Since Powell cut rates, Bonds and Bullion are up 6%, Stocks are down 6%, and the dollar is unchanged…

#EpicPolicyFail

Chinese stocks played catch-up with US stocks yesterday after the hope-filled tariff-delay comments…

Source: Bloomberg

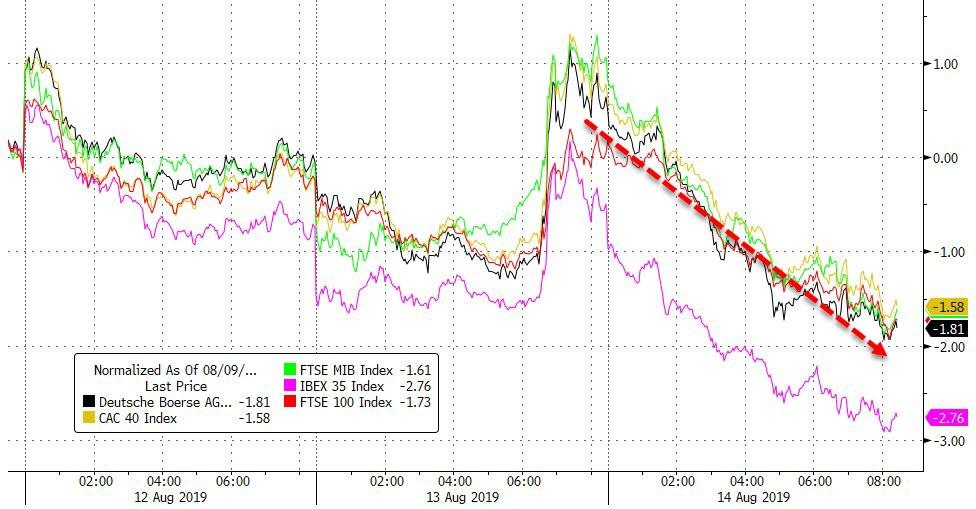

European stocks were dumped today…

Source: Bloomberg

Meanwhile, elsewhere in Europe, that insane 2117 maturity Austrian bond reached $200 (after being issued at $99.502 in 2017), up 72% YTD

Source: Bloomberg

The duration of the bond is set to be around 44 years, making it the bond with the highest duration in the euro zone government debt market.

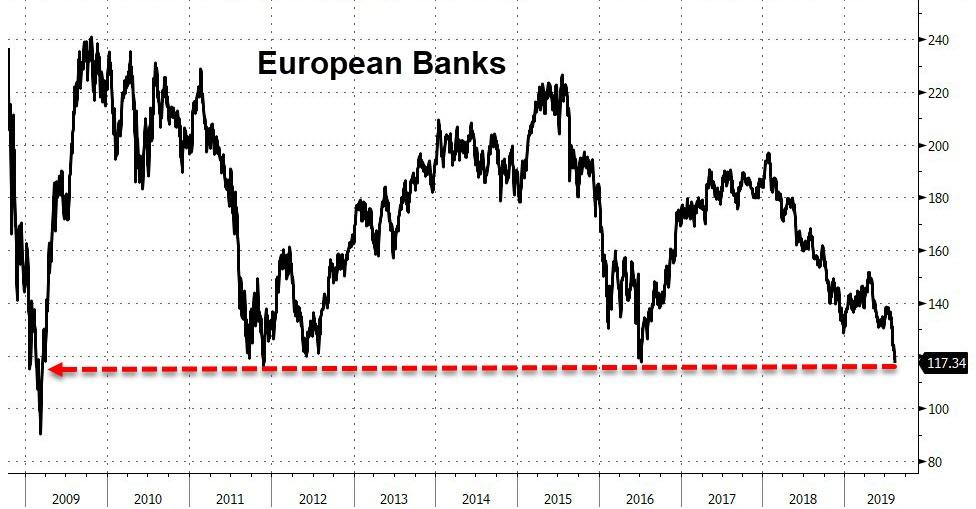

And as yields collapsed, European banks broke key support…

Source: Bloomberg

US and China stocks are exactly matched YTD (up around 14%) while Europe lags…

Source: Bloomberg

Ugly day for US stocks (down broadly 3%) as stops were run yesterday and dismal data from China and Germany sparked a big de-risking…

And on the week…

Weakest close on The Dow since June 4th and a huge drop – down 801 points – the biggest since Oct 31st.. (on 8/5 The Dow dropped 767 points, 12/04 -799pts, 10/31 -832).

