There was some good and some not so good news in today’s German PMI data.

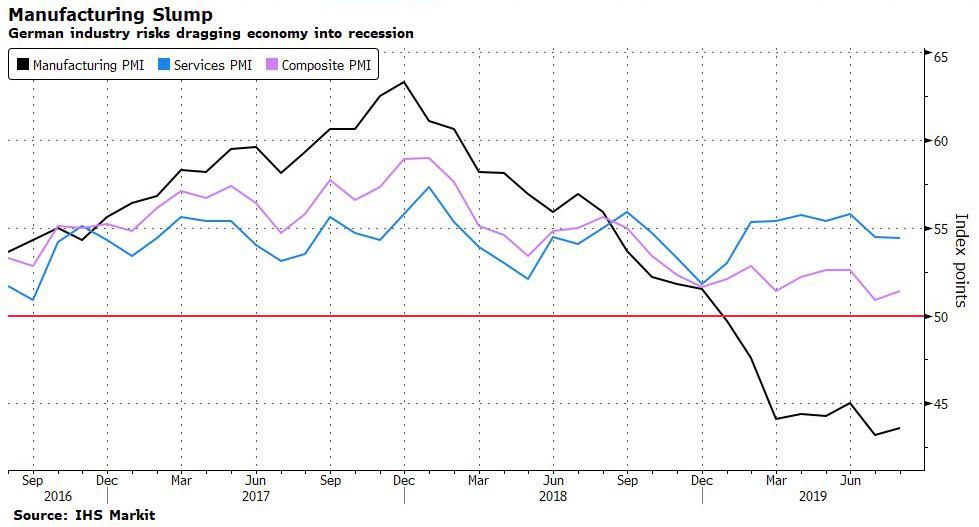

First, the good: the composite PMI rose 0.5pt to 51.4, beating expectations of another decline, and led by modest gains in the manufacturing output subcomponent even as the services PMI showed a marginal decline.

However, the underlying indices were more subdued, with new orders and employment falling more. The press release also noted a sharp fall in business expectations in the services sector. Backlogs of work across both sectors fell for a 10th month and the pace of hiring slowed, with employment in manufacturing declining at the fastest pace in seven years.

Perhaps more concerning was the outlook, which is now outright recessionary as for the first time since 2014, more companies now expect output to fall than rise over the next 12 months.

The problem for Germany is that with its manufacturing sector contracting at a dismal rate, Europe’s most powerful economy has no buffer left – as a reminder, last week we learned that the economy shrank in the second quarter and real-time sentiment indicators confirm that another contraction in Q3 is virtually inevitable, guaranteeing a technical recession.

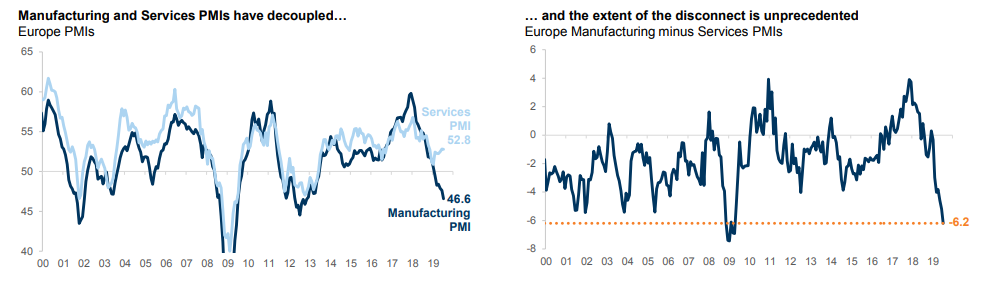

The persistent German weakness, driven in particular by mounting global trade tensions, car industry woes and slowing demand in China, certainly doesn’t bode well for the broader euro area. The silver lining: whereas European manufacturing is now screaming recession, at least services remain well in expansionary territory. However, with the spread now at all time highs, it is only a matter of time before services tumble.

Indeed, while the headline German composite PMI unexpectedly rebounded modestly in August to 51.4 from 50.9, the manufacturing index remained far below 50, signaling a seventh month of contraction.

Meanwhile, analysts continue to clamor for Merkel to do something besides lip service to the coming recession, and unleash fiscal stimulus: “Somehow they are not looking at this data,” said ING economist Carsten Brzeski. “The German government should react. We have this stagnation of the entire economy now and we really need some fiscal stimulus.”

Well, the German government said it will react – we just need a deep recession first, and one is clearly approaching right on schedule. One reason Germany may ignore the issue is because the ECB is already “on top” of it, with the central bank widely expected to add monetary stimulus as soon as next month by cutting rates and/or restarting QE.

Commenting on the latest dismal data out of German, Bloomberg’s chief European economist showed a trace of optimis, saying “there’s a little light at the end of the tunnel for Germany’s economy. The PMI — a trusted gauge of economic activity — picked up a little in August. The big risk is that a fresh blow to manufacturing materializes — the U.S. goes ahead with tariffs on EU car exports, for example — or that weakness in the industrial sector spreads to services.”

Others, however, were far more pessimistic: “Germany remains a two-speed economy, with ongoing growth of services just about compensating for the sustained weakness in manufacturing,” according to Markit’s Phil Smith. “Although improving slightly, the survey’s output data haven’t changed enough to dispel the threat of another slight contraction in gross domestic product in the third quarter.”

via ZeroHedge News https://ift.tt/30qE1X5 Tyler Durden