After the 4th biggest point drop in US stock market history, this is all equity dip-buyers could manage? This won’t end well…

China was mysteriously panic-bid overnight after plunging at the open after US stocks crashed…

Source: Bloomberg

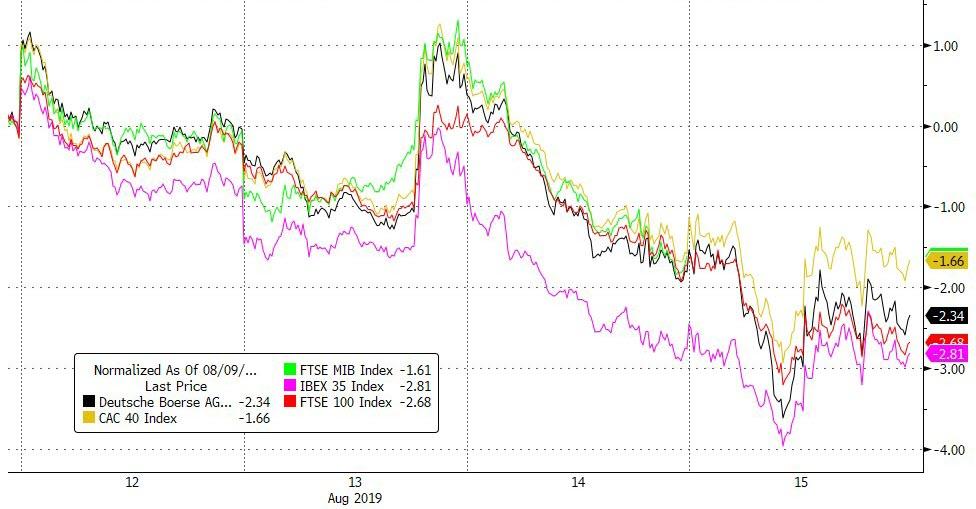

More stimulus promises did nothing to help European stocks…

Source: Bloomberg

EU banks broke to a new cycle low…

Source: Bloomberg

After ECB promised more stimulus, Bund yields crashed to a stunning record low of -71bps (down 21 of last 24 days)…

Source: Bloomberg

Also of note, in the crazy world of negative rates, the 50Y EU Swap rate has dropped below zero for the first time ever…

Source: Bloomberg

US equities whipsawed by headline-reading algos early on as China threatened retaliation, WMT surged, and China offered some hope for a deal before Trump confirmed on his terms…

An afternoon buying spree (paging Steve Mnuchin) lifted The Dow, S&P, and Nasdaq into the green for the day

On the week, Trannies are the biggest losers

The Dow bounced back above its 200DMA…

Small Caps tumbled to May lows and bounced a smidge, dramatically below the 200DMA…

