While Deutsche Bank’s Jim Reid is enjoying a brief vacation in the Alps, he must have had a dull day on holiday as he kept emailing his team about the first 2s10s inversion in 4,453 days, and asked his co-worker to put in this blurb in this morning’s “Morning Reid” note to reflect his – now far more gloomy – view:

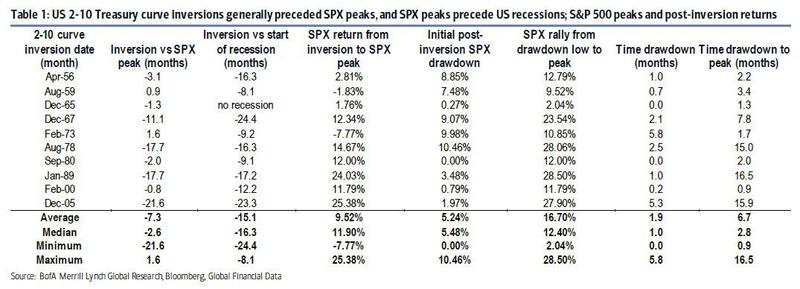

“Although other measures of the US yield curve have progressively inverted over the last few quarters, for me yesterday’s 2s10s inversion is the one that worries me most. In my opinion, it has the best track record for predicting an upcoming recession over more cycles than any of the others. Indeed, every inversion since 1956 has seen a recession follow. Although the median length of time to a recession is 17 months, credit spreads have pretty much exclusively widened from the point of inversion onwards.

Of those 2 of the 9 recessions since the 1950s took more than 2 years to materialise after the first inversion though. The first in the mid-1960s (took nearly 4 years) was due to a Fed policy error where the Fed didn’t raise rates as expected (they actually cut) with inflation rising. The curve re-steepened and only inverted again as the Fed reversed course and hiked a few quarters later. The recession soon followed the subsequent inversion. The second, following the May 1998 inversion, took 34 months until a recession arose but the inversion was relatively brief and occurred just prior to the Russian/LTCM crisis where the Fed rapidly cut 75bps thus re-steepening the curve. The Fed then raised rates again from 1999 and the curve re-inverted in early 2000, around a year before the actual recession.

So, the conclusion is that the Fed has successfully acted before to delay the inversion turning into a recession but only on 2/9 occasions.

Given that the market already prices in 65bps of cuts before year end it feels like they might need to out-pace that to make it 3 out of 10 where they’ve delayed the recession. I should say that our analysis uses closing prices, and we actually closed at 0.1bps last night so I have to be a bit careful here. But having spent most of my career suggesting that this was the most reliable indicator that the US cycle is entering its last act, I have to become far more negative now it looks likely to be triggered, especially given the history of credit spreads immediately after.

As an aside, I don’t think this time is different because of term premium being much lower and global QE etc. as we think the causality is through animal spirits. In an inverted yield curve environment, this gets increasingly drained and thus impacts financial and economic activity. So I really don’t care why the curve inverts, just that it does.

via ZeroHedge News https://ift.tt/3035ZrO Tyler Durden