When stocks rise – usually because the Fed made some guttural, dovish noise and promised even more monetary Kool-Aid – the bulls are delighted, and go to great lengths to mock the bears and short sellers who are “obviously wrong.” However, when stocks plunge – as they did yesterday – there is an utmost urgency to i) explain that the sellers are clueless/have no idea that stocks are massively undervalued, ii) find the sellers, and iii) failing that, blame the selloff on the algos (and in some very specific cases – like Goldman and oil for example – blame negative gamma).

That’s precisely what happened following yesterday’s 800 point Dow plunge, which the bulls and other liquidity addicts quickly accused the algos, quants and various other machines who – the narrative goes – of mindlessly latching on to the plunge in bonds yields, sending stocks tumbling.

Only that’s not true, and as Nomura’s quant team writes today, the magnitude of yesterday’s sell-off suggests that panic-selling by longer-term investors was the driving force, rather than trading by algo players, to wit:

When a sell-off like yesterday’s happens, commentators scanning the supply/demand landscape in a hunt for the principal culprit tend to single out algorithmic traders, but we think they would be wrong to do so in yesterday’s case.

And while Nomura concedes that both CTAs and risk-parity funds participated in the selling, the Japanese bank sees no signs that they exited longs or deleveraged “on the sort of scale that could make for a sell-off of yesterday’s magnitude.” Furthermore, while it is plausible to think that some anti-momentum algorithmic traders momentarily dumped stocks in response to the signal sent by the inversion of the 10yr-2yr yield curve, Takada thinks that the large and continuous sell-off that progressed from that point on was in all likelihood led by panic-selling on the part of longer-term investors. Indeed, recall that in December 2018, algos were treated as a convenient scapegoat for longer-term investors’ shift away from stocks and into bonds as other segments of the yield curve started to invert.

Some more details:

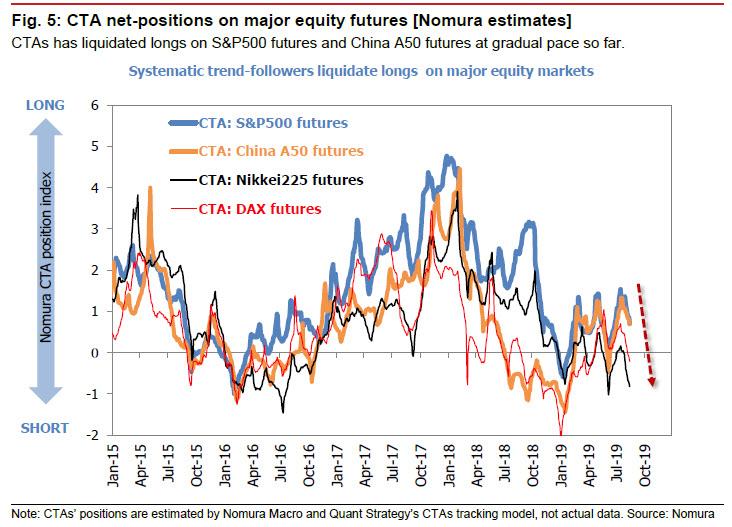

- Trend-chasing CTAs were net sellers of equity futures in major markets. With the S&P 500 stuck below 2,960 (which is the average break-even line for CTAs’ net buying since June), CTAs have continued closing out longs. As of now, CTAs have only closed out 54% of the net long position they held on 16 July (the recent peak in that position), so they still have quite a way to go. CTAs are also still selling China A50 futures at index readings below 13,440 (representing their average cost of net buying since June). Meanwhile, CTAs continue to accumulate short positions in Nikkei 225 futures and DAX futures. We estimate that CTAs’ existing short positions break even at 21,200 (for the Nikkei 225) and 11,630 (for the DAX). In each of these markets, selling by CTAs looks merely steady, not frantic.

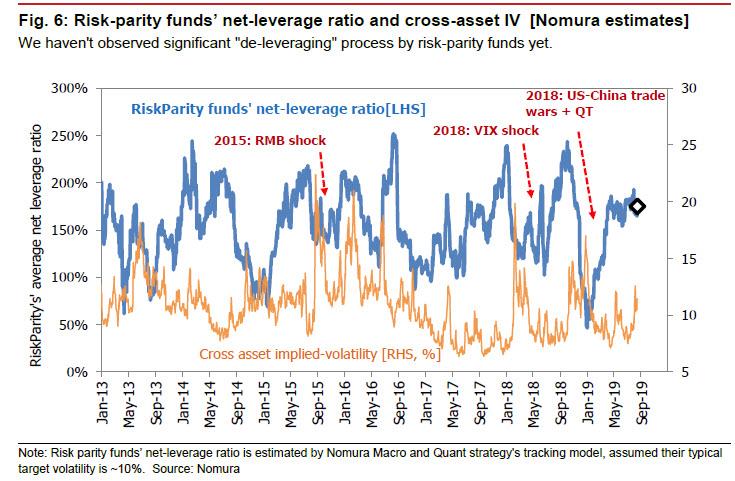

- Little evidence of much market activity by risk-parity funds. Some funds may have moved to rebalance their portfolios in response to the rise in stock market volatility, but most are probably waiting until their regular month-end portfolio rebalancing comes around. Cross-asset volatility has not increased all that dramatically, and risk-parity funds’ portfolio leverage has held steady at around 170%; we see no evidence of significant deleveraging.

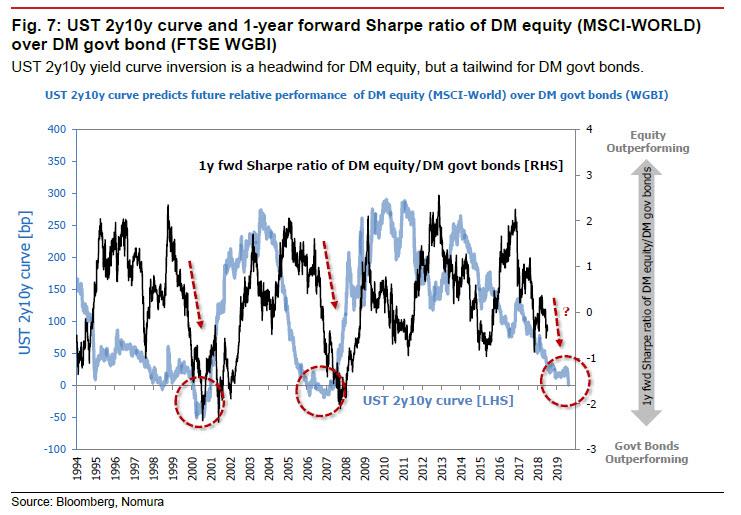

But while yesterday’s selling may have been all humans, the real question is whether it will continue – regardless if human or machine-driven. To this point, Nomura makes one final, ominous observation: with the 10yr-2yr UST yield curve having briefly inverted yesterday, an interesting phenomenon that tends to occur after such inversions is that stocks tend to consistently underperform bonds over the subsequent 12 months (measured using one-year forward rolling Sharpe ratios).

Here, Nomura’s quant team argues that the historical underperformance of stocks in these circumstances is powered by an undercurrent of longer-term investors quietly executing an allocation shift away from stocks and into bonds, upon reading the inversion of the yield curve as a signal of a coming recession.

This is also why yesterday’s symbolically-loaded inversion of the 10-2 spread did much to induce panicky behavior (stock-selling and bond-buying) among longer-term investors, be they man or machine.

via ZeroHedge News https://ift.tt/2Z9SNEa Tyler Durden