The Dow was rescued by WalMart’s big gains…

But GE crashed on Markopolous exposures…

Defensives dominated the days…

Source: Bloomberg

Source: Bloomberg

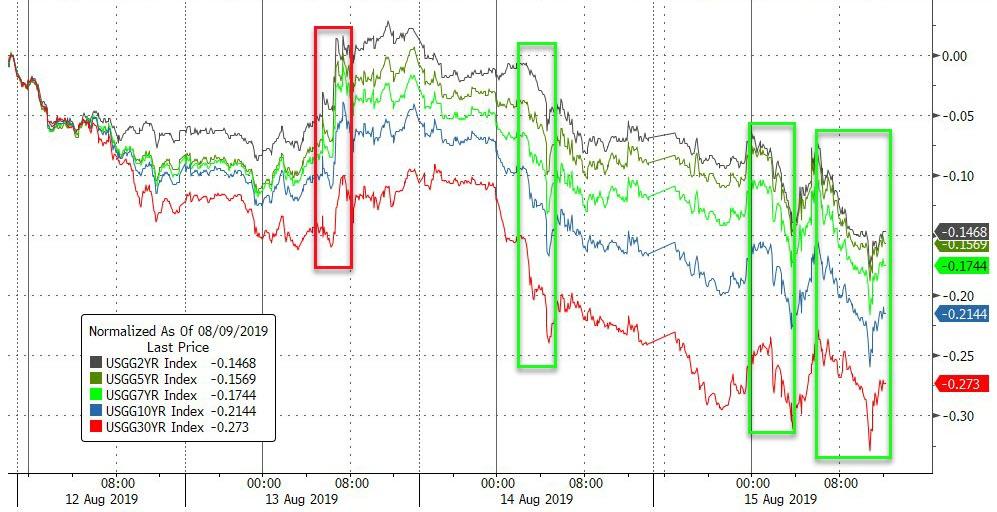

Treasury yields tumbled on the day (again) with the short-end outperforming this time (2Y -7bps, 30Y -3bps)…

Source: Bloomberg

30Y broke below 2.00% for the first time ever (and 2Y broke below 1.50% for the first time since 2007 as did 10Y)…

Source: Bloomberg

And the 10Y Yield is testing back towards record lows…

Source: Bloomberg

The yield curve story was mixed – 2s10s rose back from inversion…

Source: Bloomberg

BUT remember the 3m10Y – which is the most accurate recession indicator – remains deeply inverted…

Source: Bloomberg

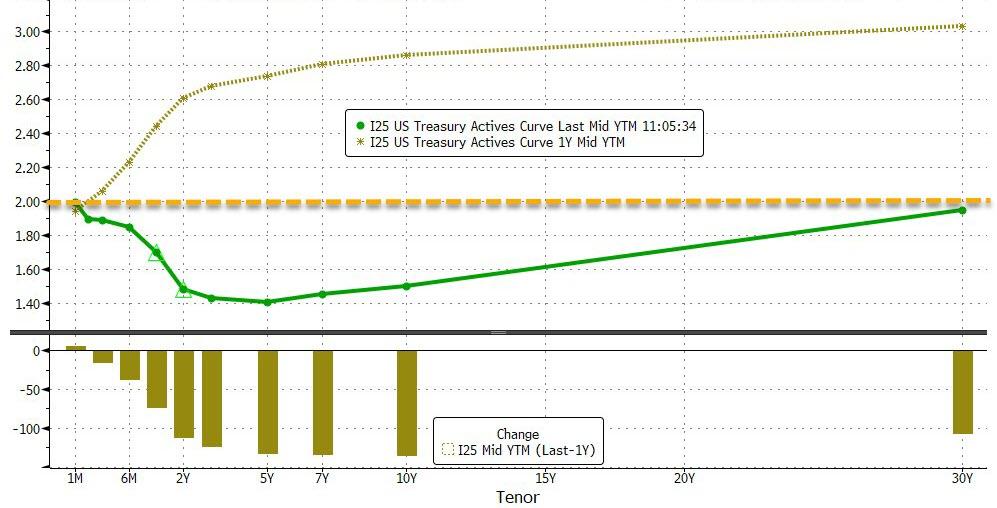

What a difference a year makes – entire curve now below 2.00% but entire curve was above 2.00% exactly one year ago…

