This week was brought toy by the words “Distorted”, “Different This Time”, & “Resilient” and the number 800 (points down in the Dow)…

China’s National Team was very evident in their stock market this week (as economic data collapsed along with social order in Hong Kong)

Source: Bloomberg

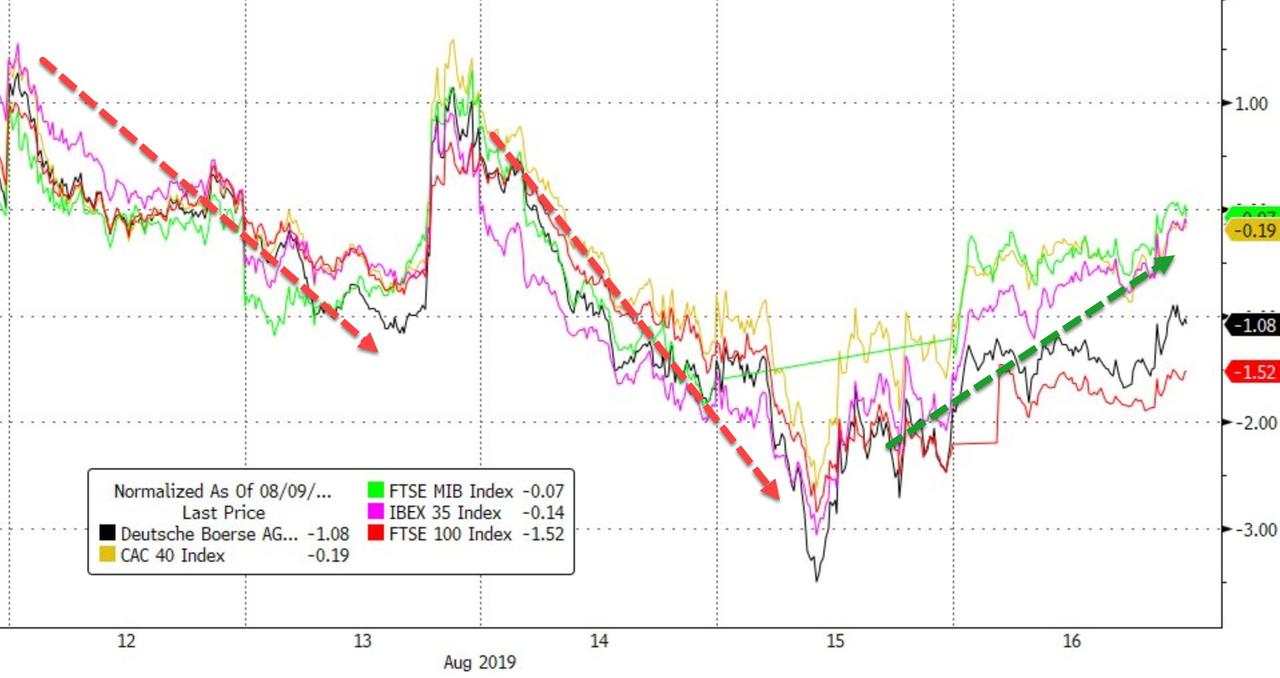

European stocks bounced back from early carnage on hopes of German fiscal recklessness…

