But, but, but… yesterday CNBC was telling us about how strong the consumer is and how bonds must be wrong.

UMich Consumer Sentiment collapsed in August (flash data) ,slumping to 92.1 from July’s 98.4, missing all forecasts in Bloomberg’s survey of economists. The gauge of current conditions decreased to 107.4 while the expectations index dropped to 82.3, bringing both readings to the lowest levels since early this year.

Current economic conditions are at their weakest since Trump was elected (Nov 2016).

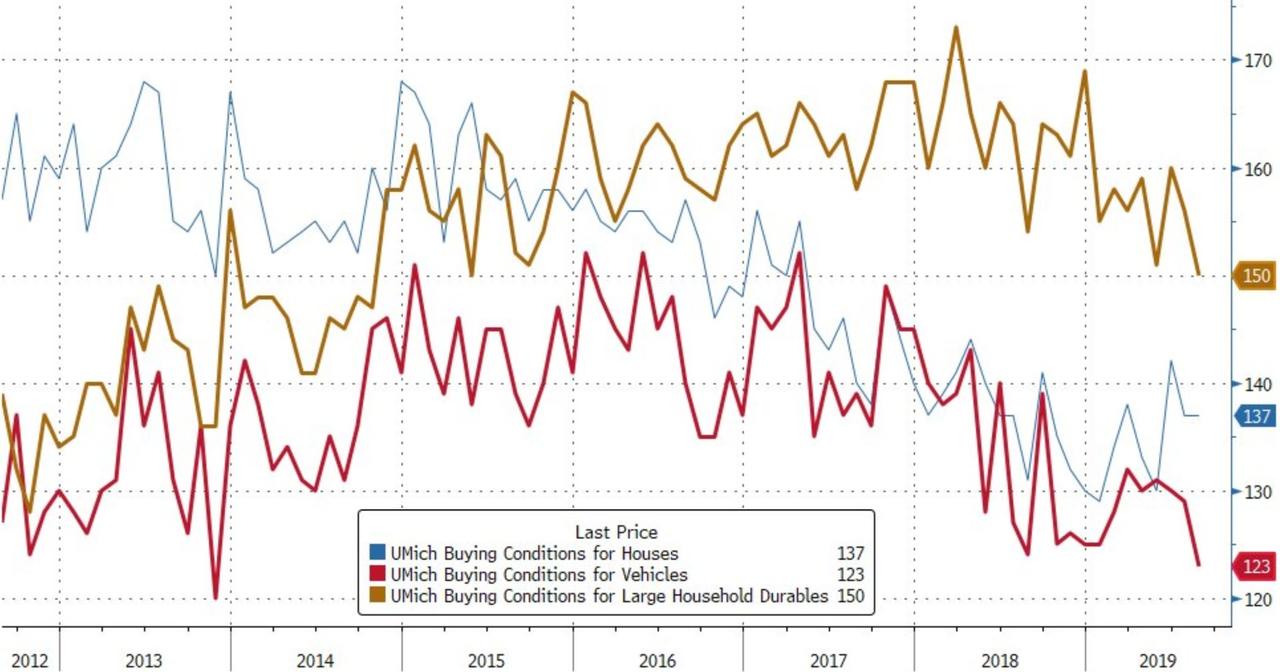

And buying conditions crashed to cycle lows…

Consumers “strongly reacted” to the proposed increases in tariffs on Chinese goods, a subject that was spontaneously cited by 33% of those surveyed, near the recent peak of 37%, according to the report. Americans also concluded, following the Federal Reserve’s first interest-rate cut in a decade, that they may need to be more cautious about spending in anticipation of a potential recession, the report said. As UMich notes:

Consumers concluded, following the Fed’s lead, that they may need to reduce spending in anticipation of a potential recession.

Perhaps the most important remaining pillar of strength for consumer spending is favorable job and income prospects, although the August survey indicated some concerns about the future pace of income and job gains. It is likely that consumers will reduce their pace of spending while keeping the economy out of recession at least through mid 2020.

So, Powell’s rate-cut backfired beautifully.

via ZeroHedge News https://ift.tt/2z4ZI30 Tyler Durden