Today’s dump occurred after a 3rd failed test of the Fib 61.8% retrace of the July tumble…

The Dow closed below its 200DMA

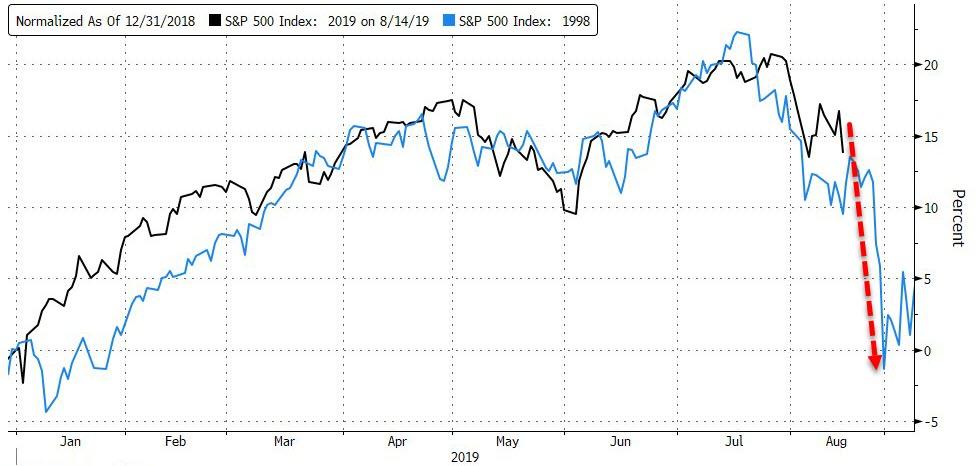

Party like its 1998…

Source: Bloomberg

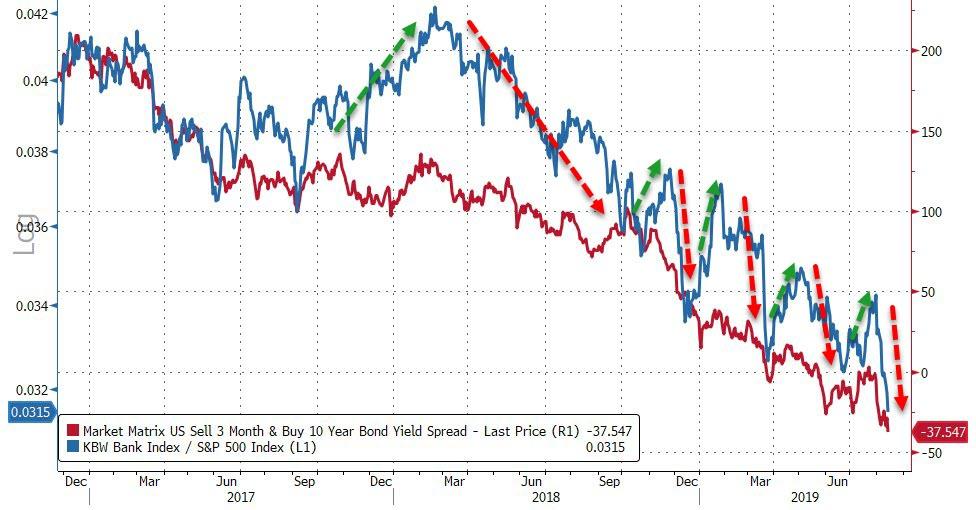

Bank stocks were battered, once again catching down (relative to the broad market) to the collapsing yield curve (how many more false starts in financials will traders willing bid for)

