One day after a torrid relief rally, equity futures treaded water in Tuesday’s muted session, as investors paused after a three-day run that was driven by hopes that major economies would engage in fiscal stimulus to counter a slowing global economy, and after what appeared to be an attempt by Hong Kong leader Carrier Lam to defuse the tense situation with a promise to immediately establish a platform for dialogue, investigate complaints against police and institute a wide-ranging fact-finding study into the demonstrations. Treasuries climbed and the Bloomberg dollar index traded near the year’s high.

After a volatile start to the month on worsening U.S.-China trade tensions, stock indexes rebounded sharply, with the S&P 500 and the Nasdaq erasing last week’s losses on signs Germany and China are considering stimulus, while a since denied WaPo report late on Monday said White House officials are discussing the possibility of a temporary payroll tax cut in an effort to boost the economy.

Asian stocks traded mixed as the region enjoyed a mild tailwind after the strong performance in US where stimulus hopes as well as trade optimism underpinned the S&P 500 and DJIA to a 3rd consecutive win streak. ASX 200 (+1.2%) and Nikkei 225 (+0.6%) gained with outperformance in Australia fueled by the energy sector after recent gains in oil prices and with earnings heavily in focus including BHP, while advances in Tokyo were limited by an uneventful currency and despite reports Japan permitted additional exports of high-tech material to South Korea. Elsewhere, Hang Seng (-0.2%) and Shanghai Comp. (-0.1%) traded indecisively as participants digested the mixed signals from the PBoC which conducted reverse repos but resulted to a net daily drain, and set its Loan Prime Rate at 4.25% which was lower than the previous 1yr LPR of 4.31%, as well as the Lending Rate of 4.35%, although not as low as some had anticipated.

European stocks give up earlier gains as banks, real estate stocks dropped. The Stoxx 600 Index was 0.1% lower, giving up advance of as much as 0.4% as the regional benchmark traded in line with U.S. equity futures. Utilities were the worst-performing European sector, down 1.1%; real estate -1%, banks -0.7%; Among gainers, healthcare is up 0.6%, food and beverages +0.4%

In the US, index futures struggled for traction after the underlying benchmarks rose on Monday, when the U.S. commerce secretary said the nation will delay restrictions on some operations of China’s Huawei Technologies. The decision was seen as encouraging for the long-awaited trade pact between the world’s two largest economies. Still, the Chinese company said the temporary relief doesn’t change the fact that it’s been treated “unjustly.”

Retailers Home Depot and Kohl’s both missed estimates for their quarterly sales on Tuesday. U.S.-listed shares of Baidu jumped 9.9% after the Chinese internet search giant reported better-than-expected quarterly earnings.

All eyes this week will be on Wednesday’s release of minutes from the Federal Reserve’s July policy meeting and Chair Jerome Powell’s speech on Friday at the Jackson Hole central bankers’ conference. Even as Powell classified last month’s interest rate cut as a “mid-cycle” policy adjustment, traders are currently fully pricing in another rate cut in September. Powell’s remarks will be closely monitored for hints if more policy easing is in store, especially as the U.S.-China trade war seems far from resolved and growing fears of recession, signaled by the inversion of the U.S. yield curve last week.

“Our thesis maintains that over the next six months equity markets should do better, really mainly underpinned by the lower interest rates around the world,” Jun Bei Liu, a portfolio manager at Tribeca Investment Partners in Sydney, told Bloomberg TV. “Of course, there’s a few issues that arise. One is that the valuations seem incredibly high. And the trade conflict is another uncertainty at this point.”

Meanwhile, Trump’s top economic adviser, Larry Kudlow, will speak with business leaders this week amid concerns about the rising odds for a recession, the trade war and whipsawing markets.

In geopolitical news, US and South Korea will wrap up week-long military exercises as scheduled, while North Korea condemned South Korea for joint military drills and warned of consequences. Elsewhere, President Trump spoke to India PM Modi and Pakistan PM Khan regarding trade, strategic partnerships and for the countries to work towards reducing tensions in Kashmir, while he suggested the situation is tough, but they had good conversations.

Additionally, the US conveyed its strong position to Greek government regarding Iranian oil tanker it alleged is carrying illicit oil to Syria, while US warned any effort to assist the tanker could be viewed as material support to a US-designated terrorist organization.

