It wasn’t supposed to be like this.

First the Fed eased, but since it was just a 25bps cut framed as a “mid-cycle adjustment”, it disappointed the market which promptly plunged.

Immediately after, Trump realized that to force a bigger rate cut from the Fed, he has to escalate the trade war with China and destabilize the global economy. He did that by threatening to impose tariffs on the remaining $300BN in Chinese imports, and the market promptly plunged some more.

Then, in a remarkable reversal, hoping to halt the drop in the market, Trump delayed the imposition of most of the consumer-focused tariffs, which helped spark a dramatic market rebound, which however was quickly offset by the 2s10s yield curve – also known as the “recession radar” – inverting, German GDP contracting and China posting the worst manufacturing print in 17 years, and the market crashed.

So with the countdown to a recession officially started, China’s economy reeling and credit-creation engine sputtering, Europe on the verge of a double whammy of economic and political crisis courtesy of Germany and Italy, is a bear market now inevitable?

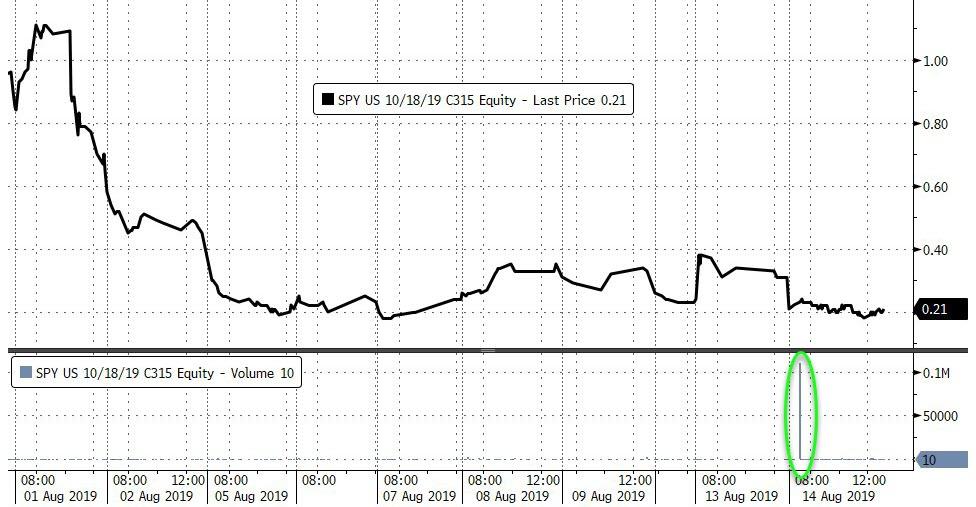

The answer, at least according to one trader, is a resounding no, because as Bloomberg first reported, an unknown trader just put on a call spread trade on the SPY ETF that stands to make a gargantuan profit if the market surges by 10% by October 18.

Whether this is a bet on Trump amicably concluding trade war with China in just over 8 weeks, or far more likely, that Powell will launch QE in the coming weeks, is unclear, but what we do know is that the biggest trade among U.S.-listed option contracts on woeful Wednesday was a call spread where one investor bought a lot of $315 October calls…

…. and sold $320 October calls on the SPDR S&P 500 ETF.

The trade, according to Bloomberg, amounted to the equivalent of 11 million shares and positions for the ETF to rally about 10%, and was partially funded by selling the $270-$276 put spread on the equivalent of 1.1 million shares.

The punchline: if the S&P500 surges to where the $315 SPY calls end up in the money and are fully exercised, the trade will yield a net position of about $3.5 billion for the investor.

In other words, if Powell folds to presidential pressure and goes all-in to support stocks by launching QE in the next two months, at least one trader will be able to retire very soon.

Of course, if Trump fails to deliver world peace and if Powell disappoints and only cuts another 25bps in the coming months, and stocks plummet, the trade may be stuck working for a long, long time due to his substantial downside risk.

“While the call spread on the surface looks bullish, being short the downside put spread makes this a very risky trade,” said Alon Rosin, Oppenheimer’s head of institutional equity derivatives. Additionally the strategy could also potentially be a hedge against a large portfolio of shorts and help offset a quick market surge, he said.

While nowhere near as aggressive, in recent days both Goldman and JPMorgan – which have S&P year-end targets of 3,100 and 3,200 respectively – have urged their clients to use index calls to bet on a rebound in the S&P500. That in itself virtually assures that such a dramatic move in the index is unlikely as the banks’ own traders are positioning in the opposite direction, and would do anything to avoid substantial payouts to clients.

In any case, whatever the trader’s underlying motive, one thing is certain: if the Fed does go ahead and announce a new round of asset purchases (i.e. QE), not only will Trump be delighted, but this massively levered bullish trade could end up being one of the most profitable in history. And finally for all those who think there is no chance the Fed will shock the market and unveil QE4, we remind readers that first Bank of America and then JPMorgan both predicted that the Fed may have no choice but to launch QE in the coming weeks as a result of an unprecedented drain in liquidity resulting from the Treasury’s accelerate rebuild of its $350 billion cash balance, which as we saw in yesterday’s “terrible” 52-week auction – and today’s stock market plunge – is already starting to hurt the overall market.

Of course, there is a far simpler reason why the Fed may launch QE soon: the market crashes in the next several days.

via ZeroHedge News https://ift.tt/2H6Vz2R Tyler Durden