Source: Bloomberg

Treasury yields collapsed today, led by the long-end (30Y -13bps, 2Y -8bps)…

Source: Bloomberg

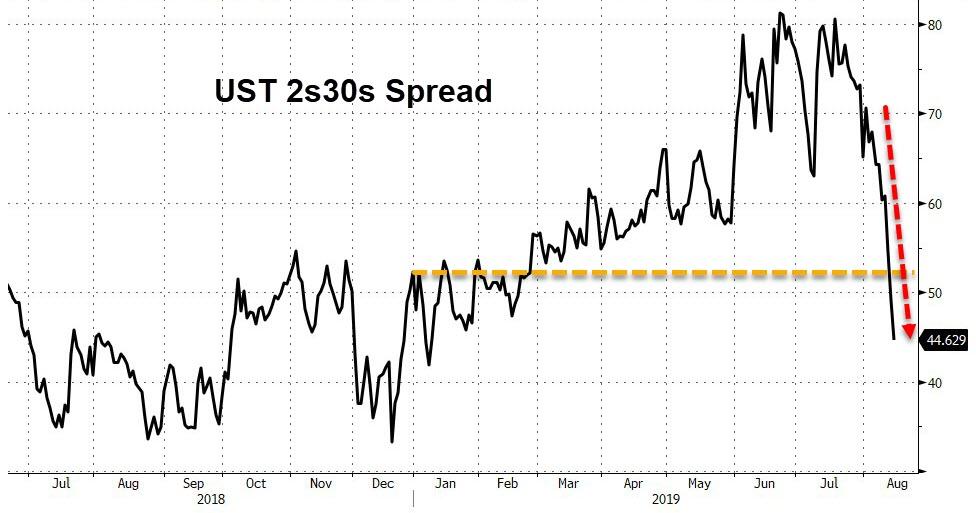

2s30s has crashed further into the red for the year…

Source: Bloomberg

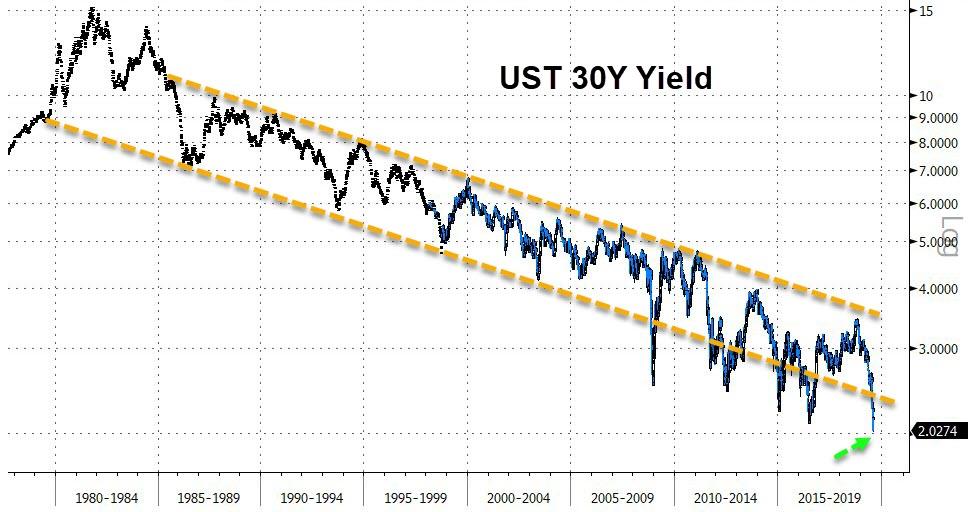

The 30Y Treasury yield tumbled to an all-time record low today, trading as low as 2.01%…

Source: Bloomberg

And the 10Y term premium tumbled to a record low…

Source: Bloomberg

The yield curve completed its inversions today with 2s10s finally crossing the zero line…

Source: Bloomberg

For the first time since 2007…

Source: Bloomberg

Don’t worry about recession though because former Fed Chair Yellen said the yield curve may be less of a reliable signal at the moment. Thanks Janet!

Germany, Canada, and UK also inverted.