In FX, the Bloomberg Dollar Spot Index pared Asia-session losses as corporates and algorithms sold off the euro and sterling following the London market open. Haven currencies the yen and Swiss franc led gains versus the dollar in the G-10 but moves were in narrow ranges; Australia’s dollar rose against most of its major peers.

U.S. Treasuries and most euro-area bonds gained after the drop in the previous session while Italian notes slipped before Prime Minister Giuseppe Conte addresses Parliament about the country’s political crisis

In commodities, oil futures were steady while gold rose back over $1500.

Looking at the day ahead, eyes will be on Italy with PM Conte due to address the Senate, possibly leading to a confidence vote. There are no releases due in the US while the only Fedspeak scheduled is from Daly at 9.30pm BST and Quarles at 11pm BST. Home Depot, Medtronic, and TJX are among companies reporting earnings.

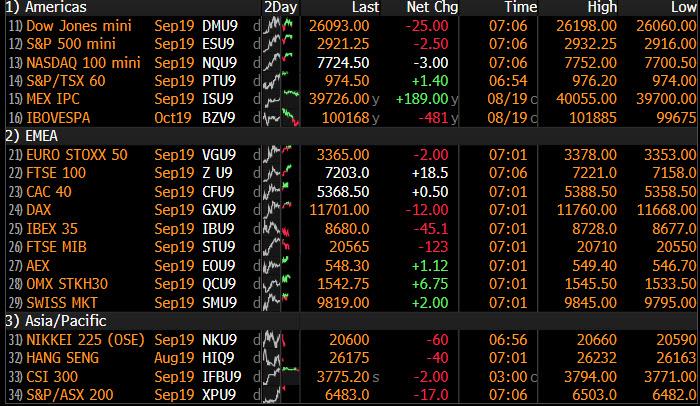

Market Snapshot

- S&P 500 futures up 0.1% to 2,926.75

- STOXX Europe 600 up 0.09% to 374.21

- MXAP up 0.5% to 152.95

- MXAPJ up 0.4% to 495.66

- Nikkei up 0.6% to 20,677.22

- Topix up 0.8% to 1,506.77

- Hang Seng Index down 0.2% to 26,231.54

- Shanghai Composite down 0.1% to 2,880.00

- Sensex up 0.1% to 37,439.88

- Australia S&P/ASX 200 up 1.2% to 6,544.96

- Kospi up 1.1% to 1,960.25

- German 10Y yield fell 2.7 bps to -0.675%

- Euro down 0.02% to $1.1076

- Italian 10Y yield rose 4.2 bps to 1.088%

- Spanish 10Y yield fell 1.4 bps to 0.119%

- Brent futures up 0.3% to $59.89/bbl

- Gold spot up 0.4% to $1,501.50

- U.S. Dollar Index little changed at 98.36

Top Headlines

- China’s new one-year reference rate for bank loans will start at 4.25%, according to a statement from the central bank on Tuesday. That compares to the 4.24% median estimate in a Bloomberg survey of 11 traders and analysts. The previous loan prime rate was 4.31%, while the one-year benchmark lending rate is 4.35%. China will set the LPR on the 20th day of every month

- Federal Reserve Bank of Boston President Eric Rosengren continued to push back against further interest-rate cuts by the central bank, arguing he’s not convinced that slowing trade and global growth will significantly dent the U.S. economy. President Trump urges Fed cut of 100 basis points, cites world economy

- The White House dismissed the idea that the administration is looking to cut payroll taxes as a way to bolster consumer spending, as economic indicators increasingly point to a potential downturn.

- In a letter to European Council President Donald Tusk, U.K. Prime Minister Boris Johnson said he wants to replace the so-called backstop provision in the divorce agreement with a “legally binding commitment” not to build infrastructure or carry out checks between Northern Ireland and the Republic of Ireland — the U.K.’s new frontier with the EU — as long as the bloc promises the same.

