At least one reserve bank globally is starting to ponder the question that many central banks across the world will soon inevitably be asking: what happens if we cut to zero and the economy continues to falter?

This has led Australia to start considering QE, following in the footsteps of a world full of central bankers all offering each other as much confirmation bias necessary to continue to walk down the path of eventual economic destruction.

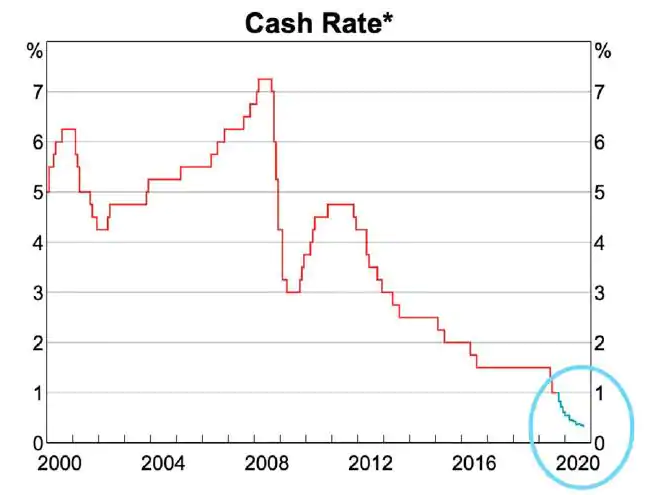

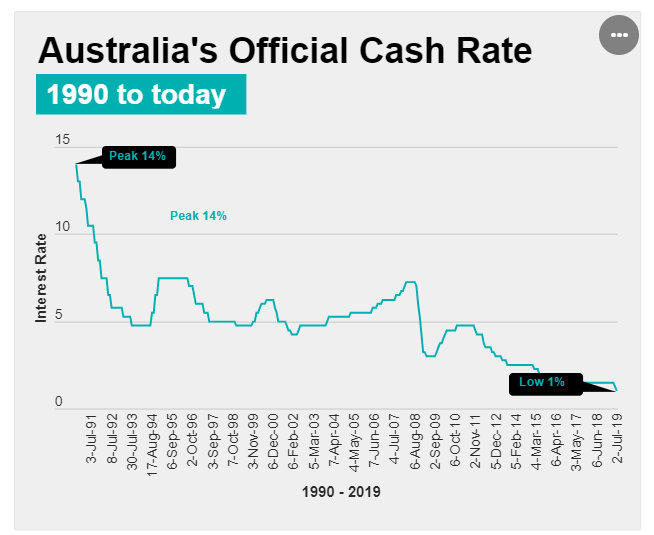

In Australia, the reserve bank has cut to 1% and “nobody expects them to stop cutting,” according to News.com.au. The bank released this chart days ago, showing that market is expecting further cuts.

The average of all expectations is for the market to fall to 0.37% by September 2020. That exact outcome is described as “unlikely”, but the RBA could have rates at 0.25% or 0.5% by then. That would only leave room for one or two more cuts before rates are at zero.

Then what? Destroy your currency and print your way out of your problems.

Apparently convinced that economies only exist as permanent booms now, the RBA said last week that it would begin a program similar to QE in the United States, wherein the central bank would buy financial assets in exchange for cash. The RBA is considering buying Australian government bonds.

“We could take action to lower the risk-free rates further out along the term spectrum,” said the RBA Governor.

Justifying this nonsense, the article then gives the quintessential example of how QE bond buying works in practice:

Bonds are how the government borrows. Here’s how it works in simplified terms:

The government offers to sell a piece of paper that says, “Australia will pay you back a million dollars in 10 years” (a 10-year bond).

Someone buys that for, let’s say, $900,000.

In this way the government just borrowed $900,000 and the $100,000 difference, spread over 10 years, is the return on investment for the buyer. The return on investment in bonds is known as the yield. It is usually expressed as a percentage, and it’s really important.

Yields change constantly in the secondary market as people trade the bonds they buy at varying prices.

When the RBA buys Australian Government bonds from the people who hold them, it is expected to have an effect on bond yields. The reason? Bidding to buy bonds will push up their price. The price of a bond determines the return on it, aka the yield.

The higher the price, the lower the yield. For example, imagine if someone bought that 10-year bond mentioned earlier for $1 million, it would have a yield of 0 per cent.

The RBA has said that by buying bonds, it is seeking a “spillover” effect, where it hopes to reduce bond yields across the market, which would in turn encourage economic activity.

The RBA Governor said:

“Europe’s the best example… They’ve also had success in lowering government bond yields, which is a risk-free rate, and therefore they’ve had success in lowering interest rates across the economy for private borrowers as well.”

But even the author of the article, economist Jason Murphy, couldn’t do the mental gymnastics necessary to pretend that QE makes sense at this point.

“What’s crazy about all this is we are talking about an extraordinary kind of monetary policy when the economy is not extraordinarily bad,” the article states.

“Australia is talking about bringing it in now. There’s something disconcerting about that,” it concludes.

We couldn’t agree more.

via ZeroHedge News https://ift.tt/2NfePza Tyler Durden