Source: Bloomberg

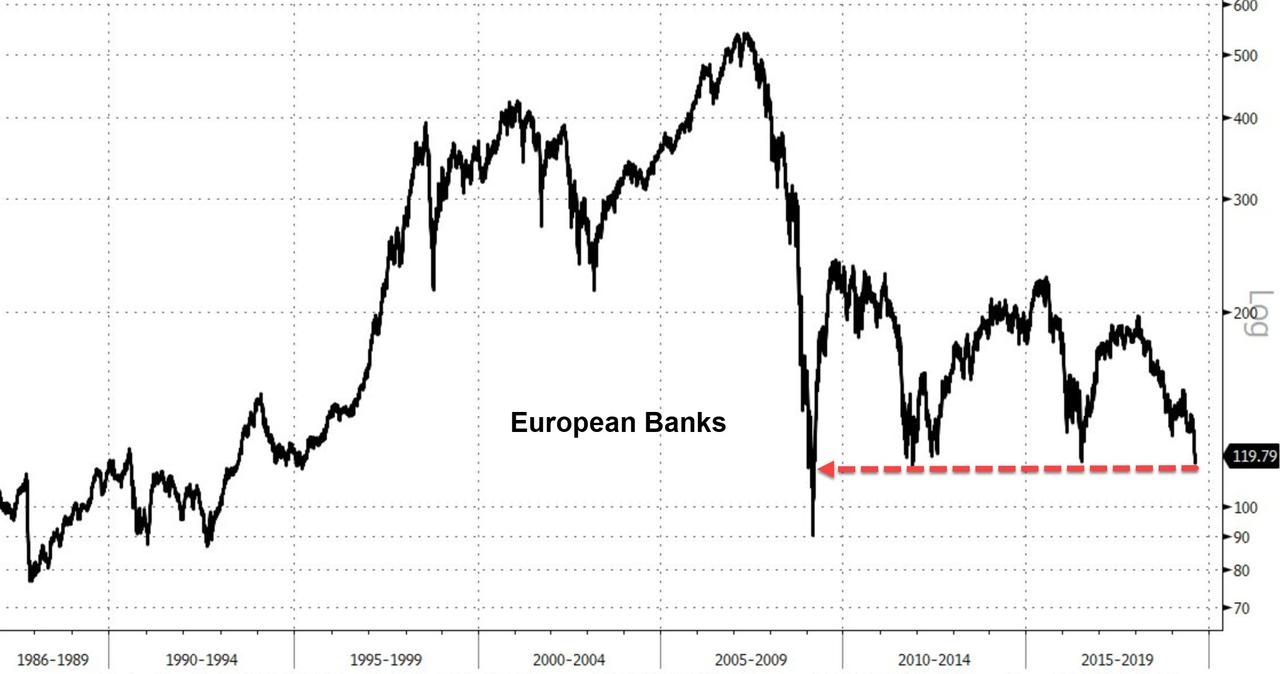

European Banks bloodbath’d…

Source: Bloomberg

US equities staged a valiant recovery after the midweek collapse – following President Trump’s call to the big bank CEOs…Trannies were the laggards as Nasdaq outperformed but all major US indices ended red on the week…

Defensive stocks dominated cyclicals on the week…

Source: Bloomberg

VIX was up marginally on the week but ended back below 19…

Source: Bloomberg

Stocks and bonds decoupled as the former rallied back from near disaster and the latter ignored the propaganda…

