Submitted by Nicholas Colas of DataTrek

More Americans live alone than ever before, some 28% of the population. They actually outnumbers households with 4+ people and demographic trends point to even more single-person households over the next decade. This is one of those long-term secular trends that should be part of every investor’s checklist when considering the merits of a company’s product/service offering.

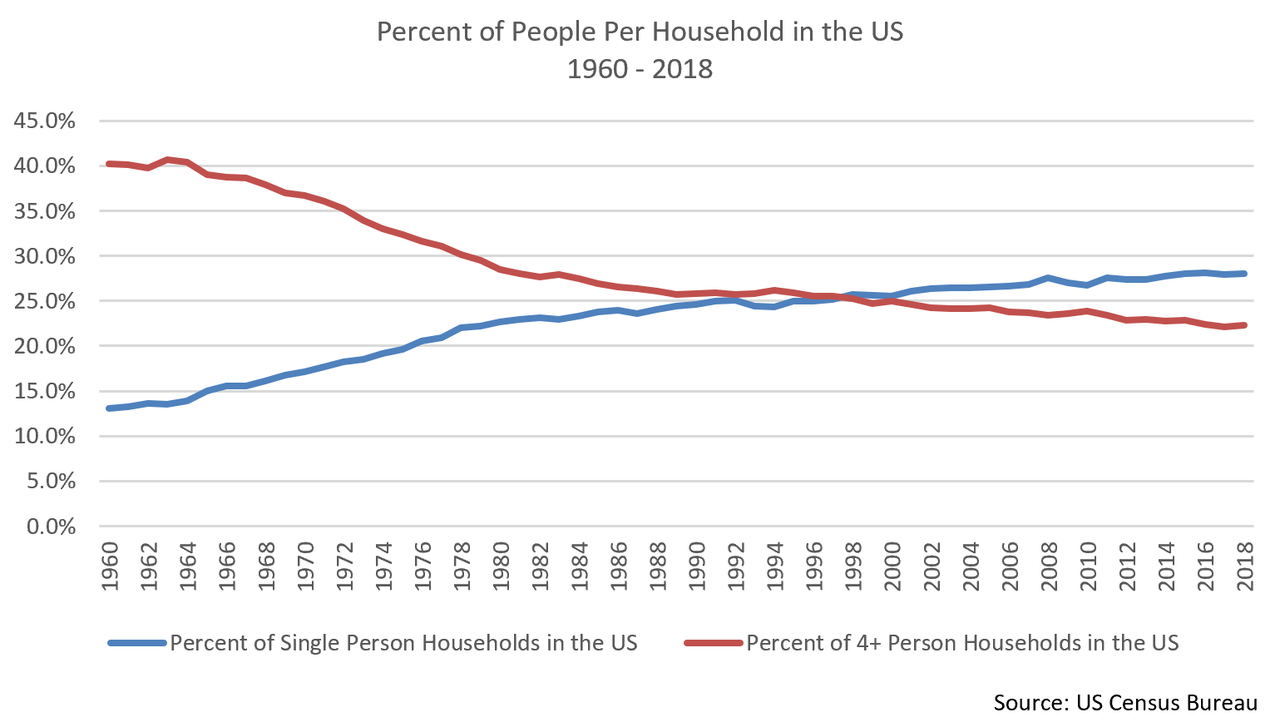

First, a brief overview of the data (graph below):

- As of 2018, 28.0% of Americans lived alone. The raw numbers: 35.7 million single-person households and 127.6 million total households.

- That percentage has been rising steadily for +50 years.

- In 1960, for example, only 13.1% of Americans lived alone. If you walked into a random American house back then, you were 3x more likely to see 4 or more residents. Now, the odds favor meeting only one inhabitant.

- The crossover point between single-person households and 4-or-more was 1998.

- The trend to more Americans living alone rather than in a “traditional” 2-adults, 2-or-more kids household is the central reason the number of people/household has declined from 3.3 in 1960 to 2.5 today.

Why is this happening?

- Greater female labor force participation, which allows women the choice of living alone, is one factor. LFP for this cohort went from 38% in 1960 to 60% in 2000 and is at 57% today.

- Lower birthrates is another, with the US going from 3.7/woman in 1960 to 1.8 today.

- An aging population is the last variable, since men typically die 5 years earlier than women. Data from other aging populations such as Europe (33% 1-person households) and Japan (35%) show where the US statistics will likely go in coming years.

Why does this matter from an investment perspective?

- The US consumer is the backbone of the domestic economy, and the growing percentage of 1-person households is theoretically a secular positive. Single person households do not typically share durable goods like motor vehicles, major appliances, rent/mortgage or even smaller items like media subscriptions. They therefore will tend to consume more than a multiple-person household.

- The offsetting problem: since America’s growing single-person household percentage is partly due to an aging population, consumption will be lower than if this was all due to millennials living alone.

Bottom line: the growth of single-person US households is one of those big macro trends that should filter its way into considering what sorts of companies will prosper in the next decade. Just ask yourself “would a person living alone buy X, subscribe to Y, or use Z’s services?” If the answer is a resounding “yes”, that’s a good start.

Sources:

CME FedWatch (odds of rate cuts): https://www.cmegroup.com/trading/interest-rates/countdown-to-fomc.html

US Census (Households by size): https://www.census.gov/data/tables/time-series/demo/families/households.html

via ZeroHedge News https://ift.tt/33ZpfZE Tyler Durden