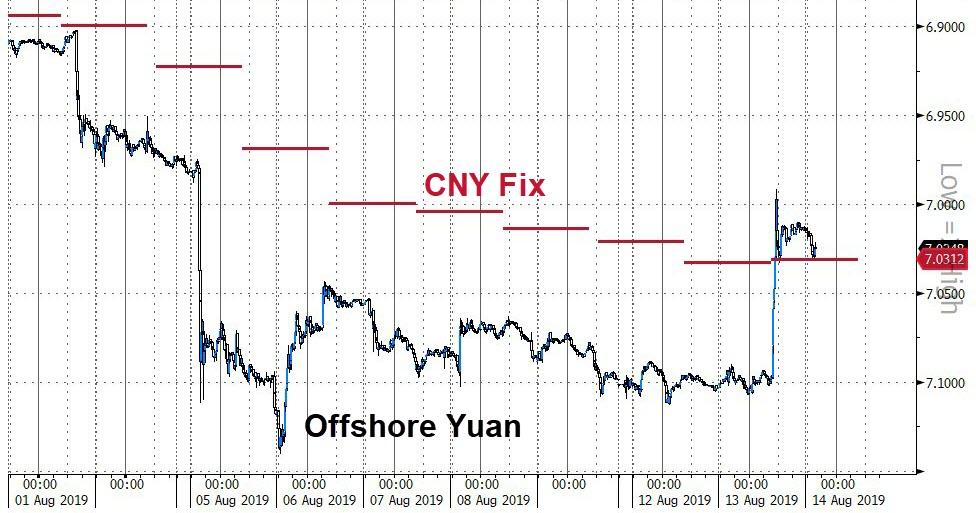

Finally, for a few minutes the world spiked after China set the yuan fix slightly stronger; we are not so impressed, nor is the yuan…

And stocks and bond yields tumbling…

So with inflation spiking, currency crashing, social-unrest; will the PBOC flood the nation with cash to ensure happiness at October’s CCP Anniversary?

It’s just that the sugar high from the injection is getting shorter…

Chen Yuan, former deputy governor of PBOC warned that “the trade war is evolving into a financial war and a currency war.”

As goes China, so goes the world.

via ZeroHedge News https://ift.tt/2MhoHbV Tyler Durden