Apartments in the Wall Street area languished into late summer as a glut plagues the Manhattan real estate market, reported Bloomberg.

“There was so much new development in that neighborhood, and I think that many of the people who wanted to buy there did,” said Steven Gottlieb, a broker at Warburg Realty. “I don’t know that there is such a huge a demand for that neighborhood anymore.”

Lower Manhattan apartment inventory spiked 24% in 2Q19 YoY, led by a tidal wave of new supply, according to a report by Corcoran Group.

The supply has caused panic in the area, average resale prices have fallen 11%, and average new development prices plunged 46%.

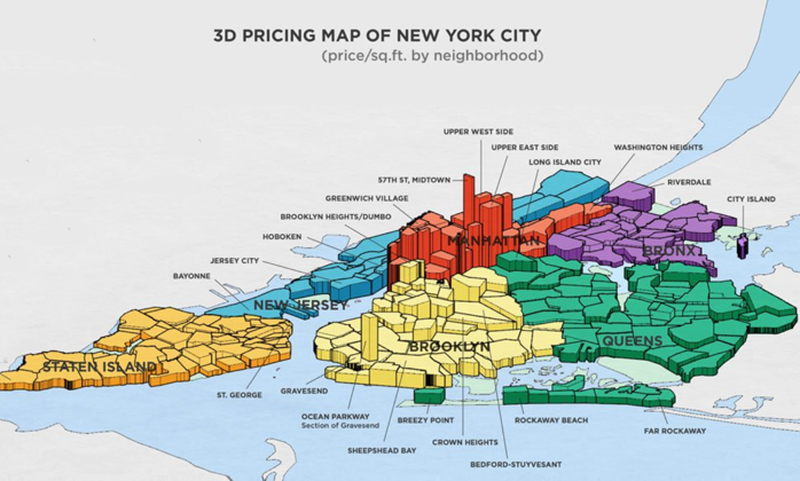

The days of $1,600 per square foot are over. This was the first time that has happened since 2013, signaling the slowdown in the overall Manhattan real estate market is gaining momentum in 2H19.

“Buyers are keenly aware of the amount of inventory available, and want to negotiate at all price points,” said Garrett Derderian at the brokerage Core.

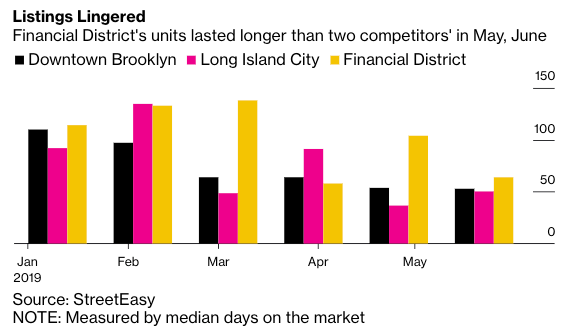

StreetEasy says data from May and June shows the median time that Lower Manhattan apartments had been on the market was longer than Brooklyn and Long Island City.

Four new luxury residential towers are expected to open in Lower Manhattan in 2020, including residential towers at 130 William St., 77 Greenwich St., 25 Park Row, and 1 Wall St. The new supply won’t just make it harder for existing listings to sell, but could lead to further price declines for the next several years.

The Real Deal reported that developer Metro Loft is in contract to purchase AIG’s headquarters at 175 Water St in 2021. As soon as that happens, the developer will transform the top half of the building into residential units, could add to supply in 2022 to 2024.

Martin Eiden, a broker at Compass Real Estate, said it’d been at least a decade since conversions of office-to-residence projects were done, and it now seems like that trend is reemerging into 2020.

Bloomberg notes one of the first office-to-residence conversions in the area was at 15 Broad St., the former headquarters of JPMorgan Chase & Co., was completed in 2006. A 28th-floor studio with two bathrooms currently lists for about $1.5 million.

Down the street, 25 Broad St., a condo conversion completed in April, has two-bedroom, two-bath unit listed for about $1.6 million.

With the migration of some of the largest financial institutions from Lower Manhattan to Midtown in recent years, the highest paid jobs have also gravitated north, forcing developers to build smaller apartments for entry-level analysts in the financial district.

“The majority of housing stock available for purchase consists of one-bedroom or studio floorplans,” said broker Gill Chowdhury at Warburg Realty.

Scott Avram, senior vice president of development at Lightstone Group, a developer in the area, said singles or young families could find Lower Manhattan appealing because of the housing glut, has transformed it into a buyers market.

“If you want to live in Manhattan, you can often get the best product and the best value, whereas people were previously priced out of Manhattan and had to move to Brooklyn and Long Island City,” Avram said.

However, the housing decline isn’t just limited to Lower Manhattan, mega-mansions in the Hamptons, Wall Street’s favorite party spot, are also languishing, indicating the high-end market has peaked. And it makes sense why President Trump is demanding 100bps cuts and QE-4, it’s because his economic advisors have told him the real estate market, and the overall economy, are quickly slowing ahead of an election year.

via ZeroHedge News https://ift.tt/2Zaqhmy Tyler Durden