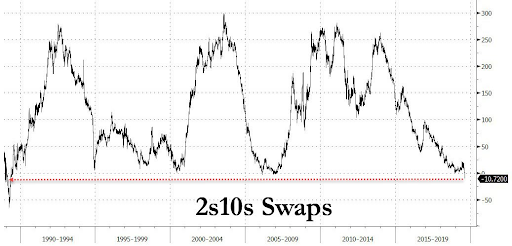

And the 2s10s swap curve is its most inverted ever…

Source: Bloomberg

And don’t forget, a flattening 2s10s curve has historically led to a secular rise in volatility…

Source: Bloomberg

Having trodden water for 2 weeks since the spike and dump on Powell and Tariffs, the dollar broke back higher today…

Source: Bloomberg

Offshore Yuan slipped back below the fix…

Source: Bloomberg

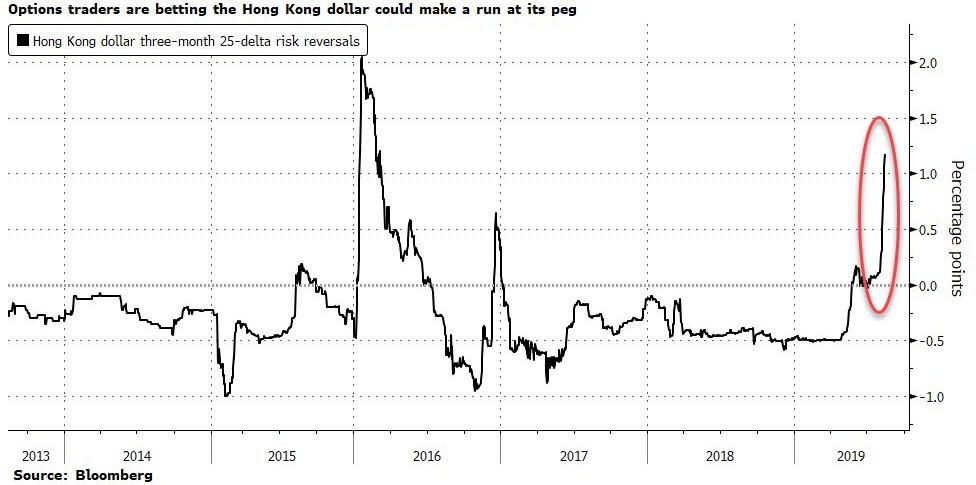

And options traders are betting that the HKD breaks the peg…

Source: Bloomberg

As Bloomberg’s Gregor Stuart Hunter notes, the Hong Kong dollar’s peg to its U.S. counterpart — unbroken since the 1980s — is drawing some skepticism as anti-government protests swell. Options traders are paying the most since 2016 for bets that the currency tests or breaches its 7.85 per dollar limit, relative to a contrary wager that the currency strengthens. “Folks are looking at the Hong Kong protests and don’t see any off-ramp, just escalation, and pushing up the risk premium,” said Cliff Tan, head of global markets research for East Asia at MUFG Bank.

