Despite yesterday’s hope-filled ramp (on tariff-delay headlines) – which has been entirely erased and then some…

…the cost of protecting stocks from a market crash are soaring. Deep out-of-the-money options to protect themselves against drastic downside have seen dramatic increases.

Source: Bloomberg

And so, with the cost of protection so high, traders are looking for cheaper alternatives.

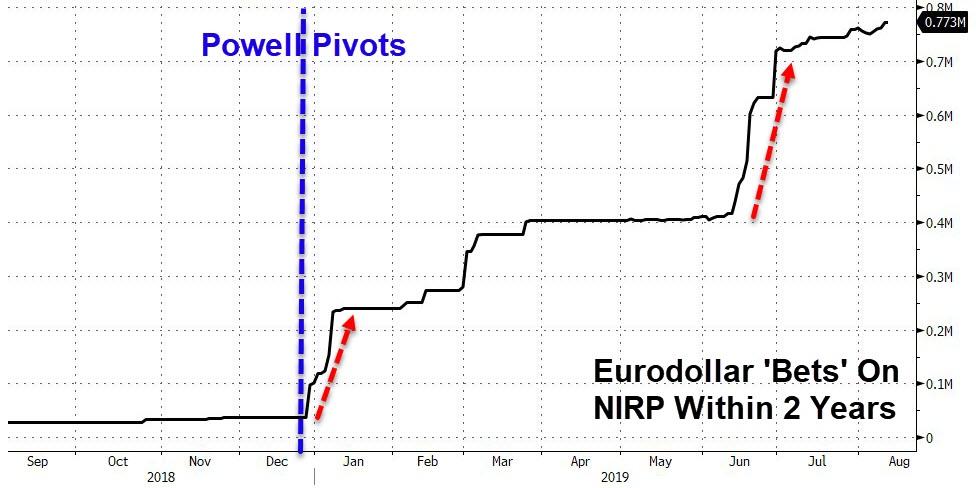

Since the Fed folded in December, basically admitting it is terrified to raise rates any more and willing to backtrack due to market fragility, IceFarm Capital’s Michael Green explained previously, it appears many market participants are piling into Par Eurodollar calls:

[the chart shows the cumulative open interest in par calls on eurodollar futures contracts that expire in 2019, 2020, and 2021 – basically options on short-term interest rates with a strike price of zero, such that they pay out if the Fed takes rates negative]

When queried whether this is indeed a trade to bet on a market drop, Michael Green responded as follows:

[A reader] thought this might be an attempt by hedge funds to hedge out their exposure to rising interest rates very cheaply.

My initial idea was that it’s actually could be a bet on negative rates (if for some reason the Fed had to come back into the picture with more QE).

The bottom line:

“Deep OTM puts on the S&P are very expensive while par ED calls are relatively cheap. In my view, we are at that inflection point where the Fed is going to start to waffle… the bear market beckons and they will not be able to stick with their [mid-cycle adjustment] rate guidance. Of course, markets tend to frown on Central Bankers revealed as less than omniscient…”

So, stop buying those deep OTM puts and start buying cheap ED Par Calls because the only way we get ZIRP is if the market crashes.

As Bloomberg notes, one such position is a $1.25 million wager – bought Friday and Monday – that the Fed will cut rates by a quarter point three more times this year and at least four times next year, and leave them at the zero lower bound until late 2021.

This fits with an increasing number of analysts who see NIRP coming to USA inevitably, including last week Pacific Investment Management Co. joined the chorus of voices warning that U.S. Treasury yields may eventually go negative.

And the market is already shifting to that opinion with the entire Treasury curve now inverted and 30Y Yields (at a record low) below the Effective Fed Funds rate.

via ZeroHedge News https://ift.tt/2MfycbH Tyler Durden