As the protests in Hong Kong enter their 11th week with a massive rally on Sunday, more Hong Kongers are beginning to worry that their money isn’t safe any more, and a great exodus of capital has begun – an exodus that has challenged the Hong Kong dollar’s multi-decade standing peg to the greenback, just as hedge fund investor Kyle Bass bet would happen.

Particularly after this week’s protests at the airport, and the intensifying threats from Beijing, more people are looking for ways to move their money to safer havens, particularly as the Hong Kong market, which was resilient during the early days of the protests, has started to soften.

Sarah Fairhurst, a 52-year-old partner at the Lantau Group, an economic consulting firm, said she transferred 200,000 Hong Kong dollars (about $25,500) into British pounds last week because of concerns about the protests.

“It’s very unsettling here,” said Ms. Fairhurst, who has lived in Hong Kong for 12 years. She said seeing videos of police using tear gas near her office have made her particularly nervous. “I don’t know what’s going to happen, but I know that I don’t want my money trapped here.”

There has been a rash of disappointing economic data as tourism and business confidence have suffered. Meanwhile, the movement has raised uncomfortable questions about Hong Kong’s ability to maintain the “one country, two systems” ethos, WSJ reports.

More are beginning to worry about their money.

Though it’s clearly not the consensus view at this point, it seems like Bass is no longer alone in believing that the Hong Kong dollar’s longstanding peg to the greenback – which has persisted since 1986 – could be in danger. 42-year-old Ming Chung runs a business exporting building materials. He said he dropped plans to buy a property in Hong Kong and instead invested HK$4 million ($510,000), into a greenback-based insurance product.

Why? Because he said he no longer trusts the market in Hong Kong.

“It’s a safer investment as opposed to buying property in Hong Kong,” Mr. Chung said. “Because of the protests, I don’t trust the market.” He said he was worried about the Hong Kong dollar’s longstanding link to the US dollar breaking and considered the latter a safer currency

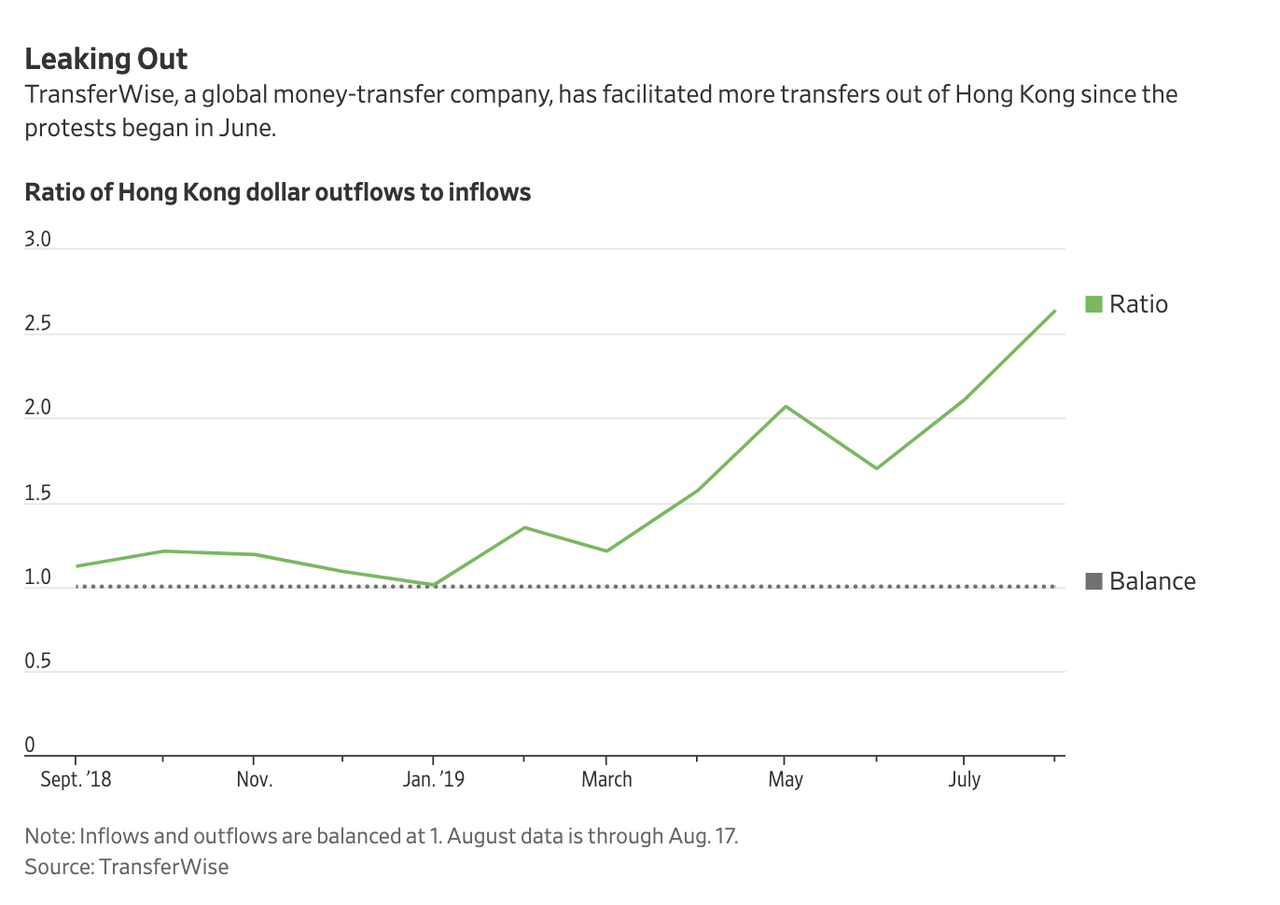

And when it comes to remittances and other personal international payments, there’s no question: Money leaving HK is swiftly outpacing money moving in.

TransferWise, a London-based international bank transfer company that facilitates international bank transfers, mostly for individuals and small businesses, said it has seen a significant pickup in outbound flows over the past ten weeks since the protests started. Before that, the rate of money moving into and out of HK was pretty consistent.

The company said that for every $1 that customers moved into Hong Kong in August, about $2.64 left the city.

Following the violent clashes at Hong Kong International airport this week, protests this weekend were relatively peaceful. Media reports claimed some 1.7 million marched in the streets on Sunday.

Still, with Beijing still holding military exercises right on the other side of the border, we imagine these fears won’t abate any time soon.

via ZeroHedge News https://ift.tt/30fOioL Tyler Durden