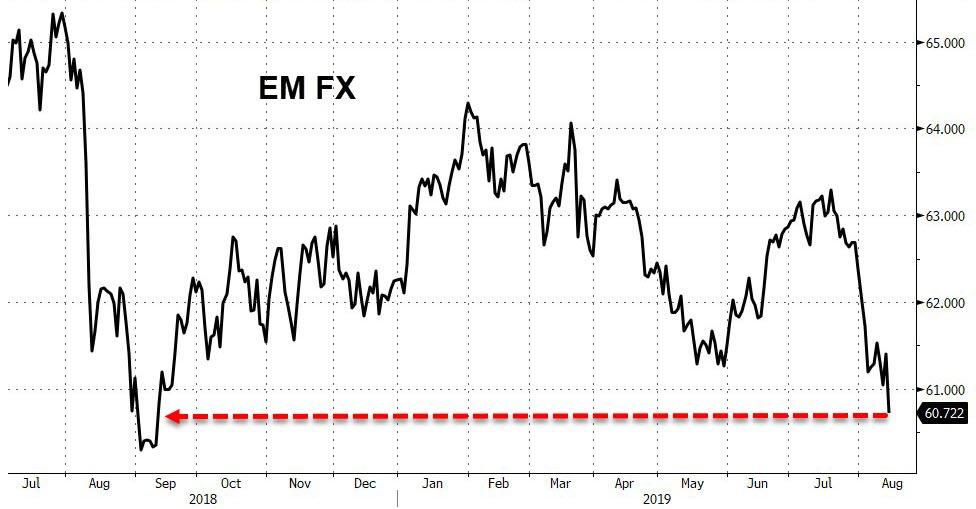

Emerging Market currencies have re-collapsed to recent cycle lows…

Source: Bloomberg

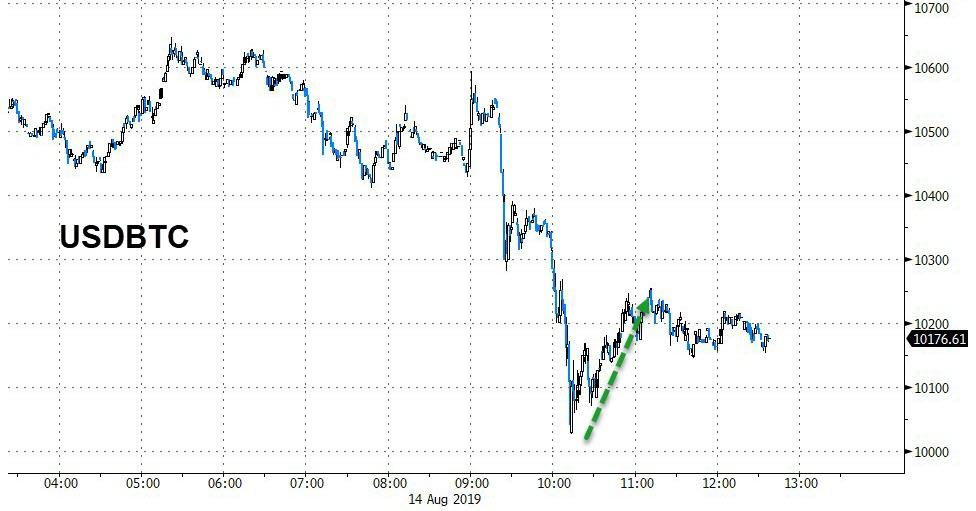

Cryptos were clubbed like baby seal…

Source: Bloomberg

As Bitcoin bounced off $10,000…

Source: Bloomberg

Gold gained on the day despite dollar strength but oil was pounded…

Source: Bloomberg

Gold prices retraced yesterday’s lows as safe-haven bids hit…

Negative-yielding debt continues to soar…

Source: Bloomberg

BofAML’s Commodity Strategist Michael Widmer argues that successive rounds of monetary easing have had a series of side effects, including higher gold prices. Widmer notes that successive rounds of easing have delivered less bang for the buck and markets are much less enthusiastic about further stimulus. Quantitative failure, under which markets refocus on elevated debt levels or the lack of global growth would likely lead to a material increase in volatility. At the same time, and perhaps perversely, such a sell-off may prompt central banks to ease more aggressively, making gold an even more attractive asset to hold. Although his 2Q20 forecast is $1,500/oz, (where Gold trades today), in this sell-off scenario, he sees the potential for gold to rise towards $2,000/oz.

Oil prices cratered today, erasing all of yesterday’s gains.

Finally, as Albert Edwards warns:

“The answer seems pretty obvious to me. The bond markets are telling us that the cycle is ending with the central banks having failed to drive core CPI inflation higher.

So Japanese-style outright deflation lies ahead at a time when western economies have piled debt sky high.”

Who could have seen that coming?

Gold tops stocks YTD and bonds are about to overtake the S&P too…

Source: Bloomberg

The dollar shortage continues…

Source: Bloomberg

Tremendous amounts of money pouring into the United States. People want safety!

— Donald J. Trump (@realDonaldTrump) August 14, 2019

via ZeroHedge News https://ift.tt/2KNB4Jn Tyler Durden