Jerome Powell’s Jackson Hole speech was supposed to be the most important even of an otherwise sleepy, August day day, after which traders could quietly exit for the rest of the day and commence drinking. It did not quite work out that way.

Not only did Powell’s speech barely make the top 3 most important events, but Friday ended up being an exercise in surreal market newsflow, and one of the biggest drops of 2019 to boot.

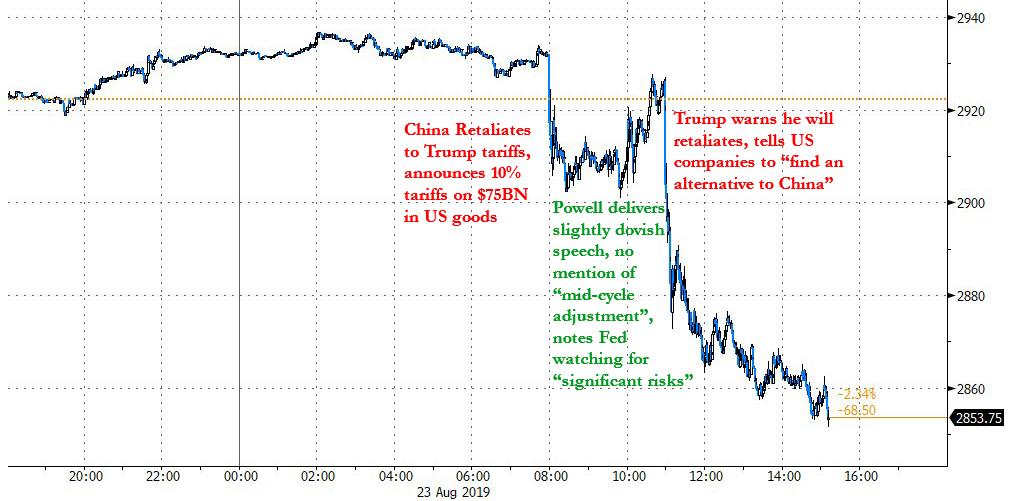

With a few hours left before Jackson Hole, as traders were getting ready to trade Powell’s Jackson Hole speech which was a big dud, and did not reveal anything new (as even Trump figured out when he blasted the Fed chief slamming “As usual, the Fed did NOTHING!” and asking “who is our bigger enemy, Jay Powell or Chairman Xi?”), China shocked the market by unveiling that it would retaliate by slapping 10% tariffs on another $75BN in US imports, which sent stocks sharply lower at first. Then, Powell’s remarks managed to somewhat stabilize sentiment, and the S&P almost regained all losses… before all hell broke loose and in a vicious tirade, Trump first slammed Powell, effectively calling him an enemy of the state”, and then warned he would retaliate to China soon, while ordering US companies (can a US president dictate to companies what they can and can not do?) to find an “alternative” to China.

The result was a violent slam lower in risk assets, with the S&P tumbling over 70 points, the Dow plunging over 500 point, its 3rd such drop in the month of August, which has emerged as the worst month for stocks since December 2018…

… and the VIX soaring, just as dealers had exited their “negative gamma” hedges, forcing them all to load up on VIX futures all over again.

Every sector was lower on massive volume and wide breadth.

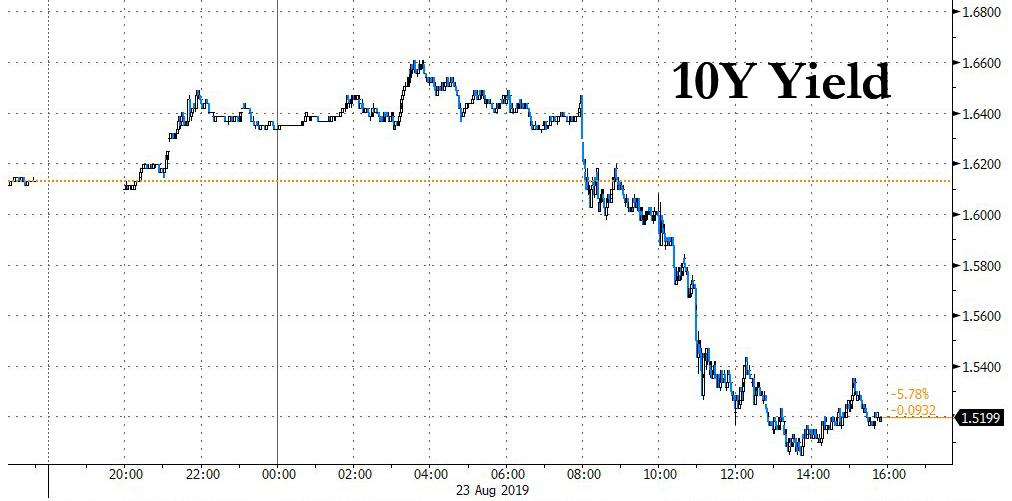

Not surprisingly, as risk tumbled, safe havens, soared, and as the 10Y yield tumbled…

… so did 2Y, which meant that the 2s10s yield was once again dipping in and out of negative territory all day.