Source: Bloomberg

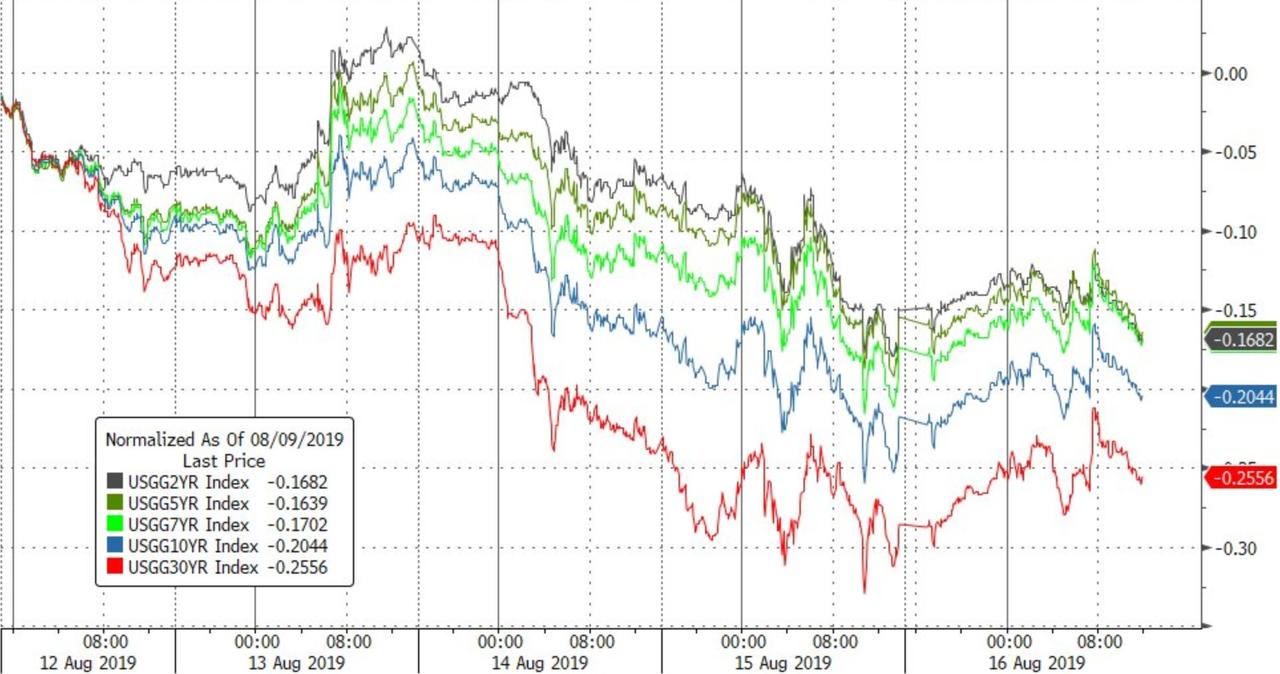

A big week for bonds with 30Y Yields cratering over 25bps – the biggest weekly drop since June 2012…

Source: Bloomberg

30Y yields fell to a record low, below 2.00%. And have collapsed 60bps in 3 weeks – the biggest crash in yields since August 2011’s Black Monday following the US debt downgrade…

Source: Bloomberg

While 2s10s did invert briefly this week, it is the 3m-10Y that is more accurate and that remains deeply inverted…

