Oil prices held on to gains overnight after a surprisingly large crude draw reported by API (though crude is down about 18% from its late April highs as the trade war between the U.S. and China, the world’s biggest economies, weighs on demand.).

“The drawdown will certainly help support sentiment,” said Daniel Hynes, a senior commodity strategist at Australia & New Zealand Banking Group Ltd. in Sydney.

“But the market is definitely taking the glass-half-empty type approach to data.”

API

-

Crude -3.454mm (-1.8mm exp)

-

Cushing -2.803mm – biggest draw since Feb 2018

-

Gasoline -403k

-

Distillates +1.806mm

DOE

-

Crude -2.73mm (-1.8mm exp)

-

Cushing -2.485mm

-

Gasoline +312k

-

Distillates +2.61mm

After two weeks of unexpected builds, crude inventories drew down more than expected last week (though less than API reported) and Gasoline stocks rose modestly…

Source: Bloomberg

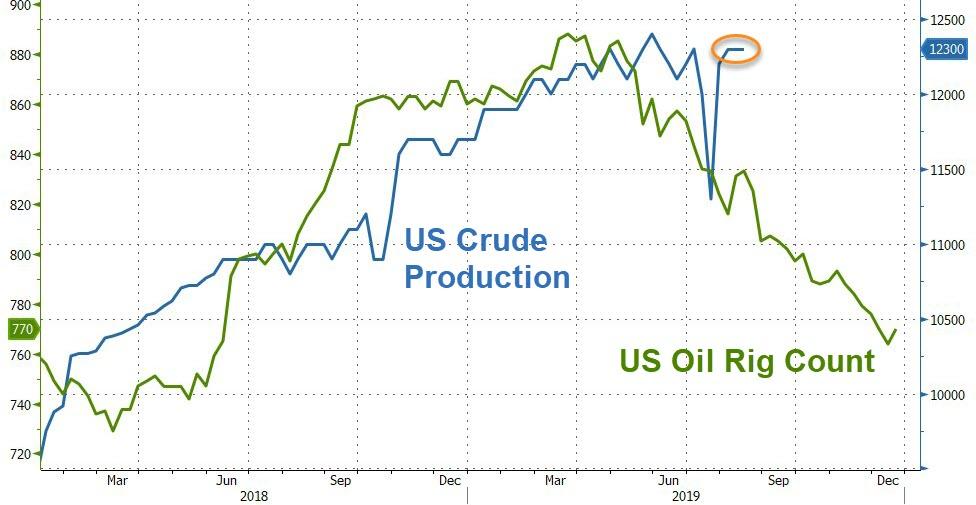

Despite the ongoing collapse in the oil rig count, US crude production remains near record highs…

Source: Bloomberg

WTI tested above $57 ahead of this morning’s inventory data but slid lower after the DOE data printed below API’s…

“It’s a tight market right now,” said Bjarne Schieldrop, the Oslo-based chief commodities analyst at SEB AB. “But the assumption is that the future will be very bleak and bearish.”

via ZeroHedge News https://ift.tt/2TRY3ra Tyler Durden