- Italy’s Deputy Prime Minister Matteo Salvini dangled the prospect of tax cuts and a boost in government spending for Italians in a final push to force new elections that could secure him the premiership

- Europe has had enough of Trump’s tirades from trade to security. When Emmanuel Macron welcomes Donald Trump to the Group of Seven summit in France, loosening Europe’s dependence on the U.S. will be on his mind

- The U.K. said it was “extremely concerned” by reports that a Hong Kong consulate worker was detained during a recent trip to mainland China, a case that threatens to add to strains between Beijing and London

- Hong Kong leader Carrie Lam pledged to immediately establish a platform for dialogue, investigate complaints against police and institute a wide-ranging fact- finding study into the demonstrationsAustralia’s central bank is ready to cut interest-rates further if a buildup of evidence suggests this would boost the economy, and said it reviewed global experience with unconventional steps in minutes to its Aug. meeting

- China is considering allowing provincial governments to issue more bonds for infrastructure investment, people familiar with the matter said, a move that would boost government stimulus as the economy continues to decelerate

Asian equity markets traded mixed as the region benefitted somewhat from the mild tailwind after the strong performance in US where stimulus hopes as well as trade optimism underpinned the S&P 500 and DJIA to a 3rd consecutive win streak. ASX 200 (+1.2%) and Nikkei 225 (+0.6%) gained with outperformance in Australia fuelled by the energy sector after recent gains in oil prices and with earnings heavily in focus including BHP, while advances in Tokyo were limited by an uneventful currency and despite reports Japan permitted additional exports of high-tech material to South Korea. Elsewhere, Hang Seng (-0.2%) and Shanghai Comp. (-0.1%) traded indecisively as participants digested the mixed signals from the PBoC which conducted reverse repos but resulted to a net daily drain, and set its Loan Prime Rate at 4.25% which was lower than the previous 1yr LPR of 4.31%, as well as the Lending Rate of 4.35%, although not as low as some had anticipated. Finally, 10yr JGBs were subdued amid the mostly positive overnight risk tone and following mixed results at the 20yr auction which showed weaker demand amid higher accepted prices.

Top Asian News

- Carl Huttenlocher’s Myriad Asset Plans to Open Singapore Office

- Hong Kong Rates May Spike as Funds Depart, Morgan Stanley Says

- Thailand’s Cabinet Approves Stimulus Package of About 316b Baht

- Fortis CEO Plans Cost Cuts of 20% to Nurse It Back to Health

This morning sees mixed trade in major European stocks [Eurostoxx 50 Unch] as sentiment is tentative ahead of this week’s events in the form of FOMC/ECB minutes and Fed Chair Powell’s speech at the annual Jackson Hole Symposium. Sectors are also mixed with no clear standouts, although the mining sector is resilient despite earnings from mining giant BHP (-0.7%) which missed on underlying net and warned of the impact from rising protectionism on the mining sector. In terms of individual movers, Pandora (+5.2%) rose to the top of the Stoxx 600 amid earnings in which the Co. initiated a wholesale inventory buyback program for Q3. Meanwhile, Casino (+4.0%) shares follow closely after the Board approved new French asset arbitrations for a target amount of EUR 2bln by the end of the first quarter in 2021. On the flip side, Royal Mail (-5.3%) fell to the foot of the pan-European index after the Communication Workers Union stated that a deal which included pay rises and new pension proposals is under threat from the Co’s management. Finally, Bayer (BAYN GY) shares saw modest upside amid reports that the Co. is to sell its animal health business unit to Elanco for USD 7.6bln, divestment is expected to be closed in mid-2020.

Top European News

- UBS’s Christine Novakovic Is Promoted to CEO of European Unit

- Danske Bank Does Away With Job Titles as New CEO Makes His Mark

- Polish Government Hit by Hate-Campaign Allegations Before Polls

- German Real Estate Stocks Decline After Court Backs Rent Freeze

In FX, the Aussie and Pound at opposite ends of the G10 ranks, as Aud/Usd is bolstered between 0.6755-95 in wake of latest RBA minutes and a more balanced assessment of the economic situation after recent rate cuts and fiscal support via tax rebates that alongside stabilisation in the housing market should support consumption after firmer GDP growth in Q2. Conversely, Cable has lost grip of the 1.2100 handle that coincided with 200 HMA support and extended losses when stops were tripped through the 10 DMA (1.2099) to a low of 1.2084 amidst ongoing no deal Brexit worries following UK PM Johnson’s letter to EU’s Tusk stipulating that withdrawal negotiations are contingent on removing the Irish border proposal.