Source: Bloomberg

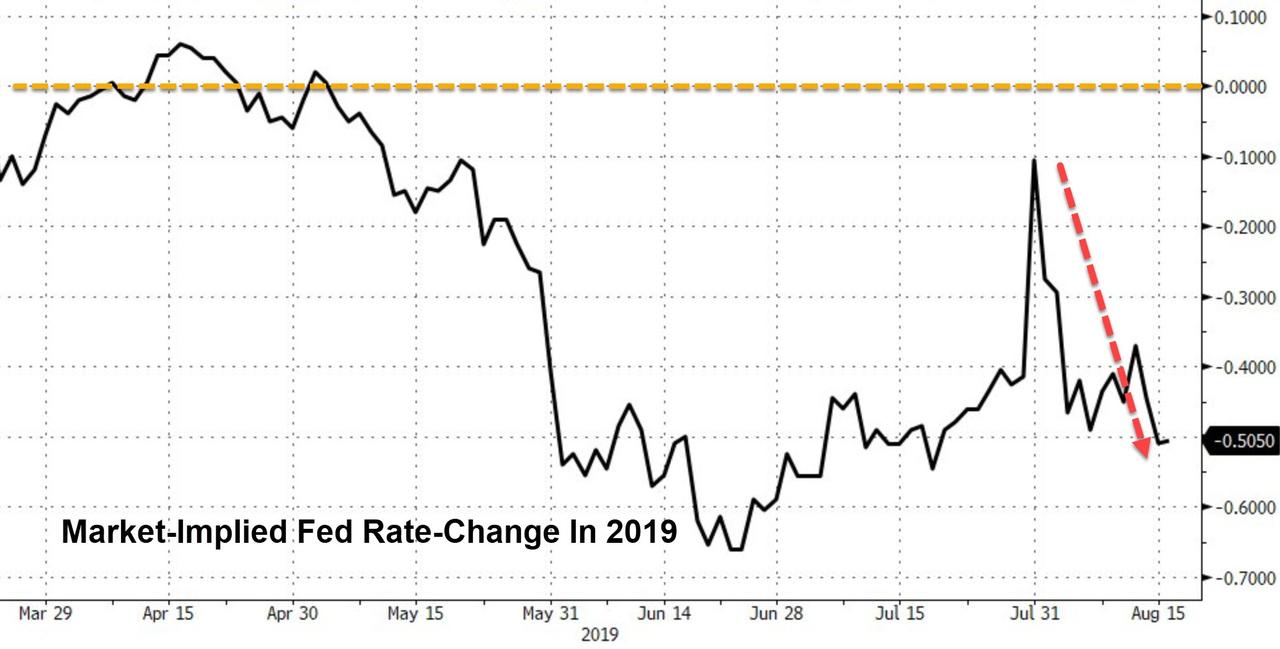

Markets shifted to demand a more dovish Fed this week…

Source: Bloomberg

The dollar rallied on the week but remains below the post-Powell spike…

Source: Bloomberg

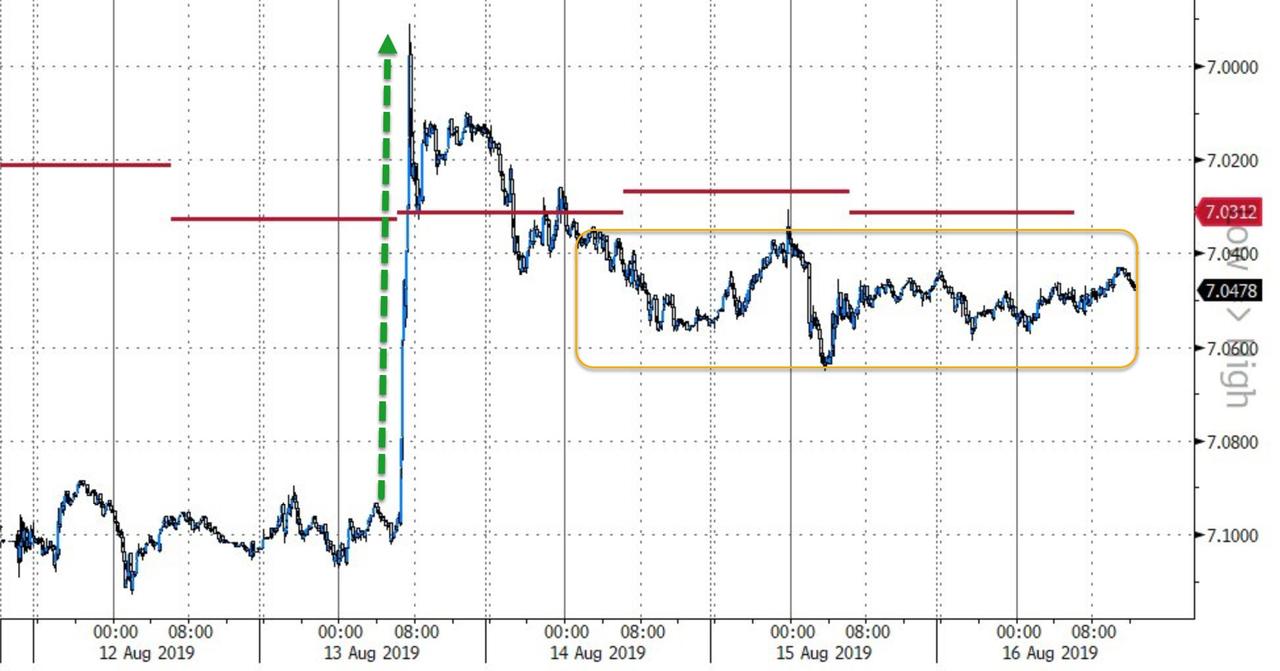

Yuan was stable for the rest of the week after spiking on tariff delays…

Source: Bloomberg

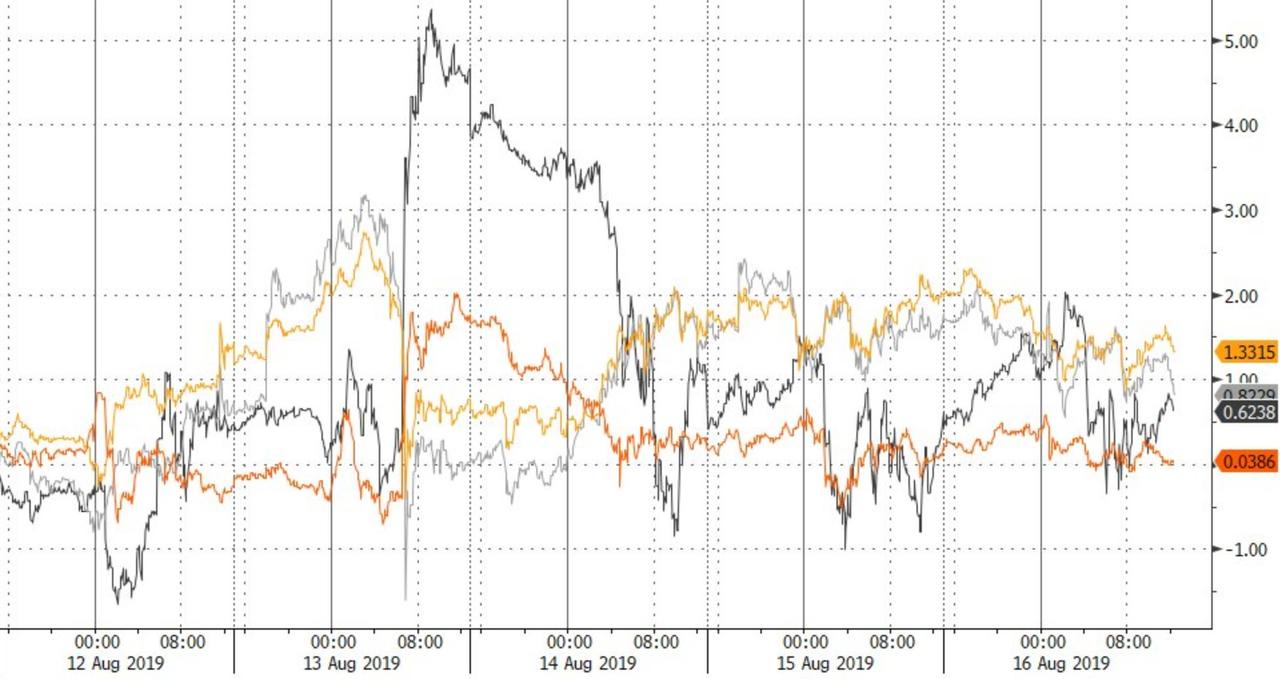