Amid this wholesale panic out of safe havens, there were two surprises. Not the surge in gold, which exploded higher hitting a six and a half year high of $1,530…

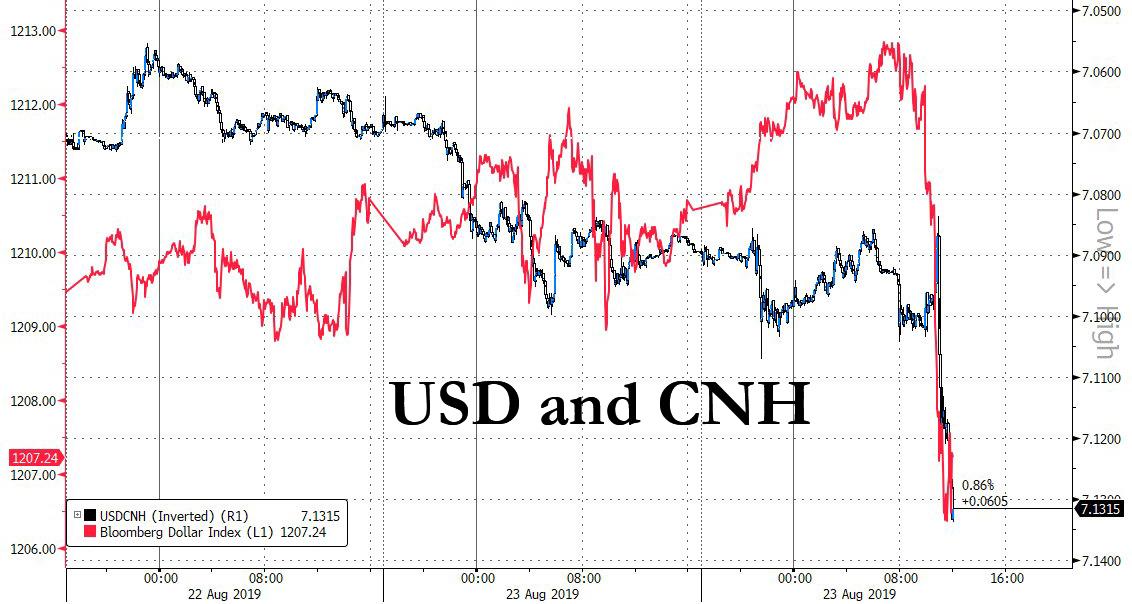

… what was surprising was the plunge in the dollar – as traders feared that Trump would announce an outright currency market intervention to devalue the greenback – however as the yuan plunged even more…

… and even without an official statement from Trump – we are still waiting for the mystery afternoon announcement – the dollar index suffered its biggest one day drop in over a month.

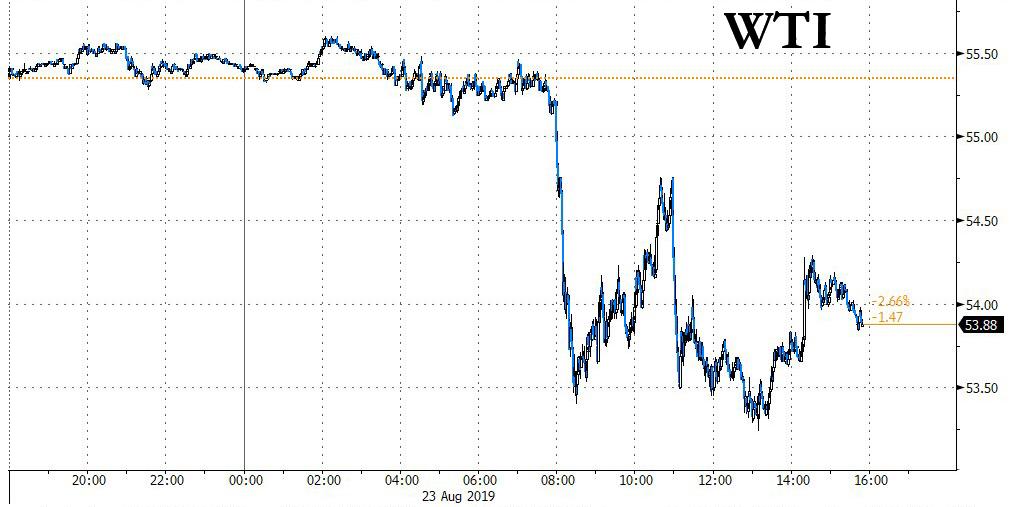

There was not respite in commodities either, with oil tumbling after China announced it would apply tariffs on US oil imports, prompting traders to fear a drop in imminent collapse in global oil demand by the world’s largest oil importer.

What is most scary is that the day is not yet over, and we are now waiting with bated breath for the president to deliver on his promise of unveiling some other mystery response to China which he had not shared even with the Fed. As such, we expect that the reason for the violent flush in the last 30 minutes of trading had to do with traders wishing to be flat over a weekend, where any surreal development is now clearly possible.

Stay tuned.

via ZeroHedge News https://ift.tt/2ZmDDeZ Tyler Durden