Source: Bloomberg

And TIPS markets are pricing in a deflationary future…

Source: Bloomberg

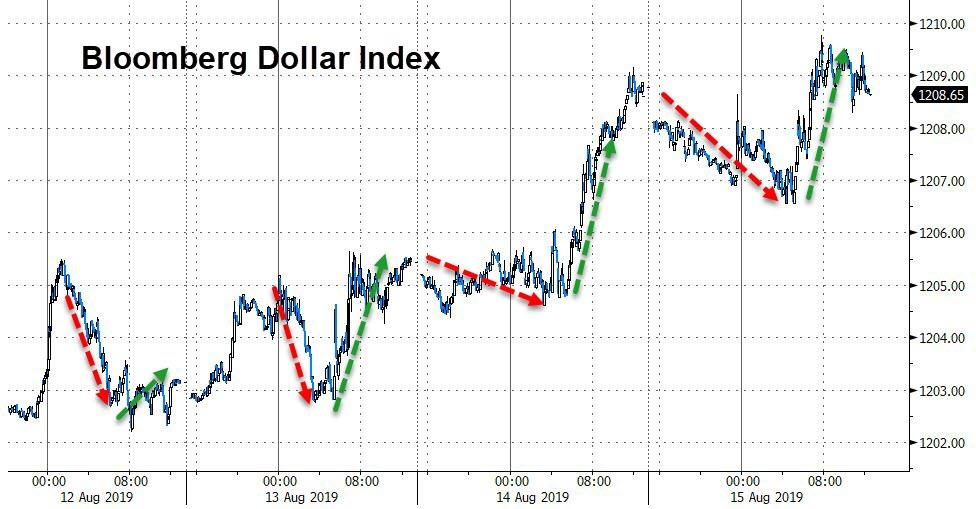

Overnight weakness in the dollar ramped higher once again today (starting to see a pattern here)…

Source: Bloomberg

Yuan weakened modestly overnight (even as the PBOC fixed it stronger again)…

Source: Bloomberg

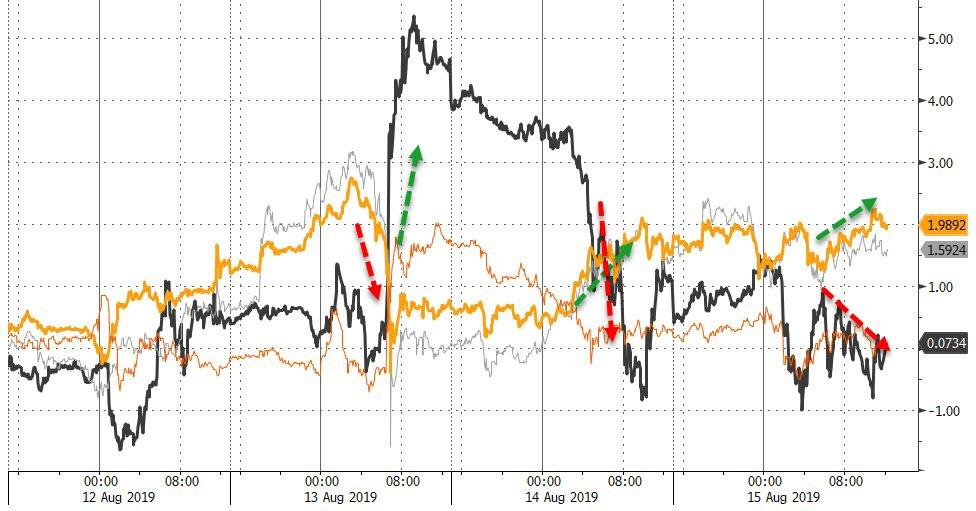

Which is notable as China appeared to start trying to squeeze the shorts with a liquidity squeeze overnight…

Source: Bloomberg

And it appears Hong Kong authorities intervened to keep the HKD away from the low-end of the USD peg…

Source: Bloomberg

Cryptos got hit hard overnight but bounced back as Europe opened…

Source: Bloomberg

But Bitcoin bounced back above $10k by the end…

Source: Bloomberg

Oil and gold diverged once again today as did copper (lower) and silver (higher)…

Source: Bloomberg

WTI is back below $55…

Gold futures’ bounce off $1500 continues…

Global Negative-yielding debt topped $16 trilion for the fiorst time ever, and gold tracked it perfectly (but bitcoin appears to have decoupled for now)…

Source: Bloomberg

Treasury yields imply gold should be higher or copper lower…

Source: Bloomberg

Finally, we have seen the emergence of another ominous Hindenburg Omen…

Source: Bloomberg

We all know who to blame… right Mr. Trump?

“The Fake News Media is doing everything they can to crash the economy because they think that will be bad for me and my re-election. The problem they have is that the economy is way too strong and we will soon be winning big on Trade, and everyone knows that, including China! “

At least The Fed wasn’t immediately blamed this time.

via ZeroHedge News https://ift.tt/2KBYJxN Tyler Durden