EM FX tumbled for the 5th week in a row…

Source: Bloomberg

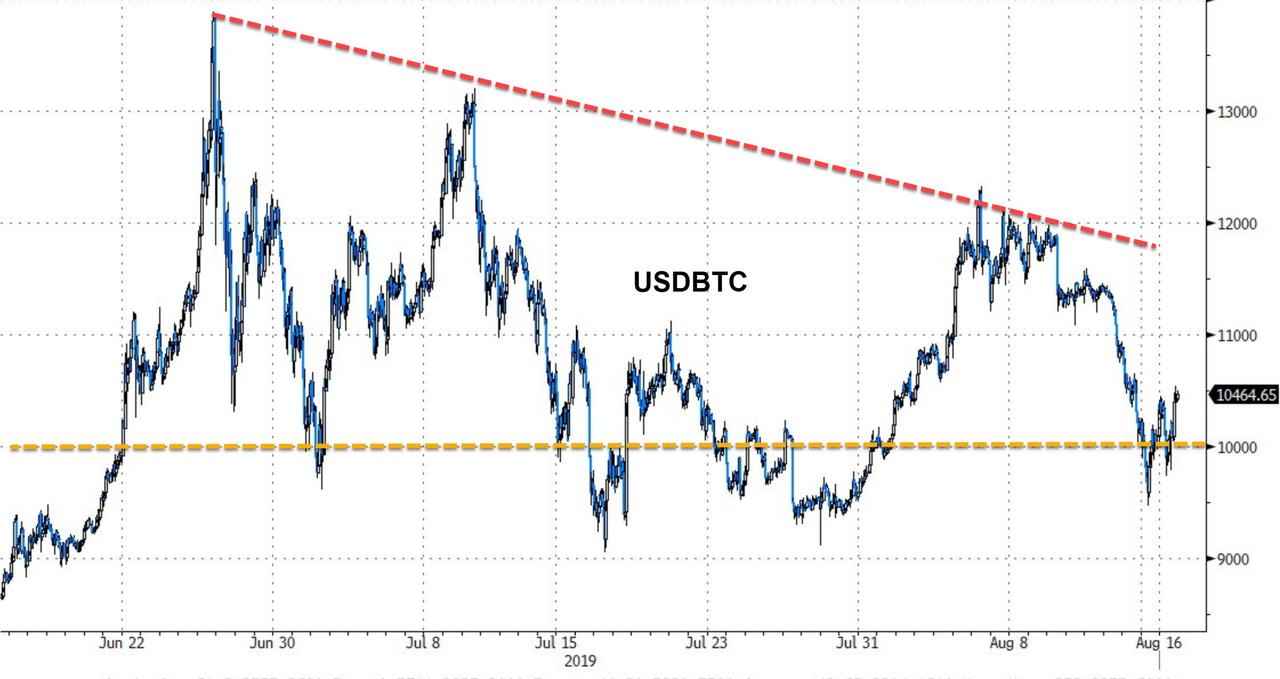

Cryptos had a rough week…

Source: Bloomberg

But Bitcoin managed to get back above $10k…

Source: Bloomberg

Amid the chaos in bonds and stocks, commodities looked positively serene…

Source: Bloomberg

Aside from some chaos in crude…

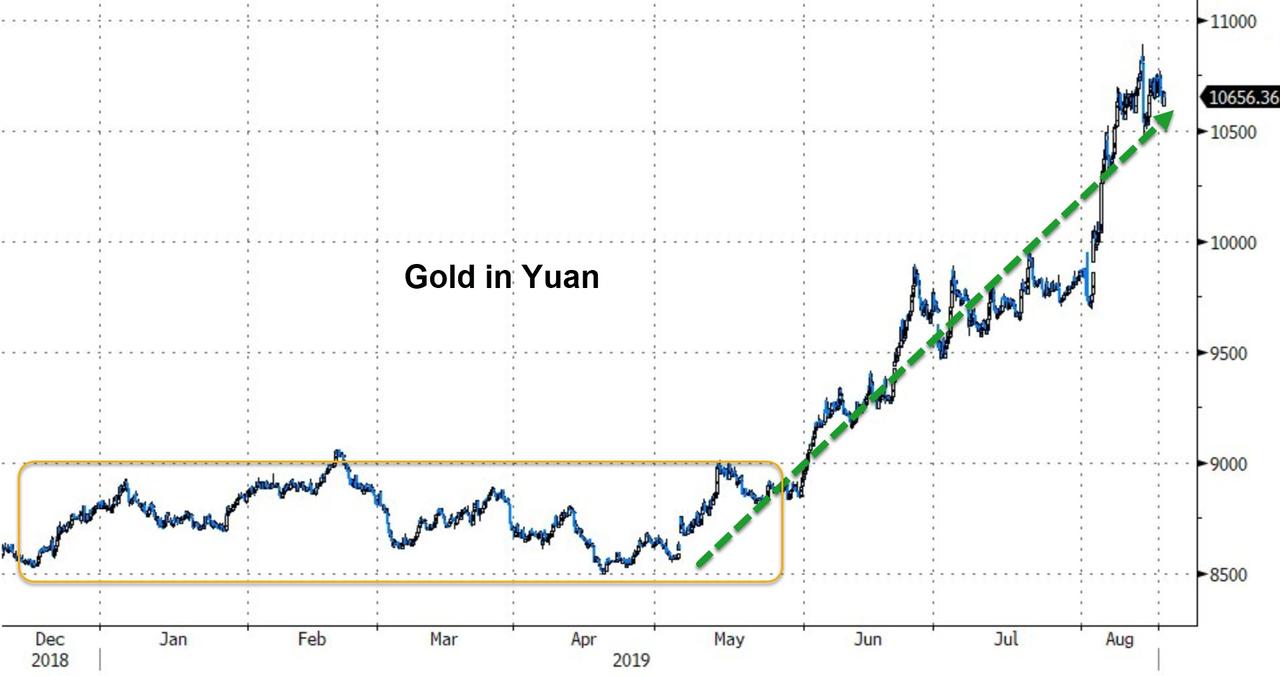

Yuan continues to devalue against gold…

Source: Bloomberg

Finally, as @LukeGromen noted so eloquently: “Have you ever seen people running into a burning building for safety? You have now.”

Source: Bloomberg

Almost $17 trillion of negative-yielding debt globally!

And a Hindenburg Omen hit stocks this week…

Source: Bloomberg

via ZeroHedge News https://ift.tt/2z990e1 Tyler Durden