With the foul stench of WeWork’s bizarre IPO prospectus accumulating over the markets, odious details continue to be emitted from the company’s community-adjusted bowels. One of these is that the company is the functional equivalent of a sweatshop, jamming more people into its “office” space than almost any commercial landlord, according to Bloomberg.

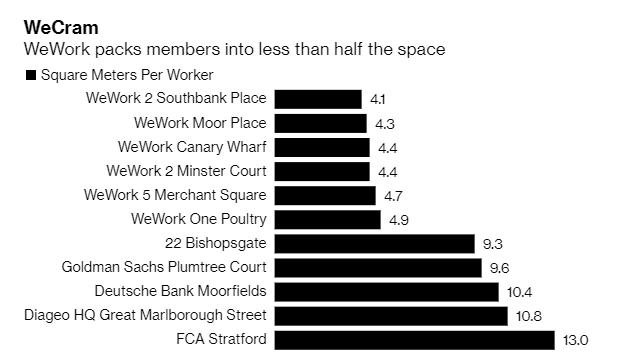

One example is in London, where the company provides “about half” of the 8 to 10 square meters per person recommended by the British Council for Offices industry association. WeWork recently opened a space in the Waterloo district that has a 6,414 person capacity, which equates to less than 4.1 square meters per person. That size is compared to two standard doors laying side-by-side.

The company’s latest large lease in London’s Canary Wharf district can house 6,009 people, according to company documentation. This same space was previously occupied by about 900 employees of the European Medicines Agency, which moved as a result of Brexit.

According to WeWork’s IPO prospectus, the company’s 40 million square-foot pipeline of locations has capacity for 724,000 workstations. This math comes out to about 5.1 square meters each. For contrast, Regus rental offices offer about 12 square meters per workstation.

WeWork uses desks typically smaller than those by its competitors, which permit it to cram people into its glass-partitioned offices tighter without them noticing. The company also provides telephone booths at some of its locations and fixed phone lines are an extra.

As an offset, the company offers “generous” common areas inclusive of everything from skate ramps to basketball hoops. Which, incidentally, may explain why America’s productivity is collapsing.

A company spokesperson said: “When members join WeWork, in addition to their private office they have access to our diverse array of common areas, including shared seating and workspace areas, conference rooms, pantries, and more.”

WeWork hasn’t advertised its use of space to its customers, but it is trying to use it as a way to reassure potential investors. As of the time of its IPO, the cost for an employee in a building is about $7,304 a year compared to $17,158 at a standard lease building.

We have a slightly different take on things. Perhaps what investors should take away from this isn’t that WeWork is offering its space efficiently, but rather that there is no more juice to squeeze out of its real estate lemon, should the company want to try to bolster efficiency at some point in the future when its investors start demanding profits. Like all good companies do when ripping off retail investors coming to market with an initial public offering, WeWork may have already put as much lipstick on its real estate pig as possible.

via ZeroHedge News https://ift.tt/33R2qqJ Tyler Durden