While stocks have a ways to drop before they catch down to the December 2018 lows, one market is starting to feel dangerously similar to the late 2019 chaos. As readers will recall, the first market to get whacked in Q4 was the leveraged loan market which froze up virtually overnight as countless deals were pulled due to “market conditions.” That time is again now, because no less than five leverage loan deals for a total of $1.3 trillion have been pulled in the past few weeks, a harbinger of a far more ominous lock up in the fixed income market.

The latest deal to get pulled was a loan by Vewd Software, a streaming-service provider, which joined peers such as Golden Hippo, Glass Mountain Pipeline Holdings, Chief Power Finance and fitness-center builder Life Time, all of whom hoped to raise funds in the secured debt market, and found the market too cold.

For much of the past 3 years, the leveraged loan market grew at a breakneck pace, courtesy of the Fed’s tightening which pushed up the libor floor on loan deals, promising rates that kept up with the Fed Funds rate. As such, it quietly emerged as a favorite of private equity firms, funding payouts to partners and buyouts of targeted companies at record-low borrowing costs for a decade, doubling in size to about $1.2 trillion and even surpassing the total size of the US junk bond market.

And now, for the second time in under a year, the loan market is experiencing a “rare moment of sobriety” according to Bloomberg, as investors who smell a recession – and far more rate cuts – shy away from companies that just a few months ago might have had no problem to sell loans.

Besides deals that were pulled outright, new issuers are finding a far more hostile reception, with some borrowers forced to pay much more than they originally planned when they came to market. The trigger: now that the Fed has entered an easing cycle, further LIBOR upside is a thing of the past, while the possibility of continued rate cuts by the Federal Reserve has killed the attractiveness of floating-rate deals less attractive, while companies vulnerable to trade wars have had to promise even higher yields.

Speaking to Bloomberg, Jeff Cohen, global head of levfin capital markets at Credit Suisse said that the market has seen “widely divergent pricing outcomes.”

One example of a firm finding market conditions less than hospitable was DNA-testing firm Ancestry.com which increased the pricing of a loan financing a dividend to its private equity owners, and which also reduced the size of the payout by $200 million.

Another firm had to sharply hike the yield on its offering to find investor demand: Total Safety, owned by private equity firm Littlejohn & Co., priced a $367.5 million loan this month to finance its acquisition of Sprint Safety at a discount of 93 cents on the dollar – one of the steepest discounts this year according to Bloomberg, which also noted that the yield on the debt spied to about 10%. Banks arranging the loan offering the buyout of independent broker-dealer Advisor Group also had to sweeten terms, as did other private equity firms that launched loans with increasingly aggressive terms they later had to scale back.

That said, we are still some ways away from the total loan market freeze observed for a few weeks in December: even with the current “loan lull” which has affected some $1.3 billion in loan notional, over $28 billion of leveraged loans managed to price successfully this month as bankers cranked out deals before a late summer lull.

