According to CNBC, Trump is currently meeting with his trade aides…

- TRUMP MEETING WITH HIS TRADE AIDES NOW, CNBC REPORTS

… to decide what additional measures and tariffs to declare against China, and if there is one currency that Trump’s economic team is currently keeping an eye on it is China’s yuan.

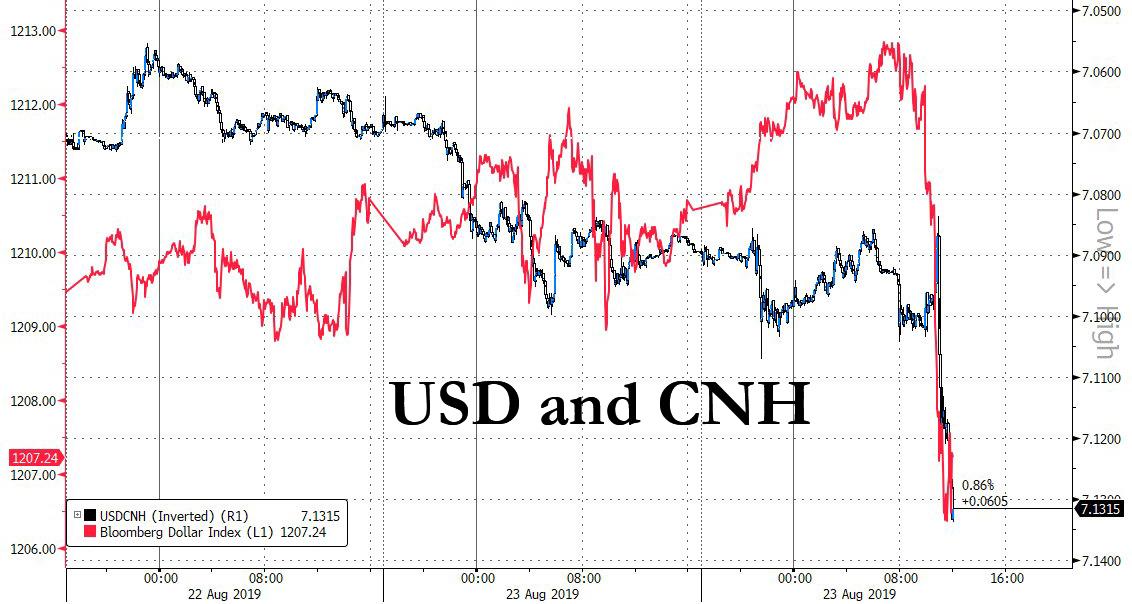

What said team is seeing is nothing short of carnage, because – somewhat paradoxically – even as the Bloomberg dollar index is plunging ever since Trump unleashed his tirade targeting China for daring to retaliate to US tariffs, the offshore yuan is plunging even more, tumbling below 7.13 – a new 11.5 year low – in what the White House can correctly interpret as official intervention to weaken the currency which should be rising against the greenback, yet is doing precisely the opposite.

Which brings us to the only possible question: when will the US intervene in the FX market, and how much offshore Yuan will the US Treasury buy. As a reminder, the US could deploy up to $146 billion in yuan purchasing power if intervention was launched, the combination of the Treasury’s Exchange Stabilization Fund and the central bank’s firepower.

“If an intervention does go ahead, I think the US would probably target specific currencies such as the renminbi, rather than attempt to achieve broad-based dollar weakness,” said Stephen Oh, global head of credit and fixed income at PineBridge Capital, which manages $97bn of assets.

The only question then is how will China respond. And luckily, we wrote an article on precisely that last night, and noted that top Chinese bankers in London warned that the “drama” that would follow any US attempt to weaken the dollar by intervening in renminbi markets — a move that would be seen by Beijing as a “political act.” A hostile “political act.”

Yet such an act looks increasingly likely after Trump has repeatedly taken aim at China (and Europe) both on Twitter and elsewhere for “playing currency games” as the trade war has morphed into a currency war, if not a full-blown one yet.

* * *

Hhow likely is that the US and China would launch all out currency war at each other in the FX market?

Last month US Treasury secretary Steven Mnuchin said there was no change “as of now” to America’s currency policy but added that a different stance could be considered in the future. To be sure, investors are growing more cautious and are increasingly unwilling to short the yuan over fears of a surprise intervention by the US. One head of a currency trading platform that serves US hedge funds told the FT that his clients have begun to stay away. “They don’t want to be on the wrong side of the Fed.” Something tells us that neither does China.

via ZeroHedge News https://ift.tt/30xQtnW Tyler Durden