- USD – It remains incremental and partly due to weakness elsewhere, but the DXY has inched closer to early August highs ahead of 98.500, at 98.425 vs 98.448, with perhaps some independent impetus coming via comments from Fed’s Rosengren underscoring his decision to vote against July’s FOMC rate cut. On that note, Daly and Quarles are on today’s docket as the clock ticks down to Wednesday’s FOMC minutes and then Jackson Hole that could be a platform for providing fresh policy guidance from the Fed and other global Central Banks.

- JPY/CHF – The Yen and Franc have both regained an element of safe-haven allure as the recent/nascent recovery in risk sentiment stalls or falters. Usd/Jpy is drifting back below 106.50 and Usd/Chf is pivoting 0.9800, while Eur/Chf has retreated towards 1.0850 in the run up to Italian PM Conte’s Senate speech at 14.00BST that will seal the fate of Rome’s coalition Government.

- NZD/EUR/CAD – All narrowly mixed against the Greenback, with the Kiwi still lagging and slipping nearer 0.6400, while Aud/Nzd is inching higher above 1.0550 on diverging RBA/RBNZ near term policy outlooks. Elsewhere, the single currency is slipping further below 1.1100 amidst reports or corporate offers and eyeing short term chart support at 1.1065 before 1.1050 and the 1.1027 ytd base, while the Loonie is holding within a tight range in the low 1.3300 area and just ahead of underlying bids said to be sitting from 1.3340-50, with Canadian manufacturing sales due later.

- EM – Turkish Lira losses are stacking up after latest CBRT efforts to promote bank lending via reserve ratio enticements linked to loan quotas, and with the technical landscape turning increasingly bearish as Usd/Try clears more key levels. So far, the 50 DMA has been surpassed on the way to circa 5.7500 exposing a Fib just shy of 5.7550 and then 5.7681 that constitutes a lower high from late July.

- RBA Minutes from August 6th meeting stated the board would consider further policy easing if needed and that it is reasonable to expect extended period of low rates, while it added risks to economy tilted to the downside, there are few signs of inflationary pressures emerging and noted downside risks to CPI components. However, the minutes also stated the RBA saw firmer GDP growth in Q2 and outlook for consumption is more balanced than for some time, while it noted consumption was helped by tax rebates and there was stabilization in housing markets. (Newswires)

In commodities, WTI and Brent futures are posting modest gains in early EU trade with little in the way of a catalyst thus far to influence price action ahead of this week’s inventory data, FOMC/ECB minutes and Fed Chair Powell’s speech. The former reclaimed the 56/bbl handle during Asia-Pac hours and has since been edging towards 56.50/bbl. Meanwhile, the latter straddles around the 60/bbl mark after having found a base at 59.55/bbl overnight. Looking ahead (aside from macro-newsflow), focus will be on the API crude stocks release which is expected to show a headline crude drawdown of 1.9mln barrels. Elsewhere, gold prices are marginally firmer and back around the USD 1500/oz mark amid potential dip-buying ahead of this week’s key risk events; meanwhile, IMF data showed that central banks continued to buy gold in July despite the yellow metal hitting 6yr highs. Copper prices are in the red today and back below the 2.6/lb level, albeit price action is relatively contained. Finally, Dalian iron ore futures declined for a fourth consecutive session as supply concerns continued to ease amid rising iron ore exports from Australia and Brazil.

US Event Calendar

- 4:30pm: Fed’s Daly Takes Part Quora session online

- 6pm: Fed’s Quarles Discusses Community Development

DB’s Craig Nicol concludes the overnight wrap

With the main risk events this week still a few days away, including the Jackson Hole on Friday and PMIs on Thursday, risk assets have awoken from the weekend in a much better mood compared to the last two Mondays. Indeed the cumulative percentage move of the other two Mondays in August prior to yesterday was -4.18% so yesterday was a welcome break.