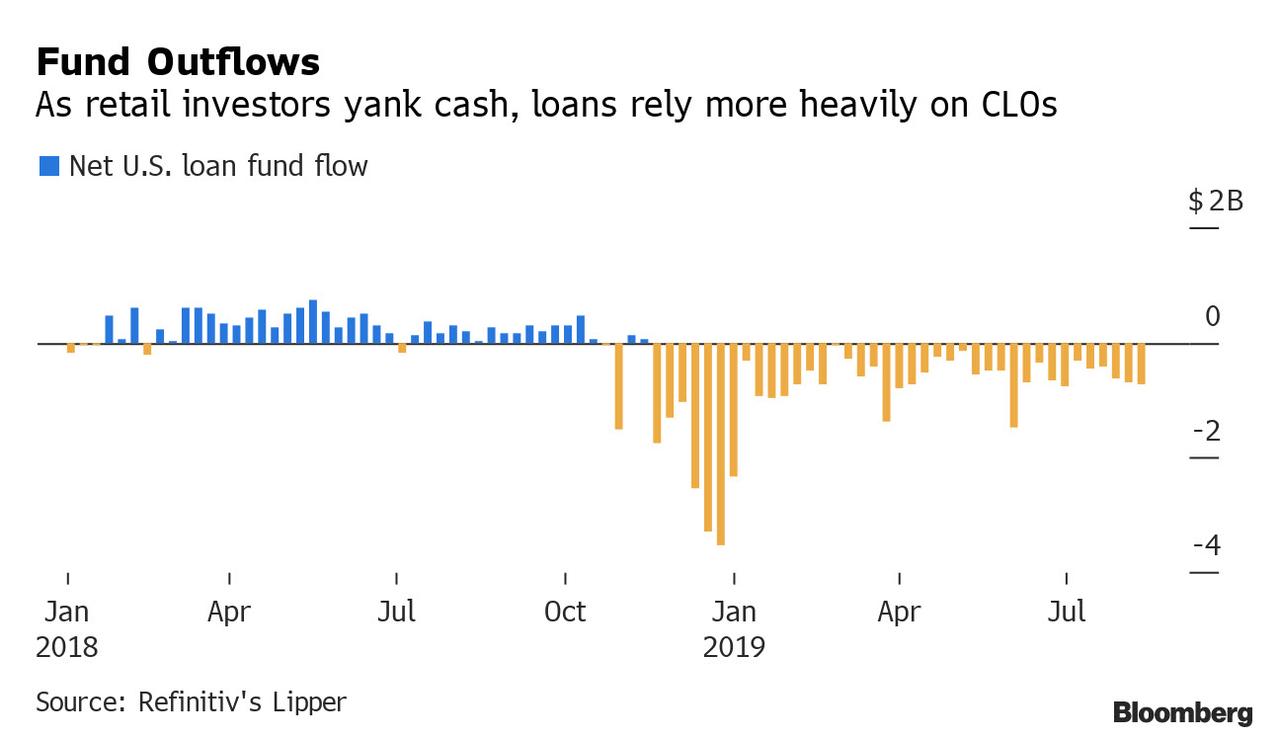

Yet curiously, despite the broad improvement in the leverage loan market since the December fiasco, one wouldn’t know it by looking at investor fund flows: indeed, retail fund flows have been negative for 39 straight weeks starting in late 2018 – the longest such run ever – as most retail investors have boycotted the asset class.

But if the one traditional buyer is absent, who is buying? The answer: CLOs of course, although these have a limit on how much lower-rated debt they can buy. Even so, as Drew Sweeney, a managing director at TCW Group told Bloomberg, while the appetite for lower-rated debt among managers of collateralized loan obligations will be limited, the still-expanding CLO market has plenty of cash looking for a home.

“I do think there will be demand for higher-quality paper from almost every constituent — CLOs, retail and crossover investors,” Sweeney said.

Even with the neverending CLO bid – much of which funded by Japanese pensioners – cyclical companies could have an uphill battle selling debt with recession fears buzzing, and some bankers have found themselves wrong-footed by investors’ sudden aversion to risk. One example noted by Bloomberg, includes a group of banks led by Barclays and Deutsche Bank, which held on to at least half of the $1.7 billion-equivalent of loans they arranged earlier this year for Advent International Corp.’s buyout of an Evonik Industries AG plastics division, as the banks couldn’t find enough willing investors with whom to park the debt.

What happens next? Well, there are two options: either the market freeze continues as the December 2018 “Ice-Nine” of the loan market indefinitely postpones the entire pipeline, or the more optimistic investors end up being right: they are merely waiting to approach the market after Labor Day on Sept. 2, when the liquidity – they hope – will return to the market. That’s when we will also see just how easy it will be for a consortium of banks to sell a whopping $7 billion loan to help finance the merger of T-Mobile US and Sprint.

via ZeroHedge News https://ift.tt/2L1dLMA Tyler Durden