Last night the S&P 500 ended +1.21% which means it’s now roughly an equal distance apart from the intraday post Trump trade tweet lows of early August and the highs prior to the tweet at the end of last month. It’s also on a three-day winning run and believe it or not, has actually risen for seven of the last ten days even if it might not feel like it. The NASDAQ and DOW also closed +1.35% and +0.96% respectively yesterday as cyclical sectors staged a comeback though every industry group ended the session higher. In sympathy, rates sold off although that was also perhaps partly a reflection of the fiscal stimulus talk in Germany – despite it not being a new story – and the reports late Friday that the US Treasury Department was looking to “refresh its understanding of market appetite” for super-long dated issuance, perhaps up to 100 years. The end result was 10y Treasuries closing +5.2bps higher at 1.607%, though 2-year yields sold off more steeply, rising +6.8bps to 1.546%. That took the 2s10s curve down -1.4bps to 5.9bps, even though it had touched 10.6bps intraday at one stage. Bunds also rose +3.7bps which put them back at the lofty heights of -0.652%. Amazingly that is only the fourth time in the last twenty-four sessions that Bund yields have risen.

Anyway, the only real news that markets had to feed off was the slew of positive trade (and economy) comments from the US administration over the weekend and then Commerce Secretary Ross following up with the announcement that the US will ease sanctions on Huawei for another 90 days. To be fair that doesn’t make the US position on Huawei any clearer and it still remains to be seen if President Trump will use the company as trade leverage or instead completely disengage. For now, the decision has been punted another 90 days until mid-November.

As for Asia overnight, moves have been fairly muted with the Hang Seng (+0.01%) and Shanghai Comp (+0.07%) in particular virtually little changed. The Nikkei (+0.52%) and Kospi (+0.61%) have advanced a bit more while in FX, all G10 currencies are making advances this morning (range c. +0.1% to +0.2%) while the onshore Chinese yuan is trading down -0.24% at 7.0679. Elsewhere, futures on the S&P 500 are up +0.11%. Treasuries are also a little stronger following the story in the Washington Post that the White House had denied that it was considering payroll taxes cuts as a way of boosting consumer spending.

In other news, Italy’s FTSE MIB rallied +1.93% yesterday which compared to a +1.14% gain for the broader STOXX 600. BTPs (+4.6bps) sold off a similar amount to Bunds with the moves coming before PM Conte is due to testify in front of the Senate today. The latest signals from the Five Star Movement have indicated that they will try to prevent Conte from losing a no-confidence vote, and several prominent members of the opposition Democrats, including two former prime ministers, said that their party should join Five Star in a new government. It will likely be a close vote if the Senate ends up deciding on the no confidence measure today.

In other news, the only data out yesterday came in Europe where the final July core CPI reading for the Euro Area was confirmed at +0.9% yoy and unchanged versus the flash. A slight downward revision to the headline however (-0.5% mom from -0.4%) meant that the annual reading slipped back to +1.0% yoy which puts it at the lowest since November 2016. There wasn’t any data from Germany, but there was some attention paid to the Bundesbank’s monthly report which warned that there is a risk of recession next quarter. The national central bank cited weak industrial activity as a key factor contributing to the risk of a second quarterly contraction. Our economists have a similarly bearish view, as highlighted in their latest report available here .

As for the US, there wasn’t any data, though Boston Fed President Rosengren did give somewhat hawkish comments. He said that he “wants to see evidence we are going into something that is more than a slowdown” before he will support additional easing. Recall that he dissented against the rate cut in July. He downplayed overseas headwinds, saying that “just because other countries are weak, if we’re strong, it doesn’t necessarily mean we should be easing as well.” The market currently fully prices a rate cut at the September meeting, plus around a 22% chance for a 50bps cut instead. Rosengren’s comments highlighted how hard it will be to generate a consensus for the more expansive easing option.

Finally, it’s worth noting another round of provocative tweets from President Trump, who criticized “the horrendous lack of vision by Jay Powell and the Fed.” He went on to say that “the Fed Rate, over a fairly short period of time, should be reduced by at least 100 basis points, with perhaps some quantitative easing as well.” Markets did not really respond to the remarks.

To the day ahead now, where plenty of eyes will be on Italy with PM Conte due to address the Senate, possibly leading to a confidence vote. As for data, this morning includes July PPI data in Germany, June construction output data for the Euro Area and the August CBI survey data in the UK. There are no releases due in the US while the only Fedspeak scheduled is from Daly at 9.30pm BST and Quarles at 11pm BST.

via ZeroHedge News https://ift.tt/2HhY1nb Tyler Durden